- Data from October 2010, most recent data: Further Eurostat information, Main tables and Database.

Creating, exploiting and commercialising new technologies has become essential in the global race for competitiveness. High-technology or 'high-tech' sectors are key drivers of economic growth, productivity and social protection, and are generally a source of high value added and well-paid employment. Technology-intensive enterprises are often referred to as 'high-technology' – or 'high-tech' – companies.

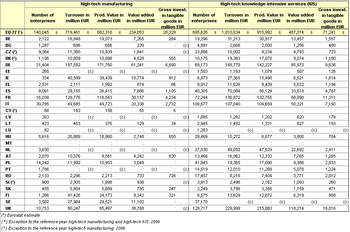

But what exactly is high-tech? Eurostat collects all available high-tech statistics for the European Union under the more formal name 'Statistics on high-tech industry and knowledge-intensive services' and defines high-tech according to three approaches: the sector approach, the product approach and the patent approach. The sector approach looks at: the high-tech manufacturing sector, medium high-tech manufacturing sector, and high-tech knowledge-intensive service sector, focusing on employment, earnings and economic indicators as shown in Table 1. The product approach looks simply at whether a product is a high-tech product or not and examines trade in high-tech products. The patent approach looks at whether a patent is a high-tech patent or not and also defines what biotechnology patents are.

Main statistical findings

Economic statistics on high-tech sectors

In 2004, the European Union had almost 140 000 enterprises in high-tech manufacturing and four times as many in high-tech knowledge-intensive services (600 000). High-tech manufacturers were most numerous in Italy, Germany, France and Poland, accounting together for around two-thirds of the high-tech sector in the EU. The United Kingdom counted the most enterprises in the high-tech KIS sector (120 938), comprising almost one-fifth of the EU total, followed by Italy, Germany and France.

A different picture emerges when considering turnover; Germany led the way in 2004, with a total turnover of EUR 150 billion in high-tech manufacturing, ahead of France (EUR 141 billion) which had ranked first in the previous year. The United Kingdom ranked third (EUR 90 billion), although its turnover had gone down from 2003. One of the main reasons for this is the size of the high-tech manufacturing sector in the UK, which is smaller than its main EU counterparts. This is particularly relevant when compared to Italy, which counted almost three times as many enterprises in high-tech manufacturing as the UK.

Turning to the high-tech KIS sector, it is striking that turnover, both in terms of production value and value added, were almost twice as high in the United Kingdom than in Italy. Germany was well ahead in terms of value added generated by high-tech manufacturing, with almost EUR 50 billion, while the UK was ahead in KIS with just under EUR 100 billion.

Average labour productivity in the EU in high-tech sectors was EUR 69 000. However, in individual Member States it varied considerably around this average. As in the previous year Ireland remained in first position with an average labour productivity of EUR 145 000, followed by Luxembourg with EUR 115 000. Among the new Member States, only Cyprus was above the EU average, with EUR 75 000, while labour productivity in Portugal, Italy and Greece hovered just below the EU average.

Trade in high-tech products

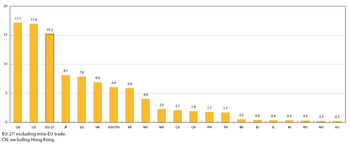

In 2006, aside from the world's four leading economies, where the EU is counted as a single economic area (entity), only ten other countries (entities) recorded shares of more than 1 % of global exports in high-tech products (see Graph 1). The four leaders at world level were China (17.1 %), the United States (17.0 %), the EU (15.2 %) and Japan (8.1 %). Among all the countries, Singapore, Hong Kong, 'other Asian countries' and South Korea each accounted for more than 5 % of high-tech exports. Behind this group of countries came Malaysia, with 4 %, and a group comprising Mexico, Canada, Switzerland, the Philippines and Thailand, each with shares of around 2 % of global exports. Brazil, Indonesia, Israel, India, the Russian Federation, Norway and Australia each registered global export shares in high-tech products ranging between 0.5 % and 0.2 %.

In 2006, the 21 largest exporting countries (entities) accounted for 99 % of global exports in high-tech products.

Employment in high-tech

In 2006, 39 million people worked in the manufacturing sector in the EU, which equates to 18.2 % of total EU employment. With more than 8 million, Germany counted the most people employed in manufacturing, followed by Italy and the United Kingdom. Of these 39 million workers, almost 12 million were employed in medium-high-tech manufacturing and only 2.3 million in high-tech manufacturing (see Table 2).

In the EU, women accounted for 30.8 % of employment in manufacturing overall. In every EU Member State the share of women employed in the manufacturing sector was below 50 %, although gender parity was almost achieved in Bulgaria and Romania (49.6 % and 48.0 % respectively); as a general rule, this ratio was often higher in the newer Member States. In medium-high-tech manufacturing, the share of female employment was lower than in high-tech manufacturing (23.8 % and 34.8 % respectively), and women in the latter sector outnumbered their male counterparts in Bulgaria, Hungary and Slovakia.

European employment in total manufacturing increased slightly between 2001 and 2006. This was also true for the medium-high-tech manufacturing sector. However, the number of jobs in high-tech manufacturing decreased on average by 1.7 % a year during the same period. At Member State level, employment in this sector grew in nine Member States, with the largest increases registered in Slovakia and Poland. In general, the countries where employment in high-tech manufacturing increased are the countries that have recently joined the EU. This was also the case for Spain and Turkey. Conversely, in Sweden and the Netherlands employment in high-tech manufacturing was down by more than 10 % between 2001 and 2006.

High-tech employment at regional level

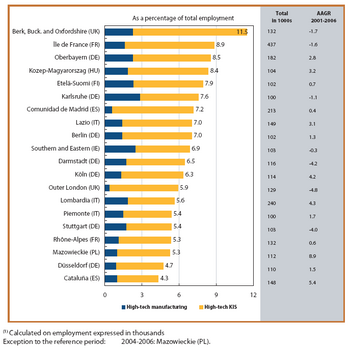

Figure 2 presents the top 20 regions (at NUTS level 2) in terms of employment in high-tech sectors in 2006, as a share of total employment and the annual average growth rate from 2001 to 2006. In 2006, the leading region was Berkshire, Buckinghamshire and Oxfordshire (UK - see list of country abbreviations), with high-tech sectors accounting for 11.5 % of total employment. This was followed by Île de France (FR), with 8.9 % and Oberbayern (DE), with 8.5 %.

Out of the 20 leading regions, seven were found in Germany, three in Italy, two each in France, the UK and Spain, and one in Ireland, Finland, Hungary and Poland, the two latter countries being the only representatives from the New Member States.

In terms of annual average growth rate, employment in high-tech sectors as a share of total employment increased in 13 of the 20 leading regions. Mazowieckie (PL) showed the highest growth rate (8.9 %), followed by Cataluña (ES), with an increase of 5.4 % on average per year. In contrast, over the same period the share of employment in high-tech sectors fell in Outer London (UK), Darmstadt (DE) and Stuttgart (DE) by an annual average of 4.8 %, 4.2 %, and 4.0 % respectively. Employment in high-tech sectors also decreased in Berkshire, Buckinghamshire and Oxfordshire (UK), Île de France (FR), Karlsruhe (DE) and Southern and Eastern (IE). Most of the population employed on high-tech was devoted to high-tech knowledge-intensive services (high-tech KIS). Karlsruhe, in Germany, and Southern and Eastern, in Ireland, show the highest percentages of employment in high-tech manufacturing, while Outer London (UK) and Comunidad de Madrid (ES) can be found at the lower end of the top 20 regions.

Considering the difference between the shares of people employed in high-tech manufacturing and the share of people employed in high-tech KIS, the largest discrepancies were found in Berkshire, Buckinghamshire and Oxfordshire (UK), Île de France (FR), Comunidad de Madrid (ES) and Outer London (UK).

Data sources and availability

High-tech statistics uses various other domains and sources mainly within Eurostat's official statistics (CIS, COMEXT, HRST, LFS, SBS, SES, PAT and R&D). Its coverage and availability is therefore dependent on these other primary sources.

The sectoral approach is an aggregation of manufacturing industries according to technological intensity (R & D expenditure/value added) and based on the Statistical Classification of Economic Activities in the European Community (NACE) at 2- or 3-digit level for compiling aggregates related to high-technology, medium high-technology, medium low-technology and low-technology. Services are mainly aggregated into knowledge-intensive services (KIS) and less knowledge-intensive services (LKIS) and defined according to a similar logic at NACE 2-digit level.

Note that due to the revision of NACE from NACE Rev. 1.1 to NACE Rev. 2 the definition of high-technology industries and knowledge-intensive services has changed. For high-tech statistics this means that two different definitions (one according NACE Rev. 1.1 and one according NACE Rev. 2) will be used in paralell as long as necessary. The data in this article is as defined by NACE Rev. 1.1.

The product approach was devised to complement the sectoral approach. The product list is based on the calculations of R&D intensity by groups of products (R & D expenditure/total sales). The groups classified as high-technology products are aggregated on the basis of the Standard international trade classification. The product approach is used for data on high-tech trade.

Due to the revision of SITC from SITC Rev. 3 to SITC Rev. 4 the definition of high-tech products has also changed. High-tech statistics will start publishing statistics based on SITC Rev. 4 sometime in 2009. The data in this article is as defined by SITC Rev. 3.

High-tech patents and biotechnology patents are defined according to the patent approach. The groups are aggregated on the basis of the International patent classification - 8th edition. Biotechnology patents are also aggregated on the basis of the IPC - 8th edition.

For more detailed information of the various high-tech definitions see:

- High-tech aggregation by NACE Rev. 1.1

- High-tech aggregation by NACE Rev. 2

- High-tech aggregation by SITC Rev. 3

- High-tech aggregation by SITC Rev. 4

- High-tech aggregations by patents

Context

EP/Council Decision 1608/2003 concerning the production and development of Community statistics on science and technology and Commission Regulation 753/2004 addressing statistics on science and technology determine the production and development of statistics on high-tech (in particular with regard to activities, products, contribution to the whole economy, etc.).

Further Eurostat information

Publications

- Science, technology and innovation in Europe - Statistical book 2008

- Science, technology and innovation in Europe - Pocketbook 2008

- China passes the EU in High-tech exports - Statistics in focus 25/2009

- Who are the people employed in high-tech and in which regions do they work? - Statistics in focus 51/2008

- High-tech knowledge-intensive services - Statistics in focus 18/2008

- Trade in high-tech products - Statistics in focus 7/2008

- Biotechnology in Europe - Patents and R&D investments - Statistics in focus 100/2007

- Regional employment in high-tech sectors - Statistics in focus 102/2007

Main tables

- Science and technology, see:

- High-tech industry and knowledge-intensive services (t_htec)

Database

- Science and technology, see:

- High-tech industry and knowledge-intensive services (htec)

- High-tech industries and knowledge-intensive services: economic statistics at national level (htec_eco)

- High-tech industries and knowledge-intensive services: employment statistics at national and regional level (htec_emp)

- High-tech industries and knowledge-intensive services: science and technology statistics at national and regional level (htec_sti)

Dedicated section

Methodology / Metadata

- High-tech industry and knowledge-intensive services (ESMS metadata file - htec_esms)

Other information

- Decision (EC) 1608/2003 (Legal text)

- Regulation (EC) 753/2004 (Legal text)

External Links

- DG Enterprise: European innovation scoreboard

- OECD:Statistical analysis of science, technology and industry