Short-stay accommodation offered via online collaborative economy platforms

Data extracted in July 2024

Planned article update: 2 July 2025

Highlights

In 2023, almost 719 million nights were booked via collaborative economy platforms – an increase of more than 20%.

In 2023, Paris was again the most popular city - almost 20 million guest nights were booked there via online platforms.

The collaborative economy had a significant impact on the tourist accommodation market in the past decade. Online platforms make it easier for service providers to advertise their rooms or apartments to potential guests and this easier access to the market, for owners as well as for guests, increased the attention for this segment of the market. An agreement between the European Commission and four large online collaborative economy platforms (Airbnb, Booking, Expedia Group and Tripadvisor), signed in March 2020, allows Eurostat to compare guest nights spent in short-stay accommodation offered via online platforms from 2018 onwards. The expression 'platform tourism', refers to short-term rentals, such as apartments, booked through these four platforms, excluding other forms of accommodation, such as hotels or campsites.

The Covid-19 pandemic had major impacts on all sectors of tourism between 2020 and 2022, but platform tourism has rebounded and is exceeding pre-pandemic levels. This fast growth continued in 2023. This article focuses on national, regional and city level data on guest nights spent in 2023. A separate article focusing on the impact of the pandemic is available as well. Finally, a shorter article focusing on monthly data which is updated quarterly is also available.

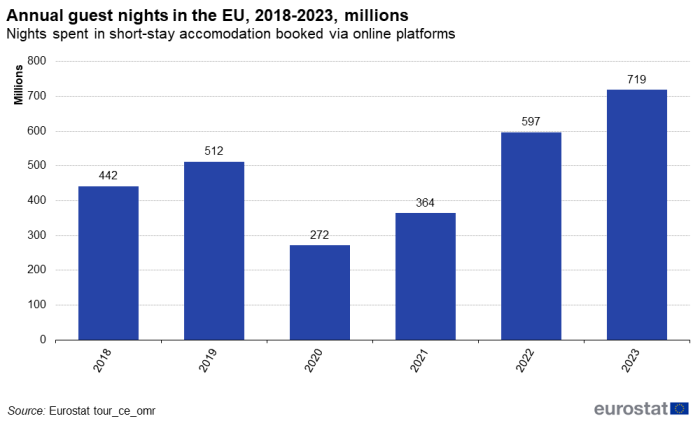

In 2023, 719 million guest nights were spent in accommodation booked via the four online platforms, compared with 597 million in 2022 and 364 million in 2021. This means that the fast growth observed in 2022 continued in 2023, with a growth of around 20.5% compared with the previous year (see Figure 1). The number of guest nights was far above pre-pandemic levels (512 million guest nights in 2019).

Full article

In 2023, almost 2 million tourists per night slept in a bed booked via the platforms

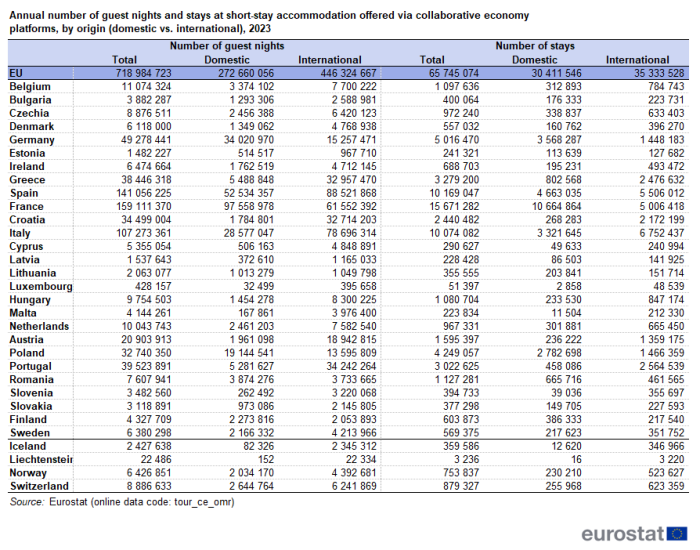

In 2023, almost 719 million guest nights spent in the European Union (EU) were booked via the four online platforms, (see Table 1 and Figure 1), or on average 1.97 million guests each day. The number of guest nights takes into account the number of nights spent during a stay and the number of tourists in the travel party. The concept is similar to the 'nights spent at tourist accommodation establishments' generally used in official tourism statistics, and will be the focal volume indicator in this article. Almost one-quarter of these nights were spent in France (159 million guest nights), followed by Spain (141 million). Italy (107 million guest nights), Germany (49 million) and Portugal (40 million) complete the top five. Additional countries with over 10 million guest nights recorded in 2023 were Greece (38 million), Croatia (34 million guest nights), Poland (33 million), Austria (21 million), Belgium (11 million) and the Netherlands (10 million).

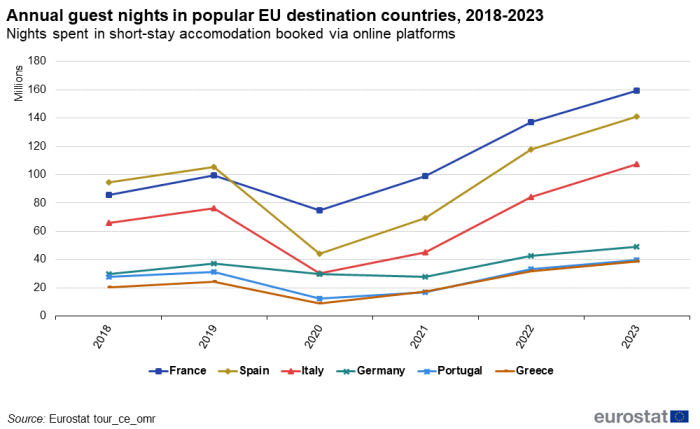

After the pre-pandemic record year of 2019 with 512 million guest nights spent, the pandemic lead to a huge contraction by 47% in 2020 (272 million), followed by the beginnings of a recovery in 2021 (364 million; +34%). In 2022, the pre-pandemic baseline was exceeded for the first time (597 million; +64%). In 2023, the growth continued at a very fast level (719 million; +21%). This general trend in the years following the pandemic remains true when looking at the most popular countries (see Figure 2). Particularly year-to-year growth exceeding the total EU growth can be observed in Italy (+27.5%) and Greece (+21.6&%). In countries such as France and Germany, which experienced a smaller dip during the pandemic compared with other countries, growth in 2023 has been less pronounced (+16.0% in both countries).

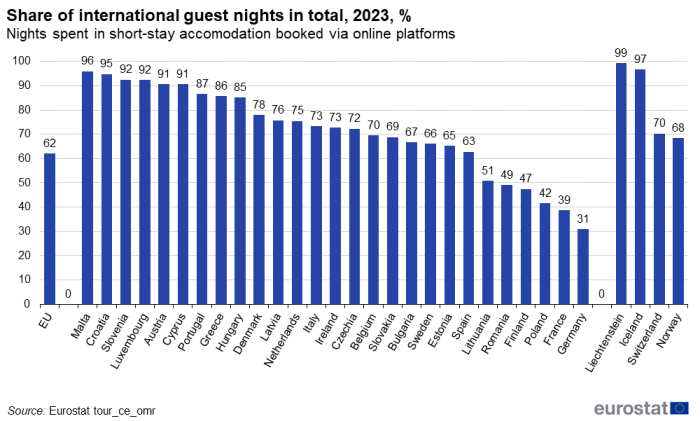

In the EU, 6 out of every 10 guest nights were spent by a tourist from another country (446 million guest nights, or 62.1%). However, this share has decrease when compared with pre-pandemic times (67% in 2019) and is recovering only slowly (59.9% in 2022). In 8 out of the 31 EU and EFTA countries in the analysis, the share of international guest nights exceeded 90% (see Table 1 and Figure 3). In 3 countries, Liechtenstein, Iceland, and Malta, the international share was more than 95%.

Looking at another indicator, the 719 million guest nights spent in the EU during 2023 represented 66 million stays (see Table 1). Stays correspond to the number of individual bookings of short-term rental accommodation, not taking into account the length of the stay. This means that each minute, around 125 stays were booked and each day more than 180 000. The highest number of stays were recorded in France (15.6 million stays), Spain (10.2 million stays) and Italy (10.1 million stays). These 3 countries accounted for more than half of the total number of stays in 2023.

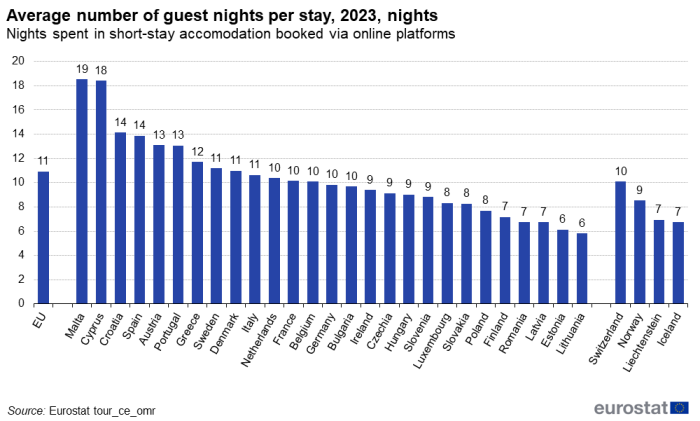

On average in the EU, throughout 2023, one booking or stay represented 10.9 guest nights (see Figure 4). The highest number of guest nights per stay (not to be confused with the average duration of the stay, which does not take into account the number of guests) was observed in the southern countries Malta (19 guest nights per stay), Cyprus (18 nights), Croatia, Spain (14 nights) and Portugal (13 nights), as well as in Austria (13 nights). At the other end of the spectrum, a stay at a destination in Estonia or Lithuania, led to, on average, no more than 6 guest nights. Over time, the average length of stays has stayed more or less constant over time, notwithstanding a minor bump during the pandemic (11.2 in 2018; 11.7 in 2020).

More than 1 in 3 guest nights were spent in the peak months July and August

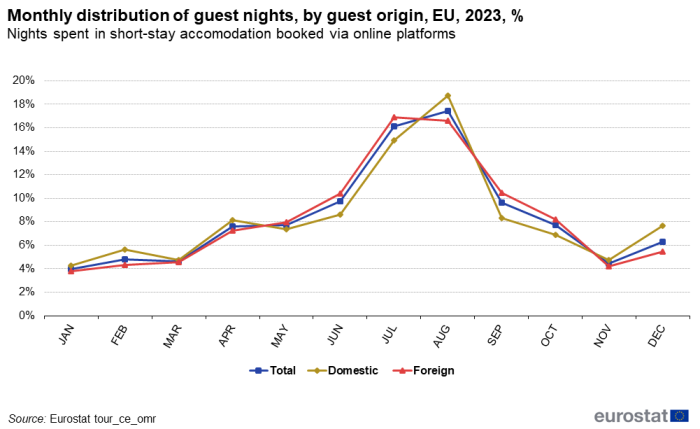

Seasonality in tourism generally peaks in the 2 summer months of July and August, and this is no different for the accommodation booked via online platforms. More than a third of guest nights spent in short-term rentals during 2023 occurred in July (16.1%) and August (17.4%) (see Figure 5). The slowest months were January, February, March and November, each accounting for around 4-5% of the total number of guest nights spent during 2023.

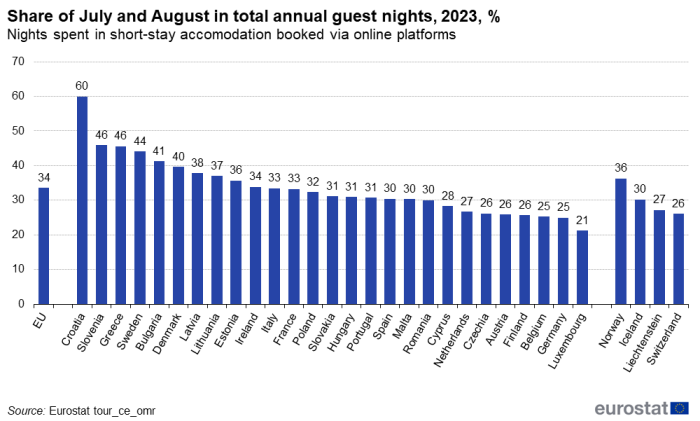

In all EU and EFTA countries but Finland (where it is July and December), July and August are the 2 busiest months, but the level of seasonality (measured as the share of July and August in the total guest nights spent during the year) is highest in Croatia (60% of annual guest nights recorded in July or August), Slovenia (46%), Greece (46%) and Sweden (44%) (see Figure 6). In Luxembourg (21%), Germany (25%), Belgium (25%) and Finland (26%), the 2 summer months were less dominant.

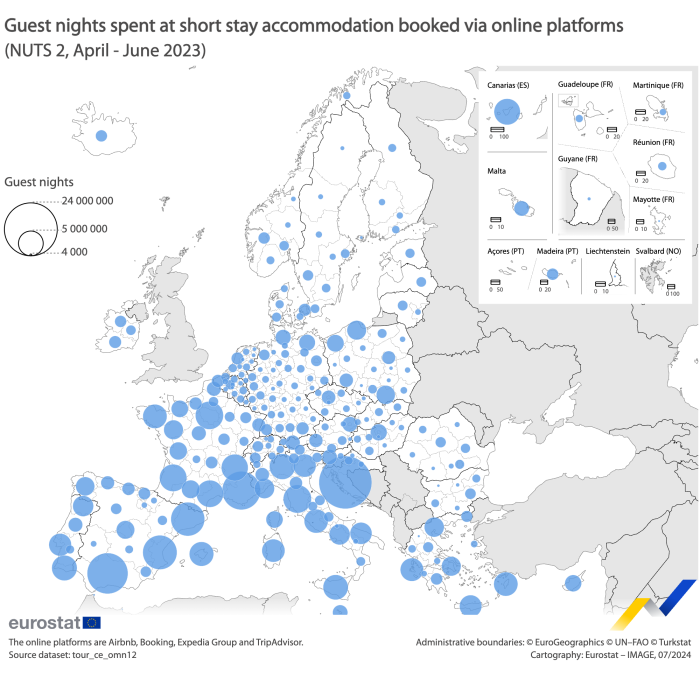

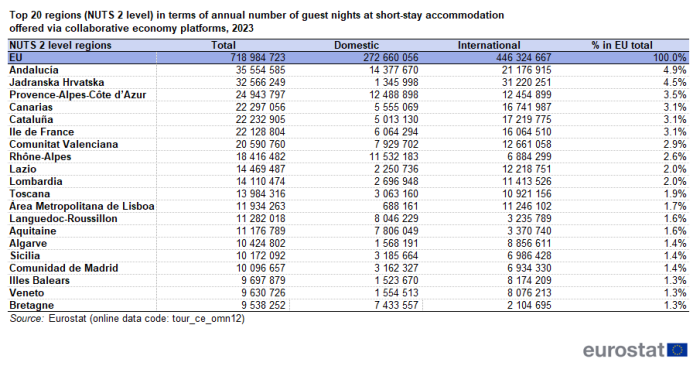

The 20 most popular regions account for nearly half the total guest nights

The 27 Member States of the EU are divided in 242 statistical regions (NUTS 2 level, see highlight figure). In 2023, in 17 of these regions, the number of guest nights spent at accommodation facilities booked via the four online platforms exceeded 10 million guest nights. The 3 most popular regions in the EU in 2023 were Andalucia (36 million guest nights), Jadranska Hrvatska (Adriatic Croatia, 33 million), and Provence-Alpes-Côte d'Azur (25 million). Together, these 3 regions accounted for almost 13% of the guest nights spent in the EU that were reserved via the platforms. The 20 most popular regions account for nearly half (47%) of the total number of guest nights spent via the platforms (see Table 2). Most of these top 20 regions are located in Spain (7 regions), France (6), or Italy (5). Croatia and Portugal have one region each in the top 20.

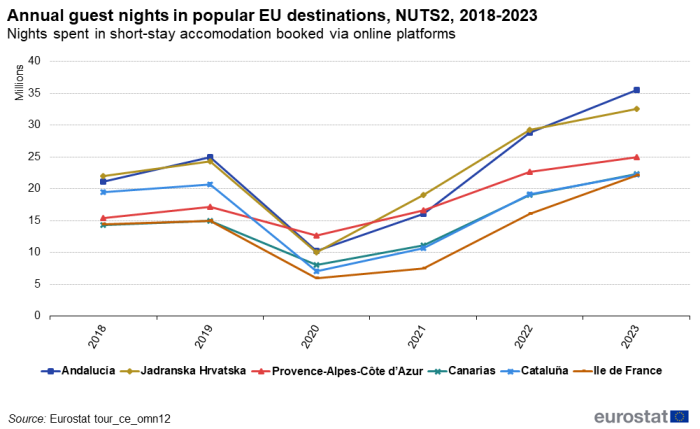

The development over time of the six most popular regions shows not a lot of relative movement. All six regions have exceeded their pre-pandemic baseline, and Andalucía is now the most popular region, having overtaken Jadranska Hrvatska.

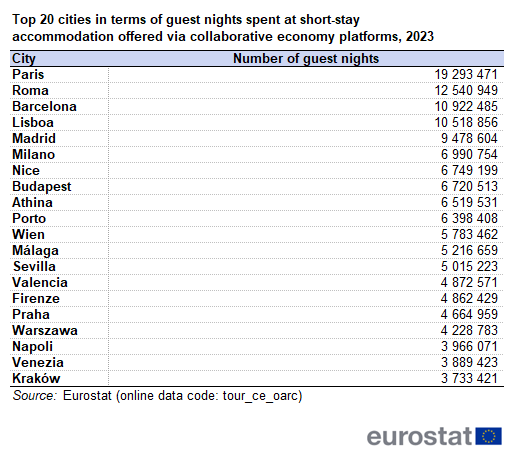

Paris was again the most popular city

The four platforms send data to Eurostat at the level of Local Administrative Units (LAUs), the data can be aggregated to the level of the most significant cities in Europe. In the EU and EFTA, 60 cities recorded more than one million guest nights in 2022 (see Table 3 for the top 20). The top city destinations for tourists booking their accommodation through any one of the four platforms were Paris (19.3 million guest nights, or more than 52 000 guests on an average night), Rome (12.5 million), Barcelona (10.9 million), Lisbon (10.5 million) and Madrid (9.5 million). Taken together, these five cities account for around 8.7% (62.8 million) of all nights spent in the EU booked via the four platforms (719 million).

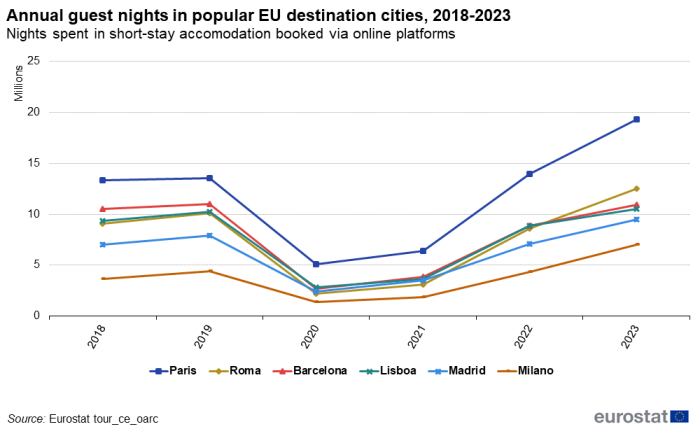

Looking once again at the development over time of the most popular cities (Figure 8), it becomes clear that the popularity of city tourism experienced a strong rebound in tourism activity in the post-pandemic period. All cities except Barcelona have now exceeded their pre-pandemic records. The Italian cities Milan (+60%) and Rome (+46%) showed the most significant increases in guest nights in 2023.

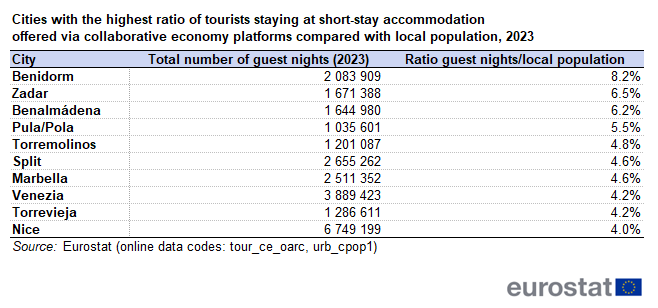

When considering the local population figures, the European cities that had, on an average night in 2023, the highest ratio of tourists staying in platforms-listed accommodation as compared with local residents, were Benidorm, Benalmádena and Torremolinos in Spain (8.2%, 6.2% and 4.8%), as well as Zadar and Pula in Croatia (6.5% and 5.5%) (see Table 4). To put these values in perspective, this ratio is 0.44% for the EU as a whole.

Feedback

To help Eurostat improve these experimental statistics, users and researchers are kindly invited to give us their feedback by email

Source data for tables and graphs

Data sources

The article is based on data provided to Eurostat by four international platforms (Airbnb, Booking, Expedia Group and Tripadvisor), following agreements on data exchange concluded early 2020. The data covers short-stay accommodation in the EU and EFTA countries, offered by service providers via any one of these four online collaborative economy platforms.

Both the article and the data only refer to the accommodation offered through the four platforms, and can – due to possible overlaps – not be added to other tourism statistics on holiday rentals or other types of accommodation such as hotels, available via European statistics on tourist accommodation. Additionally, only merged data for the four platforms is released: no data on individual platforms is disclosed.

This article uses data that are published as experimental statistics. Such statistics use new data sources or methods to match user needs, but have not yet reached the maturity of fully-fledged official statistics. The project pioneers Eurostat's use of privately held data via a direct cooperation with the industry, to produce reliable data covering the entire EU in a coherent way.

Scope and key concepts

- Scope: the data covers holiday rentals (excluding hotels and campsites) offered via four online collaborative economy platforms.

- Number of stays: number of times a facility offered via the platforms was occupied.

- Number of nights: number of nights a facility offered via the platforms was occupied

- Number of guest nights: number of nights spent during a stay, taking into account the size of the travel party; this article. mainly focuses on this concept (e.g.: a family of four staying 3 nights in an apartment represents 1 stay, 3 nights and 12 guest nights).

- Domestic guest nights: guest nights spent by tourists who are residents of the country visited.

- International guest nights: guest nights spent by tourists who are non-residents to the country visited.

- Cities are those local administrative units (LAU) where at least 50% of the population lives in an urban centres; an urban centre is a cluster of contiguous grid cells of 1 km2 with a density of at least 1 500 inhabitants per km2 and collectively a population of at least 50 000 inhabitants. A city can be composed of several local administrative units. For the purpose of these statistics, only 'selected cities' are considered, namely those cities that fulfil at least one of the following criteria: i. capital cities; ii. cities having at least 200 000 inhabitants; iii. other cities in a country that, jointly, account for 90% of annual guest nights spent in cities of that country. Further information on the delineation of the 'selected cities', namely which local administrative units they comprise, can be found

here.

here.

Context

The collaborative economy, also called the sharing economy, covers a great variety of sectors and is rapidly growing across Europe. In the tourism sector, the collaborative economy provides many exciting opportunities for citizens as consumers as well as for micro-entrepreneurs and SMEs. At the same time, its rapid development has led to challenges, particularly in popular tourist destinations. As a result, cities and other communities are seeking to strike a balance between promoting tourism, with the economic benefits it brings, and maintaining the integrity of local communities. To promote a balanced development of the collaborative economy, the Commission issued guidelines to EU countries in 2016 on how existing EU rules apply to the collaborative economy. A series of workshops in 2017 and 2018 identified policy principles and good practices specifically on collaborative short-term accommodation services.

In March 2020, the Commission reached a landmark agreement with Airbnb, Booking, Expedia Group and Tripadvisor on data sharing. The agreement, signed between each platform and Eurostat on behalf of the European Commission, allows Eurostat to obtain key data from the four collaborative platforms and publish key statistics on short-term accommodation rentals concluded through these platforms on its website. In particular, platforms agreed to share, on a continuous basis, data on the number of nights booked and the number of guests. The privacy of citizens, including guests and hosts, is protected in line with applicable EU legislation and data will not allow individual citizens or property owners to be identified. The data provided by the platforms is then subject to statistical validation and aggregated and published by Eurostat.

The agreement has allowed, for the first time, access to reliable data about holiday and other short-stay accommodation offered via these collaborative economy platforms. It helps to close an information gap, since data on holiday homes, apartments and rooms in otherwise private buildings are often outside the scope of existing tourism registers.

Direct access to

See also

Database

- Tourism (tour), see:

- Accommodation offered via collaborative economy platforms - experimental data (tour_ce)

- Occupancy - monthly data (tour_ce_om)

Dedicated section

Methodology