Government finance statistics: long-term debt securities

The general government financial accounts cover transactions in financial assets and liabilities as well as the stock of financial assets and liabilities. In recent quarters, the liabilities of euro area governments increased because governments borrowed to finance their deficits to acquire assets. The incurrence of liabilities occurred notably by issuing long-term debt securities (bonds) that are issued with a maturity longer than a year. At the end of the first quarter of 2024, these financial instruments made up around 70% of total liabilities of the euro area governments.

This information comes from data on quarterly government finance published by Eurostat today. The article presents a handful of findings from the more detailed Statistics Explained article.

Source dataset: gov_10q_ggfa

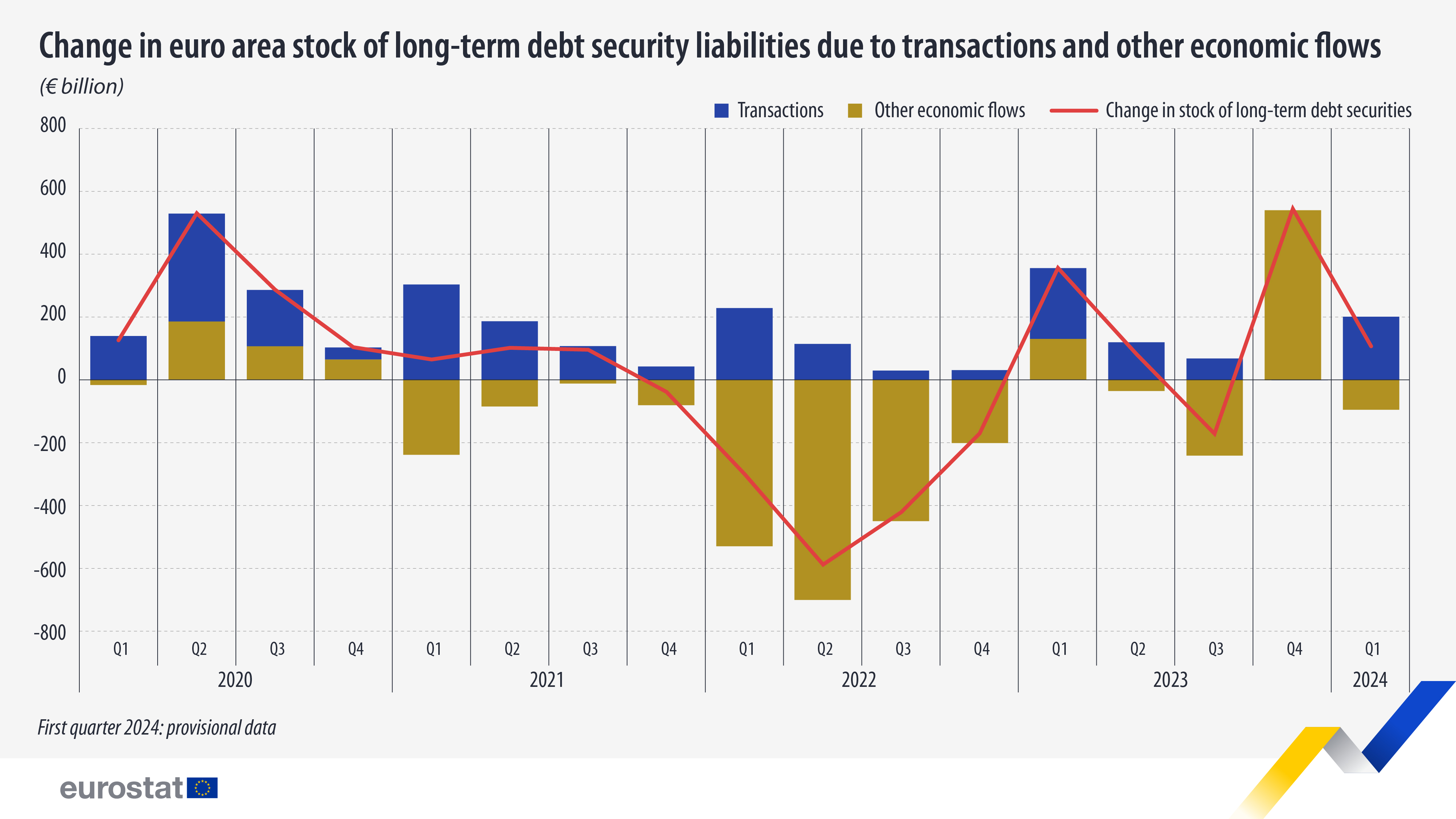

The outstanding amount of liabilities changes either due to transactions (mainly due to net issuances, but also due to accrued interest) or due to other economic flows (mainly price changes also known as nominal holding gains or losses, e.g. due to changes in the prevailing interest rates). As long-term debt securities are traded on the financial markets, the market value of these instruments changes constantly over time. In the first quarter of 2024, the market value of euro area long-term debt securities declined by around €95 billion, while the net issuance of long-term debt securities amounted to around €201 billion. This resulted in a €106 billion higher stock at market value at the end of the first quarter of 2024 as compared with the end of 2023.

For more information

- Statistics Explained article on quarterly government finance statistics

- Thematic section on government finance statistics

- Database on quarterly government finance statistics

- Database on government finance statistics

Methodological notes

- In the European System of Accounts (ESA 2010), most assets and liabilities are valued at market value. This means that the stock of financial assets and liabilities fluctuates due to transactions, but also due to "other flows", notably revaluations (nominal holdings gains and losses).

- Long-term debt securities are part of the general government gross debt as covered in the Maastricht debt definition stipulated in the Excessive Deficit Procedure. Thus, stock data on long-term debt securities are also published at face value, which does not take into account most price changes. The stock at face value can differ significantly from the stock at market value.

If you have any queries, please visit our contact us page.