Data extracted in June 2025.

Planned article update: June 2026

Highlights

In 2023, the largest natural gas import and production company had the lowest market penetration in Ireland at 22%, in Lithuania and Czechia, it was 23%.

Cumulative market share of the largest gas companies in the EU, 2023

This article takes a look at the natural gas markets in the European Union (EU). It presents recent statistical data on market concentration. Specifically, it analyses the number of companies that bring natural gas to the national market by importing it or producing it (IMport and PROduction = IMPRO) and retail companies across EU Member States, Bosnia and Herzegovina, Montenegro, Moldova, North Macedonia, Georgia, Serbia, Türkiye and Kosovo*. For Denmark, Germany, Malta and the Netherlands the data is only partially available.

In 2023, the estimated number of main natural gas IMPRO companies (those with a market share of 5% or more) was 81, down from 87 companies in 2022. There were some fluctuations in these numbers across different countries.

The estimated total number of natural gas IMPRO companies in the EU, increased in 2023 by 10, reaching 603, compared to 593 in 2022.

(*)This designation is without prejudice to positions on status, and is in line with UNSCR 1244/1999 and the ICJ Opinion on the Kosovo Declaration of Independence.

General overview

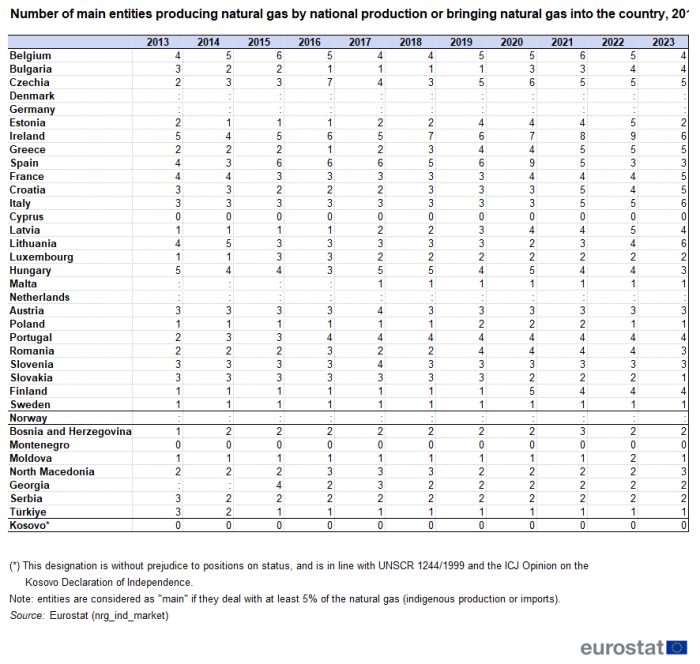

During 2013-2023 the estimated number of main companies with a market share above 5%, that either produced natural gas by national production or brought natural gas into the country (IMPRO) decreased from 87 to 81 companies in the EU, without including Denmark, Germany and the Netherlands (from where no data are available).

In the EU, the total number of natural gas IMPRO companies increased significantly in the period from 2013, when the figure stood at 346 (excluding Denmark, Malta and the Netherlands). In 2023, there were around 603 companies (missing data: Denmark and the Netherlands). This means that a significant number of new (small size) companies entered the IMPRO natural gas market during this period.

Natural gas market - import and production (IMPRO)

The information in Table 1 refers to the total number of companies that brought natural gas to the national market by importing it or producing it (IMPRO companies). In 2023, 1 single company dominated the market in Malta and Sweden. Finland saw the largest increase, from 13 IMPRO companies in 2022 to 24 in 2023. Between 2022 and 2023, the total number of IMPRO companies remained stable in 9 EU countries (Belgium, Germany, Croatia, Italy, Luxembourg, Malta, Slovenia, Slovakia and Sweden). Increases were observed in 9 EU countries, while the number of IMPRO companies went down in 6 EU countries.

Source: Eurostat (nrg_ind_market)

Table 2 shows the number of main IMPRO companies that have a market coverage of at least 5% of the total national indigenous production and import of natural gas. 4 EU countries (Malta, Poland, Slovakia and Sweden) declared only 1 single enterprise to have a significant share in 2023. Ireland, Italy and Lithuania reported 6 companies, this being the largest number reported by EU countries. During the period 2013-2023, the estimated number of main IMPRO companies (5%) in the EU fluctuated between 58 and 87 companies. Compared with 2022, the estimated total number of main IMPRO companies in 2023 decreased from 87 to 81.

Source: Eurostat (nrg_ind_market)

Figure 1 displays the cumulated market shares of main IMPRO companies in a given country having each a share of at least 5% of their respective national markets. Market dominance was lowest in Spain (45.9%), which means that relatively small IMPRO companies cover more than half (54.1%) of the total national gas market.

Source: Eurostat (nrg_ind_market)

Table 3 displays the market share of the single largest IMPRO company as a share of national indigenous production and import. Apart from Malta and Sweden, where only one entity dominates the national market, figures of 80% and above, for the largest IMPRO company are observed in Slovakia (94%), Poland (90%), Estonia (87%), Slovenia (80%) and Luxembourg (80%). The lowest market penetration of the largest IMPRO company at national level was observed in Ireland (22%).

Source: Eurostat (nrg_ind_market)

Natural gas market - retail

EU countries, as well as Bosnia and Herzegovina, Montenegro, Moldova, North Macedonia, Georgia, Serbia, Türkiye and Kosovo also reported information for 2023 concerning the retailing (sales) sector for natural gas.

Table 4 presents information on the total number of retailing companies that sell natural gas to final customers. In 2023, Germany had by far the highest number of retailers, 973, followed by Italy with 634. Between 2022 and 2023, the number of retailers decreased in 12 EU countries, remained stable in 7 and increased in six EU countries that reported data.

Source: Eurostat (nrg_ind_market)

Table 5 shows the number of main retailers (retailers are considered as "main" if they sell at least 5% of the total national natural gas consumption). The estimated figures have been slightly increasing since 2013 and reached 113 in 2023. The largest number of main retailers (8), were operating in Finland, 7 in Austria, and 6 retailers were operating in each of 3 EU countries (Greece, the Netherlands, and Italy) that report data.

Figure 2 illustrates the cumulative market shares of main natural gas retailers for the EU countries available as well as for North Macedonia, Türkiye, Serbia, Bosnia and Herzegovina, Moldova and Georgia. Looking at the remaining retail market, which is the market that is covered by smaller retail companies that have a market coverage of less than 5%, this market was largest in Germany (86.7%). This market share was below 10% in 5 of the EU countries that reported this information.

Source: Eurostat (nrg_ind_market)

Table 6 displays the percentage market share of the largest natural gas retailer of total national consumption. This share for 2023 was highest in Sweden (72%) and Bulgaria was in second place with a 66% market share of the largest natural gas retailer. The smallest market penetration for the largest retail company on national level was observed in Italy (12%).

Source: Eurostat (nrg_ind_market)

Source data for tables and graphs

Data sources

The information on electricity and natural gas market indicators is collected via a voluntary data collection. Although the participation of countries in this voluntary data collection is very high, sometimes the information on individual indicators is not available or is confidential.

The full dataset is available at

Context

The EU has acted to liberalise electricity and gas markets since the second half of the 1990s. Directives adopted in 2003 established common rules for internal markets for electricity and natural gas. Up to now, significant barriers to entry remain in many electricity and natural gas markets as seen through the number of markets still dominated by (near) monopoly suppliers.

In 2019, the European Commission presented the Clean energy for all Europeans package [1]. The Commission completed a comprehensive update of its energy policy framework to facilitate the transition away from fossil fuels towards cleaner energy and to deliver on the EU's Paris Agreement commitments for reducing greenhouse gas emissions.

Directive 2009/73/EC of the European Parliament and of the Council of 13 July 2009 concerning common rules for the internal market in natural gas aims to introduce common rules for the transmission, distribution, supply and storage of natural gas with the objectives of providing market access and enabling fair and non-discriminatory competition.

Regulation (EU) 2019/942 of the European Parliament and of the Council of 5 June 2019 establishing a European Union Agency for the Cooperation of Energy Regulators. ACER, among others, assists the regulatory authorities in carrying out, at EU level, the regulatory tasks performed in the EU countries.

Explore further

Other articles

Database

- Energy (nrg), see:

- Energy statistics - market structure indicators - natural gas and electricity (nrg_market)

- Energy market indicator (nrg_ind_market)

- Energy Statistics - quantities (nrg_quant)

- Energy Statistics - quantities, annual data (nrg_quanta)

- Supply, transformation and consumption - commodity balances (nrg_cb)

- Supply, transformation and consumption of gas (nrg_cb_gas)

- Supply, transformation and consumption - commodity balances (nrg_cb)

- Energy Statistics - quantities, monthly data (nrg_quantm)

- Energy statistics - supply, transformation, consumption (nrg_10m)

- Supply of gas - monthly data (nrg_103m)

- Energy statistics - supply, transformation, consumption (nrg_10m)

- Energy Statistics - quantities, annual data (nrg_quanta)

- Energy statistics - prices of natural gas and electricity (nrg_price)

- Energy statistics - natural gas and electricity prices (from 2007 onwards) (nrg_pc)

- Gas prices for household consumers - bi-annual data (from 2007 onwards) (nrg_pc_202)

- Gas prices for non-household consumers - bi-annual data (from 2007 onwards) (nrg_pc_203)

- Household consumption volumes of electricity by consumption bands (nrg_pc_204_v)

- Non-household consumption volumes of electricity by consumption bands (nrg_pc_205_v)

- Gas prices components for household consumers - annual data (nrg_pc_202_c)

- Gas prices components for non-household consumers - annual data (nrg_pc_203_c)

- Energy statistics - natural gas and electricity prices (from 2007 onwards) (nrg_pc)

Thematic section

Visualisation

Methodology

- Energy Statistics - quantities, annual data (ESMS metadata file — nrg_quant_esms)

Legislation

- Directive 2009/73/EC of 13 July 2009 concerning common rules for the internal market in natural gas and repealing Directive 2003/55/EC

- Summaries of EU legislation: Internal market for gas

- Regulation (EU) 2019/942 of 5 June 2019 establishing a European Union Agency for the Cooperation of Energy Regulators

- Summaries of EU legislation: Agency for the cooperation of national energy regulators

- Regulation (EC) No 715/2009 of 13 July 2009 on conditions for access to the natural gas transmission networks and repealing Regulation (EC) No 1775/2005

- Summaries of EU legislation: Natural gas transmission networks