Environmental tax revenue shows slight decline in 2022

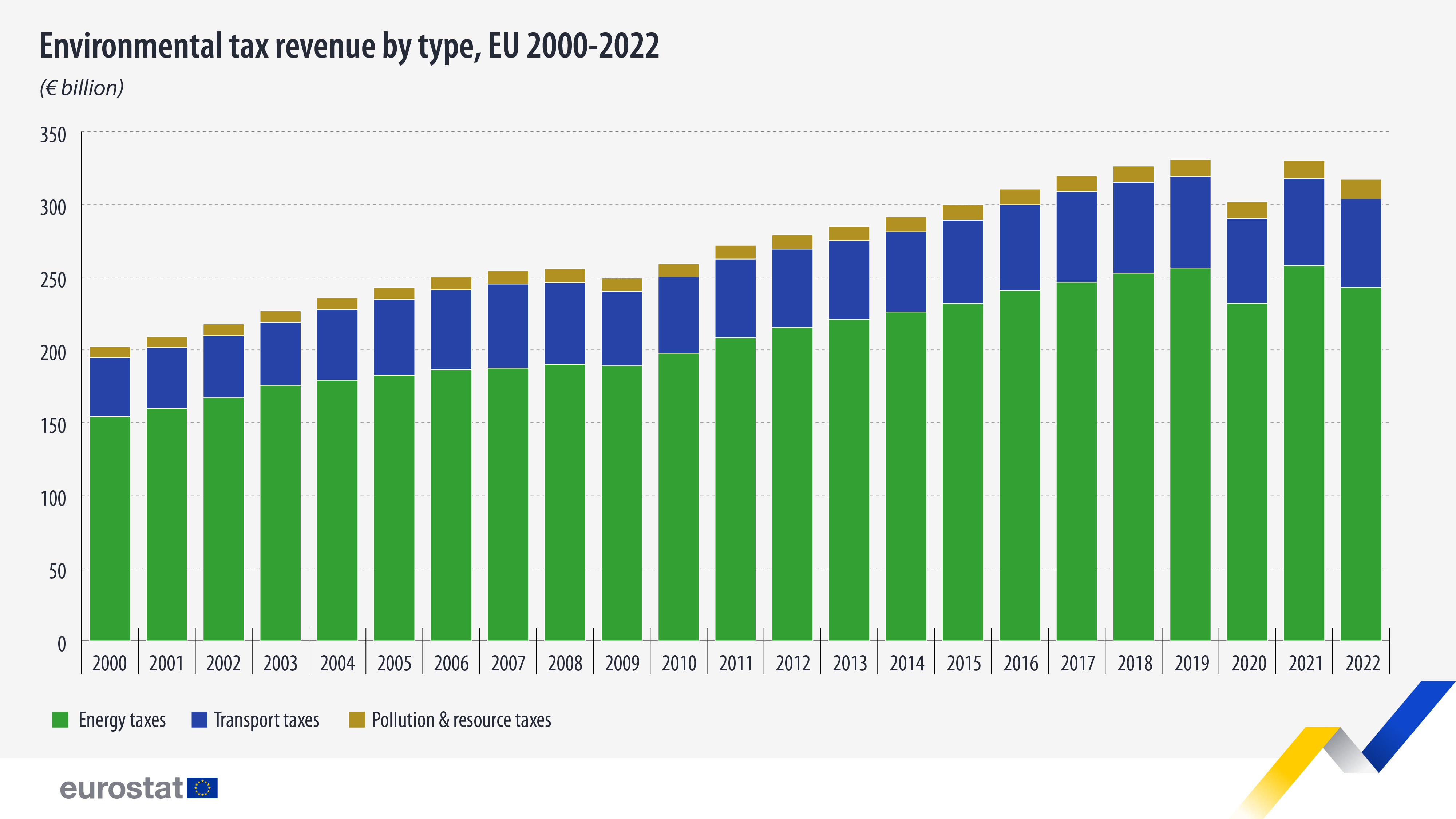

In 2022, environmental tax revenue in the EU amounted to €317.2 billion (2.0% of the EU’s gross domestic product; GDP) compared with €330.2 billion recorded in 2021, indicating a 4% decrease (-€13 billion).

The long-term upward trend resumed after the exceptional years of 2020 and 2021 (COVID-19). However, 2022 remains notable due to the situation in the energy markets. The decline in total environmental tax revenues from 2021 to 2022 was primarily due to a decrease (-€15.1 billion) in energy tax revenues, which totalled €243 billion in 2022.

On the other hand, pollution and resource taxes increased by 10% (+€1.2 billion) and transport taxes registered a small uptake of 1% (+€809 million).

Source dataset: env_ac_taxind2

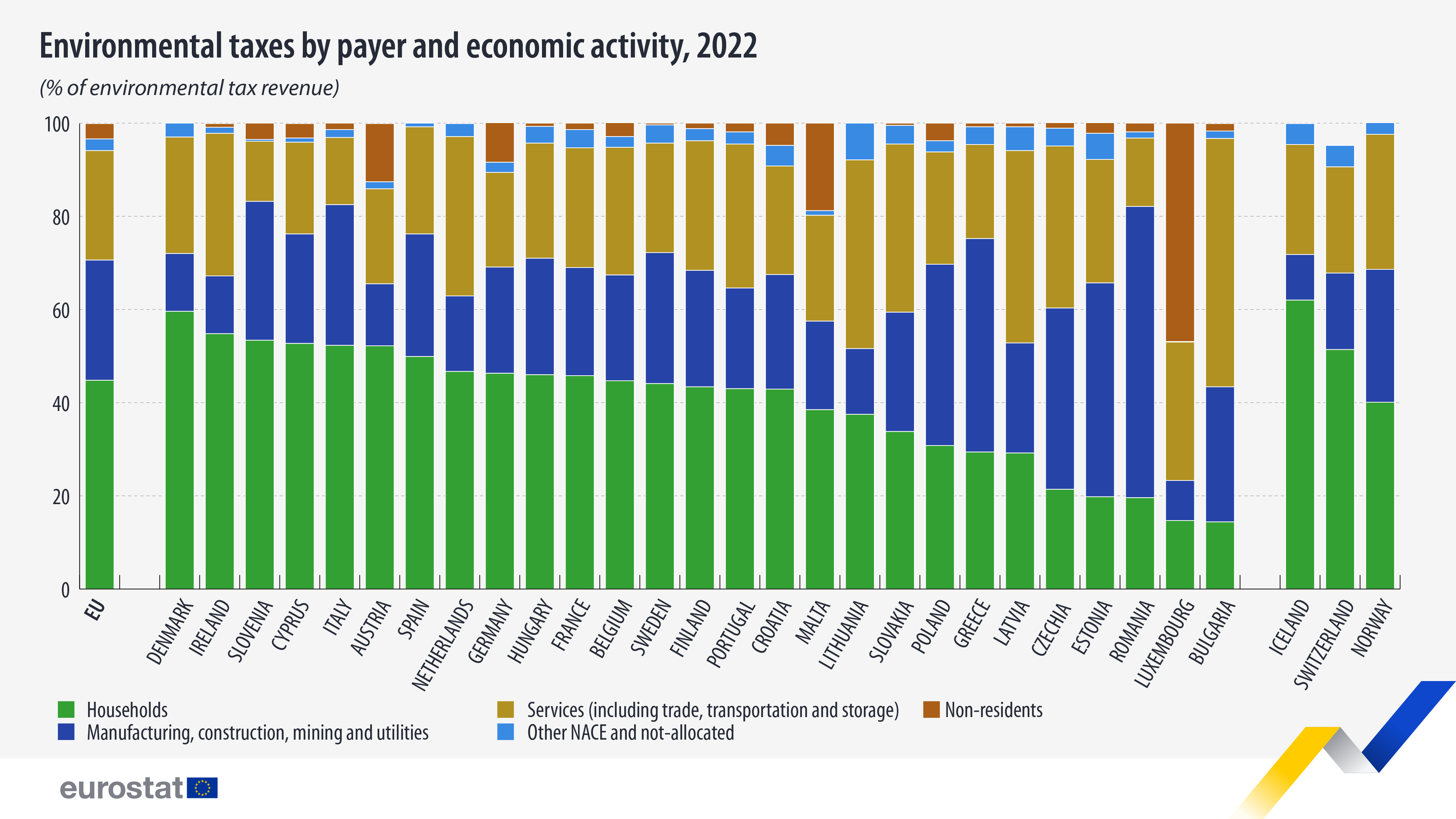

At EU level in 2022, corporations generated most environmental tax revenues, accounting for 52% of the total. Most of this corporate contribution came from companies in manufacturing, construction, mining, and utilities (26%) and the services sector (24%). Households contributed with 45% of the total environmental tax revenues.

In 17 EU countries households paid more than 40% of the total environmental tax revenues, varying between 60% in Denmark and nearly 40% in Malta.

At the national level, corporations contributed on average with more than 50% of the total tax revenues in most EU countries. Only in a few countries did non-residents significantly contribute to the environmental tax revenues, with the highest share in Luxembourg (46%).

Source dataset: env_ac_taxind2

This information comes from data on environmental taxes by economic activity published by Eurostat today. The article presents a handful of findings from the more detailed Statistics Explained article.

For more information

- Statistics Explained article on environmental tax statistics

- Statistics Explained article on environmental tax statistics – detailed analysis

- Environmental taxes – a statistical guide – 2024 edition

- Thematic section on environment

- Database on environmental taxes

If you have any queries, please visit our contact us page.