Comparative price levels for investment

Data from 20 June 2024

Planned article update: 17 December 2024

Highlights

In 2023, price levels for investment in the EU were highest for Germany (24 % above the EU average) and lowest for Croatia (36 % below the EU average).

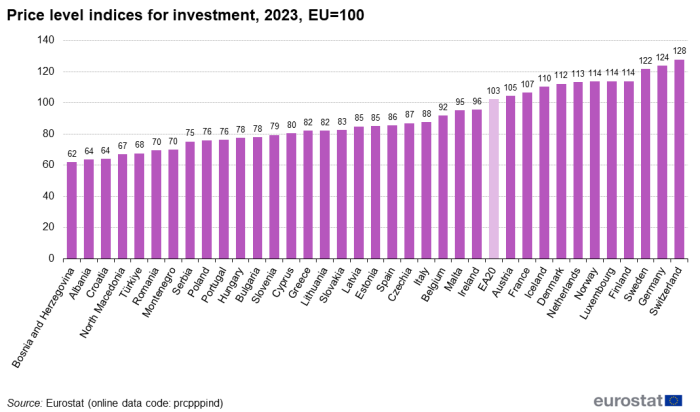

Price level indices for investment, 2023

This article focuses primarily on price levels of investment in the European Union (EU) Member States, covering also three EFTA countries (Iceland, Norway and Switzerland), as well as six EU candidate countries (Albania, Bosnia and Herzegovina, Montenegro, North Macedonia, Serbia and Türkiye).

Full article

Overview

In 2023, the highest price levels for investment among the EU Member States were observed in Germany at 24 % above the EU average, while in the least expensive EU Member State for investment, Croatia, the price level was 36 % below the EU average. These are the main conclusions drawn from the results of two price surveys carried out in 2023 within the Eurostat-OECD Purchasing Power Parities (PPP) Programme. The two surveys cover construction (residential buildings, non-residential buildings and civil engineering works) and machinery, equipment and other products.

The results of the surveys are expressed in price level indices, which provide a comparison of countries' price levels with respect to the EU average.

Figure 1 shows the 2023 price level indices for total investment. Switzerland and Germany recorded the highest price levels for investments, with price level indices of 128 and 124, respectively. At the other end of the spectrum, the least expensive country for investment was Bosnia and Herzegovina, with a price level index of 62.

Machinery, equipment and other products

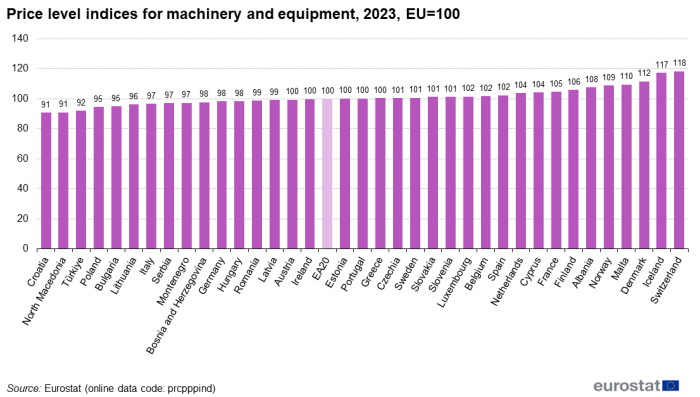

Figure 2 shows the price level indices for machinery and equipment, including metal products and equipment, electrical and optical equipment and transport equipment (see classification of investment products used). Among all 36 countries, the most expensive country for machinery, equipment and other products was Switzerland, with a price level index of 118, while Croatia and North Macedonia were the least expensive ones, both with a price level index of 91. The main characteristic shown by this chart is that the price levels for this type of product are relatively homogeneous across countries.

Source: Eurostat (prc_ppp_ind)

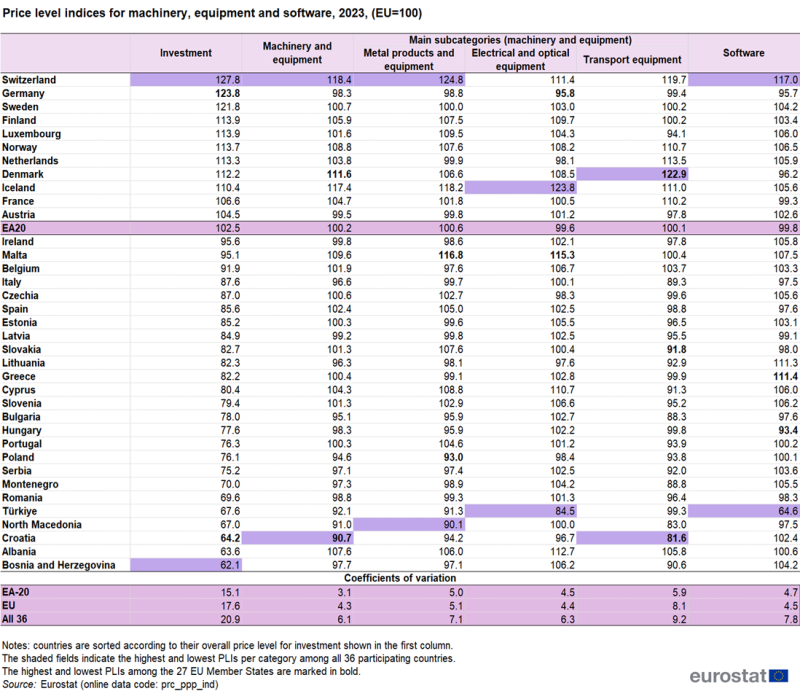

Table 1 shows the countries' price level indices for the aggregate machinery and equipment as well as for its three main sub-categories: metal products and equipment, electrical and optical equipment and transport equipment. In addition, the price level indices for software are shown. Countries are sorted according to their overall price level for investment shown in the first column. The shaded fields indicate the highest and lowest price level indices per category among all 36 participating countries. The highest and lowest price level indices among the 27 EU Member States are marked in bold.

Source: Eurostat (prc_ppp_ind)

Besides total machinery and equipment, Switzerland was the most expensive country as well for metal products and equipment, and for software. Among all 36 countries, Iceland had the highest price level for electrical and optical equipment, while Denmark registered the highest price level index for transport equipment.

By contrast, Croatia was the least expensive country for total machinery and equipment, as well as for sub-category transport equipment. For metal products and equipment, North Macedonia was the least expensive country, while for the other 2 sub-categories (electrical and optical equipment, and software) Türkiye registered the lowest price level indices.

Looking at the EU Member States, the results show that Denmark was the most expensive country for total machinery and equipment, while Malta was the most expensive for metal products and equipment, and for electrical and optical equipment. Greece showed the highest price for software.

At the bottom of the table, coefficients of variation are provided for the euro area (EA-20), the European Union (EU) and the group of all countries participating in the program (all 36). The coefficient of variation is defined as the standard deviation of the price level indices of the respective group of countries as percentage of their average price level index. The higher the coefficient of variation, the higher is the price dispersion in the respective category.

The coefficients of variation at the bottom of Table 1 confirm the relatively low price dispersion across countries for these investment products. The highest homogeneity is visible within the euro area.

Among all 36 countries, transport equipment shows the highest price variation across countries.

Construction

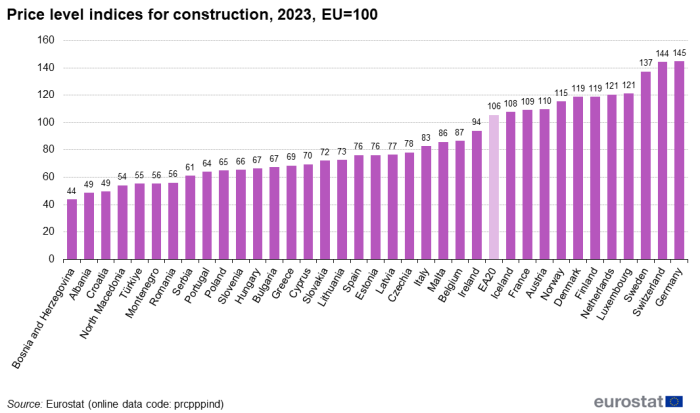

Figure 3 presents the price level indices for construction. The most expensive countries for construction investment were Germany, Switzerland and Sweden with price level indices of 145, 144, and 137 respectively. On the other hand Bosnia and Herzegovina, Albania and Croatia were the least expensive countries for investment in construction, showing price levels below 50 % of the EU average.

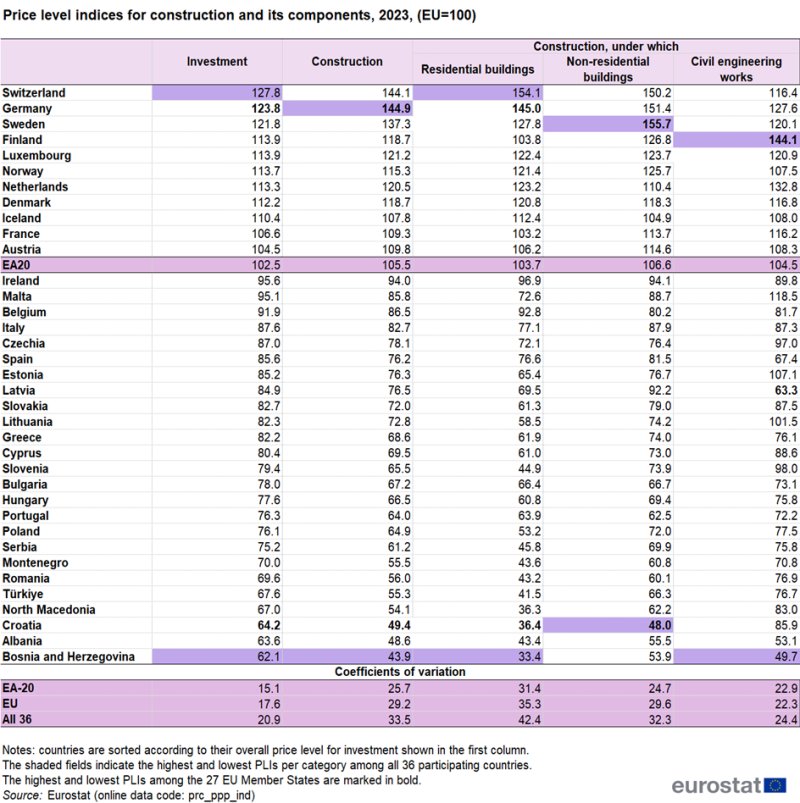

Table 2 shows the price level indices for the main categories of construction expenditure (residential buildings, non-residential buildings and civil engineering works). Countries are sorted according to their overall price level for investment shown in the first column. As in Table 1, the shaded fields indicate the highest and lowest price level indices per category among all 36 participating countries. The highest and lowest price level indices among the 27 EU Member States are marked in bold.

Source: Eurostat (prc_ppp_ind)

Looking at the EU Member States, Germany was the most expensive for residential buildings, Sweden had the highest price level for non-residential buildings, while Finland was the most expensive for civil engineering works. At the other end of the spectrum, the least expensive EU Member State for construction investments was Croatia, which was also the least expensive country for the sub-categories residential buildings and non-residential buildings. For the sub-category civil engineering works, the lowest price level indices were shown by Latvia.

Among all 36 countries, Switzerland had the highest price levels for residential buildings. Bosnia and Herzegovina was the least expensive country for residential buildings and for civil engineering works.

Price dispersion is higher within the 36-country group. It is less significant in the euro area (EA-20) than in the EU as a whole. Price dispersion for all categories of construction is higher than that for total investment, due to the higher share of labour input into construction and the high dispersion of wages across countries. Price dispersion is the highest for residential buildings, followed by non-residential buildings.

Data sources

The data in this article are produced by the Eurostat-OECD Purchasing Power Parities (PPP) Programme. The full methodology used in the programme is described in the Eurostat-OECD Methodological manual on purchasing power parities available free of charge from the Eurostat website.

The PPP concept

In their simplest form PPPs are nothing more than price relatives that show the ratio of the prices in national currencies for the same good or service in different countries. For example, if the price of a hamburger in Sweden is 28.60 Swedish krona and in Italy it is 2.76 euro, the PPP for hamburgers between Sweden and Italy is 28.60 krona to 2.76 euro or 10.36 krona to the euro. In other words, for every euro spent on hamburgers in Italy, 10.36 krona would have to be spent in Sweden in order to obtain the same quantity and quality – or volume – of hamburgers.

Published PPPs usually refer to product groups or broad aggregates like gross domestic product (GDP) rather than to individual products. However, these aggregate PPPs are based on data for individual goods and services.

Price level indices

Price levels as presented in this publication are the ratios of PPPs to exchange rates. They provide a measure of the differences in price levels between countries by indicating for a given product group the number of units of common currency needed to buy the same volume of the product group or aggregate in each country.

Price level indices provide a comparison of the countries' price levels relative to the European Union average: if the price level index is higher than 100, the country concerned is relatively expensive compared to the EU average, while if the price level index is lower than 100, then the country is relatively inexpensive compared to the EU average. The EU average is calculated as the weighted average of the national price level indices, weighted with expenditures from national accounts, corrected for price level differences.

Price level indices are not intended to rank countries strictly. In fact, they only provide an indication of the order of magnitude of the price level in one country in relation to others, particularly when countries are clustered around a very narrow range of outcomes. The degree of uncertainty associated with the basic price data and the methods used for compiling PPPs may cause minor differences between the price level indices and result in differences in ranking which are not statistically or economically significant.

The impact of exchange rate changes on price level indices

As explained above, the price level index for a given country is calculated as its PPP divided by its annual average exchange rate to the euro. This implies that exchange rate movements have an impact on the price level indices. The depreciation of a country's currency against the euro will make the country less expensive in comparison to euro area countries and this will be shown as decrease of the relative price level expressed in the price level index.

Main characteristics of the survey on prices for machinery, equipment and other products

The survey on prices for machinery, equipment and other products is carried out every 2 years. The last survey was carried out in April, May and June 2023. Countries collected prices for around 500 items, divided over nine sub-groups. The survey covers the three main sub-categories of machinery and equipment (metal products and equipment; electrical and optical equipment; and transport equipment) as well as the software category.

From the sub-groups listed as investment categories, no prices are collected for other transport equipment, boats, steamers, tugs, floating platforms and rigs, locomotives, rail-cars, vans, wagons and other rail equipment, aircrafts, helicopters, hovercrafts and other aeronautical equipment, and products of agriculture, forestry and other products. price level indices for these sub-groups are estimated taking PPPs of other sub-groups as proxy.

Prices refer to purchasers' prices including non-deductible VAT.

Main characteristics of the survey on construction prices

The 2023 survey on construction prices, whose results are published in this article, was carried out in May, June and July 2023.

Countries collected prices for a list of "bills of quantities", which are comparable construction projects such as a detached house, an office building or an asphalt road. Each bill of quantities consists of a number of chapters or major components (like earthworks, concrete, masonry, etc.) which are made up of items or elementary components (like excavation of the terrain, dumping and compacting of soil, etc.).

The construction projects are divided into 3 sub-categories: residential buildings (comprising 3 bills of quantities: a detached house, an apartment building and a renovation of a detached house), non-residential buildings (comprising 2 bills of quantities: a light industrial building and an office building) and civil engineering works (also 2 bills of quantities: an asphalt road and a resurfacing of an asphalt road).

Countries are asked to collect purchasers' prices for the bills of quantities, i.e. prices actually paid in markets for the elementary components that make up those bills of quantities and the additional expenses incurred that build up to the project total cost paid by the client. Non-deductible VAT is added to these purchasers' prices.

Context

Purchasing power parities (PPPs) are indicators of price level differences across countries. PPPs tell us how many currency units a given quantity of goods and services costs in different countries. PPPs can thus be used as currency conversion rates to convert expenditures expressed in national currencies into an artificial common currency, the purchasing power standard, eliminating the effect of price level differences across countries.

The main use of PPPs is to convert national accounts aggregates, like the gross domestic product (GDP) of different countries, into comparable volume aggregates. Applying nominal exchange rates in this process would overestimate the GDP of countries with high price levels relative to countries with low price levels. The use of PPPs ensures that the GDP of all countries is valued at a uniform price level and thus reflects only differences in the actual volume of the economy.

PPPs are also applied in analyses of relative price levels across countries. For this purpose, the PPPs are divided by the current nominal exchange rate to obtain a price level index which expresses the price level of a given country relative to another, or relative to a group of countries like the EU.

The common rules for the provision of input data, and for the calculation and dissemination of PPPs, are laid down in Regulation (EC) No 1445/2007 of the European Parliament and of the Council of 11 December 2007.

Direct access to

- Comparative price levels (tec00120)

- Price and volume convergence between EU Member States (tec00121)

- GDP per capita in PPS (tec00114)

- Purchasing power parities (PPPs), price level indices and real expenditures for ESA 2010 aggregates (prc_ppp_ind)

- Convergence indicators (prc_ppp_conv)

- Eurostat-OECD Methodological manual on purchasing power parities

- Purchasing power parities (ESMS metadata file — prc_ppp_esms)

- Regulation (EC) No 1445/2007 of 11 December 2007 establishing common rules for the provision of basic information on Purchasing Power Parities and for their calculation and dissemination

- Summaries of EU Legislation: Purchasing power parities