Strengthen the means of implementation and revitalise the global partnership for sustainable development

Data extracted in April 2025.

Planned article update: June 2026.

Highlights

This article is a part of a set of statistical articles, which are based on the Eurostat publication ’Sustainable development in the European Union — Monitoring report on progress towards the SDGs in an EU context — 2025 edition’. This report is the ninth edition of Eurostat’s series of monitoring reports on sustainable development, which provide a quantitative assessment of progress of the EU towards the SDGs in an EU context.

SDG 17 calls for a global partnership for sustainable development. It emphasises the importance of macroeconomic stability and of mobilising financial resources for developing countries. It also stresses the importance of trade and equitable rules for governing it. The goal also emphasises the importance of access to science and technology, in particular internet-based information and communications technology.

Partnerships for the goals in the EU: overview and key trends

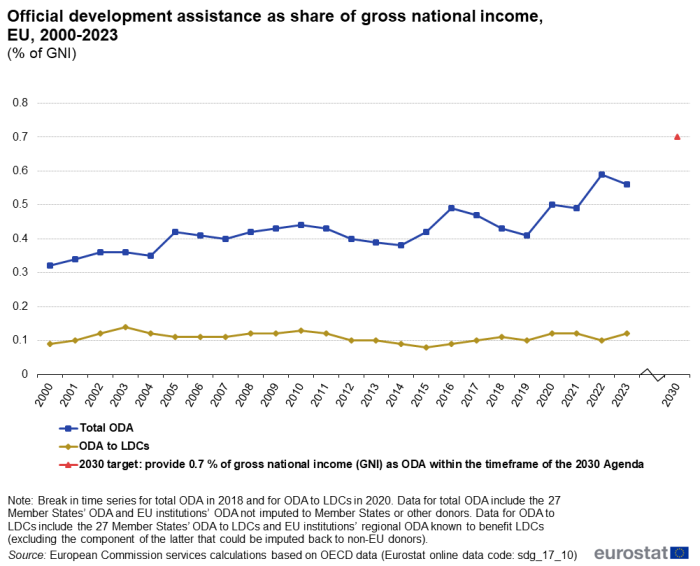

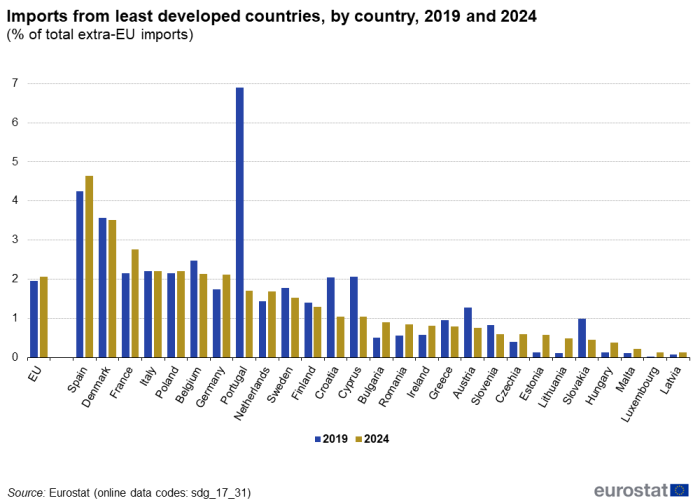

Partnership is at the essence of the EU and an overarching principle to approach the SDGs within and beyond the EU boundaries. Monitoring SDG 17 in an EU context focuses on global partnership, financial governance and access to technology. Over the assessed five-year period, the EU made moderate progress in the area of global partnerships. EU financing to developing countries has grown slightly, and the support to Ukraine has helped move the EU closer to its official development assistance (ODA) target. Moreover, the share of imports from least developed countries has increased. The picture is less favourable for financial governance within the EU, as exemplified by a falling share of environmental taxes in total tax revenues and high levels of general government gross debt. Meanwhile, access to technology in the EU progressed, with a significant increase in the share of households connected to high-speed internet.

Global partnership

To achieve the SDGs, partnerships are necessary between governments, the private sector, civil society and other parties. Wealthier economies such as the EU can support the implementation of the 2030 Agenda in developing countries through public and private, domestic and international resources. These resources can be both financial and non-financial [1]. This article focuses on the former. Overall, the global partnership indicators show a mixed picture for the EU over the past few years.

The EU supports country-led development through a range of financial support mechanisms

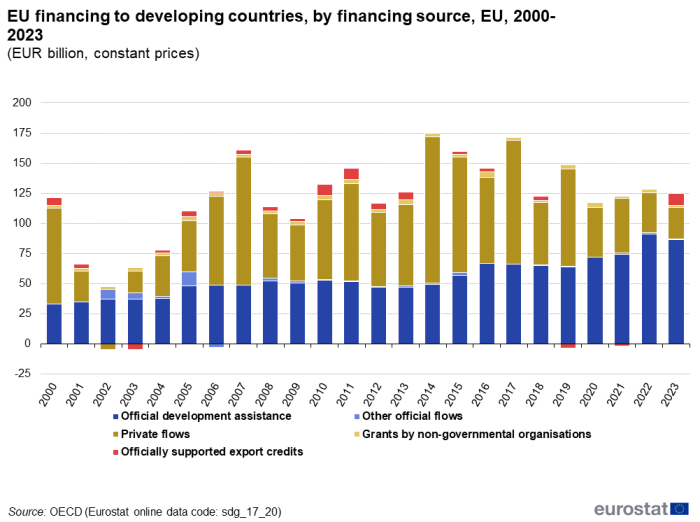

In 2015, in the Addis Ababa Action Agenda, all countries recognised that international public finance plays an important role in complementing countries’ domestic efforts to mobilise public resources, especially in the poorest and most vulnerable countries. Official development assistance (ODA), other official flows (OOFs), private flows, such as foreign direct investment (FDI), grants by non-governmental organisations (NGOs) and officially supported export credits [2] are some of the financial flows from the EU and its Member States to developing countries.

Regarding the total volume of financial flows from the EU to developing countries, the Organisation for Economic Co-operation and Development (OECD) estimates that total public and private EU financing to developing countries amounted to EUR 126.4 billion in 2023. When accounting for inflation, this is about the same level as the financial flows provided by the EU ten years earlier (in 2013) but is — in part substantially — lower than the amounts provided between 2014 and 2017. ODA has been the most reliable and steady financial flow from the EU to developing countries, while private flows have varied strongly over the years. The slight increase in EU financing to developing countries over the past five-year period is a result of a 32% growth in ODA and an uptake of officially supported export credits, while private flows have fallen by 50% since 2018.

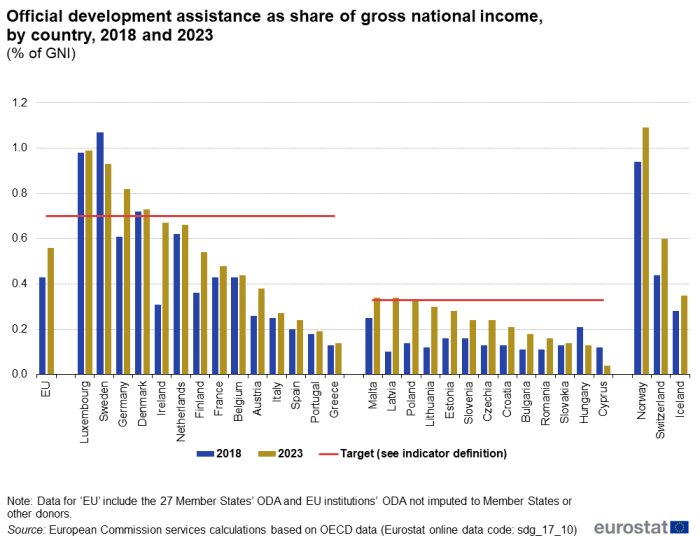

Official development assistance: a long struggle to meet targets

The idea that donor countries should contribute 0.7% of their gross national income (GNI) to ODA has been on the international agenda for half a century. The EU is collectively committed to providing 0.7% of GNI as ODA within the timeframe of the 2030 Agenda, as affirmed in the New European Consensus on Development. Member States that joined the EU after 2002 have committed to providing 0.33% of their GNI for ODA. As a whole, the EU spent 0.56% of its GNI on ODA in 2023, which is significantly higher than the 0.49% provided in 2021, but lower than the 0.59% provided in 2022. The 2022 and 2023 figures include support to Ukraine, which has helped move the EU closer to its ODA target. However, only four EU countries — Luxembourg, Sweden, Germany and Denmark — achieved the 0.7% target in 2023, meaning additional efforts will be needed to meet the collective EU target by 2030.

The EU remains the world’s biggest ODA donor

In 2023, the EU again maintained its position as the biggest ODA donor globally, providing about EUR 95.5 billion. This figure refers to the combined ODA provided by the 27 EU Member States and EU institutions. Moreover, with 0.56% in 2023, the EU’s overall ODA/GNI ratio was significantly higher than for most other Development Assistance Committee’s (DAC) donors such as Canada, Japan and the United States.

The EU seeks to support least developed countries in particular

To direct resources where they are most needed — least developed countries (LDCs) and countries in states of fragility and conflict — the EU has a target to collectively provide 0.15–0.20% of GNI to LDCs in the short term, reaching 0.20% within the timeframe of the 2030 Agenda. In 2023, the EU’s collective official development assistance to LDCs accounted for 0.12% of GNI. The EU has thus not progressed towards its 0.20% target over the past few years. In 2023, three Member States —Luxembourg, Sweden and Germany — already exceeded the 2030 target for the GNI ratio of ODA to LDCs.

ODA is only a part of several financing mechanisms

The EU seeks to ensure that developing countries can combine aid, investment and trade with domestic resources and policies to build capacity and become self-reliant. ODA, for example, can be used as a catalyst to mobilise other financial resources such as domestic tax revenues or resources from the private sector. Other innovative instruments have been developed, such as blending grants with loans, guarantees or equity from public and private financiers. Since 2019, a comprehensive view of the official flows from EU institutions to developing countries is available under the Total Official Support for Sustainable Development (TOSSD) framework, which also tracks support to international public goods. Between 2019 and 2022, the average annual TOSSD from EU institutions amounted to EUR 33.5 billion [3]. EU financial support, combined with domestic and private revenues, can provide a basis for achieving the 2030 Agenda’s goals, allowing for investment in social services, clean energy, infrastructure, transport and information and communications technologies. In the best case, developing countries could leapfrog some of the unsustainable modes of production and consumption that industrialised countries use.

Around 2% of all extra-EU imports come from least-developed countries

Trade’s potential contribution to sustainable development has long been acknowledged. This is reflected in the EU's 2021 Trade Policy Review, along with the European Green Deal which stresses the contribution that trade policy can make to achieving the EU’s ambition on sustainable development.

Exports can create domestic jobs and allow developing countries to obtain foreign currency, which they can use to import necessary goods. Better integration of developing countries into world markets may reduce the need for external public flows. Several of the SDGs refer to the importance of trade for sustainable development. However, it needs to be noted that the EU’s trade-related indicators do not provide insights on whether the products in question are produced in an environmentally and socially sustainable manner.

Between 2009 and 2024, the value of EU imports from developing countries (including China) increased strongly from EUR 504 billion to EUR 1 313 billion. Around 4% of these imports came from the almost 50 countries classified as least developed by the UN. EU imports from these least-developed countries more than tripled over the past 15 years, from EUR 15.8 billion in 2009 to EUR 50.3 billion in 2024. In relation to imports from all countries outside the EU, the share of imports from least-developed countries increased from 1.3% in 2009 to 2.1% in 2024. Since 2014, however, the share has stagnated, showing only small fluctuations around the 2% level. This means that over the past 10 years imports from least-developed countries have grown at a similar rate as all extra-EU imports.

Imports from all developing countries to the EU as a share of imports from all countries outside the EU increased from 42.3% in 2009 to 54.0% in 2024. Since 2021, developing countries (including China) have accounted for slightly more than half of all extra-EU imports. China (excluding Hong Kong) alone accounted for 21.3% of EU imports in 2024. This is remarkably higher than the share of imports from the United States, which accounted for 13.7% [4].

‘Aid for trade’ is a part of ODA that is targeted at trade-related projects and programmes. It aims to build trade capacity, supportive infrastructure and productive capacity in developing countries. The EU and its Member States were the leading global providers of aid for trade in 2022, providing EUR 22 billion, or 36% of global aid for trade. Just three donors — the EU institutions as well as Germany and France — provided 91% of this overall sum. The share of aid for trade to LDCs was 12% of overall aid for trade commitments in 2022 [5].

Financial governance within the EU

To help other countries to advance their economies, the EU’s own economies must also remain on a sustainable development path. Macroeconomic stability in the EU is therefore one pillar of the Union’s contribution to implementing the SDGs. In addition, the EU seeks to make its economy greener. In a global context, where consumption patterns in one region can severely impact production patterns elsewhere, it is particularly important that prices reflect the real costs of consumption and production. They should include payments for negative externalities caused by polluting activities or other activities that damage human health and the environment. Moreover, the EU has pointed out that environmental taxes may offer opportunities to reduce taxes in other areas, for example on labour.

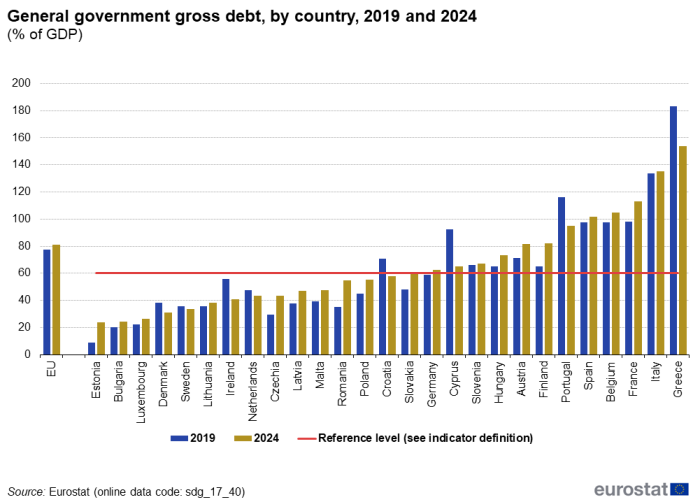

The EU’s government debt-to-GDP ratio remains above pre-COVID levels

According to the Treaty on the Functioning of the European Union, government debt should not exceed 60% of GDP in EU Member States. As a consequence of the COVID-19 crisis and related public spending, the EU’s overall debt-to-GDP ratio rose sharply in 2020 to reach 89.5%, which is a 12.1 percentage point increase compared with 2019. Since then, however, the EU’s debt-to-GDP ratio has fallen again, reaching 81.0% in 2024. This is 8.5 percentage points lower than the 2020 peak but still 3.6 percentage points higher than the 2019 value of 77.4%. The 2024 value is also slightly above the 2023 ratio of 80.8%, interrupting the downward trend visible since the 2020 peak.

In 2024, Member States’ debt-to-GDP ratios ranged from 23.6% in Estonia to 153.6% in Greece. Twelve EU countries exceeded the 60% threshold in 2024 and five Member States had debt-to-GDP ratios above 100%. Between 2019 and 2024, the strongest reductions in debt-to-GDP ratios were reported by Greece (– 29.6 percentage points), Cyprus (– 27.3 percentage points) and Portugal (– 21.2 percentage points). In contrast, the ratios rose strongest in Romania (+ 19.8 percentage points), Finland (+ 16.8 percentage points) and France (+ 14.8 percentage points).

‘Greening’ the taxation system remains a challenge

Environmental taxes help to provide the right price signals and incentives to producers, users and consumers to encourage less polluting consumption and to contribute to sustainable growth. They may also provide opportunities to reduce taxes in other areas, for example on labour, and if revenue for adequate social protection is protected, they can offer a win–win option for addressing both environmental and employment issues, as laid out in the EU’s Action Plan for Fair and Simple Taxation. Environmental taxes support the transition to a climate-neutral economy [6]. As indicated in the Communication on Business taxation for the 21st century as regards the EU tax mix, behavioural taxes, such as environmental and health taxes, continue to be of growing importance for EU tax policies. Well-designed environmental taxes help to support the green transition by sending the right price signals, as well as implementing the polluter pays principle. They also generate revenue that could compensate some of the needed labour tax cuts.

In 2023, environmental taxes accounted for only 5.2% of total tax revenues in the EU, which is the lowest share in the time series since 2000. In comparison, revenues from labour taxes were about ten times higher and accounted for 51.2% in 2023 [7]. Energy taxes constituted the main part of environmental taxes, accounting for 4.1% of tax revenues in 2023, followed by transport taxes with a share of 0.9%. In comparison, taxes on pollution and resources — the third component of environmental taxes — remained negligible, accounting for only 0.2% of total tax revenues in 2023 [8]. The share of total environmental taxes has fallen considerably since 2018, when they accounted for 6.5% of tax revenues. Across Member States, the share of environmental taxes in total tax revenues ranged from 3.1% in Luxembourg to 11.2% in Bulgaria in 2023. Compared with 2018, their share has decreased in almost all EU countries. Only four countries — Bulgaria, Greece, Romania and Sweden — reported increases in the share of environmental taxes over this period.

The ratio of labour to environmental taxes shows how much higher a country’s share of labour tax revenues is than its share of environmental taxes. In 2023, this ratio ranged from 3.2 in Bulgaria to 15.8 in Luxembourg. The ratio has increased in most Member States since 2018, indicating a relative shift in taxation from environment to labour across the EU [9].

EU Member States spend around 2% of their GDP to protect the natural environment

The decline in the prioritisation of environmental taxation is partly reflected in national environmental expenditures. National expenditure on environmental protection measures the amount of resources a country uses to protect the natural environment. It includes current expenditure on environmental protection activities, investments in these activities and net transfers to other parts of the world. At EU level, environmental protection expenditure amounted to EUR 355 billion in 2023, which corresponds to 2.1% of GDP [10].

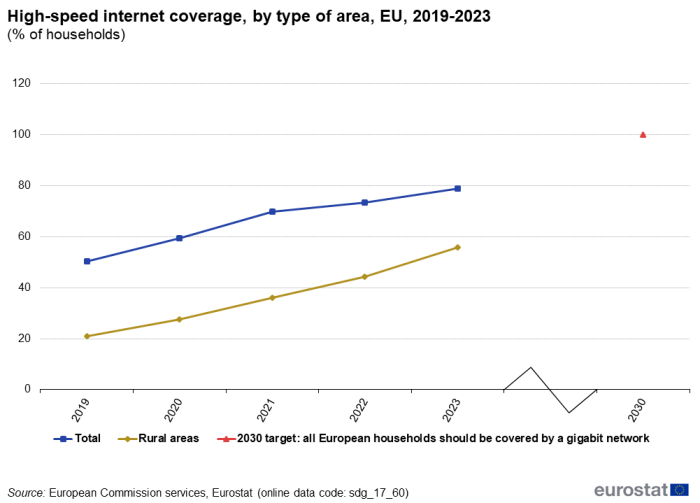

Access to technology

In today’s economies and societies, digital connections are crucial. Instant communication between individuals, bank transfers, office work, public dissemination of information and data analysis are only some of the activities that depend on the internet. Regions without fast internet connections have serious social and economic disadvantages in a digitalised world. Therefore, the EU has the ambition to have all European households covered by high-speed internet by 2030.

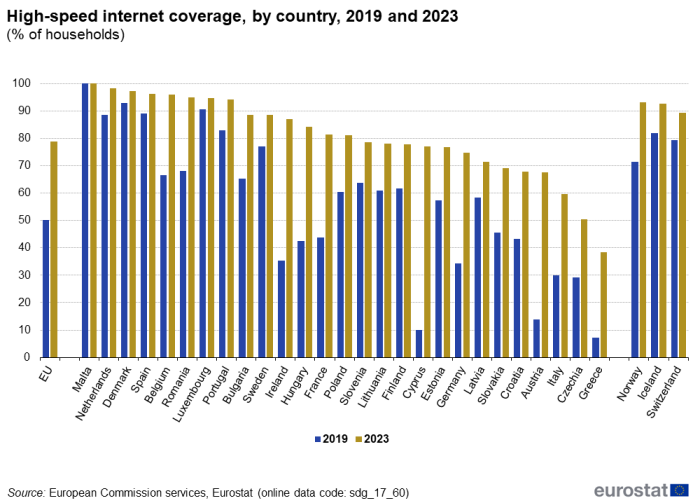

Considerable progress has been made in rolling out high-speed internet coverage across the EU

The uptake of high-speed internet coverage — referring to fibre connections or other networks offering similar bandwidth — has improved considerably over the past few years across the EU. While just about half (50.3%) of EU households enjoyed such connectivity in 2019, this share has risen considerably, reaching 78.8% in 2023. The EU has thus made strong progress towards its target of 100% coverage by 2030. Connectivity has also improved in rural areas [11]. Between 2019 and 2023, the share of rural households with a fixed high-speed internet connection increased from 21.0% to 55.7% across the EU.

At Member State level, Malta has already achieved a 100% fixed high-speed internet connectivity for all households since 2019. In 2023, it was followed by the Netherlands (98.3%), Denmark (97.2%) and Spain (96.3%). In contrast, fixed high-speed internet connections were the least widespread in Greece, with only 38.4% of households enjoying such connectivity. All remaining Member States had connection to high-speed internet rates above 50% in 2023, and in 24 of the 27 Member States more than two-thirds of households were covered.

Main indicators

Official development assistance

Official development assistance (ODA) is provided by governments and their executive agencies to support economic development and welfare in developing countries. ODA must be concessional in character, having a grant element that varies in proportion depending on the recipient. Eligible countries are included in the Organisation for Economic Cooperation and Development’s (OECD) Development Assistance Committee (DAC) official list of ODA recipients. ODA disbursements and their purpose are reported by donors to the OECD. A new methodology to calculate the ODA value of concessional loans is applied from 2018 data onwards and affects the comparability of data with previous years. Additionally, a new methodology for calculating total ODA to LDCs is applied from 2020 data onwards, by including regional net ODA known to benefit LDCs (on top of the bilateral net ODA to LDCs and imputed multilateral ODA to LDCs). The EU collectively commits to achieving the target of providing 0.7% of gross national income (GNI) for ODA within the time frame of the post-2015 agenda. The same target applies to Member States that joined the EU before 2002, taking into consideration budgetary circumstances. Member States that joined the EU after 2002 strive to increase their ODA/GNI to 0.33%.

Source: European Commission services calculations based on OECD data (Eurostat (sdg_17_10))

Source: European Commission services calculations based on OECD data, Eurostat (sdg_17_10)

Source: European Commission services calculations based on OECD data.

EU financing to developing countries

EU financing to developing countries takes a number of forms. These, as documented by the OECD, include: official development assistance (ODA) (public grants or concessional loans with the aim of supporting economic development and welfare); other official flows (OOFs) (public flows that are not focused on development or with a grant element of less than 25%); private flows (direct investment, bonds, export credits and multilateral flows); grants by non-governmental organisations (from funds raised for development assistance and disaster relief); and officially supported export credits. Data stem from the OECD (DAC).

Note: y-axis does not start at 0.

Source: OECD, Eurostat (sdg_17_20)

This indicator is defined as the share of all extra-EU imports coming from the countries classified by the UN as least developed. It indicates to what extent products from these countries access the EU market. Information for this indicator is provided by enterprises with a trade volume above a set threshold and is collected on the basis of customs declarations. This information is then adjusted by Member States to account for the impact of trade under this threshold.

Source: Eurostat (sdg_17_31)

Source: Eurostat (sdg_17_31)

General government gross debt

The Treaty on the Functioning of the European Union (TFEU) defines this indicator as the ratio of general government gross debt at the end of the year to gross domestic product at current market prices. For this calculation, general government gross debt is defined as the total consolidated gross debt at nominal (face) value in the following categories of government liabilities, as defined in ESA 2010: currency and deposits, debt securities and loans. The general government sector comprises central government, state government, local government and social security funds. The TFEU states that a Member State’s government debt-to-GDP ratio should be limited to 60%.

Note: y-axis does not start at 0.

Source: Eurostat (sdg_17_40)

Source: Eurostat (sdg_17_40)

Environmental taxes are defined as taxes based on a physical unit (or proxy of it) of something that has a proven, specific negative impact on the environment. There are four types of environmental taxes: energy taxes, transport taxes, and pollution taxes and resource taxes.

Source: Eurostat (sdg_17_50) and (env_ac_tax)

Source: Eurostat (sdg_17_50)

This indicator measures the share of households with a fixed very high capacity network (VHCN) connection. A VHCN is either an electronic communications network that consists entirely of optical fibre elements, at least up to the distribution point at the serving location; or an electronic communications network capable of delivering, under usual peak-time conditions, similar network performance in terms of available downlink and uplink bandwidth, resilience, error-related parameters, and latency and its variation. The data are collected for the Broadband Coverage in Europe studies published by the European Commission and refer to both fibre to the premises (FTTP) and Data Over Cable Service Interface Specification (DOCSIS) 3.1. DOCSIS allows adding high-bandwidth data transfer to existing cable television systems.

Source: European Commission services, Eurostat (sdg_17_60)

Source: European Commission services, Eurostat (sdg_17_60)

Footnotes

- Non-financial resources include domestic policy frameworks, effective institutions and support for good governance, democracy, rule of law, human rights, transparency and accountability; see also the Addis Ababa Action Agenda (AAAA). ↑

- Governments provide officially supported export credits through export credit agencies (ECAs) in support of national exporters competing for overseas sales. ECAs can be government institutions or private companies that operate on behalf of governments. Such support can take the form either of ‘official financing support’, such as direct credits to foreign buyers, refinancing or interest-rate support, or of ‘pure cover support’, such as export credits insurance or guarantee to cover credits provided by private financial institutions. For further details see https://www.oecd.org/en/topics/export-credits.html. ↑

- The annual average TOSSD from EU institutions is the sum of Pillar I and Pillar II for years 2019, 2020, 2021 and 2022, divided by 4. This figure best reflects EU TOSSD to date as data coverage has consistently expanded over the last four years. ↑

- Source: Eurostat (ext_lt_maineu). ↑

- European Commission (2025), EU Aid for Trade Progress Report 2024. ↑

- European Environment Agency (2023), The role of (environmental) taxation in supporting sustainability transitions, Briefing. ↑

- Taxes on labour are generally defined as all personal income taxes, payroll taxes and social contributions of employees and employers that are levied on labour income (both employed and non-employed). Data on labour taxes stem from the DG Taxation and Customs Union (‘Data on Taxation’ webpage). ↑

- Source: Eurostat (env_ac_tax). ↑

- Source: calculations based on data from DG Taxation and Customs Union (‘Data on Taxation’ webpage) and Eurostat (env_ac_tax). ↑

- Source: Eurostat (ten00135). ↑

- In the context of the EU’s digital agenda scoreboard indicators, rural areas are defined as those with less than 100 people per square kilometre. ↑

Explore further

Other articles

<footnote text will be automatically inserted if reference tags are used in article content text (use reference icon on ribbon)>

</footnotes>

Database

Thematic section

Publications

Further reading on partnership for the goals

- European Commission (2024), 2024 annual report on the implementation of the European Union’s external action instruments in 2023.

- European Commission (2024), EU Aid for Trade Progress Report 2023.

- European Commission (2021), Trade Policy Review -An Open, Sustainable and Assertive Trade Policy.

- EEA (2022), The role of (environmental) taxation in supporting sustainability transitions.

- European Union (2017), The new European Consensus on Development – EU joint statement ‘Our World, Our Dignity, Our Future’.

- OECD (2024), Development Co-operation Report 2024 – Tackling Poverty and Inequalities through the Green Transition.

- UN DESA (2024), Financing for Sustainable Development Report 2024, United Nations, New York.

Methodology

More detailed information on EU SDG indicators for monitoring of progress towards the UN Sustainable Development Goals (SDGs), such as indicator relevance, definitions, methodological notes, background and potential linkages can be found in the introduction as well as in Annex II of the publication ’Sustainable development in the European Union — Monitoring report on progress towards the SDGs in an EU context — 2025 edition’.

External links

Further data sources on partnership for the goals

- European Commission, DESI dashboard for the Digital Decade.

- European Commission, Data on Taxation Trends.

- European Union, Official Development Assistance (ODA) Dashboard.

- European Union, Total Official Support for Sustainable Development (TOSSD).

- IMF, Direction of Trade Statistics (DOTS).

- OECD, DAC1: Flows by provider (ODA+OOF+Private).

- OECD, Broadband statistics.