International trade in goods - concentration of trade

Data extracted in October 2023

Planned article update: October 2024

Highlights

In 2021, there was a higher concentration among EU Member States in the market share of the top 20 enterprises for the export of goods than for the import of goods.

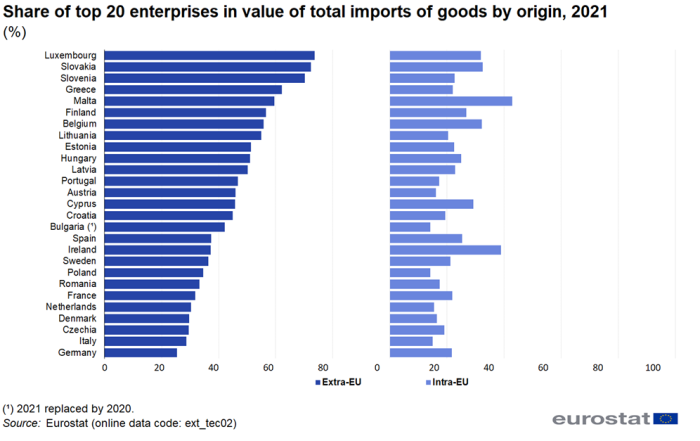

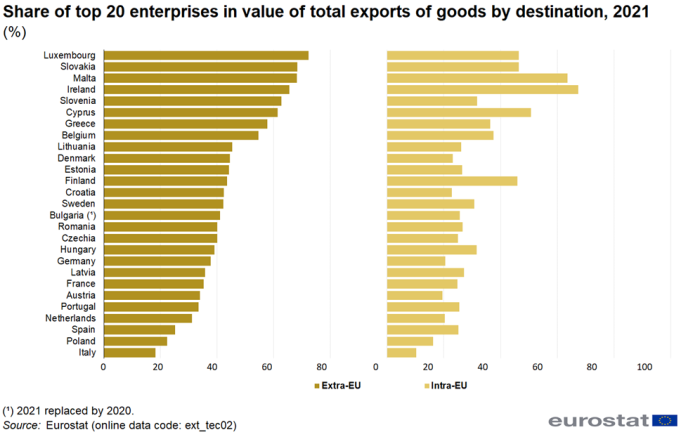

In 2021, in most EU Member States, the market concentration of the top 20 enterprises was higher for trade in goods with countries outside the EU than with countries inside the EU.

Share of top 20 enterprises in value of trade in goods, imports and exports, 2021

International trade in goods statistics play a vital role in the assessment of an economy. Combining them with additional information from other sources, particularly business statistics, significantly enriches them; providing a closer view of traders and their characteristics such as size, sector of economic activity or level of concentration. This allows for a deeper analysis of the impact of trade on employment, production and value added, essential in a globalised world where economies are increasingly interconnected.

This article focusses on the concentration of trade in the Member States of the EU. There are a number of ways to measure the concentration of trade of goods but this article uses the market share of the top 20 enterprises in trade value. Trade data are compared in four ways:

- According to the flow (imports or exports)

- Over time, comparing 2013 with 2021

- Intra-EU trade versus extra-EU trade

- Industry and wholesale and retail trade

Full article

Exports of goods were more concentrated than imports

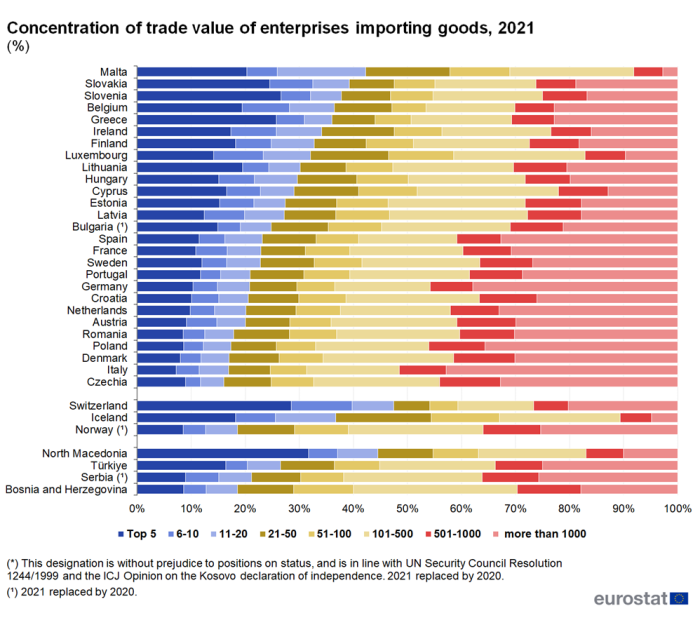

Figure 1 shows the market share of enterprises regarding imports of goods for 2021 or the last available year. Enterprises are grouped within the top 20. This is shown first for the largest five enterprises by trade value, then the next five and then the next ten. Luxembourg was the only EU Member State for which the share (42 %) of the top 20 enterprises was higher than 40 %. By contrast, the top 20 enterprises in Romania (18 %), Poland, Denmark and Italy (all 17 %) and Czechia (16 %) had a market share below 20 %.

Source: Eurostat (ext_tec02)

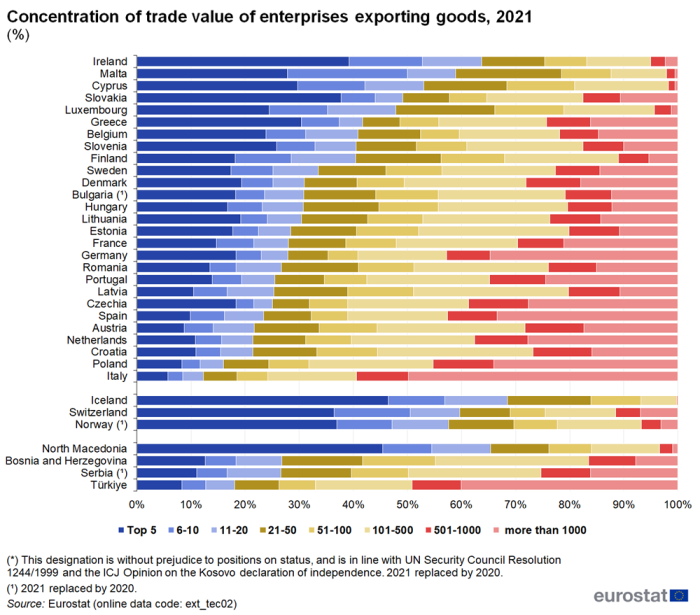

Regarding exports, there were three EU Member States in which the top 20 enterprises had a collective share of over 50 % (see Figure 2). These were Ireland (64 %), Malta (59 %) and Cyprus (53 %). There were much smaller shares in larger EU Member States, the lowest share for any top 20 enterprises being in Italy (12 %).

Source: Eurostat (ext_tec02)

There was generally a higher concentration in the market share of the top 20 enterprises for the export of goods than for the import of goods (see Figure 3). The exceptions were Italy, Latvia and Poland.

Source: Eurostat (ext_tec02)

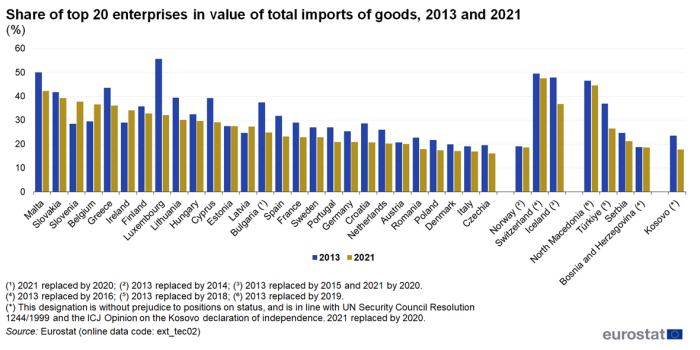

Trade, especially imports, became less concentrated over time

The market share of the top 20 enterprises regarding the import of goods generally declined between 2013 and 2021; the exceptions were Slovenia, Belgium, Ireland and Latvia (see Figure 4). Double-digit falls in market concentration were seen in Luxembourg, Cyprus and Bulgaria.

Source: Eurostat (ext_tec02)

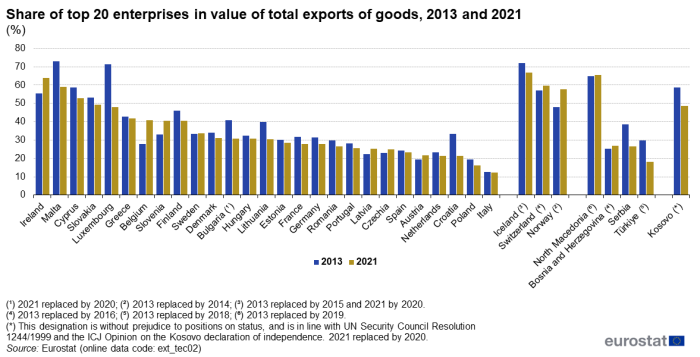

There was a similar trend in the market share of the top 20 enterprises in EU Member States regarding the export of goods. Between 2013 and 2021, there was a reduction in market concentration in 20 of the 27 EU Member States (see Figure 5) In Malta, Luxembourg and Croatia the decrease was more than 10 percentage points (pp). By contrast, increases of more than 5 pp were recorded in Slovenia, Belgium and Ireland.

Source: Eurostat (ext_tec02)

Extra-EU trade is more concentrated than intra-EU trade

In all EU Member States except Ireland, the market concentration of the top 20 enterprises was higher for extra-EU imports of goods than for intra-EU imports of goods (see Figure 6). The widest share differences were recorded in Slovenia (48 pp), Luxembourg (42 pp) and Greece (2 pp). Differences below 10 pp were only found in France (10 pp) and Germany (4 pp).

Source: Eurostat (ext_tec02)

Extra-EU exports were also more concentrated than intra-EU exports in most Member States (Figure 7). The largest differences were recorded in Slovenia (29 pp), Luxembourg and Slovakia (both 26 pp). However, in two EU Member States, export shares for the top 20 enterprises were lower when looking at extra-EU exports compared with intra-EU exports; these were Ireland and Finland (both 2 pp).

Source: Eurostat (ext_tec02)

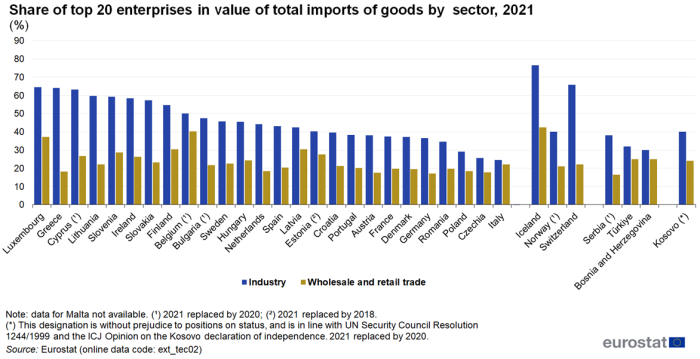

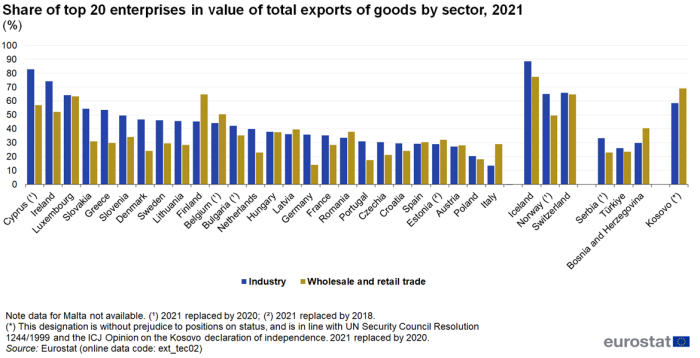

Industry is more concentrated than wholesale and retail trade

The market share of the top 20 enterprises in industry was higher than in the wholesale and retail trade sector when looking at imports, in all EU Member States (see Figure 8). The differences were largest in Greece (46 pp), Lithuania (38 pp) and Cyprus (36 pp) and lowest in Czechia (8 pp) and Italy (2 pp).

Source: Eurostat (ext_tec02)

The market share of the top 20 enterprises in industry was also higher than in the wholesale and retail trade when looking at exports, in 19 of the 27 EU Member States shown in Figure 9. Differences above 20 pp were seen in Cyprus, Ireland, Slovakia, Greece and Denmark. In eight Member States, exports were less concentrated in industry than in wholesale and retail trade. Those differences were largest in Finland (20 pp) and Italy (16 pp).

Source: Eurostat (ext_tec02)

Source data for tables and graphs

Data sources

The reporting of international trade in goods statistics by enterprise characteristics consists of a data collection independent from the monthly trade in goods statistics. This data collection has been included in the revised Intrastat (respectively Extrastat) Regulations published in 2009 that came into force for the reference year 2009 (respectively 2010) onwards.

The compilation of trade flows (exports and imports) by enterprise characteristics is based on linking micro-data on intra- and extra-EU trade with structural information from business registers. The trade value of each trader, by product code and partner country, is combined with the main enterprise characteristics (economic activity and number of employees) retrieved from the business registers. Only aggregated results (i.e. no micro-data) are provided to Eurostat. Confidentiality is applied in the statistics disseminated to ensure that it is not possible to identify an enterprise or a trader.

Definitions

Trade value

The value of traded goods is calculated at the national border, on a FOB basis (free on board) for exports and a CIF (cost, insurance, freight) basis for imports. Hence, only incidental expenses (freight, insurance) are included and they are incurred for:

- exports in the part of the journey located on the territory of the EU Member State where the goods are exported from;

- imports in the part of the journey located outside the territory of the EU Member State where the goods are imported to.

Number of enterprises

The number of enterprises consists of a count of the number of enterprises involved in trade during at least a part of the reference period. For intra-EU trade, VAT data are used to estimate the number of traders and the trade value of the smallest traders which are exempt from Intrastat reporting. These traders account for a limited share of the trade value but in terms of number of enterprises represent the majority.

Number of employees

The number of employees refers to the number of those persons who work for an employer and who have a contract of employment and receive compensation in the form of wages, salaries, fees, gratuities, piecework pay or remuneration in kind. A worker is considered to be a wage or salary earner of a particular unit if he/she receives a wage or salary from the unit regardless of where the work is done (in or outside the production unit).

To determine the enterprise size classes, the number of employees is used. The intention is to use the situation at the end of year (including seasonally active units). Since the end date approach is not harmonised, the annual average can also be used as reference calculated for a certain period.

Statistical unit

The statistical unit is the enterprise. However the enterprise concept has not yet been implemented by all the reporting countries. When the enterprise concept has not yet been implemented, reporting countries use the legal unit as an approximation of the statistical unit. More information is available in the metadata file (points 3.5 and 15.1).

Legal unit and enterprise are defined as follows:

- The legal unit is a part of the legal and administrative world. Only a legal unit may enter into contracts, be an owner of a property, rights or goods (i.e. production factors). However, a legal unit does not always reflect an economic activity. This is because a legal unit is a construct of law and administration.

- The enterprise is the smallest combination of legal units that is an organisational unit producing goods or services, which benefits from a certain degree of autonomy in decision making, especially for the allocation of its current resources. An enterprise carries out one or more activities at one or more locations. It may also be a sole legal unit.

The Business Register Regulation establishes a link between the business registers and the registers of intra- and extra-EU trade operators through a common unit of reference, namely the legal unit. The same regulation also defines the link between the legal unit and the enterprise. Via the legal unit, trade in goods data can then be linked to enterprise characteristics available in the Business Register such as the economic activity or the number of employees.

Context

International trade in goods statistics play a vital role in the assessment of every economy. Combined with additional information on characteristics of enterprises involved in international trade, such as the size and the sector of economic activity, trade data are significantly enhanced. Generally speaking, trade statistics show movements of goods between countries by goods categories. However, they do not provide explicit information on the businesses which are behind these trade flows. In a globalised world where economies are increasingly interconnected, it is more and more important to know traders and their characteristics. Answering this question requires linking trade statistics with other sources, and particularly with business statistics, which describe the structure and evaluation of the activities of businesses.

International trade in goods by enterprise characteristics is a statistical domain, which, unlike traditional trade statistics, aims at describing the structure of trade by characteristics of the trading enterprises, for instance by their economic activities, their size or concentration of trade. It is based on linking trade micro-data with business register information, allowing a deeper analysis of the impact of trade on employment, production and value added.

Direct access to

- Regulation (EC) No 222/2009 of 11 March 2009 amending Regulation (EC) No 638/2004 on Community statistics relating to the trading of goods between Member States

- Regulation (EC) No 471/2009 of 6 May 2009 on Community statistics relating to international trade with non-member countries and repealing Regulation (EC) No 1172/95

- Summaries of EU Legislation: Extrastat: statistics relating to trade with non-EU countries

- Regulation (EC) No 177/2008 of the European Parliament and the Council of 20 February 2008, establishing a common framework for Statistical Business Registers is the legal basis for business registers.

- Summaries for EU Legislation: Business registers for statistical purposes