Last update: February 2025

Why Innovation Profiles of enterprises?

Innovation in businesses is a complex process. It requires multiple capabilities and involves various activities that can result in several outcomes. The Community Innovation Survey (CIS) is the established tool for reporting on business innovation in Europe.

The measurement of innovation in businesses, and the interpretation of results, thrives on a solid conceptual and methodological foundation: the OECD/Eurostat Oslo Manual 'Guidelines for collecting and using data on innovation' (latest edition from 2018)[1]. The concepts of the Oslo Manual are acknowledged to reflect the reality in businesses best in view of their innovation. In turn, the CIS is acknowledged to implement these concepts in surveys on business innovation as well as possible. The CIS survey questions related to business innovation have been developed over many years, stood the test of time, and are today copied by many other innovation surveys worldwide. Since 2022, the CIS is conducted in all EU Member States within the framework of European Business Statistics (EBS)[2], and the data collection is guided by the 'EBS methodological manual on statistics on business innovation'. CIS results are thus comparable between the countries, as well as coherent with other business statistics.

The data collections within EBS have different user groups. They range from researchers with the capacity to understand complex concepts and interpret the data in all facets, to expert users of tabulated data, and to users who want to have a quick at-the-glance overview of business innovation. The data output of the statistical offices serves all those interests.

More than other EBS data collections, surveys on business innovation have researchers, academia, and professional users as a focus group[3]. They are mostly acquainted with the concepts and can dexterously interpret CIS data. The CIS offers researchers a myriad of possibilities to classify enterprises about their innovation – and indeed researchers have used CIS data in many ways, depending on the focus of their analysis. The CIS reports on innovation activities and shows if an enterprise has innovation capabilities, i.e. can create innovation itself. It identifies if an enterprise has 'implemented' the innovation (sold on the market or brought to use in the firm) as well as the degree of novelty of an innovation. It reports on the presence and level of research and development (R&D) activities, the presence of ongoing or abandoned innovation efforts, and the innovative potential for companies that have not introduced innovations.

Admittedly, it takes some knowledge to fully understand and disentangle the concepts of the Oslo Manual, e.g. 'innovation' in general, 'business innovation', different kinds of 'innovation implementation', 'new-to-market' versus 'new-to-the-firm product innovation’, ‘innovation activities', 'innovation capabilities', etc. The standard tabulation of aggregated CIS results, together with the metadata, methodological Statistics Explained articles and the EBS methodological manual on business innovation achieve this to a good extent.

However, there was still no at-the-glance overview of innovation in businesses before 2023. This is why Eurostat and the Statistical Offices of EU Member States developed 7 easy-to-understand Innovation Profiles. They are based on the established concepts of business innovation and account for all relevant aspects in parallel. The Innovation Profiles capture the complete picture of innovation in European businesses and provide better information to analysts and policy-makers than 1-dimensional standard indicators.

The Innovation Profiles have many advantages. They make it possible to present the various survey results (e.g. on innovation capabilities and outcomes) in terms of simple proportions of the population, which increases the possibilities for charts and visualisations. For the same reason, they facilitate the development of indicators that allow results to be compared along concepts related to business innovation.

Finally, they are very useful in the design of Microdata Linking (MDL) exercises, as they allow innovation data to be linked directly to other databases, so that aggregates from other data sources can be calculated for each of these watertight groups of enterprises.

From the CIS 2022 onwards, the Innovation Profiles are universally used to demonstrate the impact of innovation on business activities and their outcomes. Many CIS variables are broken down by Innovation Profiles. Eurostat publishes Statistics Explained articles on CIS results broken down by Innovation Profiles. This article explains the motivation and methodology behind the Innovation Profiles.

Underlying principles

Two key principles guided the construction of the Innovation Profiles:

- Mutual exclusivity: there must be no overlap between 2 profiles.

- Exhaustivity: the entire target population of the CIS must be covered.

In summary, each enterprise covered by the CIS is allocated to exactly 1 Innovation Profile. The Innovation Profiles were carefully designed and tested to ensure that these 2 principles are respected in practice.

Seven Innovation Profiles

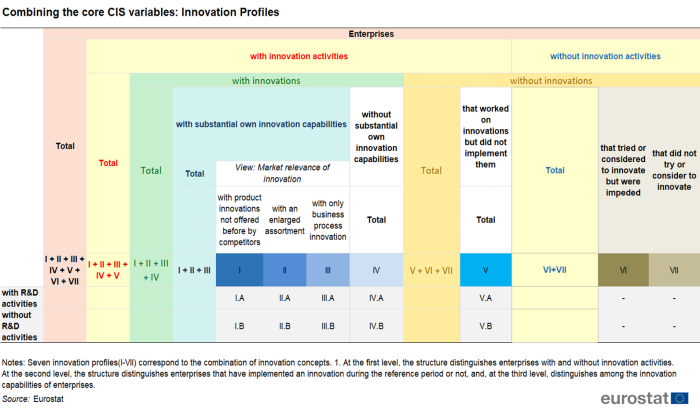

Innovation profiling takes an intuitive, pragmatic and relevant approach in choosing a hierarchy. Seven basic Innovation Profiles were developed around the lines of analysis shown below (Figure 1 presents a tabular representation of the Innovation Profiles). The CIS reports on the enterprise as the 'generator' of innovation (enterprise as the 'subject'), rather than on the innovation itself (resulting innovation as the 'object'). This logic is in line with policy purposes: the question is not "How many innovations were reported for a country and how successful were they?" The mere number of innovations is not a good indicator for a successful outcome innovation activity, and producing statistics on the success of all innovations in a country is not feasible. Instead, the question is rather: "What do enterprises do to have innovation, what conditions do they face, which conditions are favourable for innovation, and what can be done to create favourable conditions and thereby increase the competitiveness of an economy?" This logic is, therefore, also the logic of the innovation profiling.

Innovation profiling uses established concepts of measuring business innovation, and puts them into a hierarchy according to their inherent relevance for describing enterprises in view of their innovative behaviour.

- At the very top level, the structure distinguishes between firms with and without innovation activities. The Oslo Manual defines innovation activities as "all developmental, financial and commercial activities undertaken by a firm that are intended to result in an innovation for the firm" (Oslo Manual, OECD, 2018, p.68). Innovation activities are the starting point for a firm to engage in innovation. These activities characterise the firms that have either introduced at least 1 type of innovation (product or business process) or that have been involved in any ongoing or abandoned activities in pursuit of an innovation.

- At the 2nd level, the structure distinguishes enterprises that have implemented an innovation during the reference period from those that have not. The implementation of an innovation is mostly the desired outcome of innovation activity, and it is therefore again intuitively logical to place it at the second level of the innovation profiling. The concept of 'implementation' is essential to the definition of innovation in the Oslo Manual. For business enterprises, it means that their product has been introduced into the market, or that a new business process has been brought into use by the firm.

- The 3rd level refers to the innovation capabilities of enterprises. The Oslo Manual dedicates great attention to the measurement of business capabilities for innovation because it is "of critical importance for the analysis of the drivers and impacts of innovation (why some firms have innovation and others do not)" (Oslo Manual, OECD, 2018, p.35). The innovation profiling identifies innovators with their own substantial innovation capabilities. These firms develop their product or business process innovations themselves or together with other enterprises or organisations, or they co-operate on any of their innovation activities with other enterprises or organisations.

- The 4th level of analysis refers to the innovation itself. The profiles take a market perspective, and answer the basic questions: Has the enterprise introduced a product innovation not previously offered by competitors? If not: Has it improved its assortment (this includes only products that are identical or very similar to those already offered by competitors)? If not: Has it implemented any business process innovation (with a potential indirect effect on the market)?

- At the 5th level, the structure systematically distinguishes according to the possible presence of R&D (R&D performers versus non-R&D-performers) within the resulting Innovation Profiles. R&D can be an important input to innovation. Hence, its presence allows for better disentangling of the profiles of both enterprises that introduced product or business process innovations (Profiles I to IV), and those enterprises that worked on innovations but did not implement them (Profile V). Enterprises without innovation activities (Profiles VI and VII) are not subject to this ultimate alternative because, by definition, these firms do not carry out any R&D (which is considered an innovation activity); they are all considered as non-R&D-performers.

The resulting Innovation Profiles are:

PROFILE I: In-house product innovators with market novelties

This group includes enterprises that introduced a product innovation that was developed by the enterprise and that was not previously offered by competitors (new-to-market product innovation). Profile I comes closest to the intuitive idea of a breakthrough innovator who creates radically new products and pioneers them to the market. They have innovation capability and use this to compete in the existing marketplace, or even to create new markets.

PROFILE II: In-house product innovators without market novelties

This group includes enterprises that introduced a product innovation that was developed by the enterprise but that is identical or very similar to products already offered by competitors (new-to-firm product innovation). Profile II enterprises are actively trying to stay abreast with competitors by renewing or enlarging their assortment.

PROFILE III: In-house business process innovators without in-house developed product innovations[4]

This group includes enterprises that have not introduced any in-house developed product innovation (Profiles I and II), but that have introduced a business process innovation that was developed in-house. Profile III firms aim at becoming more efficient. They actively work to become more competitive by introducing better business processes. The impact of their innovation activity on the market is indirect, e.g. by being able to offer lower prices or better non-monetary conditions to their customers, or by attempting to reach new customers for their established products.

PROFILE IV: Innovators that do not develop innovations themselves

This group includes enterprises that have introduced an innovation, either a product or a business process, but none of which was developed in-house. Profile IV companies strive to be competitive in their markets by introducing better products or business processes. However, they choose not to build up innovation capabilities themselves. The improvement of their products or business processes is a result of buying in innovation from other firms and implementing it in the own firm.

PROFILE V: Non-innovators with innovation activity

This group includes enterprises that have not introduced any innovation recently, but have either ongoing or abandoned innovation activities. Enterprises from Profile V have not introduced any innovation during the 3-year reference period, but are not estranged to the idea of innovation either. They have worked on innovations in the last 3 years but have not (yet) brought them to completion and implementation (i.e. they did not sell any innovative product on the market or brought any process innovation into use within the firm); or they have simply abandoned these projects.

PROFILE VI: Non-innovators without innovation activity but with potential to innovate

This group includes enterprises that did not introduce any innovation, and had no ongoing or abandoned innovation activities, but were considering innovating. Profile VI enterprises have not introduced or worked on any innovation during the 3-year reference period, but they are not completely estranged to the idea of innovation either.

PROFILE VII: Non-innovators without innovation activity and without potential to innovate

This group includes all other enterprises. They have no innovation, they have no ongoing or abandoned innovation activities, and they have not considered innovation. They prefer to continue with business as usual and can be said to have no inclination to innovate.

Notes

- ↑ The 2018 review of the Oslo Manual 'Guidelines for collecting and using data on innovation' led to a redesign of the CIS survey starting with its 2018 wave (see the background article Community Innovation Survey). The redesign improved the information balance between innovators and low- or non-innovators because most variables are now available for all enterprises.

- ↑ Starting with the CIS 2022 round, the CIS was integrated into the framework of European Business Statistics (EBS). This means that the data are produced and transmitted to Eurostat according to Regulation (EU) 2019/2152 ('EBS Regulation') and the General Implementing Act to this regulation, Regulation (EU) 2020/1197 ('EBS GIA'). These 2 Regulations are common to other domains, for example Structural Business Statistics (SBS) and Business Demography Statistics (BD). Specifically for the Community Innovation Survey (CIS), Commission Implementing Regulation (EU) 2022/1092 applies. This framework ensures that CIS data are compatible with the output of all other European data collections on enterprises and the economy. It enables comparisons between data for different countries and from different data collections.

- ↑ This is e.g. reflected by the fact that the CIS is the only EBS data collection for which anonymised microdata are made available to researchers. See section 7.4 'Transmission of CIS microdata' in the EBS Methodological Manual on Business Innovation.

- ↑ Until the CIS2022 round, firms with product innovations that were not developed in-house were not checked further for their possible business process innovations developed in-house. Such companies were classified under Profile IV despite their innovation capabilities. This was improved from the CIS2024 onwards: now all firms that either had no product innovation or had a product innovation but not developed in-house, but that on the other hand had in-house developed business process innovations are included in Profile III. This allows Profile III to belong unambiguously to the overarching group of those companies WITH innovation capabilities. On the other side of the border, Profile IV then includes firms that have not developed any of their innovations in-house, regardless of whether they are product or business process innovations. This clearly places Profile IV within the overarching group of those firms WITHOUT innovation capabilities. This change in methodology was analysed in depth and tested by the CIS Task Force. The impact on the results is expected to be very limited. It consists exclusively of a slight shift of firms from Profile IV to Profile III, allowing the necessary shift from the group of firms without innovation capabilities to that with innovation capabilities.

Explore further

Other articles

Database

- Science and technology (scitech), see:

- Community innovation survey (inn)

- Results of the community innovation survey 2022 (CIS2022) (inn_cis13)

Thematic section

Methodology

- EBS methodological manual on statistics on business innovation

- Oslo Manual

- Community innovation survey 2020 (CIS2020) (inn_cis12) (ESMS metadata file — inn_cis12)