International trade in sporting goods

Data extracted in June 2023.

Planned article update: September 2024.

Highlights

This article analyses statistics on international trade in sporting goods for the EU. Data are also presented for the European Free Trade Association (EFTA) countries, six candidate countries (Bosnia and Herzegovina, Montenegro, North Macedonia, Albania, Serbia and Türkiye) and one potential candidate (Kosovo*). This analysis covers data from 2017 and 2022 showing:

- export and import values in absolute and relative terms (in € million and as a share of total trade respectively);

- extra-EU and intra-EU trade;

- the type of goods traded;

- the EU’s main trading partners.

Statistics on international trade in sporting goods are based on data extracted from Comext, Eurostat’s database on international trade in goods.

* This designation is without prejudice to positions on status, and is in line with UNSCR 1244/1999 and the ICJ Opinion on the Kosovo Declaration of Independence.

Full article

The value of extra-EU trade in sporting goods in 2022

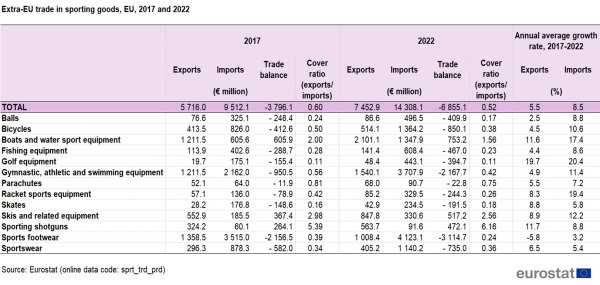

In 2022, the EU’s trade in sporting goods (the sum of extra-EU exports and imports) with the rest of the world was valued at € 21.8 billion (€ 7.5 billion of exports and € 14.3 billion of imports, see Table 1). Both imports and exports increased compared with 2017: a higher growth was recorded for imports rather than exports (+50.4 % against +30.4 %), corresponding to an increase of € 4.8 billion for imports against € 1.7 billion for exports. Looking at the overall figure, the EU’s trade deficit (imports exceeding exports) in sporting goods significantly increased by € 3.1 billion, from € 3.8 billion in 2017 to € 6.9 billion in 2022 (see Table 1).

In the five years between 2017 and 2022, there were some relevant changes in the trade balance of sporting goods.

For exports:

- the largest relative increase in sporting goods exports was in the ’golf equipment’ category, in which the exports more than doubled with a 145.5 % growth between 2017 and 2022, followed by ’sporting shotguns’ (+73.9 %) and ’boats and water sport equipment’ (+73.4 %);

- in absolute terms, the ’boats and water sport equipment’ category had the highest growth, with an increase of € 890 million between 2017 and 2022 ;

- the only category recording a decrease in exports between 2017 and 2022 was ’sports footwear’, which lost around € 350 million (-25.8 %) of its value.

For imports:

- as for exports, the ’golf equipment’ category had the highest relative increase, more than doubling its imports with a +153 % growth in the five years, followed by ‘racket sports equipment’ (+142 %);

- additional significant increases were recorded for the ’gymnastic, athletic and swimming equipment’ category, with more than € 1.5 billion growth between 2017 and 2022 (the highest in absolute terms, equal to +71.5 %) and for the ’boats and water sport equipment’ category, which more than doubled its 2017 imports;

- none of the sport categories had a decrease in imports from 2017 to 2022: the ’sports footwear’ category recorded the lowest increase in percentage terms (+17.3 %), representing nevertheless the third highest increase in absolute terms (€ 608 million).

International trade in sporting goods at national level – 10 Member States with a positive trade balance

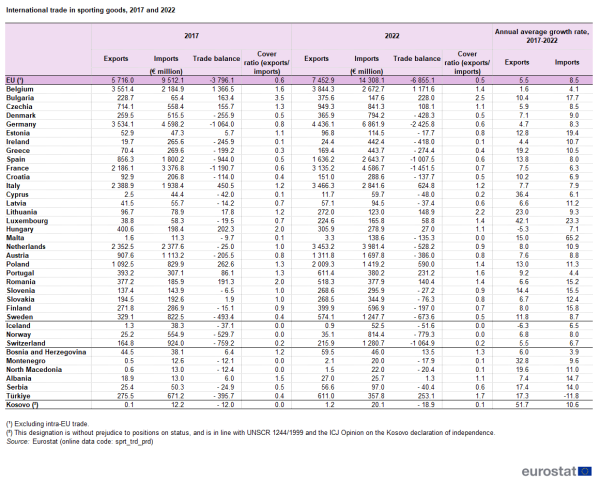

At national level, in 2022, a trade surplus (concerning intra- and extra-EU trade) was recorded in 10 Member States and a trade deficit (imports exceeding exports) in 17 Member States (see Table 2). The largest trade surplus in absolute terms, with more than € 1 000 million, belonged to Belgium, followed by Italy with € 625 million; these two countries also had the largest trade surplus in 2017.

Bulgaria recorded the highest cover ratio (exports/imports), with exports 2.5 times higher than imports. In addition to Bulgaria, Lithuania (2.2) and Portugal (1.6) were the other Member States with cover ratios greater than 1.5. Germany (with € 2.4 billion), France and Spain (with more than € 1 billion) recorded the largest deficits of trade in sporting goods, while Malta (0.02), Ireland (0.1) and Cyprus (0.2) had the lowest cover ratios.

In 2022, Germany was the EU’s largest exporter of sporting goods in terms of value, with exports around € 4.4 billion (almost € 1 billion more than in 2017), followed by Belgium with € 3.8 billion (€ 0.3 billion more than in 2017 when Belgium was the EU’s largest exporter) and Italy and the Netherlands with € 3.5 billion (€ 1.1 billion more than in 2017 for both countries). The largest importers were Germany (€ 6.9 billion, € 2.3 billion more than in 2017, the highest increase), France with € 4.6 billion (€ 1.2 billion more than in 2017) and the Netherlands with € 4 billion (€ 1.6 billion more than in 2017).

The high ranking of medium-size countries like the Netherlands and Belgium is due to the impact of quasi-transit of goods, the ’Rotterdam effect’, affecting Member States with big ports at the EU’s external border (for more details, see the Methodology/Metadata section).

EU International trade in sporting goods between 2017 and 2022

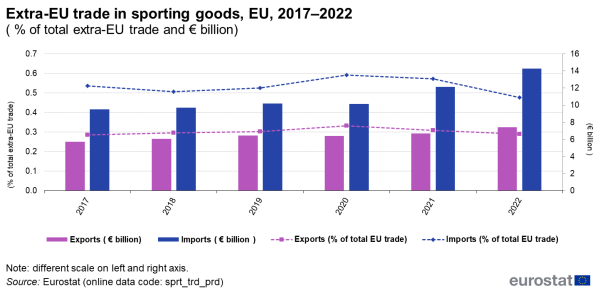

Looking at the EU international trade in sporting goods between 2017 and 2022 (see Figure 1), both imports and exports registered a steady increase in absolute terms until 2019, followed by a slight decrease in 2020 and a notable acceleration from 2021, particularly for imports (increase of € 4 billion in 2022 compared with 2020). In relative terms, the imports of sporting goods as a share of total imports decreased between 2017 and 2018, followed by an increase in 2019 and a peak of 0.6 % in 2020, before slightly decreasing in 2021 and dropping under 0.5 % in 2022. Despite a significant increase for imports in sporting goods in absolute terms in 2022, this was lower than the increase of the total EU trade. The share of exports recorded a small but steady increase until 2019, also peaking in 2020 at 0.3 % before starting to decrease similar to the share of imports in 2021 and going under 0.3 % in 2022.

(% of total extra-EU trade and € billion)

Source: Eurostat (sprt_trd_prd)

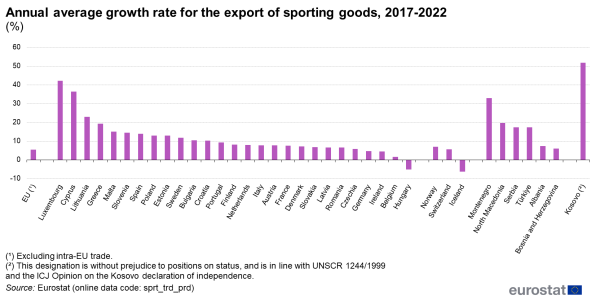

Between 2017 and 2022, the annual average growth rate (AAGR) of the EU international trade in sporting goods (excluding intra-EU trade) was 5.5 % for exports and 8.5 % for imports. The annual average growth rate of the value for exports of sporting goods (also including intra-EU trade) was positive in 26 Member States, with five registering average annual growth rates of at least 15 %: Luxembourg (with +42.1 %), Cyprus (+36.4 %), Lithuania (+23.0 %), Greece (+19.2 %), and Malta (+15.0 %) (see Figure 2). Hungary was the only Member State with a negative AAGR (-5.3 %). As regards Luxembourg, Cyprus and Malta, their relatively small volumes of sporting trade could lead to significant fluctuations for rates of change from one year to another.

(%)

Source: Eurostat (sprt_trd_prd)

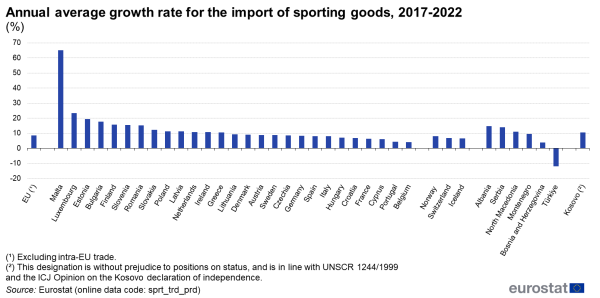

Regarding imports over the same period, all the EU Member States registered a positive value, with the highest increases in Malta (+65.2 %) and Luxembourg (+23.3 %), followed by additional five Member States (Estonia, Bulgaria, Finland, Slovenia and Romania) where the average annual growth rate of imports passed the 15 % threshold. Portugal (+4.4 %) and Belgium (+4.1 %) were the only EU Member States where the AAGR for imports, despite being positive, remained below 5 % (see Figure 3).

(%)

Source: Eurostat (sprt_trd_prd)

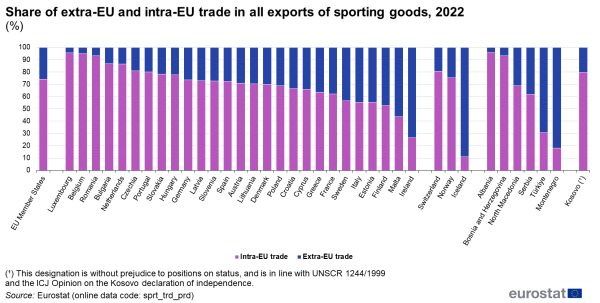

Intra-EU and extra-EU trade in sporting goods

In most Member States, the value of intra-EU trade in sporting goods was greater than the value of extra-EU trade in sporting goods

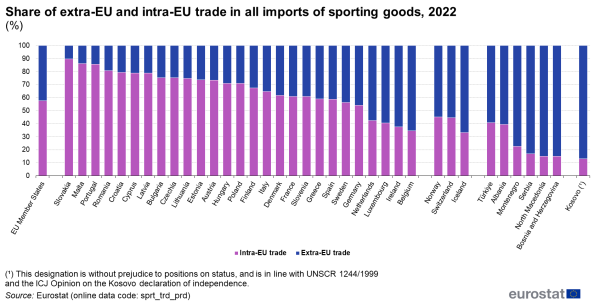

The international trade of EU Member States can be analysed from two perspectives: intra-EU trade (between EU Member States) and extra-EU trade (with non-EU countries). The ratio between the two is an indication of the heterogeneity of a country’s trade patterns and, to some extent, may reflect historical ties and geographical location.

Looking at exports in 2022, almost three-quarters of the EU’s total trade in sporting goods was intra-EU (74.2 %). At country level, intra-EU trade accounted for most exports in 25 of the EU Member States: the figures ranged from 52.6 % in Finland to 95.5 % in Luxembourg (see Figure 4). By contrast, only two Member States recorded less intra-EU than extra-EU exports, namely Malta (43.7 %) and Ireland (26.6 %).

(%)

Source: Eurostat (sprt_trd_prd)

For the whole of the EU, intra-EU imports accounted for 57.8 % of the international trade in sporting goods. Looking at individual countries, in 23 out of 27 EU Member States the value of intra-EU imports of sporting goods was greater than the value of extra-EU imports. Intra-EU imports shares for these countries varied from 54.1 % in Germany to 89.8 % in Slovakia. Four EU Member States imported more sporting goods from outside the EU than from inside (see Figure 5): the Netherlands, Luxembourg, Ireland and Belgium.

(%)

Source: Eurostat (sprt_trd_prd)

Trade in sporting goods by product

Boats and water sport equipment were the sporting goods most exported outside the EU

The list of sporting goods that are traded internationally contains the equipment necessary for doing sports (e.g. skis or balls), clothing (e.g. swimwear or footwear) and some articles that can be used for sport and leisure activities (e.g. boats and water sports equipment, bicycles or fishing equipment).

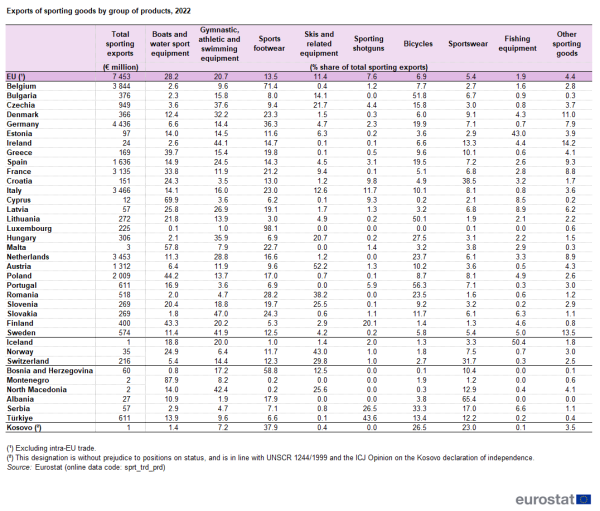

The four main groups of sporting goods, among those analysed here, are ’boats and water sport equipment’, ’gymnastic, athletic and swimming equipment’, ’sports footwear’ and ‘skis and related equipment’. In 2022, they generated almost three-quarters of the value of extra-EU exports, with ’boats and water sport equipment’ accounting for 28.2 % of the total value. ’Gymnastic, athletic and swimming equipment’ (20.7 %), ’sports footwear’ (13.5 %) and ‘skis and related equipment’ (11.4 %) were the only other three categories of sporting goods with a 2-digit share in extra-EU exports in 2022 (see Table 3).

At national level, in 2022, taking into account both intra-EU exports and extra-EU exports:

- boats and water sport equipment had the largest share in exports of sporting goods in six Member States, accounting for over half of total exports of sporting products value in Cyprus (69.9 %) and Malta (57.8 %);

- ‘gymnastic, athletic and swimming equipment’ was the main type of sporting good being exported in nine Member States;

- the value of exported products in the ’sports footwear’ category was the highest in Luxembourg (98.1 %), followed by Belgium (71.4 %), Germany (36.3 %) and Italy (23.0 %);

- skis and related equipment were the principal sporting goods exported from Austria (52.2 %), Romania (38.2 %) and Slovenia (25.5 %);

- bicycles were the most exported type of sporting good (in terms of trade value) from Portugal (56.3 %), Bulgaria (51.8 %) and Lithuania (50.1 %);

- the ‘sportswear’ category amounted to the highest share of total sporting goods export value in Croatia (38.5 %)

- in Estonia, products belonging to the ’fishing equipment’ category accounted for almost half of the total value of national exports in sporting goods (43.0 %).

Sports footwear and gymnastic, athletic and swimming equipment accounted for over half of the value of extra-EU imports of sporting goods

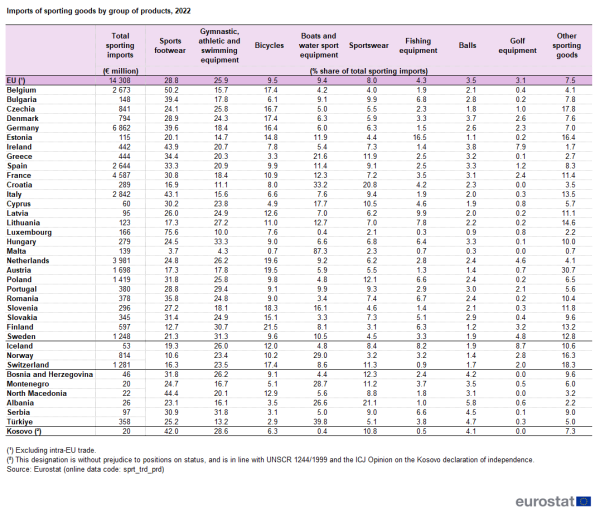

In 2022, the main two groups of sporting goods accounted for over half of the value of extra-EU imports (see Table 4). The ’sports footwear’ category represented the highest share of imports with 28.8 % of all imported sporting goods, followed by ‘gymnastic, athletic and swimming equipment’ (25.9 %).

After analysing imports in individual Member States (taking into account both intra-EU imports and extra-EU imports), the following results were shown:

- for 17 countries, imported ’sports footwear’ goods generated the highest value, accounting for 75.6 % of the total value of imports of sporting goods in Luxembourg;

- gymnastic, athletic and swimming equipment imports had the highest value in seven countries, with a peak in Hungary with 33.3 % of the total value of all imported sporting goods;

- Malta (87.3 %) and Croatia (33.2 %) imported more ’boats and water sport equipment’ in terms of value than any other type of sporting good.

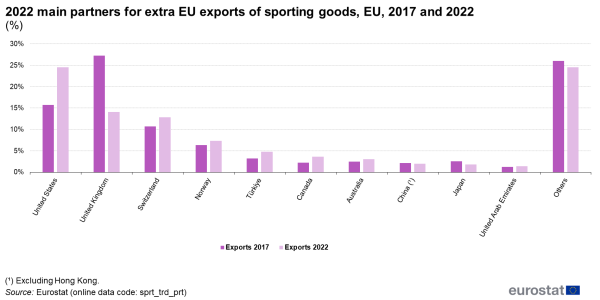

The EU’s principal partners for trade in sporting goods

The United States overtook the United Kingdom as the leading destination for EU exports of sporting goods

When considering the aggregate of the trade for all Member States, the European single market remains the major export destination and source of imports for sporting goods (see Figure 4 and Figure 5).

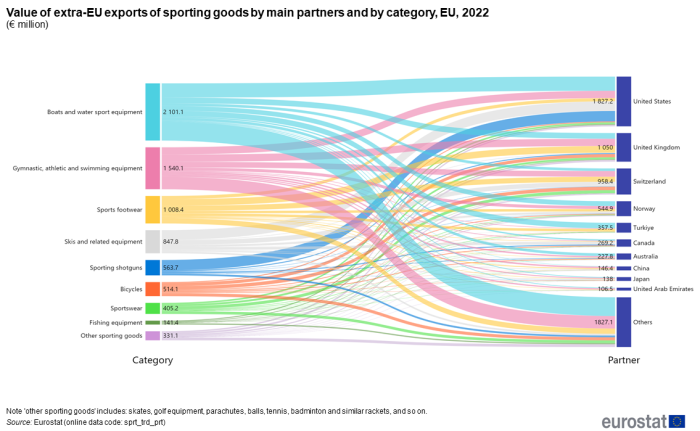

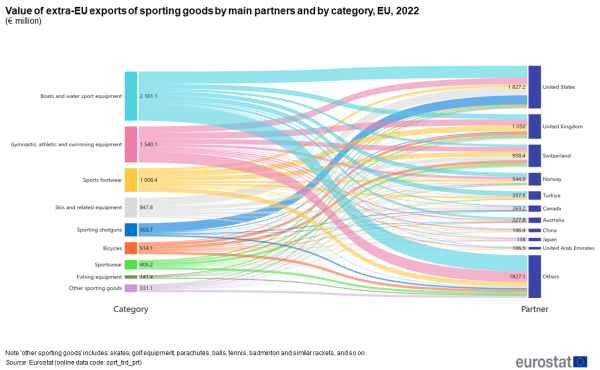

In 2022, in terms of value, the leading extra-EU destinations for sporting goods were the United States (24.5 %), the United Kingdom (14.1 %) and Switzerland (12.9 %), accounting for half of the total value of exports of sporting goods. Exports to any of the other extra-EU trade partners accounted for less than 10 % (see Figure 6).

Compared with 2017, in 2022, the United States’ share of the total value of exports of sporting goods increased by 8.7 percentage points (pp), while for the United Kingdom it decreased by 13.2 pp (it should be noted that the United Kingdom was part of the EU in 2017). The majority of the other main partners were able to increase their share of exports of sporting goods from 2017 to 2022 ‒ notably Switzerland by 2.1 pp and Türkiye by 1.6 pp; the only exceptions were China (down by 0.1 pp) and Japan (down by 0.7 pp).

(%)

Source: Eurostat (sprt_trd_prt)

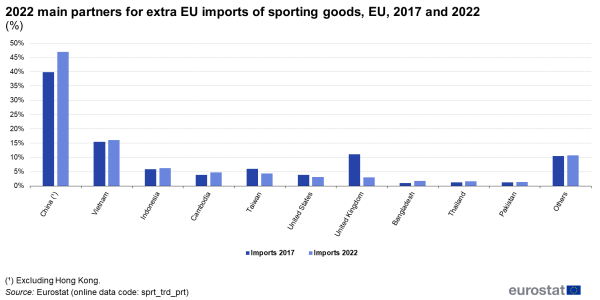

Almost half of EU imports of sporting goods came from China

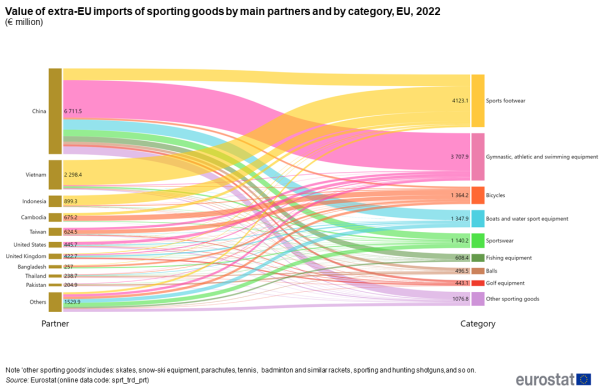

Figure 7 shows the extra-EU’s 10 main partners for imports of sporting goods. In 2022, almost half of the total value of EU imports of sporting goods was generated by imports from China (46.9 %), increasing by 7.1 pp since 2017. The second highest share belonged to Vietnam (16.1 %), followed by Indonesia with 6.3 %: both countries saw their share slightly increasing by around 0.5 pp from 2017.

As for exports, the United Kingdom’s share in the total value of EU imports of sporting goods significantly decreased, falling from 11.1 % in 2017 (third highest partner of the EU) to 3.0 % in 2022.

In addition to the United Kingdom, Taiwan and the United States were the only other main partners experiencing a decrease in their share of imports of sporting goods from 2017 to 2022 (4.4 % for Taiwan in 2022 from 6.0 % in 2017 and 3.1 % for the United States in 2022 from 3.8 % in 2017).

(%)

Source: Eurostat (sprt_trd_prt)

Extra-EU sporting goods’ trade flows by category of product

Exports to leading countries by category

In 2022, as shown in Figure 8, boats and water sport equipment were the most exported sporting products outside the EU. In terms of value, the United States was the first extra-EU country to which these products were directed. Other important trade EU partners for these products were the United Kingdom, Türkiye and Norway. With a value of over 2.1 billion euros, boats and water sport equipment accounted for approximately one third of the total extra-EU exports of sporting goods.

While the United States, the United Kingdom, Switzerland and Norway were the largest EU trade partners for all categories of products, exports of sporting goods in 2022 were directed towards a high number of countries. As shown in the chart, a value of € 1.8 billion was from sporting goods exported to countries that were not among the top 10 main EU partners (categorised as ’others’). This value was mostly from boats and water sport equipment, gymnastic, athletic and swimming equipment and sport footwear. While most of the categories of sporting goods were distributed to several extra-EU countries, the case of sporting shotguns and skis and related equipment was characterised by a concentration of exports towards the United States.

Source: Eurostat (sprt_trd_prt)

Imports from leading countries by category

Figure 9 illustrates the categories of sporting products by country of import. In 2022 China was a major EU trade partner for the imports of sporting goods. The chart shows that almost half of the value of the products imported from China was from gymnastic, athletic and swimming equipment, while the rest was distributed among all the other categories.

In contrast to the composition of exports, imports from some extra-EU countries showed a more pronounced product-specific structure. Almost the entire value of the imports from Vietnam and Indonesia in 2022 was from sport footwear, while for Taiwan and Cambodia significant shares of imported sporting products consisted of bicycles.

Source: Eurostat (sprt_trd_prt)

Source data for tables and graphs

Data sources

International trade statistics are stored in COMEXT, Eurostat’s database for international trade in goods. Comext contains statistics on goods traded between Member States (intra-EU trade) and goods traded by Member States with non-EU countries (extra-EU trade). The trade values for other political or geographical entities, such as the EFTA and candidate countries are also collected. The Comext database is built around six main dimensions:

• reporter (country declaring commercial transactions);

• partner (trade partners of the declaring country — all countries of the world);

• flow (exports and imports);

• product (items by HS, CN or SITC, BEC and CPA depending on the dataset);

• time (annual and monthly data);

• type of indicator (the value or quantity of traded products).

Based on the number of dimensions available in the Comext database, the following indicators are compiled for imports and exports of sporting goods:

• value of trade in thousands of euros (THS_EUR);

• percentage of country’s total trade (PC_TOT);

• percentage of total EU trade (PC_EU27_2020);

• percentage of total sport trade — at country and EU level (PC).

The data are compiled for the following trade partners:

• intra-EU;

• extra-EU;

• world (intra-EU and extra-EU);

• main extra-EU trading partners.

Unit of measure

Trade values are expressed in millions (106) of euros. They correspond to the statistical value, i.e. the amount which would be invoiced in the case of sale or purchase at the national border of the reporting country. It is called an FOB value (free on board) for exports and a CIF value (cost, insurance, freight) for imports.

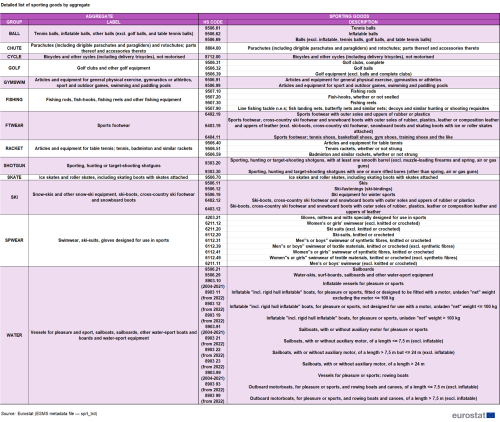

Identification of sporting goods

The identification of the list of sporting goods is based on the Vilnius Definition of sport, the Study on the Contribution of Sport to Economic Growth and Employment in the EU and the UNESCO Framework for Culture statistics (which considers sport as a domain related to culture). Internationally traded sports-related items are selected using the HS classification. They are then aggregated into meaningful groups according to sporting disciplines or specific sports equipment and accessories.

The groups of products (covered by HS 6-digit codes) are the following: i) skis and related equipment; ii) skates; iii) boats and water sport equipment; iv) golf equipment; v) racket sports (tennis and badminton) equipment; vi) balls; vii) gymnastic, athletic and swimming equipment; viii) fishing equipment; ix) bicycles; x) parachutes; xi) sportswear; xii) footwear; and xiii) sporting shotguns. Regarding ‘the boats and water sport equipment’ category, the CN codes 8903 92, 8903 31, 8903 32 and 8903 33 (Motorboats, other than outboard motorboats for pleasure or sports) have been excluded due to anomalies in trade exchanges identified for these codes.

For a detailed list of aggregates of sport products, see Table 5 and the metadata on international trade in sporting goods.

Source: Eurostat (International trade in sporting goods (sprt_trd)) (ESMS metadata file — sprt_trd)

The impact of quasi-transit ‘Rotterdam effect’

The trade flows of EU Member States may be overvalued because of the quasi-transit trade. However, the trade balance of the Member State concerned is not affected, as quasi-transit should increase by the same amount as the intra- and extra-EU trade flows (extra-EU imports followed by dispatches to the Member State of actual destination or arrivals from the Member State of actual export followed by extra-EU exports to the country of actual destination). Quasi-transit is known to affect mostly the Member States with big ports located at the EU’s external border, in particular the Netherlands, which is why its impact on figures is known as the ’Rotterdam effect’. In the case of imports, the goods destined for other EU Member States arriving in Dutch ports are recorded, according to EU rules, as extra-EU imports by the Netherlands (the country where goods are released for free circulation) and as dispatches from the Netherlands to the Member States of actual destination, even though there is no link with the Dutch economy. Quasi-transit is known to influence more the imports but exports are also affected. In exceptional cases, the customs clearance occurs not in the actual Member State of export but in the Member State of exit, i.e. the Member State from which the goods are taken out of the EU customs territory.

Context

The multiannual work programmes (EU Work Plan for Sport for 2014-2017; EU Work Plan for Sport for 2017-2020; EU Work plan for Sport for 2021-2024) are a tangible example of the increasing importance of sport in European policy initiatives. These programmes, agreed by the Council, set the priorities and the principles for cooperation between the European Commission and Member States in the field of sport.

Several expert groups have been set up to achieve concrete results. Among them, the Expert Group on the Economic Dimension of Sport (XG ECO) and the Expert Group on Health-Enhancing Physical Activity (XG HEPA) play a key role in implementing evidence-based policies in the sports sector. XG ECO, for example, has developed an economic definition of sport ('Vilnius definition'), and made progress towards developing Sport Satellite Accounts in some EU countries. XG HEPA is working on implementing the Council recommendations on physical activity adopted in 2013. These include a monitoring framework with indicators both for the level of physical activity and for policies to promote physical activity in EU countries. Eurostat comparable data on international trade, employment in sport, participation in sporting activities, etc. make a valuable contribution to the monitoring and development of the EU’s policies in this area.

Direct access to

- Intra and extra-EU trade in sporting goods by product (sprt_trd_prd)

- Intra and extra-EU trade in sporting goods by product and partner (sprt_trd_prt)

For a detailed list of aggregates of sport products, see the metadata on trade in sporting goods.

- International trade in sporting goods (sprt_trd) (ESMS metadata file — sprt_trd)

- International trade in goods (ESMS metadata file — ext_go_agg_esms)

- Vilnius definition of sport