Data extracted in September 2024.

Planned article update: July 2025.

Highlights

The EU raised €317.2 billion from environmental taxes in 2022.

Energy taxes represented more than three-quarters of EU environmental tax revenue in 2022.

(€ billion, %)

Source: Eurostat (env_ac_taxind2), (gov_10a_taxag), (nama_10_gdp)

This article presents the results of a detailed analysis of data on environmental taxes in the European Union (EU), complementing the article on Environmental tax statistics. It provides information on the evolution, drivers and payers of environmental tax revenue.

Economic instruments like environmental taxes play a crucial role in pollution control and resource management. These tools are becoming increasingly vital in the environmental policies of the European Union (EU) and OECD countries due to their flexibility and cost-effectiveness. They embody the principle that those responsible for pollution should bear the costs of their environmental impact. An environmental tax is a tax whose tax base is a physical unit (or a proxy of it) of something that has a proven, specific negative impact on the environment and which is defined in the European System of Accounts (ESA 2010) as a tax.

General overview

In 2022, EU environmental tax revenue totalled €317.2 billion, representing 4.8% of the total government revenue from taxes and social contributions (TSC) and 2% of the EU GDP. This marked a 4% decrease in 2022, following an increase of 9% in 2021 and a decrease of 9% in 2020.

Source: Eurostat (env_ac_taxind2), (nama_10_gdp), (gov_10a_taxag)

The ratio of environmental tax revenue to GDP reached its lowest point at 2% in 2022. Similarly, the share of environmental taxes in total TSC fell to a historic low of 4.9% in 2022, down from its highest point of 6.1% in 2011.

While some EU countries, like Bulgaria (+6.3%) and Greece (+3%), saw increases in environmental tax revenue between 2021 and 2022, others, such as Italy (-1.9%) and the Netherlands (-1.6%), experienced declines. See Figure 2.

Source: Eurostat (env_ac_taxind2), (gov_10a_taxag), (nama_10_gdp)

The European Green Deal recognizes the pivotal role of taxation in the transition toward a more environmentally sustainable European economy. It emphasizes the necessity to align taxation systems with EU climate objectives. Thoughtfully designed tax reforms can stimulate economic growth, reduce greenhouse gas emissions by effectively pricing carbon, and contribute to an equitable transition.

The Roadmap to a Resource Efficient Europe (European Commission, 2011) included the following milestone: by 2020, a major shift from taxation of labour towards environmental taxation will lead to a substantial increase in the share of environmental taxes in government revenue, in line with the best practice of EU countries.

However, the data shows a declining trend in the ratio of environmental taxes to total tax revenue, which has become more pronounced over the years, indicating limited progress in achieving resource efficiency objectives.

In the last years, the share of environmental taxes and labour taxes within total tax revenue continued to shrink. Labour and environmental taxes remained steady from 2010 to 2017 and then diverged. The share of labour tax increased until 2020 and then dropped, reaching a historic low in 2022, with a decline of 0.6% from the previous year. The share of environmental taxes also fell by 0.6% in 2022. These declines led to a 3.8% reduction in the share of labour taxes and a 19.8% drop in environmental taxes as part of total taxation, compared with 2010 levels. Despite this, labour taxes still made up 50.6% of total tax revenues, while environmental taxes accounted for just 4.8%, making labour taxes nearly 10.5 times larger than environmental taxes in terms of their contribution.

Source: Eurostat (env_ac_taxind2), DG TAXUD

Energy taxes stand out as the major source of EU environmental tax revenue version

Environmental tax revenue is categorized into four primary groups: energy taxes, transport taxes, pollution taxes, and resource taxes. Due to the relatively small proportion of pollution and resource taxes in the total environmental tax revenue and the challenges in classifying certain minor national taxes, this article pairs up these two types of taxes when presenting the structure of environmental taxes.

In 2022, most of the EU environmental tax revenue (76.5%) originated from energy taxes. This tax encompasses levies on energy products such as coal, oil products, natural gas, and electricity used for stationery and transport purposes. CO2 taxes, typically imposed on energy products, also fall under this category by convention.

It should be noted that the energy taxes for some countries do not include the levies imposed within the ring-fenced schemes to finance the transition to other renewable energy sources, e.g. Germany's Renewable Energy Sources Act (EEG).

Transport taxes primarily comprise taxes related to motor vehicle ownership and usage. In 2022, these taxes constituted 19.2% of the EU's total environmental tax revenue.

Pollution and resource taxes encompass various types of taxes, including those on raw material extraction, emissions to air and water (e.g., NOx, SO2), noise, and waste management. Only 4.3% of the EU's total environmental tax revenue in 2022 was generated from these taxes.

The tables below provide a comprehensive overview of revenue from environmental taxes in the EU over the period 2010-2022.

Energy taxes saw a decline of -5.8% between 2021 and 2022. When evaluating the revenue from energy taxes as a percentage of the total tax and social contribution revenue, a more diverse pattern emerges. These findings highlight that while energy taxes form a significant part of environmental taxes, the overall share of environmental taxes, inclusive of energy taxes, experiences more fluctuations when considering other taxes and social contributions.

By contrast, although transport taxes have exhibited slightly more pronounced revenue fluctuations, variations in their contribution to total environmental tax revenue, and their portion of the overall tax and social contribution revenue over the past decade, transport taxes increased by about 1 percentage point in 2022 compared with 2021.

Pollution and resource taxes revenue grew +10% in 2022 compared with 2021, while remaining practically constant in terms of revenue in per cent of total revenues taxes and social contributions.

Source: Eurostat (env_ac_taxind2), (gov_10a_taxag), (nama_10_gdp)

There are significant variations between EU countries in the distribution of these tax types. For example, energy taxes contributed 14.5% of total revenues in Bulgaria but only 2.4% in Ireland, 2.2% in Malta, and 0.06% in Czechia for transport taxes; and 2% in Croatia and 0.01% in Romania for pollution and resource taxes.

Environmental taxes exhibit variability across EU countries over time. In 2022, Bulgaria saw a 6.5% increase in energy taxes, while Italy experienced a 2% decline. Transport taxes were more stable, with Iceland reporting a slight 0.1% rise and Denmark a 0.3% drop. Pollution and resource taxes, though a small part of total environmental taxes, also showed shifts. For instance, Cyprus saw a 0.6% increase from 2021 to 2022, while Croatia reported a 0.25% drop, despite its significant share of overall tax revenue.

In 2022, corporations contributed 51.8% of environmental taxes, surpassing households, which contributed 44.9%. This marked a shift from 2021, where contributions were more evenly distributed. Corporations were the largest contributors to energy taxes (57.2%), while households paid the majority of transport taxes (67.6%) and pollution and resource taxes (53.4%). Non-residents contributed the least across all tax types.

Source: Eurostat (env_ac_taxind2), (gov_10a_taxag), (nama_10_gdp)

CO2 taxes as a distinct sub-category of energy taxes

CO2 taxes or carbon taxes are levied on the carbon content of fossil fuels. While all energy taxes increase the price of energy products, CO2 taxes must have a clear tax base (carbon content), which makes this type of tax distinct compared with other energy taxes. Consequently, a CO2 tax provides an incentive to use a fuel with lower carbon content.

CO2 taxes are regarded as a borderline case between energy and pollution taxes. However, they are recorded as energy taxes in EU statistics given that they are levied on energy products and have usually been introduced as a substitute for other energy taxes. The revenue from these taxes can be substantial compared with the revenue from pollution taxes and the recording of CO2 taxes with pollution taxes would distort both the time series at national level and for international comparison.

In recent years, several EU countries have introduced a carbon tax which ranges from less than €1 per metric ton of carbon in Poland to over €110 in Sweden, Liechtenstein and Switzerland. Apart from country-specific levies, the EU CO2 taxes also cover government revenue from the auctions of emission permits under the EU Emissions Trading System (EU ETS), which is recorded by all EU Member States.

Emission permits

The payments collected by EU Member States for emission permits (emission allowances) are one example of CO2 taxes. Under the European System of Accounts 2010 (ESA 2010), i.e. the accounting standards underpinning compilation of macro-economic statistics (National Accounts), the ETS auction revenues are recorded as taxes. Please note that ESA 2010 accounting rules are followed for compilation of all the taxation data presented in this article, including the ETS revenue described in this section.

Governments are increasingly using such emission trading systems, based on a cap and trade principle, to control total CO2 emissions. The EU ETS was introduced in 2005 and, up to 2012, governments allocated allowances for free. However, auctioning has been the default method for allocating allowances within phase 3 (2013-2020) of the EU ETS. In 2013, over 40% of the allowances were auctioned. This proportion has been increasing over recent years and is expected to further increase. In phase 4 of the EU ETS (2021-2030), the overall number of emission allowances will further decline. The system of free allocation will be re-focused on sectors at the highest risk of relocating their production outside of the EU. These sectors will receive 100% of their emission permits for free. For less exposed sectors, free allocation is foreseen to be phased out after 2026. A considerable number of free allowances will be set aside for new and growing installations.

Under ESA 2010, governments should record the proceeds from an auction of emission trading allowances as other taxes on production (D.29) and on an accrual basis (i.e. at the time of CO2 emissions covered by a permit, meaning only in the year when the permits are used (surrendered) and not when they are auctioned).

Total CO2 tax revenue relating to EU ETS allowances reported by EU countries amounted to €27.2 billion for 2022, compared with €19.4 billion for 2021, demonstrating the increasing importance of emission trading systems in shaping environmental taxation and generating government revenue.

EU countries must direct at least 50% of ETS revenue towards tackling climate change. Additionally, the EU uses a portion of this revenue to support innovation and fund the energy transition across Member States.

Evolution of environmental tax revenue in Europe between 2010-2022

Between 2010 and 2022, most EU Member States saw a decline of -0.6% in average of the share of environmental taxes within total tax revenue. Figure 5 illustrates a comparison of the share of environmental taxes within TSC for the years 2010 and 2022. Among the EU Member States, 21 countries observed a decrease in this percentage, while six countries experienced an increase. Greece showed the most substantial increase, with a +2.3% rise. Among the countries with declining trends, Ireland and Denmark recorded the most significant decreases, with Ireland's share of environmental taxes within TSC dropping from 8.6% to 5.3%, and Denmark's share falling from 8.7% to 5.9%. For changes from 2010 to 2022, see the dots and the axis on the right.

Source: Eurostat (env_ac_taxind2) and DG TAXUD

Main drivers behind the evolution of environmental taxes

This section focuses on the evolution of environmental tax revenue and its primary components—energy taxes and transport taxes—in comparison with recent developments in the EU economy and key associated economic and fiscal indicators. The COVID-19 pandemic interrupted the consistent upward trend in environmental taxes from 2010 to 2019, causing a dip in 2020. However, a sharp recovery was observed in 2021 and 2022 for all trends, except energy taxes and consequently total environmental taxes that saw a drop in 2022. Meanwhile, transport taxes rose by 1.5%, and pollution and resource taxes saw a significant 13.6% increase in 2022. Figure 6 presents the trajectory of GDP, total tax revenue, energy taxes, transport taxes, and pollution and resource taxes from 2010 to 2022, all standardised for ease of comparison (indexed to 2010).

Source: Eurostat (env_ac_taxind2), (gov_10a_taxag), (nama_10_gdp), (env_ac_tax)

Evolution of energy taxes and the implicit tax rate (ITR) on energy

The ratio of energy tax revenue to GDP in the EU has declined since 2017, with a substantial decline from 97.8% in 2021 to 86.2% for 2022. See Figure 7.

Source: Eurostat (nrg_bal_s), (nama_gdp_k), (env_ac_taxind2), (gov_10a_taxag), (nama_10_gdp)

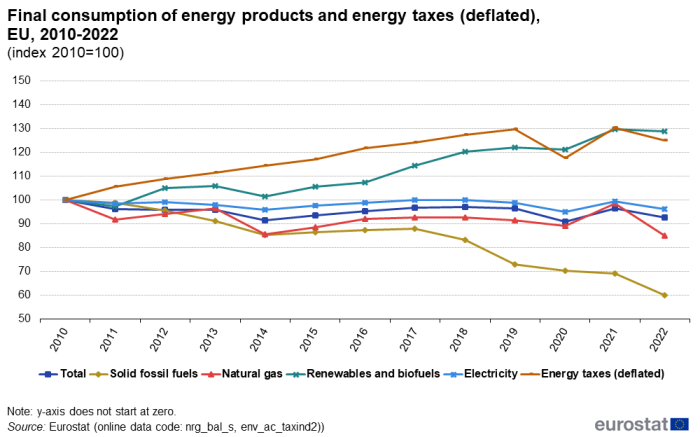

Energy intensity—measuring the energy consumption per unit of GDP—has been on a gradual decline since 2010. The reduction for 2022 is largely due to overall GDP growth, despite dips following the 2008 financial crisis and the 2020 pandemic. See Figure 8. The ITR on energy, which has been increasing over time, is illustrated by the relationship between the adjusted revenue generated from energy taxes and final energy consumption. Final energy consumption fluctuates in a range of 5% below the 2010 level.

Source: Eurostat (env_ac_tax), (ten00120), (nama_10_gdp), (nrg_100a), (nrg_ind_ei)

The ongoing transition from fossil fuels to renewables has played a crucial role in changing consumption patterns. Between 2010 and 2022 a substantial decline in solid fossil fuel consumption can be observed, while renewables and biofuel use increased by 28.7%. Despite fluctuations, consumption of electricity and natural gas remained relatively steady. The decline in greenhouse gas emissions (GHG) intensity—driven by a shift toward cleaner energy sources—reflects the growing focus on reducing emissions.

Source: Eurostat (nrg_bal_s), (env_ac_taxind2)

The relationship between energy consumption and GHG emissions can be measured through the GHG emissions intensity of energy consumption. This indicator calculates GHG emissions per unit of energy used, comparing energy-related emissions with gross inland energy consumption. In EU economies, GDP growth is often linked to higher energy consumption. As GDP rises, energy taxes also increase, but the intensity of GHG emissions gradually declines. This trend is attributed to the transition toward cleaner energy sources, which has slowed the reduction in emissions intensity despite continued economic growth.

Source: Eurostat (sdg_13_10), (env_ac_taxind2), (nama_10_gdp)

The ITR on energy in the EU increased from €203.9 in 2010 to €224.9 per tonne of oil equivalent (TOE) in 2022. ITR levels varied significantly across member states, with Greece and Denmark showing higher rates, while countries like Iceland and Hungary remained below the EU average.

Source: Eurostat (env_ac_tax), (ten00120)

Trends in transport taxes

Transport taxes are levied mainly on vehicles when they are sold (e.g. sales taxes) and then for each year they are licensed for use on the road (e.g. circulation tax). As a result, the revenue from transport taxes tends to follow the dynamics of vehicle sales and vehicle stocks. These two factors might then partly explain the reduction in transport tax revenue observed after the two main economic crises in the last two decades: the drop after 2007 and the drop in 2020 due to the Covid-19 pandemic. The number of new vehicle registrations in the EU also decreased between 2010 and 2013. In countries with high car sales taxes, the economic downturn following the financial crisis impacted on car sales and therefore on revenue from such taxes. However, demand started to pick up again from 2014, surpassing pre-crisis levels by 23 % in 2019. But the economic downturn in 2020 impacted car sales again and its revenue from taxes. In 2020, the demand returned to the level of 2014, but in the last two years there was still a slight downward trend for new registrations, whereas for transport tax revenue a slight increase could be observed. (see Figure 12).

Source: Eurostat (env_ac_tax), (road_eqr_carmot)

Since the revenue from transport taxes is also influenced by the dynamics of vehicle stocks, Figure 13 below illustrates these developments.

Source: Eurostat (env_ac_taxind2), (tran_r_vehst)

Environmental taxes by payer

Energy taxes: corporations surpass households as primary contributors

In 2022, corporations contributed 56.8% of the EU's energy tax revenue, surpassing households, which contributed 40.4%. This marks a shift of contributions to energy taxes from households to corporations. Luxembourg (51%) and Malta (37.3%) reported the highest shares of non-resident fuel purchases, followed by Austria (21%), which is nearly identical to its 2021 figures. Households in several countries, such as Denmark (60%), Slovenia (52.1%), and Cyprus (47.9%), bore a significant portion of the energy taxes in 2022, contributing around 60% or more of the total. Beyond the EU, households in Switzerland contributed approximately for 47.5% of energy taxes. The services sector, which includes transportation and trade, accounted for 24.8% of the EU's energy tax revenue. Bulgaria reported the highest share, exceeding 54%, followed by the Netherlands, Lithuania, and Latvia, each contributing about 45%. Beyond the EU, in North Macedonia, the services sector contributed approximately for 38.3% of energy taxes. Manufacturing, construction, mining, and utilities together generated 32% of the EU's energy tax revenue, with Romania recording the highest share at 67.8%, while Luxembourg had the lowest at 8.6%.

Source: Eurostat (env_ac_taxind2)

Transport taxes: households shoulder the majority of the burden

Similar to 2021, in 2022 transport taxes primarily fell on households, who contributed 68.2% of the EU's transport tax revenue. Corporations, by contrast, contributed 30.8%, as shown in Figure 15. This discrepancy is largely due to motor vehicle taxes. Among EU Member States, Spain, Italy, Malta, Austria, and Finland saw households contributing over 75% to transport tax revenue. This contrasts to Slovakia and Czechia, where corporations bore the brunt of transport taxes and households made only marginal contributions, with shares of 7.8% and 13%, respectively. Services were the second-largest EU contributors to transport taxes (24%), with Slovakia and Czechia leading in this category (exceeding 60%). By contrast, manufacturing accounted for 6.8%, while other categories contributed minimally, typically around 1%.

Source: Eurostat (env_ac_taxind2)

Pollution and resource taxes: shift from households to manufacturing

Pollution and resource taxes make up a relatively small segment of the overall environmental tax revenue. In 2022, manufacturing accounted for 47.5% of pollution and resource tax revenue, overtaking households, which contributed just for 13%. Significant disparities were observed across EU countries, with Estonia's manufacturing sector contributing 93.8%, followed by Czechia, Spain, Latvia, Romania, and Slovakia, where manufacturing accounted for over 80% each. By contrast, services were the main contributors in Ireland and Poland, with each country reporting a share of 30% or more. Portugal was the only country where households bore the largest contribution, accounting for 80% of pollution and resource taxes. Beyond the EU, patterns also varied, with Switzerland's manufacturers contributing the most (80%) and Norway's households dominating (74.5%).

Source: Eurostat (env_ac_taxind2)

Source data for tables and graphs

Data sources

Legal basis and methodology Statistics on environmental taxes by economic activity are compiled and reported under Regulation 691/2011 of 6 July 2011 on European environmental economic accounts (Annex II), amended by the Commission Delegated Regulation (EU) 2022/125 of 19 November 2021, as well as on legal acts in the area of national accounts. Data transmission became obligatory in September 2013. Prior to this, Eurostat collected the data on a voluntary basis.

Eurostat uses table 9 from the ESA transmission programme to supplement its compilation of data on environmental tax revenue for four categories of environmental taxes (energy, transport, pollution and resources). A Eurostat publication titled 'Environmental taxes - a statistical guide' constitutes the methodological basis. Detailed breakdown and sources

Environmental tax revenue is allocated according to the different economic activities that pay the taxes. Eurostat collects data on environmental taxes using a breakdown by economic activity (NACE Rev. 2 classification) supplemented by information for households, non-residents and a category not allocated.

The main sources for the allocation of taxes by economic activity are: National Accounts (mainly supply and use tables), or data on energy use, waste disposal data, etc. A third option can be direct allocation based on micro data from the fiscal administrations about tax payers for each environmental tax separately.

Data on environmental taxes can be used to analyse the revenue stream from such taxes, as well as to provide a relative measure of the importance of these taxes by calculating ratios relative to GDP or to the total revenue from all taxes and social contributions. In the first case, the comparison helps to provide an understanding of the tax burden. In the second case, the comparison helps assess whether or not there is a shift towards environmental taxes - in other words, shifting the tax burden from other taxes (for example those on labour income) towards environmental taxes.

Rising revenue from environmental taxes should be interpreted with caution. The increases may be caused by new taxes or an increase in tax rates, or may also be linked to an increase in the tax base.

Context

Economic instruments for pollution control and natural resource management are an increasingly important part of environmental policy in EU countries. These include, among others, environmental taxes, fees and charges, tradable permits, deposit-refund systems and subsidies.

Environmental taxes have been increasingly used to influence the behaviour of economic operators, whether producers or consumers. The EU has increasingly favoured these instruments because they provide a flexible and cost-effective means for strengthening the 'polluter-pays' principle and for achieving environmental policy objectives.

Under the subject of 'Greening national budgets and sending the right price signals', the European Green Deal acknowledges that well-designed tax reforms can boost economic growth and resilience to climate shocks and help contribute to a fairer society and to a just transition. They play a direct role by sending the right price signals and providing the right incentives for sustainable behaviour by producers, users and consumers. At national level, the European Green Deal will create the context for broad-based tax reforms, removing subsidies for fossil fuels, shifting the tax burden from labour to pollution and taking into account social considerations.

Environmental policy aims to achieve environmental and sustainable development goals. Policy makers use incentive-based tools to ensure that environmental solutions are found at the lowest cost, to correct externalities and/or raise revenue for specific purposes. The environmental tax revenue measured as share of all taxes and social contributions is an indicator to help assess progress towards 'greening' the taxation system.

Notes

Explore further

Other articles

Database

- Environmental tax revenues (env_ac_tax)

- Energy taxes by paying sector (env_ac_taxener)

- Environmental taxes by economic activity (NACE Rev. 2) (env_ac_taxind2)

Thematic section

Publications

- Tax revenue statistics

- Energy, transport and environment statistics - Eurostat Statistical books, 2019

- Key figures on Europe - 2019 edition - Eurostat Statistical books, 2019

Selected datasets

- Environmental tax revenues (t2020_rt320)

- Energy taxes (t2020_rt300)

- Energy taxes by paying sector (t2020_rt310)

- Implicit tax rate on energy (ten00120)

Methodology

- Environmental taxes - a statistical guide - 2013 edition - Eurostat Statistical books, 2013

- Environmental taxes by economic activity (NACE Rev. 2) (env_ac_taxind2)

- Environmental tax revenue (ESMS metadata file — env_ac_tax_esms)

- Implicit tax rate on energy (ITR) (ESMS metadata file — ten00120_esmsip)

External links

European Commission

Taxation and Customs Unit

Organisation for Economic Co-Operation and Development (OECD)

European Environment Agency (EEA)