EU’s net investment position up 21% in 2021

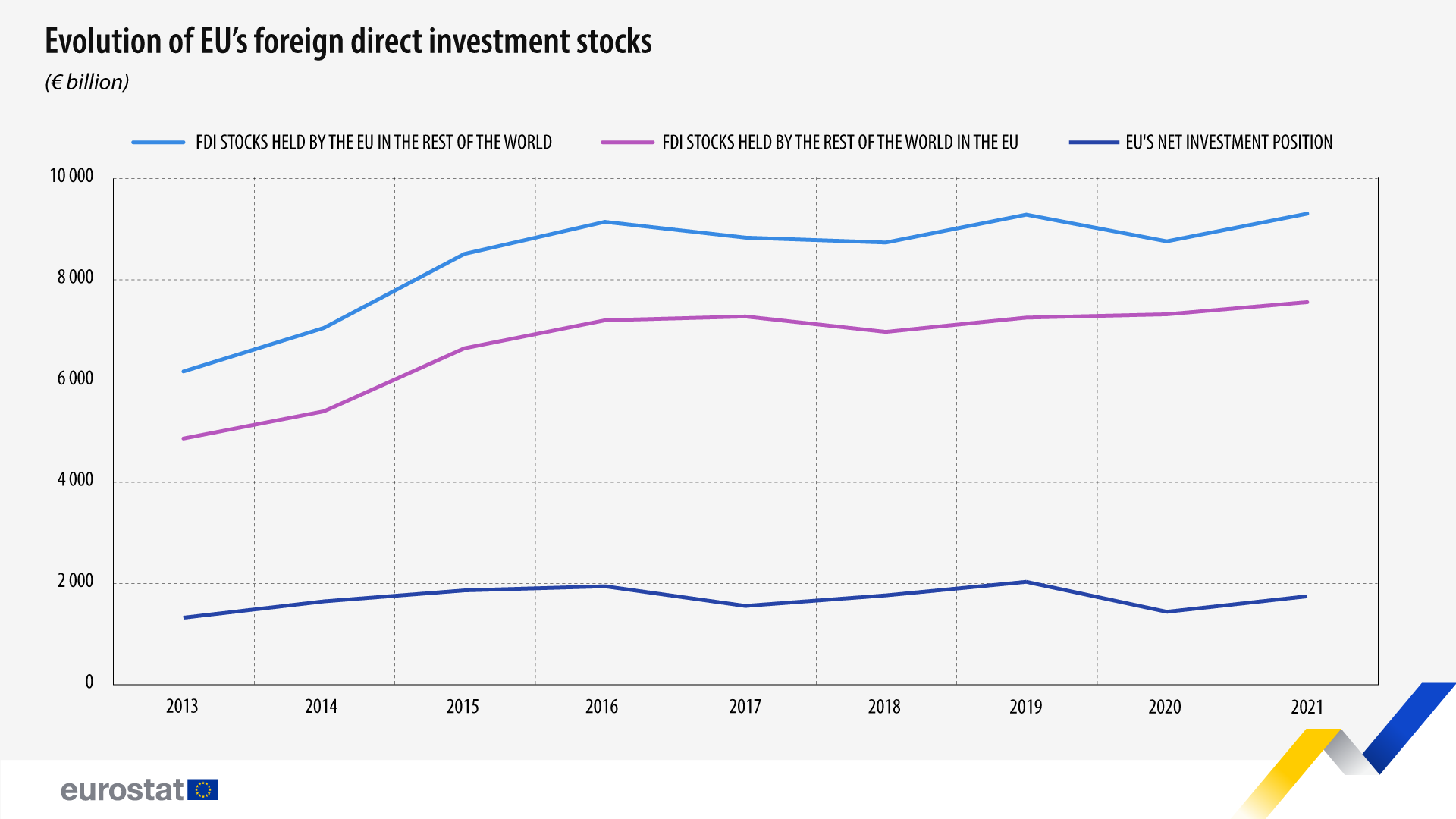

Net foreign direct investment (FDI) stocks held in the rest of the world by investors resident in the EU amounted to €9 306 billion (bn) in 2021, up 6% compared with 2020, after the sudden decrease in 2020 due to the impact of COVID-19. The total value reached in 2021 surpassed pre-pandemic values (€9 286 bn) by almost €20 bn.

The same tendency was seen in investment stocks held by the rest of the world in the EU, which increased to €7 558 bn in 2021, up 3% compared with 2020 and 4% (+€305 bn) compared with 2019.

In 2021, the EUˈs net investment position vis-à-vis the rest of the world increased by 21% to €1 747 bn (+€305 bn), compared with 2020.

Source dataset: bop_fdi6_pos

Special Purpose Entities (SPEs) resident in the EU continued to play a significant role in FDI, albeit a less prominent one than a year earlier. At the end of 2021 they accounted for 33% of the total EU FDI stocks held abroad and for 38% of the FDI stocks held by the rest of the world in the EU, compared with 36% and 43% respectively in 2020.

USA and the UK: by far the main EU’s FDI partners

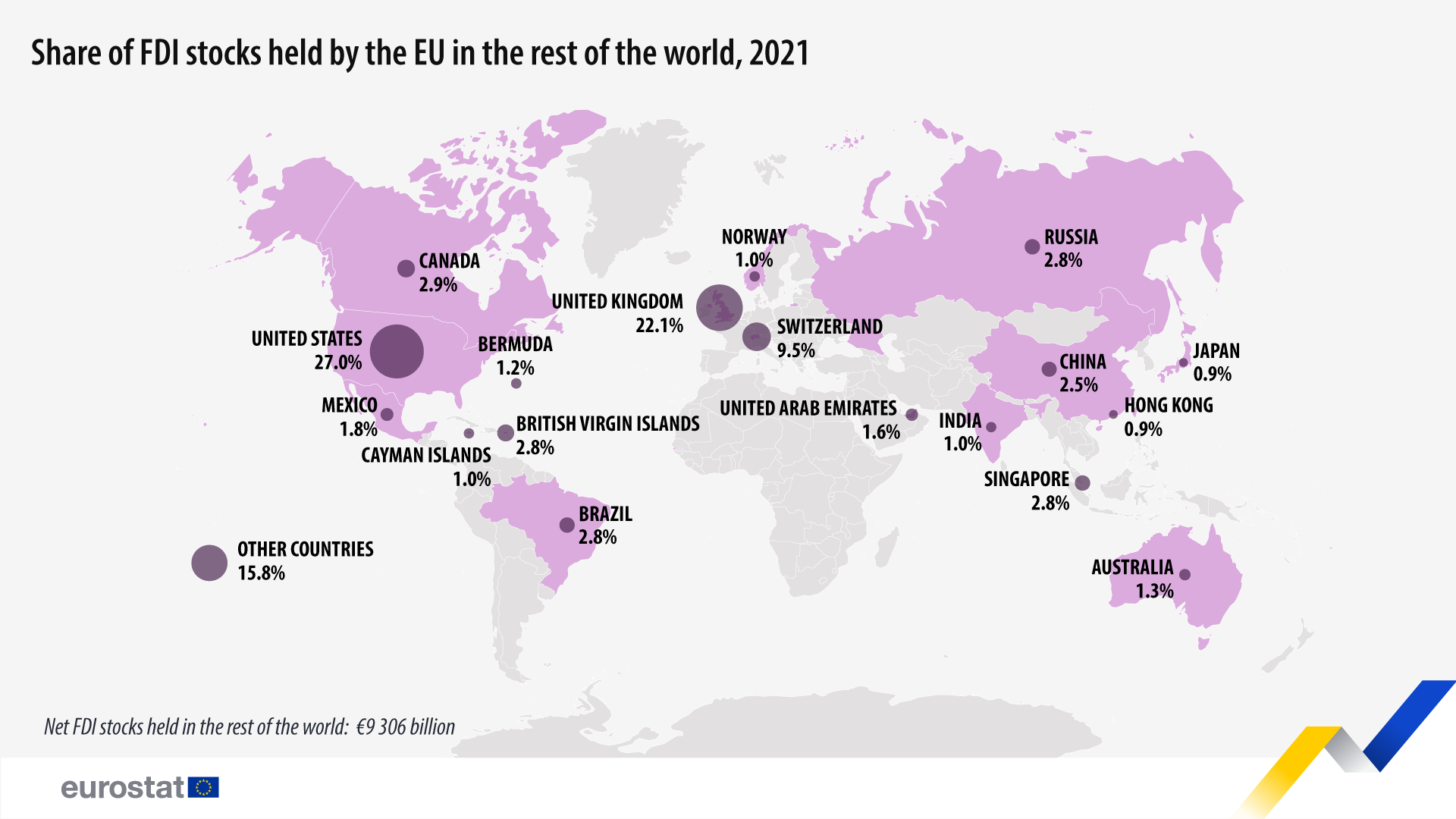

At the end of 2021, the United States absorbed 27% of the total FDI stocks held by the EU in the rest of the world (€2 512 bn), closely followed by the United Kingdom (€2 059 bn, 22%). They were far ahead of Switzerland (€885 bn, 10%), Canada (€270 bn), Singapore (€263 bn), Brazil (€262 bn), Russia (€255 bn) and China (€233 bn) all with a 3% share.

Source dataset: bop_fdi6_pos

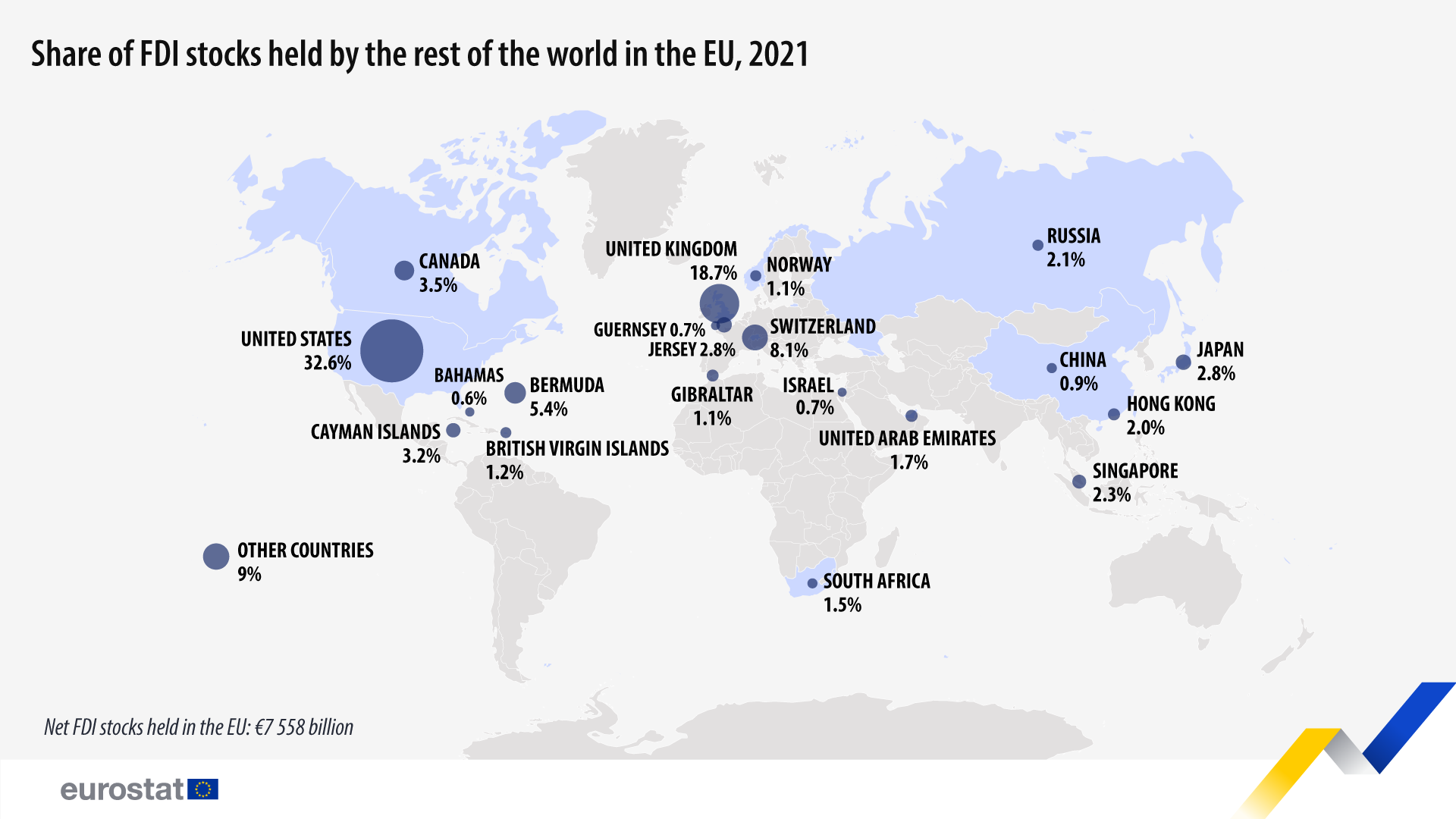

In the reverse direction, the United States' direct investors accounted for almost a third (€2 465 bn, 33%) of the total FDI stocks held by the rest of the world in the EU at the end of 2021, followed by the United Kingdom (€1 414 bn, 19%). They were followed by those from Switzerland (€613 bn, 8%), Bermuda (€405 bn, 5%), Canada (€267 bn, 4%), Cayman Islands (€239 bn, 3%), Jersey (€212 bn, 3%) and Japan (€211 bn, 3%).

Source dataset: bop_fdi6_pos

For more information

- Thematic section on foreign direct investment statistics

- Database on balance of payments and EU direct investments

- Statistics Explained article on FDI statistics methodology

Methodological notes:

- These data are subject to revision.

- FDI stocks help to quantify the impact of globalisation and measure longstanding economic links between countries (according to immediate counterpart criteria). They provide an indication of the relative importance of a country's economic presence abroad, or that of foreign partners in the reporting entity, measured in terms of FDI capital.

If you have any queries, please visit our contact us page.