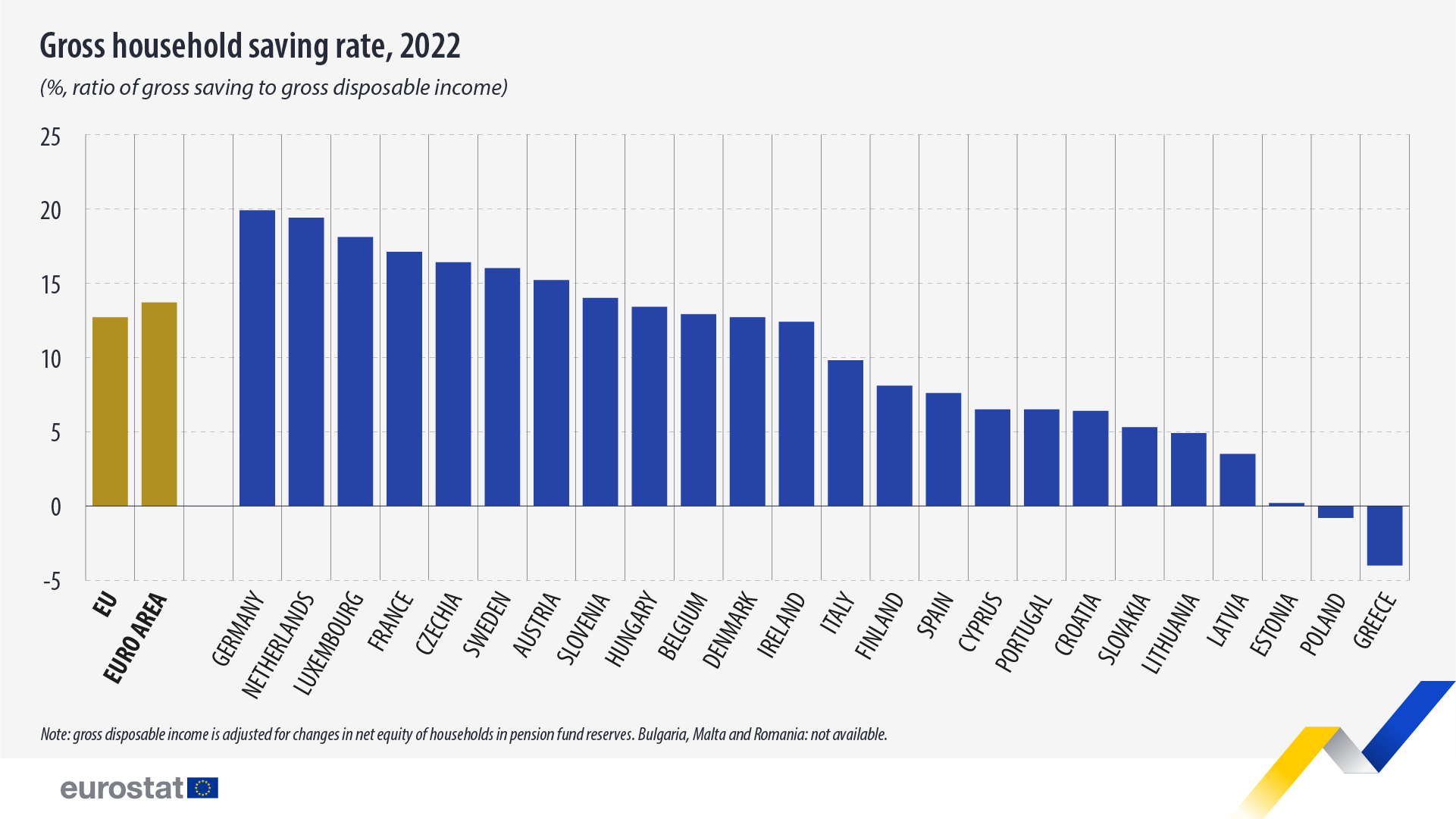

Household saving: one eighth of disposable income in 2022

In 2022, people in the EU saved on average 12.7% of their disposable income. The rate was significantly lower than in 2021 (16.4%), and closer to the values before COVID-19 pandemic.

The highest gross saving rates among the EU members in 2022 were recorded in Germany (19.9%), the Netherlands (19.4%) and Luxembourg (18.1%).

12 EU members recorded saving rates below 10.0% in 2022, among which Poland and Greece had negative rates, -0.8% and -4.0%, respectively. This indicates that households spent more than their gross household disposable income and were therefore either using accumulated savings from previous periods, or were borrowing to finance their expenditure.

Source dataset: nasa_10_ki

In 2022, real gross household adjusted disposable income per inhabitant in the EU recorded a decrease of 0.8%, while the euro area experienced a 0.9% drop, the first declines since 2013.

Looking at the developments over the past two decades, after the negative rates between 2010 and 2013 due to the global financial and economic crisis, real gross household adjusted disposable income per inhabitant was increasing from 2014 to 2021. In 2020, during the initial year of the COVID-19 crisis, the rate of change decelerated but remained positive. After a record 2.8% growth in 2021 – the highest in the past two decades – in 2022 the increase in nominal value (+6.3%) was lower than the increase of prices (+7.2%), and thus a decrease in real value was observed.

Source dataset: nasa_10_ki

This information comes from the non-financial sector accounts annual data published by Eurostat. The article presents a handful of findings from the more detailed Statistics Explained article.

For more information

- Statistics explained on household income, savings and investment

- Thematic section on institutional sector accounts

- Database on institutional sector accounts

Methodological notes

- The household saving rate is defined as gross household saving divided by gross disposable income (with the latter being adjusted for the changes in pension entitlements).

- Real gross household adjusted disposable income is the total amount of money households have available for spending and saving after subtracting income taxes and pension contributions, plus the individual goods and services received free of charge from government and non-profit institutions serving households, NPISHs (such as education and health services). Real means that its nominal value is adjusted for price increases (by the deflator of household final consumption expenditure).

If you have any queries, please visit our contact us page.