Annual national accounts - evolution of the income components of GDP

Data extracted on 10 March 2024.

Planned article update: March 2025.

Highlights

This article explains the income components of Gross Domestic Product (GDP) and presents the changes in their composition over the last 20 years as a proportion of GDP. The first part of the article presents the income components as a proportion of GDP based on the 2023 values and how these have changed over the last 20 years. The second part presents changes in main income components since 2003, which reflect the impact of the economic and financial crisis and of the COVID-19 pandemic.

Full article

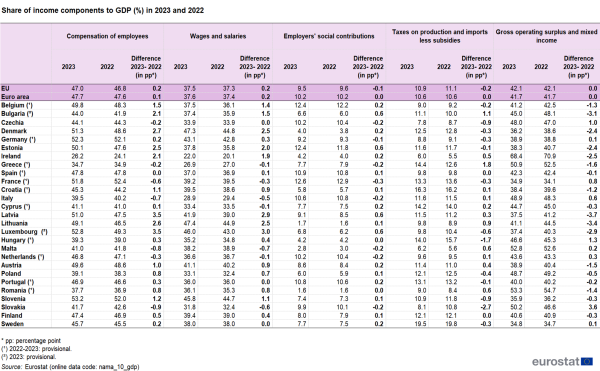

In 2023, compensation of employees was the largest income component in the European Union (EU), accounting for 47.0 % and 47.7 % of GDP in the EU and the euro area, respectively. It increased by +0.2 percentage points (pp) for the EU in comparison with 2022 and by +0.1 pp for the euro area. Taxes on production and imports (less subsidies) decreased by -0.2pp for the EU and remained stable for the euro area compared to 2022 and accounted for 10.9 % in the EU and 10.6 % in the euro area in 2023. Finally, gross operating surplus and mixed income accounted for 42.1 % of GDP for the EU and 41.7 % for the euro area, remaining stable in both the EU and the euro area in comparison with 2022.

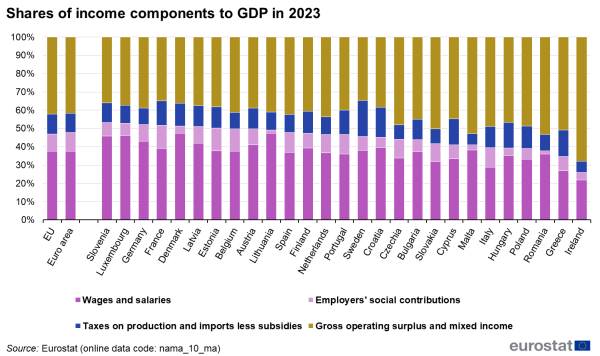

Table 1 shows the income components as a proportion of GDP in the EU and the euro area, as well as for the Member States in 2022 and 2023. The share of the income components varied significantly across the EU (see Figure 1). Compensation of employees is made up of two components: ‘wages and salaries’ and ‘employers' social contributions’.

Compensation of employees

Twelve Member States recorded a higher share of GDP than the EU average for compensation of employees. In Slovenia (53.2 %), Luxembourg (52.8%), Germany (52.3 %), France (51.8 %), Denmark (51.3 %), Latvia (51.0%) and Estonia (50.1%) this component accounted for over half the value of GDP. Fifteen Member States recorded a share of GDP that was below the EU average for compensation of employees, with the lowest proportions in Ireland (26.2 %), Greece (34.7 %) and Romania (37.7 %). This particularly low share observed in Ireland is a consequence of globalisation related effects that begun in 2015 when Irish GDP recorded an exceptional increase reflecting the activities of multinational enterprises.

Wages and salaries

Fifteen Member States recorded a higher or equal share of GDP compared to the EU average for wages and salaries with Lithuania (47.4 %), Denmark (47.3 %), Luxembourg (46.0 %) and Slovenia (45.8 %), accounting for over 45 % of GDP. The lowest proportions were recorded in Ireland (22.0 %), Greece (26.9 %) and Italy (28.9 %).

Employers' social contributions

Nine Member States recorded a higher share of GDP than the EU average for this component with the highest proportions being observed in France (12.6 %) and Belgium and Estonia (both 12.4 %). Six countries reported an employers' social contribution of less than 5 % of GDP: Romania (1.6 %), Lithuania (1.7 %), Malta (2.8 %), Denmark (4.0 %) and Ireland and Hungary (both 4.2 %).

Taxes on production and imports (less subsidies)

Fifteen Member States recorded a higher share of GDP than the EU average for this component, with the largest values observed in Sweden (19.5 %), Croatia (16.3 %) and Greece (14.4 %). Ireland (6.0 %) and Malta (6.2 %) recorded shares of less than 7 % of GDP.

Gross operating surplus and mixed income

Thirteen Member States recorded a higher share of GDP than the EU average for gross operating surplus and mixed income. In Ireland (68.4 %), Romania (53.3 %), Malta (52.8 %), Greece (50.9 %) and Slovakia (50.2 %), this component accounted for over half the value of GDP, while the lowest proportions were observed in Sweden (34.8 %), France (34.9 %), Slovenia (35.9 %) and Denmark (36.2 %). The particularly high share of this component in Ireland is related to globalisation related effects.

Changes over the last 20 years

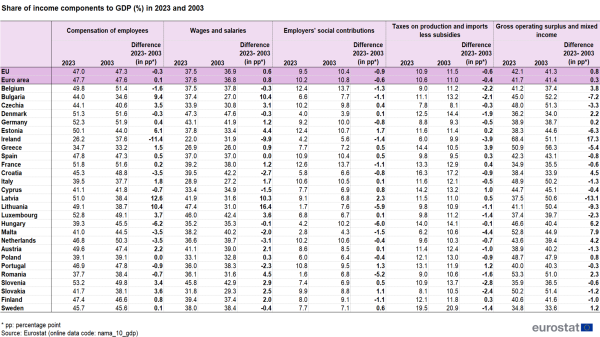

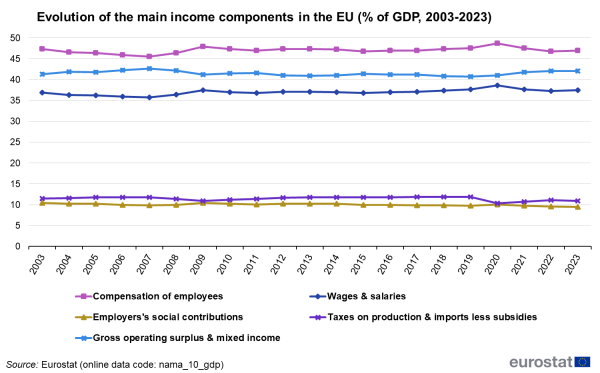

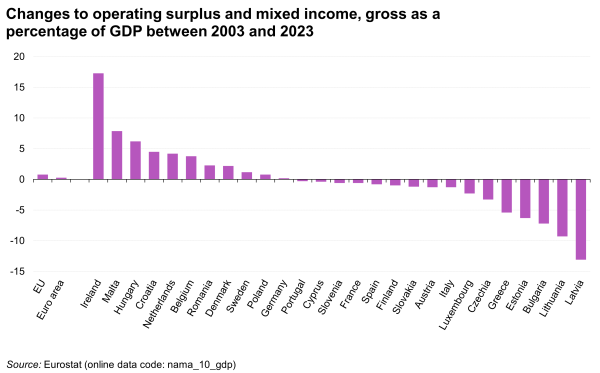

Figure 2 and Table 2 present the changes to each of the income components by Member State and the EU between 2003 and 2023. While the shares of different income components in the EU have actually been relatively stable over the last 20 years, impacts of the economic and financial crisis and the COVID-19 pandemic are visible in in 2009 and 2020. Between 2000 and 2007, a trend is observed of decreasing compensation of employees and increasing profit shares in relation to rather high increases of GDP. Then, the share of compensation of employees remained relatively resilient during the financial crisis, as profits took the biggest hits. After the crisis, trends remained relatively stable until 2019. With the COVID-19 pandemic in 2020, shares had moved to the benefit of compensation of employees and gross operating surplus and mixed income and at the expense of taxes on production and imports (less subsidies). In 2023, after two years of decrease, share of compensation of employees slightly increased but remained below pre-COVID levels. See Figure 2 and Table 2.

Source: Eurostat (nama_10_gdp)

Compensation of employees

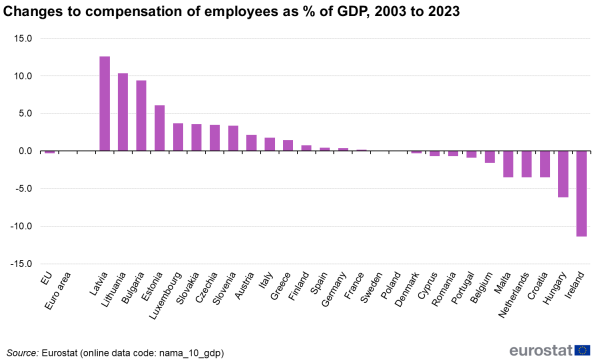

The share of compensation of employees had a decreasing trend between 2003 and 2007 then increased significantly in 2008-2009 during the economic crisis and decreased back to its early 2000 share. In 2020, this share increased during the COVID-19 pandemic but started decreasing steadily since 2021. In 2023, the trend was reversed and the share of this component increased slightly compared to 2022. Over the last 20 years, the share of compensation of employees decreased in the EU (-0.3pp) but increased slightly in the euro area (+0.1pp). Significant changes were noted across the Member States. The largest increases in the shares of GDP for compensation of employees over the last 20 years were observed in Latvia (from 38.4 % in 2003 to 51.0% in 2023 or +12.6 percentage points (pp)), Lithuania (+10.4pp) and Bulgaria (+9.4pp), while Ireland recorded the largest decrease (from 37.6 % in 2003 to 26.2 % in 2023, or -11.4pp). See Figure 3.

Source: Eurostat (nama_10_gdp)

Wages and salaries

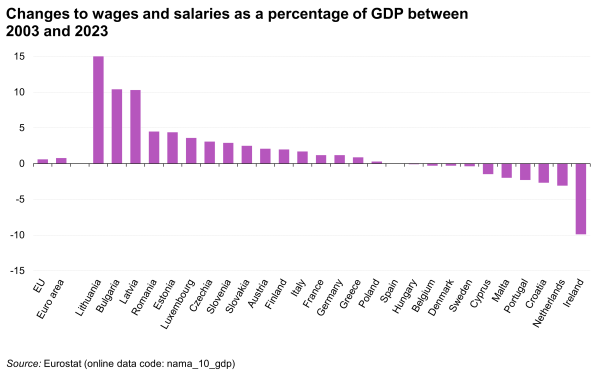

The share of wages and salaries has risen slightly in the EU over the last 20 years, (from 36.9 % in 2003 to 37.5 % in 2023, or +0.6pp) with the same trends as compensation of employees. However, this share is lower in 2023 than it was in 2019. For 16 Member States the share of this income component to GDP has increased between 2003 and 2023, with the most notable increases observed in Lithuania (from 31.0 % in 2003 to 47.4 % in 2023, +16.4pp), Bulgaria (+10.4pp) and Latvia (+10.3pp). Significant decreases in the share of this component were recorded in Ireland (from 31.9% in 2003 to 22.0 % in 2023, or -9.9pp), the Netherlands (-3.1pp) and Croatia (-2.7pp). See Figure 4.

Source: Eurostat (nama_10_gdp)

Employers' social contributions

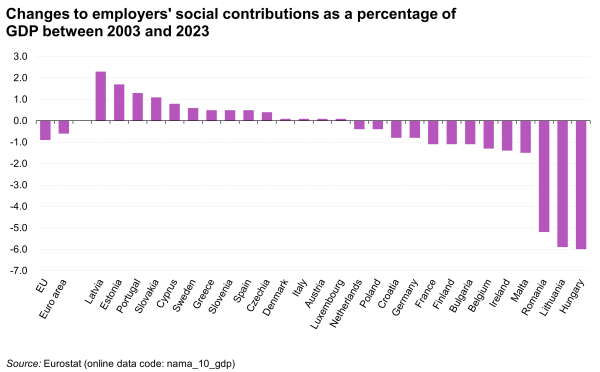

The share of employers' social contributions has decreased slightly in the EU over the last 20 years (-0.9pp). For 14 Member States the share of this income component to GDP has increased. The most notable increases were observed in Latvia (from +6.8 % in 2003 to 9.1 % in 2023, or +2.3pp), Estonia (+1.7pp) and Portugal (+1.3pp). Significant decreases in the share of this component were recorded in Hungary (from 10.2 % in 2003 to 4.2 % in 2023, or -6.0pp), Lithuania (-5.9pp) and Romania (-5.2pp). See Figure 5.

Source: Eurostat (nama_10_gdp)

Taxes on production and imports (less subsidies)

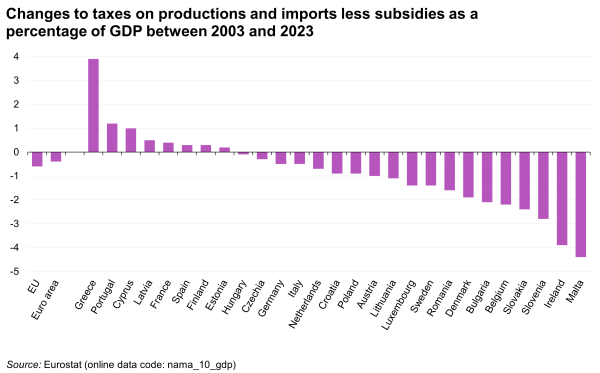

Over the past 20 years, the share of taxes on production and imports (less subsidies) increased except in 2008-2009 with the economic crisis (in 2008-2009), and in 2020 with the COVID-19 pandemic. In 2023, their share still remained below its pre-pandemic level. As a result, over the last 20 years, this share decreased slightly (-0.6pp) in the EU. Nineteen countries recorded a decrease in this share with the most significant decreases observed for Malta (-4.4pp), Ireland (-3.9pp) and Slovenia (-2.8pp). In eight Member States, the share of this income component to GDP has increased over the same period with the most notable increases observed in Greece (+3.9pp), Portugal (+1.2pp) and Cyprus (+1.0pp). See Figure 6.

Source: Eurostat (nama_10_gdp)

Gross operation surplus and mixed income

The share of gross operating surplus and mixed income increased steadily between 2003 and 2007 and took a big hit during the financial crisis in 2008-2009. Since 2016, this share decreased slightly up until 2019, but since 2020 has increased. As a result, over the last 20 years, this share increased slightly in the EU (+0.8pp) and in the euro area (+0.3pp). The largest increases in the share of GDP to gross operating surplus and mixed income were observed in Ireland (from 51.1 % in 2003 to 68.4 % in 2023, or +17.3pp), Malta (+7.9pp) and Hungary (+6.2pp), while the largest decreases in this share were recorded in Latvia (from 50.6 % in 2003 to 37.5 % in 2023, or -13.1pp), Lithuania (-9.3pp) and Bulgaria ( -7.2pp). See Figure 7.

Source: Eurostat (nama_10_gdp)

![]() Annual national accounts - evolution of the income components of GDP: tables and figures

Annual national accounts - evolution of the income components of GDP: tables and figures

Data sources and availability

GDP at market prices is the final result of the production activity of resident producer units. The income components of GDP are the main focus of the generation of income accounts, which can also be presented by industries. The aim of the GDP income components is to show how the value added, which has been generated in the production process, covers compensation of employees and other taxes (less subsidies) on production. The balancing item of this account is the operating surplus of the production units and mixed income of the households who act as producing units in the domestic economy. They present the income components from the point of view of the source sectors, rather than the destination sectors. Figure 1 shows the generation of income account for the EU in 2023.

GDP and main components

Income components of GDP

Compensation of employees (D.1) is defined as the total remuneration, in cash or in kind, payable by an employer to an employee in return for work done by the latter during an accounting period. It is made up of two main components.

The first component is wages and salaries (D.11), both in cash and in kind, and the second is employers' social contributions (D.12).

Some examples of transactions included in wages and salaries are basic wages and salaries that are payable to employees at regular intervals, enhanced payments such as overtime, night work, weekend work or disagreeable or hazardous circumstances. They include bonuses, holiday pay for official holidays and annual leave and housing allowances.

Employers' social contributions (D.12) are the social contributions payable by employers to social security schemes or other employment-related social insurance schemes to secure social benefits for their employees. These may be either "actual" or "imputed" contributions. Examples of these include actual payments made by employers for the benefit of employees to insurers such as social security and other employment-related social insurance schemes. They also include imputed contributions which represent the counterpart to their social insurance benefits paid directly by employers to their employees without involving an insurance enterprise or autonomous pension fund with a segregated funding reserve.

Compensation of employees is also presented by industry through the NACE Rev.2 A*10 classification.

Taxes on production and imports (D.2) consist of compulsory, unrequited payments, in cash or in kind, which are levied by general government, or by the institutions of the EU in respect of the production and importation of goods and services, the employment of labour, the ownership or use of land, buildings or other assets used in the production process. These taxes are payable irrespective of profits made.

Subsidies (D.3) are current unrequited payments which general government or the institutions of the EU make to resident productions. Their objective is mainly for influencing levels of production, prices of product or the remuneration of the factors of production.

Gross operating surplus (B.2g) and mixed income (B.3g) is the balancing item of the generation of income account. Operating surplus is a measure of the surplus accruing from the production process before deducting any explicit or implicit interest charges, rent of other property incomes payable on the financial assets, land or other natural resources which have contributed to this production. The latter contains an element of remuneration for work done by the owner or other members of the households that cannot be separately identified from the return to the owner as an entrepreneur and it is associated with the self-employed.

Context

European institutions, governments, central banks as well as other economic and social bodies in the public and private sectors need a set of comparable and reliable statistics on which to base their decisions. National accounts can be used for various types of analysis and evaluation. The use of internationally accepted concepts and definitions permits an analysis of different economies, such as the interdependencies between the economies of the EU Member States, or a comparison between the EU and non-member countries.

Direct access to

- European sector accounts — background (background article)

- Main users of national accounts (background article)

- Update of the 1993 SNA and revision of ESA 95 (background article)

- Annual national accounts (t_nama)

- Annual national accounts (nama_10)

ESMS metadata files

- Annual national accounts (ESMS metadata file — nama10_esms)

- Supply, use and Input-output tables (ESMS metadata file — naio_10_esms)

Methodology manuals

- Essential SNA — Building the basics — 2014 edition

- European system of accounts — ESA 2010

- European system of accounts — ESA 2010 — Transmission programme of data (multilingual)

- Eurostat-OECD methodological manual on purchasing power parities

- Handbook on price and volume measures in national accounts

- Manual on the changes between ESA 95 and ESA 2010 — 2014 edition

Other methodological information

- National accounts, see Methodology: