Archive:South Korea-EU - international trade in goods statistics

- Data extracted in September 2017. Most recent data: Further Eurostat information, Main tables and Database. Planned article update: October 2018.

This article provides a picture of the trade in goods between the European Union (EU) and South Korea. It analyses the type of goods exchanged between the two economies and the shares of each EU Member State in those exchanges.

Source: Eurostat (ext_lt_introle)

Source: Eurostat (ext_lt_introle)

Source: Eurostat (ext_lt_maineu)

Source: Eurostat (ext_lt_maineu)

Source: Eurostat DS-018995

Source: Eurostat DS-018995

Source: Eurostat (ext_st_eu28sitc)

Source: Eurostat (ext_st_eu28sitc)

Source: Eurostat DS-018995

Source: Eurostat DS-018995

Main statistical findings

- In 2016, South Korea was the sixth largest exporter and importer of goods in the world with a share of 4.0 % of world exports and a share of 3.2 % of world imports.

- Among EU's trading partners, South Korea was the ninth largest partner for exports and the eighth largest partner for imports in 2016.

- EU trade position with South Korea, turned from a 17 billion euro deficit in 2007 to a 2.5 billion euro surplus in 2016.

- Manufactured good have a share of 86 % of EU exports to South Korea 94 % of EU imports from South Korea.

- Among EU Member States, Germany is the largest importer from and exporter to South Korea and also has the largest trade surplus with South Korea

EU and South Korea in world trade in goods

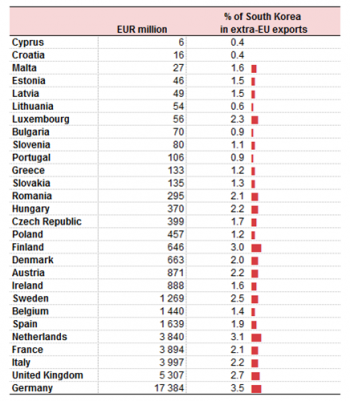

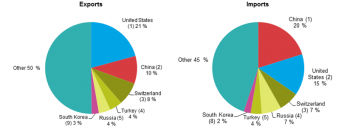

Figure 1 shows that the four largest exporters account for almost half of the world exports. The largest is China (17 %) followed by the EU (16 %), the United States (12 %) and Japan (5 %). The same four also account for almost half of the world imports but in different order. Here the USA (18 %) leads, followed by the EU (15 %), China (12 %) and Japan (5 %). South Korea is the sixth largest exporter (4 %) and importer (3 %) of world exports in both cases just behind Hong Kong.

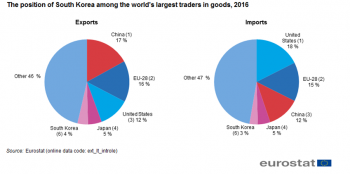

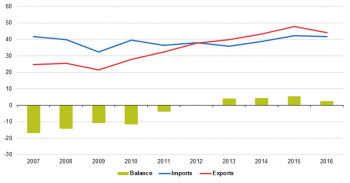

Figure 2 focuses on the evolution of trade in the EU and South Korea over the period 2007-2016. From 2007 to 2011 imports and exports for both economies developed in similar fashion with a low point in 2009 followed by a recovery. However after 2011 EU exports continued to grow while its imports remained stable while South Korean exports fell, again with imports remaining stable. Consequently the cover ratio of the EU improved and passed the 100 % mark in 2013. The South Korean cover ratio began to drop although remains substantially larger than that of the EU due to its large exports of energy products.

EU deficit fell by two thirds since 2008

Figure 3 shows that in 2016, South Korea had a share of 2.8 % in extra-EU exports (EUR 58 billion) and 3.7 % in extra-EU imports (EUR 63 billion). This meant it was the 7th largest partner for both imports to the EU and exports from the EU in both cases behind Japan. The top 7 for both imports and exports was completed by the United States, China, Switzerland, Russia and Turkey.

South Korea recorded a trade surplus with the EU from 2007 to 2016 (see Figure 4). In this time span, trade between the two economies hit a low in 2009, but recovered, peaking in 2012 after which exports to South Korea remained stable while imports from South Korea started falling even below their 2009 value in 2016. Due to the falling imports the trade deficit fell from 52 billion in 2008 to 15 billion in 2016.

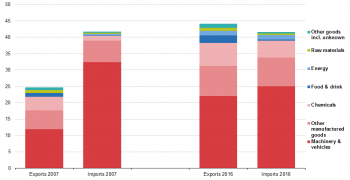

Manufactured goods dominate exports to South Korea

When breaking down imports and exports by SITC groups, the main categories driving the exports to South Korea are 'machinery and vehicles' (41 %), 'chemicals' (10 %) and 'other manufactured goods' (30 % ). Together these manufactured goods accounted for over 80 % of the EU exports in 2016 (see Figure 5). In 2007, almost 60 % of imports from South Korea consisted of energy products; but by 2016 this share dropped just below 50 %. In the same period imports of 'food & drink' grew from 4 % to 10 %.

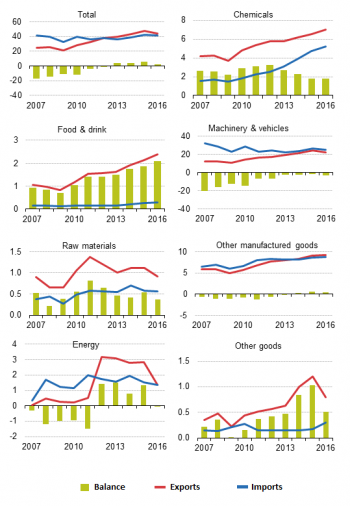

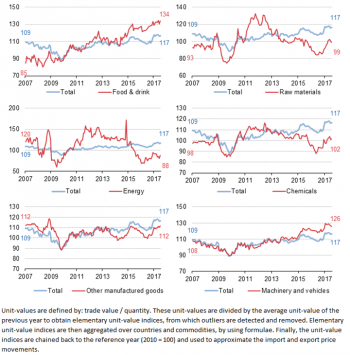

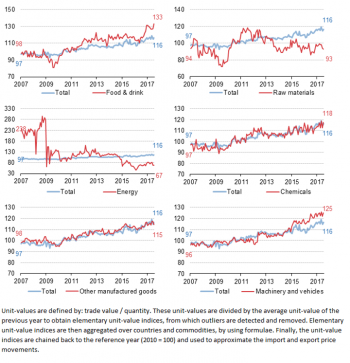

Figure 6 shows the evolution of EU imports and exports by SITC group since 2007. The EU has a large trade deficit in 'energy' and a smaller deficit in 'food & drink'. In 'machinery and vehicles', 'other manufactured goods' and to a lesser extent in 'chemicals' and 'other goods' the EU has a trade surplus with South Korea. Finally in 'raw materials' imports and exports are almost equal.

Figure 7a shows the unit value index for EU imports from South Korea by SITC group. The total index is largely dominated by 'energy' although in 2016 this index was 14 points below the total index. All other indexes grew more than the total index, most notably the index for food & drink which had been 45 points below the total index in 2012 but reached more than 50 points above in 2016

On the export side, the energy index fluctuated considerably, reflecting prices on world markets in 2017 it was 25 points below the total index. The other indexes stayed relatively close to the total index with the largest difference recorded by raw materials (+ 7 points) and chemicals (- 8 points).

Comparing import and export indexes for the different groups shows small differences for other manufactured goods and chemicals. Export indexes grew stronger than import indexes for machinery and vehicles (120 vs 111), energy (89 vs 76) and most notably in raw materials (121 vs 97). The opposite was the case for food & drink (117 vs 147).

Most traded goods: energy products

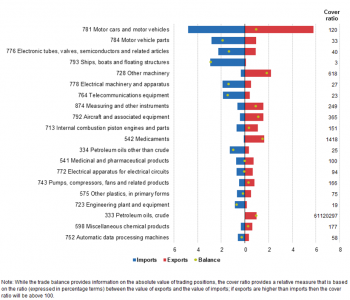

Figure 8 gives more details about the goods exchanged between the EU and South Korea, showing the top 20 traded goods at a more detailed level (by SITC level 3). Those top 20 goods covered a little over half of total traded goods in 2016. Eight products among the top 20 belong to the 'machinery & vehicles' group and four to 'energy'. Crude petroleum and natural gas were the top two products.

Another interesting way to look at data is to investigate the export/import ratio of traded goods, in order to better identify the direction taken by flows and specialisation between the two areas. These ratios can be found in the right margin of Figure 9. There are five products (crude petroleum, natural gas, fish, aluminium and liquefied propane and butane) with ratios below 10 indicating far larger imports to the EU from South Korea than exports from the EU to South Korea. There were no other products in the top 20 with ratios between 10 and 100. In the range between 100 and 300 there were four products (Non-crude petroleum, medicaments, measuring and other instruments, other machinery and motor vehicle parts, showing trade flows in both directions. For the remainder of the top 20 EU exports to South Korea were clearly larger than EU imports from South Korea, most notably in motor cars and vehicles.

North Sea countries trading most with South Korea

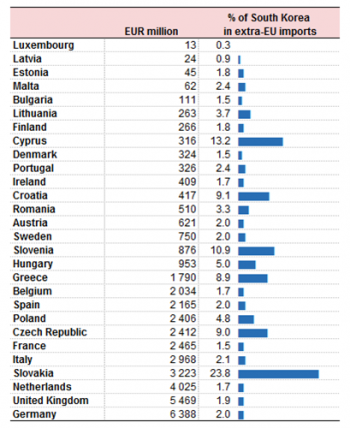

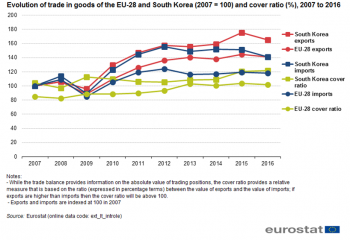

Figure 9a shows Member States' imports from South Korea and the share of the partner South Korea in national extra-EU imports. Table 9b provides similar information but concerning Member States' exports to South Korea.

There were three Member States whose imports from South Korea in 2016 were higher than EUR 10 billion: the United Kingdom (EUR 16 billion), Germany and the Netherlands (both EUR 11 billion). Two of South Korea's neighbours, Sweden (10 billion) and Denmark (4 billion) completed the top five who were all located on the border of or close to the Northsea. Together these five accounted for 82 % of all EU imports from South Korea. South Korea is a very important trade partner for Sweden and Denmark who respectively get 27 % and 19 % of their extra-EU imports from South Korea

The same five Member States were also the largest exporters to South Korea but in a different order with Sweden (EUR 13 billion) being the top exporter and the only one above 10 billion euro. Their combined share in exports to South Korea was a little over 72 %. Three Member States have more than 10 % of their extra-EU exports with destination South Korea. These are Sweden (25 %), Denmark and Estonia (both 16 %).

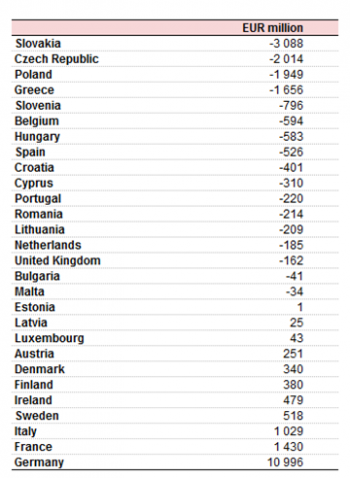

Figure 9c shows that 11 Member States had a trade deficit with South Korea in 2016, ranging from just 1 million euro for Malta to 12.3 billion euro for the United Kingdom. The remaining 17 Member States had a trade surplus, starting at 36 million euro for Croatia to 3.1 billion euro for Sweden. Poland (EUR 1.3 billion) was the only other Member State with a surplus exceeding 1 billion euro while Denmark (EUR 991 million) was just below that number.

Data sources and availability

EU data is taken from Eurostat's COMEXT database. COMEXT is the reference database for international trade in goods. It provides access not only to both recent and historical data from the EU Member States but also to statistics of a significant number of third countries. International trade aggregated and detailed statistics disseminated via the Eurostat website are compiled from COMEXT data according to a monthly process.

Data are collected by the competent national authorities of the Member States and compiled according to a harmonised methodology established by EU regulations before transmission to Eurostat. For extra-EU trade, the statistical information is mainly provided by the traders on the basis of customs declarations.

EU data are compiled according to Community guidelines and may, therefore, differ from national data published by the Member States. Statistics on extra-EU trade are calculated as the sum of trade of each of the 28 EU Member States with countries outside the EU. In other words, the EU is considered as a single trading entity and trade flows are measured into and out of the area, but not within it.

Data for the other major traders are taken from the Comtrade database of the United Nations. Data availability differs among countries, therefore Figure 1 shows the latest common available year for all the main traders. For the calculation of shares the world trade is defined as the sum of EU trade with non-EU countries (source: Eurostat) plus the international trade of non-EU countries (source: IMF Dots database).

Methodology

According to the EU concepts and definitions, extra-EU trade statistics (trade between EU Member States and non-EU countries) do not record exchanges involving goods in transit, placed in a customs warehouse or given temporary admission (for trade fairs, temporary exhibitions, tests, etc.). This is known as 'special trade'. The partner is the country of final destination of the goods for exports and the country of origin for imports.

Product classification

Information on commodities exported and imported is presented according to the Standard international trade classification (SITC). A full description is available from Eurostat's classification server RAMON.

Unit of measure

Trade values are expressed in millions or billions (109) of euros. They correspond to the statistical value, i.e. to the amount which would be invoiced in case of sale or purchase at the national border of the reporting country. It is called a FOB value (free on board) for exports and a CIF value (cost, insurance, freight) for imports.

Context

Trade is an important indicator of Europe's prosperity and place in the world. The block is deeply integrated into global markets both for the products it sources and the exports it sells. The EU trade policy is an important element of the external dimension of the 'Europe 2020 strategy for smart, sustainable and inclusive growth' and is one of the main pillars of the EU's relations with the rest of the world.

Because the 28 EU Member States share a single market and a single external border, they also have a single trade policy. EU Member States speak and negotiate collectively, both in the World Trade Organization, where the rules of international trade are agreed and enforced, and with individual trading partners. This common policy enables them to speak with one voice in trade negotiations, maximising their impact in such negotiations. This is even more important in a globalised world in which economies tend to cluster together in regional groups.

The openness of the EU's trade regime has meant that the EU is the biggest player on the global trading scene and remains a good region to do business with. Thanks to the ease of modern transport and communications, it is now easier to produce, buy and sell goods around the world which gives European companies of every size the potential to trade outside Europe.

See also

Further Eurostat information

Data visualisation

Main tables

- International trade in goods (t_ext_go), see:

- International trade in goods - long-term indicators (t_ext_go_lti)

- International trade in goods - short-term indicators (t_ext_go_sti)

Database

- International trade in goods (ext_go), see:

- International trade in goods - aggregated data (ext_go_agg)

- International trade in goods - long-term indicators (ext_go_lti)

- International trade in goods - short-term indicators (ext_go_sti)

- International trade in goods - detailed data (detail)

- EU trade since 1988 by SITC (DS-018995)

Dedicated section

Methodology / Metadata

- International trade in goods statistics - background

- International trade in goods (ESMS metadata file — ext_go_esms)

- User guide on European statistics on international trade in goods

Source data for tables, figures and maps (MS Excel)

External links

- European Commission