Data extracted in May 2024.

Planned article update: 19 June 2025.

Highlights

Current account balance, 2023

The balance of payments records all economic transactions between resident and non-resident entities during a given period. This article presents data on the current and financial accounts of the balance of payments for the European Union (EU) and its Member States. Data are presented following the methodology of the IMF's sixth balance of payments manual (BPM6).

The balance of the current and capital accounts determines the exposure of an economy to the rest of the world, whereas the financial account explains how it is financed. There are also transactions that take place in the financial account, only. Ideally, the balance of the current and capital accounts should equal the total net of the financial account, otherwise net errors and omissions are recorded. Articles on foreign direct investment (in chapter 4) provide more information on one component of the financial account, while an article on international trade in services focuses on one component of the current account.

Current account

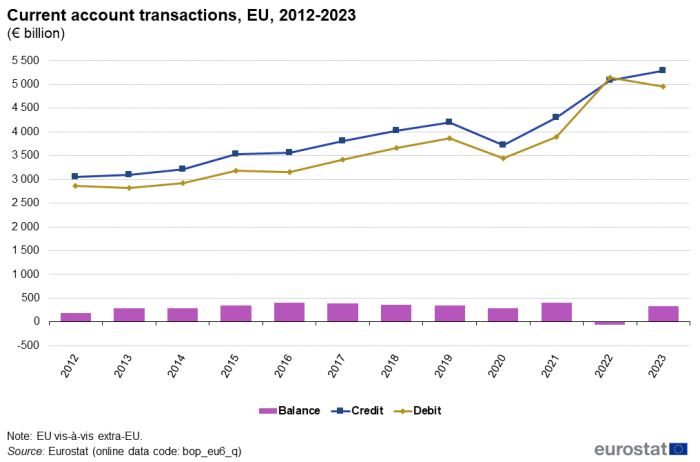

The current account of the EU, (EU vis-à-vis extra-EU), showed a surplus of €329.2 billion in 2023 (see Figure 1), corresponding to 1.9 % of gross domestic product (GDP). By comparison, in 2022 the current account exhibited a deficit of -€56.1 billion. Since 2012, the surplus in the current account balance for the EU increased from 1.7 % of GDP (or €191.7 billion) to 3.2 % in 2016 (or €402.5 billion). Since then, it has been slowly decreasing in absolute values as well as a share of GDP until 2020. After a significant increase from 2020 to 2021, the current account of the EU for 2022 exhibited a deficit for the first time since 2008. This was mostly caused by a significant deficit in the goods account (-1.1 % of GDP) and in the secondary income account (-0.6 % of GDP), while the services and the primary income account recorded surpluses.

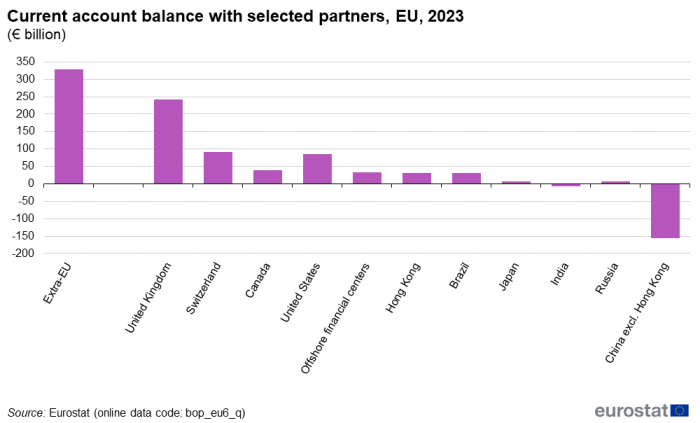

Among the partner countries and regions shown in Figure 2, the EU's current account deficit was by far the largest with China, standing at (-€156.8 billion) in 2023, followed by India (-€7.6 billion). On the other hand, the highest current account surpluses were recorded with the United Kingdom (€242.9 billion), Switzerland (€91.4 billion) and the United States (€85.6 billion). An overall surplus was also recorded with Canada, offshore financial centres[1], Hong Kong, Brazil, Japan and Russia.

(€ billion)

Source: Eurostat (bop_eu6_q)

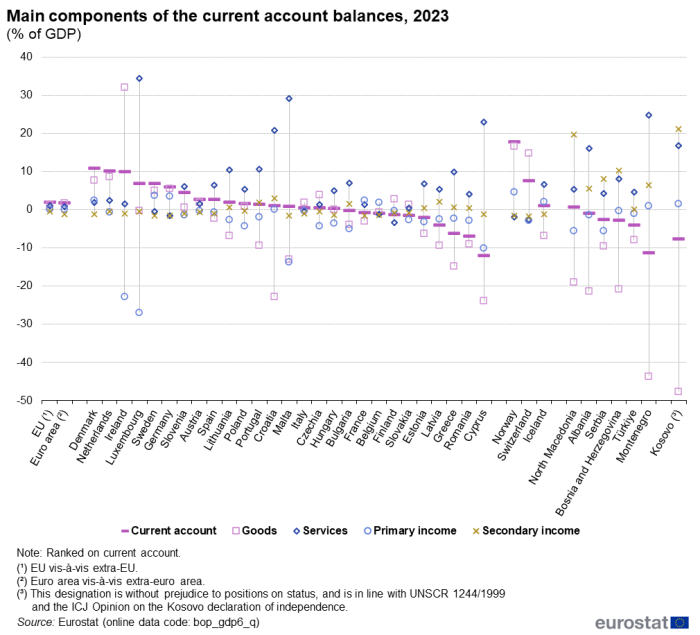

There were just 10 EU Member States that reported current account deficits in 2023 vis-à-vis the rest of the world compared with 19 in 2022. Surpluses were recorded by 17 Member States (see Figure 3 and Table 1). The largest relative current account deficits measured as a share of GDP were observed in Cyprus (-12.1 %), Romania (-7.0 %) and Greece (-6.3 %), while Denmark (10.9 %), the Netherlands (10.1 %) and Ireland (9.9 %) reported the most surpluses relative to GDP in their current accounts. In absolute terms, however, Germany recorded by far the largest current account surplus (€243.1 billion) and Romania the largest current account deficit (-€22.6 billion).

(% of GDP)

Source: Eurostat (bop_gdp6_q)

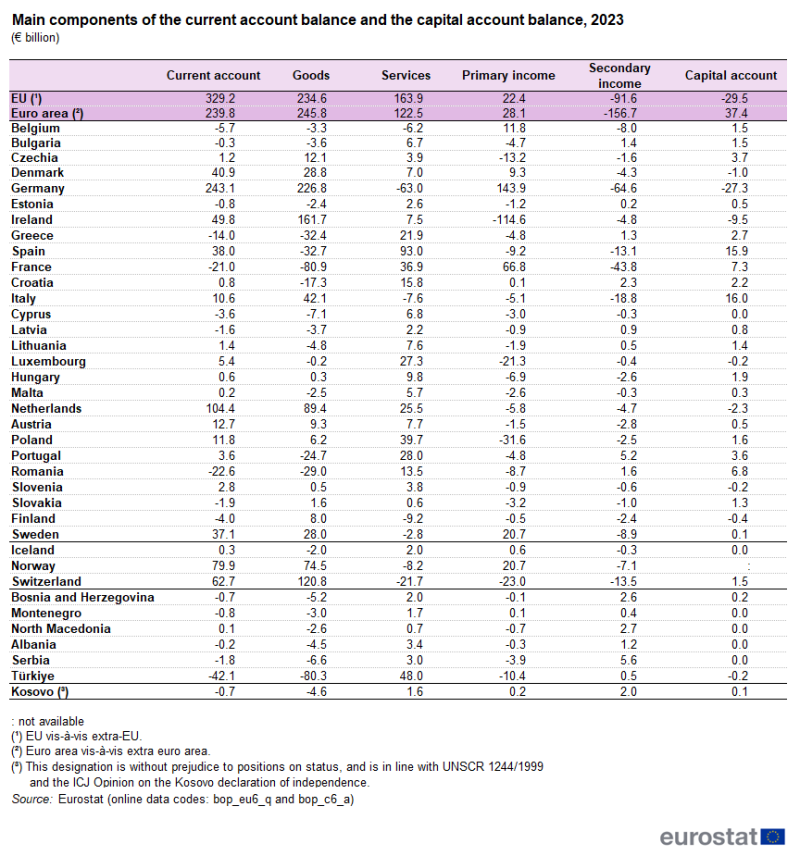

By taking a closer look at the current account components, it becomes apparent that the EU's current account surplus in 2023 was mostly built upon positives balances in the goods and services accounts and to a lesser extent in the primary income account (€234.6 billion, €163.9 billion and €22.4 billion respectively) despite a negative balance in the secondary income account (-€91.6 billion) — see Table 1. The current account surplus for the euro area (€239.8 billion) was generated by a huge surplus in the goods account (€245.8 billion), a considerable positive balance for services (€122.5 billion), and to a lesser extent by a surplus in primary income (€28.1 billion). The surplus was partly offset by a large negative balance in the secondary income account (-€156.7 billion).

At Member State level, Germany (€226.8 billion) and Ireland (€161.7 billion) displayed the largest surpluses vis-à-vis the rest of the world (intra-EU + extra-EU) in absolute terms in the goods accounts resulting, inter alia, from cross border activities of domestic MNEs, merchanting or processing activities. The Netherlands (€89.4 billion), Italy (€42.1 billion) and Denmark (€28.8 billion) were also amongst the major net exporters of goods, while 14 EU Member States faced negative balances in their goods accounts in 2023. Among those, France was by far the largest net importer of goods (-€80.9 billion), followed by Spain (-€32.7 billion) and Greece (-€32.4 billion). The highest net exporters of services in 2023 were Spain (€93.0 billion), Poland (€39.7 billion) and France (€36.9 billion). Net importers of services were Germany (-€63.0 billion), Finland (-€9.2 billion), Italy (-€7.6 billion), Belgium (-€6.2 billion) and Sweden (-€2.8 billion).

Among EFTA countries, Norway (€79.9 billion) reported a significant current account surplus in 2023 due to a huge surplus for goods (€74.5 billion). Iceland exhibited a low current account surplus (€0.3 billion) generated by transactions concerning services (€2.0 billion) and primary income (€0.6 billion).

(€ billion)

Source: Eurostat (bop_eu6_q) and (bop_c6_a)

Altogether 13 Member States recorded surpluses for goods in 2023, while 22 Member States recorded surpluses for services with the rest of the world — see Figure 3. Among those with the largest relative exposure to surpluses in goods were Ireland (32.0 % of GDP), the Netherlands (8.6 % of GDP) and Denmark (7.7 % of GDP). The highest relative surpluses in services were measured for Luxembourg (34.4 % of GDP), Malta (29.2 % of GDP) and Cyprus (23.0 % of GDP). The economies with the largest relative net deficit in goods were Cyprus (-23.9 % of GDP), Croatia (-22.8 % of GDP) and Greece (-14.7 % of GDP). Finland exhibited the highest relative net deficit (-3.3 % of GDP) for services.

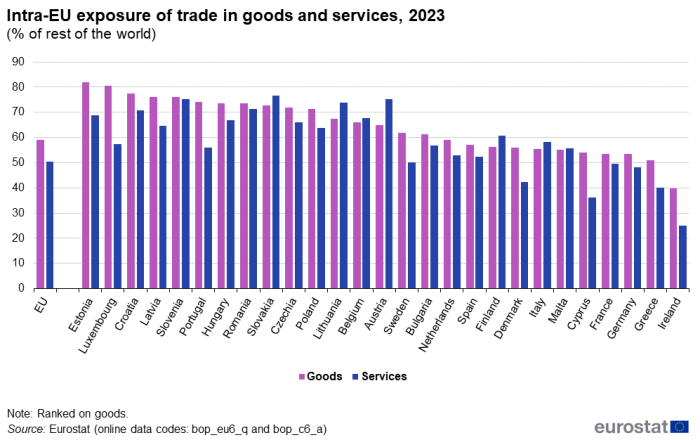

Overall 58.9 % of EU Member States' international trade in goods and more than half of their trade in services (50.5 %) were related to trade with other EU countries in 2023 — see Figure 4. Cross-border trade in goods with EU partners was highest in Estonia (82.1 %) and in addition 10 other Member States recorded also shares of over 70 %. The lowest share was reported by Ireland (39.9 %). Cross-border trade in services with other EU economies was most prominent in Slovakia (76.5 %), Slovenia and Austria (both 75.2 %), and lowest in Ireland (25.0 %).

(% of rest of the world)

Source: Eurostat (bop_eu6_q) and (bop_c6_a)

Capital account

The capital account of the EU traditionally displays a deficit, resulting from considerable net capital transfers to the rest of the world. In 2023, this trend continued with a capital account deficit of -€29.5 billion — see Table 1.

Looking at individual country data, 7 Member States recorded a negative capital account balance. The highest capital account deficit was reported by Germany (-€27.3 billion, 0.7 % of GDP).

Financial account

The financial account consists of direct investment (FDI), portfolio investment, other investment, (net) financial derivatives and employee stock options and reserve assets. Financial account transactions are split into assets and liabilities that are recorded as net values (net acquisition of financial assets, net incurrence of liabilities). Accordingly, the financial account balance is interpreted as net lending to the rest of the world when positive, and net borrowing from the rest of the world when negative.

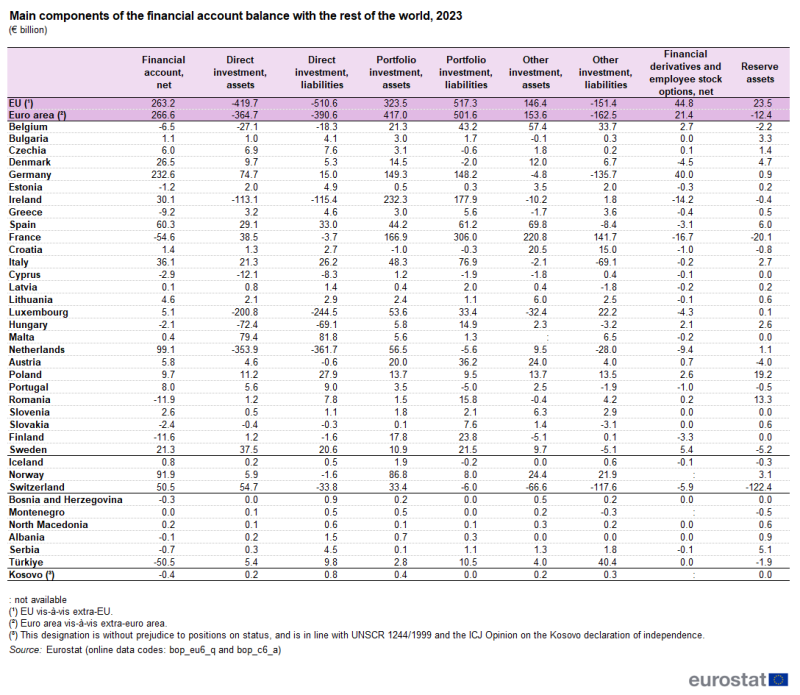

The overall net value of the EU financial account (EU vis-à-vis extra-EU) changed back from negative in 2022 (-€109.0 billion) to positive (€263.2 billion) in 2023. The net value of the euro area financial account is similarly positive (€266.6 billion). These balances related to 1.6 % of GDP (EU) and 1.9 % of GDP (euro area). The recorded net financial account surplus of the EU resulted mainly due to transactions in other investment which contributed in net terms €297.8 billion to the positive EU net financial account value. For direct investment, the EU's financial account exhibited a low net surplus of €90.9 billion in 2023, resulting from higher decreases based on net direct investment liability transactions (-€510.6 billion) compared with lesser decreases in net direct investment assets transactions (-€419.7 billion) vis-à-vis extra-EU.

(€ billion)

Source: Eurostat (bop_eu6_q) and (bop_c6_a)

In 2023, the largest net lender vis-à-vis the rest of the world in absolute terms in the EU was Germany with €232.6 billion (see Table 2). The German financial surplus was mainly achieved through net decreases of liabilities in other investment (-€135.7 billion), net acquisitions of direct investment assets (€74.7 billion) and net financial derivatives and employee stock options (€40.0 billion). France in contrast was the largest net borrower from the rest of the world in 2023 with a financial account deficit of -€54.6 billion. The financial account deficit of France resulted mainly from net incurrences of liabilities in portfolio investment (€306.0 billion) outweighing net acquisitions of portfolio investment assets (€166.9 billion). The Netherlands (-€353.9 billion) and Luxembourg (-€200.8 billion) recorded the largest net decreases in direct investment assets as well as the highest decreases in direct investment liabilities (-€361.7 billion) repsectively (-€244.5 billion). Regarding portfolio investment Ireland recorded the highest increase of net assets (€232.3 billion) and France the largest increase in net liabilities (€306.0 billion). The major hubs for financial account transactions in the EU in 2023 were France, the Netherlands and Ireland.

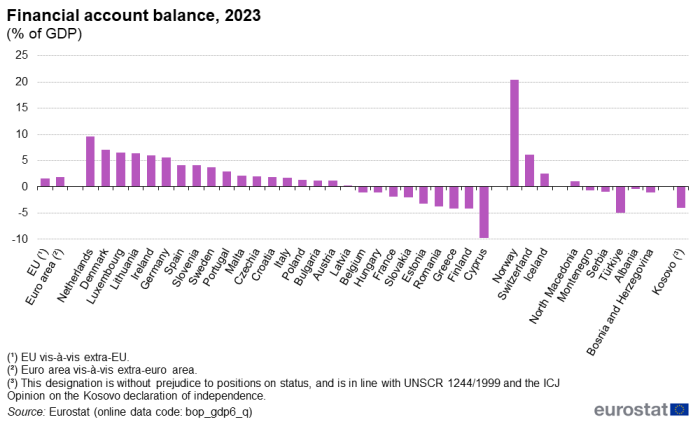

Among EFTA countries, Norway recorded by far the highest surplus in the net financial account (€91.9 billion). Norway's positive balance in its financial account was mainly determined by considerable portfolio investment net acquisition of assets (€86.8 billion). Looking at the financial account balance of individual countries relative to their GDP, a total of 18 EU Member States were net lenders vis-à-vis the rest of the world in 2023 and showed surpluses in their net financial accounts. The highest value relative to its GDP was reported by the Netherlands (9.6 %) and Denmark (7.1 %). By contrast, 9 EU Member States were net borrowers, among those Cyprus (-9.7 % of GDP) exhibited the highest relative deficit in regard to its GDP — see Figure 5.

Source data for tables and graphs

Data sources

The main methodological reference used for the production of balance of payment statistics is the sixth edition of the Balance of Payments and International Investment Position Manual (BPM6) of the International Monetary Fund (IMF). This set of international standards had been developed, partly in response to important economic developments, including an increased role for globalisation, rising innovation and complexity in financial markets, and a greater emphasis on using the balance sheet as a tool for understanding economic activity (asset–liability principle). The IMF Statistics Department has launched the update of the BPM6 targeting to publish an updated version of the Manual (BPM7) by March 2025. The BPM6 update is being coordinated with the update of the System of National Accounts 2008 (2008 SNA).

The transmission of balance of payments data to Eurostat is covered by Regulation (EC) No 184/2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment. New data requirements according to the BPM6 are included in Commission Regulation (EU) No 555/2012 of 22 June 2012 and Commission Regulation (EU) No 1013/2016 of 8 June 2016 as an amendment to the above.

In April 2024, the first provisional data for the 4th quarter of 2023 became available, from which the first estimate of the annual results for 2023 have been produced.

Current account

The current account of the balance of payments provides information not only on international trade in goods (traditionally the largest category), but also on international transactions in services, primary and secondary income. For all these transactions, the balance of payments registers the value of credits (exports) and debits (imports). A positive balance — a current account surplus (which applied to the EU since 2008 but changed in 2022) — shows that an economy is earning more from its international export transactions than spending abroad from import transactions with other economies, and is therefore a net creditor (net exporter) towards the rest of the world.

The current account gauges a country's economic situation in the world, covering all transactions that occur between resident and non-resident entities. More specifically, the four main components of the current account are defined, according to the BPM6, as follows.

- International trade in goods covers general merchandise, net exports of goods under merchanting and non-monetary gold. Exports and imports of goods are recorded on a so-called free-on-board (FOB) valuation — in other words, at market value at the customs frontiers of exporting economies, thus including charges for insurance and transport services up to the frontier of the exporting economy. As a consequence for imports an FOB adjustment is required in order to deduct the value of freight and insurance premiums incurred for the transport up to the border of the importing economy.

- International trade in services consists of the following items: manufacturing services performed on physical inputs owned by others (goods for processing), maintenance and repair services, transport services performed by EU residents for non-EU residents, or vice versa, involving the carriage of passengers, the movement of goods, and auxiliary services, such as cargo handling charges, packing and repackaging, towing not included in freight services, pilotage and navigational aid for carriers, air traffic control, salvage operations, agents' fees, and so on; travel, which includes primarily the goods and services EU travelers acquire from non-EU residents, or vice versa; and other services, which include construction services, insurance and pension services, financial services, charges for the use of intellectual property not included elsewhere, telecommunications, computer and information services, other business services (which comprise research and development services, professional and management consulting services, technical and other trade-related services, personal, cultural and recreational services, and government services not included elsewhere).

- Primary income covers basically three types of transactions: compensation of employees paid to non-resident workers or received from non-resident employers, investment income from direct, portfolio, other investment and reserve assets, and other primary income (taxes on production and on imports, subsidies and rent). All investment income components cover income on equity and investment fund shares (divided between distributed and accrued income) and interest from investment in debt securities, deposits or loans, and investment withdrawals from income of quasi-corporations.

- Secondary income includes general government current transfers, for example payments of current taxes on income and wealth, social contributions and benefits, transfers related to international cooperation, and current transfers related to financial and non-financial corporations, households, or non-profit organisations.

Capital account

The capital account of the balance of payments provides information on the acquisition of non-financial assets by residents in the rest of the world, or by non-residents in the compiling economy, for example investment in real estate. It also includes capital transfers by general government and financial, non-financial corporations, households or non-profit organisations (also specifically covering debt forgiveness).

Financial account

The financial account of the balance of payments covers all transactions associated with changes of ownership in financial assets and liabilities of an economy with the rest of the world. The financial account is broken down, according to the BPM6, into five main components: direct investment, portfolio investment, financial derivatives (other than reserves) and employee stock options, other investment, and reserve assets. All components are recorded according to the asset–liability principle, which supports the full implementation of the balance sheet approach in the financial account. In this regard, net values are recorded and have to be interpreted by keeping the underlying gross transactions in mind — net acquisition of assets is based on the acquisition of new assets minus the sale of assets during the observed period, while net incurrence of liabilities consists of the issue of new liabilities minus redemptions of outstanding liabilities. The resulting balance of net assets minus net liabilities is interpreted as net lending to the rest of the world when positive, or net borrowing when negative.

Direct investment implies that a resident direct investor makes an investment that gives control or a significant degree of influence on the management of an enterprise in another economy. Within this classification, FDI in equity/investment fund shares (plus reinvestment of earnings where applicable) and in debt securities are distinguished. A breakdown is required for transactions by a direct investor in direct investment enterprises, reverse investments and international transactions between fellow enterprises with the ultimate controlling parent being either resident or non-resident. More aspects are covered in dedicated articles on foreign direct investment (in chapter 4).

Portfolio investment records the transactions in negotiable financial securities with the exception of the transactions which fall within the definition of direct investment or reserve assets. Two main components are identified: equity securities and debt securities (bonds and notes or money market instruments).

Financial derivatives (other than reserves) and employee stock options are financial instruments that are linked to another specific financial instrument, indicator or commodity, and through which specific financial risks can be traded in financial markets in their own right. Transactions in financial derivatives are treated as separate transactions, rather than integral parts of the value of underlying transactions to which they may be linked. They are disseminated as net value of assets and liabilities only.

Other investment covers the following types of instruments — other equity, currency and deposits (in general, the most significant item), loans, insurance/pension/and standardised guarantee schemes, trade credits and advances, other accounts receivable/payable and special drawing rights.

Reserve assets are foreign financial assets available to and controlled by monetary authorities; they are used for financing and regulating payments imbalances or for other purposes.

Context

The EU is a major player in the global economy for international trade in goods and services, as well as foreign investment. Balance of payments statistics give a complete picture of all external transactions for the EU and its individual Member States. Indeed, these statistics may be used as a tool to study the international exposure of different parts of the EU's economy, indicating its comparative advantages and disadvantages with the rest of the world, and to calibrate the implied macroeconomic risks for the economy. The financial and economic crisis 2007-2008 underlined the importance of developing such economic statistics insofar as improvements in the availability of data on the real and financial economies of the world could have helped policymakers and analysts when the crisis unfolded; for example, if internationally comparable information about financial transactions and exposure in specific assets and liabilities had been available earlier.

The European Commission launched new policy proposals in this domain aiming to stimulate the economic recovery (such as the European Fund for Strategic Investments), and to launch regular initiatives to calibrate macroeconomic risks in the EU Member States (such as the Macroeconomic imbalance procedure). Further details on the European Commission's initiatives are available from the website of the European Commission's Directorate-General for Economic and Financial Affairs, where more detailed information may be found on a range of recent priorities, for example Growth and Investment and the The European semester.

Footnotes

- ↑ Offshore financial centres (OFC) is an aggregate which includes 40 countries. As examples, the aggregate contains European financial centres, such as Liechtenstein, Guernsey, Jersey, the Isle of Man, Andorra, and Gibraltar; Central American OFC such as Panama and Caribbean islands like Bermuda, the Bahamas, the Cayman Islands and Turks and Caicos Islands; and Asian OFC such as Bahrain, Hong Kong, Singapore and Philippines.

Explore further

Other articles

- Balance of Payments and International Investment Position Manual (BPM6)

- Balance of payment statistics - background

- Balance of payments statistics - quarterly data

- International trade in goods

- International trade in services

- Economic globalisation indicators

- Personal transfers and compensation of employees

Database

Publications

- Quality report on balance of payments (BOP), international trade in services (ITS) and foreign direct investment (FDI) - 2022 edition — Statistical Reports

- Quality report on balance of payments (BOP), international trade in services (ITS) and foreign direct investment (FDI) - 2020 edition — Statistical Reports

- Quality report on balance of payments (BOP), international trade in services (ITS) and foreign direct investment (FDI) - 2019 edition — Statistical Reports

- Current account asymmetries in EU-US statistics - 2019 edition — Statistical Reports

- Quality report on balance of payments, international trade in services and foreign direct investments — 2018 edition — Statistical Reports 05/01/2018

- Transatlantic trade in services: Investigating bilateral asymmetries in EU-US trade statistics — Statistical Reports 18/12/2017

- Consistency between national accounts and balance of payments statistics — Statistical Reports 21/09/2017

- EU current account surplus €107.9 bn — News Release from 09/04/2024

- EU-27 current account deficit €7.9 bn — News Release 41/2023 of 05/04/2023

- EU current account surplus €49.6 bn — News Release 39/2022 of 5/04/2022

- EU current account surplus €110.3 bn — News Release 42/2021 of 9/04/2021

- EU-27 current account surplus €90.9 bn — News Release 59/2020 of 8/04/2020

- EU28 current account surplus €38.6 bn — News Release 60/2019 of 5/04/2019

- EU28 current account surplus €63.5 bn — News Release 61/2018 of 10/04/2018

Methodology

- Compilers guide on European statistics on international trade in goods — 2017 edition Publication 17/05/2017

- Handbook on the compilation of statistics on illegal economic activities in national accounts and balance of payments Publication 06/03/2018

- Manual on goods sent abroad for processing — 2014 edition Publication 17/09/2014