Archive:Singapore-EU - international trade in goods statistics

Planned article update: March 2022

Highlights

This article provides a picture of the international trade in goods between the European Union (EU) and Singapore. It analyses the type of goods exchanged between the two economies and the shares of each EU Member State in those exchanges.

This article is part of an online publication providing recent statistics on international trade in goods, covering information on the EU's main partners, main products traded, specific characteristics of trade as well as background information.

Full article

Recent developments

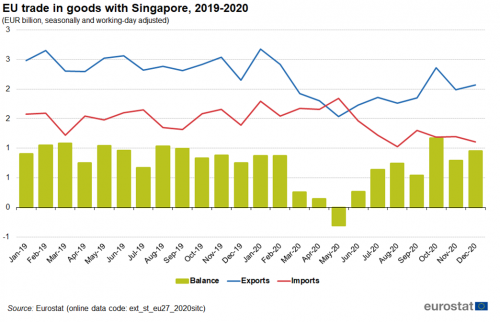

The COVID-19 crisis caused both exports and imports between the EU and Singapore to fall in 2020. Exports reached a minimum of EUR 1.5 billion in May 2020. By December 2020 they had recovered to EUR 2.1 billion. Imports reached a minimum of EUR 1.0 billion in August 2020. By December 2020 they had recovered to EUR 1.1 billion.

Figure 2 compares trade with Singapore to trade with other non EU countries. Between January 2019 and December 2020, exports to Singapore decreased by 16.8 % while exports to other non EU countries decreased by 2.3 %. Imports from Singapore decreased by 29.6 % while imports from other non EU countries decreased by 9.6 %.

Source: Eurostat (ext_st_eu27_2020sitc)

EU and Singapore in world trade in goods

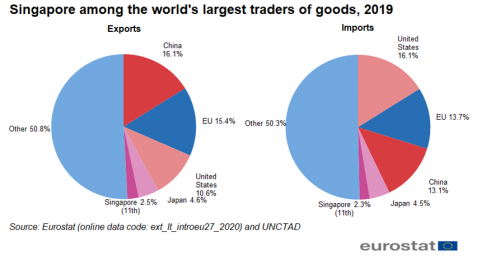

Figure 3a shows the position of Singapore among the largest traders of goods in the world in 2019. The four largest exporters were China (EUR 2 233 billion, 16.1 %), the EU (EUR 2 132 billion, 15.4 %), the United States (EUR 1 468 billion, 10.6 %) and Japan (EUR 630 billion, 4.6 %). The four largest importers were the United States (EUR 2 293 billion, 16.1 %), the EU (EUR 1 940 billion, 13 .7%), China (EUR 1 857 billion, 13.1 %) and Japan (EUR 644 billion, 4.5 %). Figure 3b has some more details. It shows that Singapore (EUR 349 billion, 2.5 %) was the eleventh largest exporter in the world between Russia (EUR 375 billion, 2.7 %) and Taiwan (EUR 295 billion, 2.1 %). It was also the eleventh largest importer in the worldSingapore (EUR 321 billion, 2.3 %) between Canada (EUR 414 billion, 2.9 %) and Taiwan (EUR 257 billion, 1.8 %).

Source: Eurostat (ext_lt_introeu27_2020) and UNCTAD

Source: Eurostat (ext_lt_introeu27_2020) and UNCTAD

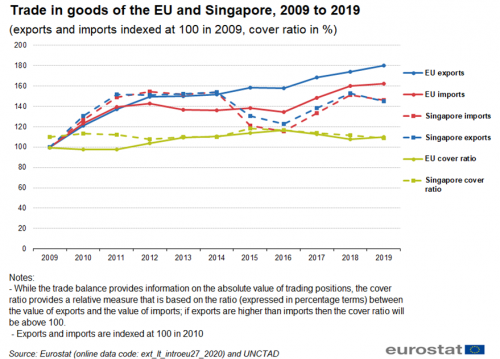

The imports and exports of goods of the EU and Singapore indexed at 100 in 2009 for the period to 2019 are shown in Figure 4. It also shows the cover ratio (exports / imports) for this period. Exports from the EU were lowest in 2009 (100) and highest in 2019 (180). Imports to the EU were lowest in 2009 (100) and highest in 2019 (163). The cover ratio for the EU was lowest in 2011 (97 %) and highest in 2016 (116 %) and was 110 % in 2019. Exports from Singapore were lowest in 2009 (100) and highest in 2014 (154) and were 145 in 2019. Imports to Singapore were lowest in 2009 (100) and highest in 2012 (154) and were 146 in 2019. The cover ratio for Singapore was lowest in 2012 (108 %) and highest in 2015 (118 %) and was 109 % in 2019.

Source: Eurostat (ext_lt_introeu27_2020) and UNCTAD

Both exports to and imports from Singapore increased between 2010 and 2020.

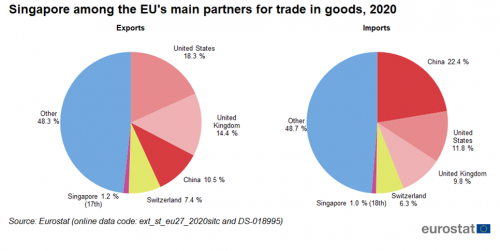

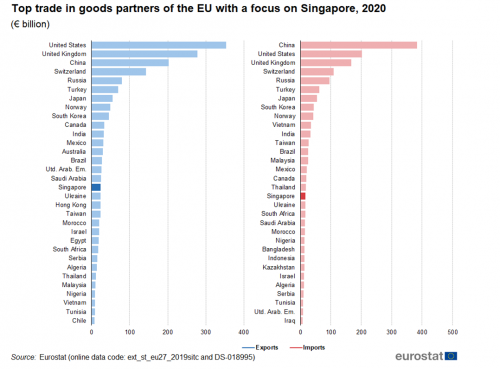

The position of Singapore among the largest trade partners of the EU in 2020 can be seen in Figure 5a. The four largest export partners of the EU were the United States (18.3 %), the United Kingdom (14.4 %), China (10.5 %) and Switzerland (7.4 %). The four largest import partners of the EU were China (22.4 %), the United States (11.8 %), the United Kingdom (9.8 %) and Switzerland (6.3 %). Figure 3b has some more details. It shows that Singapore (EUR 24 billion, 1.2 %) was the 17th largest export partner of the EU, between Saudi Arabia (EUR 25 billion, 1.3 %) and Ukraine (EUR 23 billion, 1.2 %). In imports Singapore (EUR 17 billion, 1.0 %) was the 18th largest partner of the EU, between Thailand (EUR 18 billion, 1.0 %) and Ukraine (EUR 17 billion, 1.0 %).

Source: Eurostat (ext_st_eu27_2019sitc) and Comext DS-018995

Source: Eurostat (ext_st_eu27_2019sitc) and Comext DS-018995

Figure 6 shows the exports, imports and trade balance between the EU and Singapore from 2010 to 2020. In 2010, the EU had a trade surplus with Singapore of EUR 6 billion. The trade surplus remained throughout the whole period, reaching EUR 7 billion in 2020. Both exports to and imports from Singapore increased between 2010 and 2020. EU exports to Singapore were highest in 2018 (EUR 31 billion) and lowest in 2010 (EUR 21 billion). EU imports from Singapore were highest in 2018 (EUR 19 billion) and lowest in 2014 (EUR 15 billion).

Source: Eurostat (ext_st_eu27_2019sitc) and Comext DS-018995

EU-Singapore trade by type of goods

The breakdown of EU trade with Singapore by SITC groups is shown in Figure 7. The red shades denote the primary products: food & drink, raw materials and energy, while the blue shades show the manufactured goods: chemicals, machinery & vehicles and other manufactured goods. Finally, other goods are shown in green. In 2020, EU exports of manufactured goods (86 %) had a higher share than primary goods (13 %). The most exported manufactured goods were machinery & vehicles (44 %), followed by other manufactured products (21 %) and chemicals (21 %). In 2020, EU imports of manufactured goods (83 %) also had a higher share than primary goods (8 %). The most imported manufactured goods were chemicals (43 %), followed by machinery & vehicles (22 %) and other manufactured products (18 %).

Source: Eurostat (ext_st_eu27_2019sitc) and Comext DS-018995

Figure 8 shows the evolution of EU imports and exports by SITC group since 2010. In 2020, the EU had trade surpluses in machinery & vehicles (EUR 3.8 billion), other manufactured products (EUR 2.4 billion), food & drink (EUR 0.9 billion), energy (EUR 0.9 billion) and other products (EUR 0.6 billion). The EU had trade deficits in raw materials (EUR 0.1 billion) and chemicals (EUR 2.9 billion).

Source: Eurostat (ext_st_eu27_2019sitc) and Comext DS-018995

EU-Singapore most traded goods

More detail about the goods exchanged between the EU and Singapore is given in Figure 9, showing the 20 most traded goods at SITC-3 level. These top 20 goods covered 56 % of total trade in goods in 2020. Seven belonged to machinery and vehicles, six to chemicals, four to other manufactured products, two to energy and one to food and drink. The most traded product group at this level was medicaments. Another interesting way to look at the data is to investigate the cover ratio (exports / imports) of traded goods, showing the direction of the trade flows between the two economies. These ratios can be found in the right-hand margin of Figure 9. Five products were below 50 %, indicating EU imports from Singapore were at least twice as large as EU exports to Singapore. Seven products were above 200 %, indicating EU exports to Singapore were at least twice as large as EU imports from Singapore. Eight products were between 50 % and 200 %, showing more balanced trade.

Source: Eurostat DS-018995

Trade with Singapore by Member State

Table 1a shows the imports of goods from Singapore by Member State. The three largest importers from Singapore in the EU were the Netherlands (EUR 4 674 million), Belgium (EUR 3 765 million) and Germany (EUR 3 369 million). Slovenia (3.8 %) had the highest share for Singapore in its extra-EU imports.

Source: Eurostat (ext_st_eu27_2019sitc) and Comext DS-018995

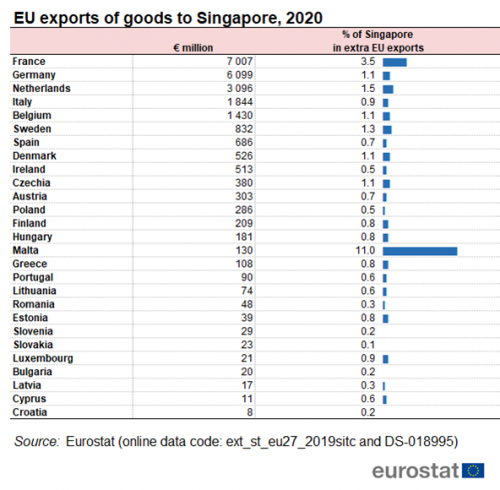

Table 1b shows the exports of goods to Singapore by Member State. The three largest exporters to Singapore in the EU were France (EUR 7 007 million), Germany (EUR 6 099 million) and the Netherlands (EUR 3 096 million). Malta (11.0 %) had the highest share for Singapore in its extra-EU exports.

Source: Eurostat (ext_st_eu27_2019sitc) and Comext DS-018995

The trade in goods balance between the EU Member States and Singapore is shown in Table 1c. It shows that 17 Member States had a trade surplus with Singapore. The largest surplus was held by France (EUR 5 205 million), followed by Germany (EUR 2 730 million) and Italy (EUR 1 375 million). There were ten Member States that had a trade deficit with Singapore. The largest deficit was held by Belgium (EUR 2 335 million), followed by the Netherlands (EUR 1 578 million) and Slovenia (EUR 552 million).

Source: Eurostat (ext_st_eu27_2019sitc) and Comext DS-018995

Source data for tables and graphs

Data sources

EU data is taken from Eurostat's COMEXT database. COMEXT is the reference database for international trade in goods. It provides access not only to both recent and historical data from the EU Member States but also to statistics of a significant number of third countries. International trade aggregated and detailed statistics disseminated via the Eurostat website are compiled from COMEXT data according to a monthly process.

Data are collected by the competent national authorities of the Member States and compiled according to a harmonised methodology established by EU regulations before transmission to Eurostat. For extra-EU trade, the statistical information is mainly provided by the traders on the basis of customs declarations.

EU data are compiled according to Community guidelines and may, therefore, differ from national data published by the Member States. Statistics on extra-EU trade are calculated as the sum of trade of each of the 27 EU Member States with countries outside the EU. In other words, the EU is considered as a single trading entity and trade flows are measured into and out of the area, but not within it.

The United Kingdom is considered as an extra-EU partner country for the EU-27 for the whole period covered by this article. However, the United Kingdom was still part of the internal market until the end of the transitory period (31 December 2020), meaning that data on trade with the United Kingdom are still based on statistical concepts applicable to trade between the EU Member States. Consequently, while imports from any other extra-EU-27 trade partner are grouped by country of origin, the United Kingdom data reflect the country of consignment. In practice this means that the goods imported by the EU-27 from the United Kingdom were physically transported from the United Kingdom but part of these goods could have been of other origin than the United Kingdom. For this reason, data on trade with the United Kingdom are not fully comparable with data on trade with other extra-EU-27 trade partners.

Data for the non EU-27 countries used in figures 1-3 are taken from the UNCTAD database of the United Nations. For the calculation of shares, the world trade is defined as the sum of EU trade with non-EU countries (source: Eurostat) plus the international trade of non-EU countries (source: UNCTAD).

Methodology

According to the EU concepts and definitions, extra-EU trade statistics (trade between EU Member States and non-EU countries) do not record exchanges involving goods in transit, placed in a customs warehouse or given temporary admission (for trade fairs, temporary exhibitions, tests, etc.). This is known as 'special trade'. The partner is the country of final destination of the goods for exports and the country of origin for imports.

Product classification Information on commodities exported and imported is presented according to the Standard international trade classification (SITC). A full description is available from Eurostat's classification server RAMON.

Unit of measure Trade values are expressed in millions or billions (109) of euros. They correspond to the statistical value, i.e. to the amount which would be invoiced in case of sale or purchase at the national border of the reporting country. It is called a FOB value (free on board) for exports and a CIF value (cost, insurance, freight) for imports.

Context

Trade is an important indicator of Europe's prosperity and place in the world. The block is deeply integrated into global markets both for the products it sources and the exports it sells. The EU trade policy is an important element of the external dimension of the 'Europe 2020 strategy for smart, sustainable and inclusive growth' and is one of the main pillars of the EU's relations with the rest of the world.

Because the 27 EU Member States share a single market and a single external border, they also have a single trade policy. EU Member States speak and negotiate collectively, both in the World Trade Organization, where the rules of international trade are agreed and enforced, and with individual trading partners. This common policy enables them to speak with one voice in trade negotiations, maximising their impact in such negotiations. This is even more important in a globalised world in which economies tend to cluster together in regional groups.

The openness of the EU's trade regime has meant that the EU is the biggest player on the global trading scene and remains a good region to do business with. Thanks to the ease of modern transport and communications, it is now easier to produce, buy and sell goods around the world which gives European companies of every size the potential to trade outside Europe.

Direct access to

- International trade in goods (t_ext_go), see:

- International trade in goods - long-term indicators (t_ext_go_lti)

- International trade in goods - short-term indicators (t_ext_go_sti)

- International trade in goods (ext_go), see:

- International trade in goods - aggregated data (ext_go_agg)

- International trade in goods - long-term indicators (ext_go_lti)

- International trade in goods - short-term indicators (ext_go_sti)

- International trade in goods - detailed data (detail)

- EU trade since 1988 by SITC (DS-018995)

- International trade in goods statistics - background

- International trade in goods (ESMS metadata file — ext_go_esms)

- User guide on European statistics on international trade in goods