New data on R&D Tax Incentives from OECD

date: 27/01/2021

On 16 December, OECD has updated its database on R&D tax incentives for 2018 and published its yearly report.

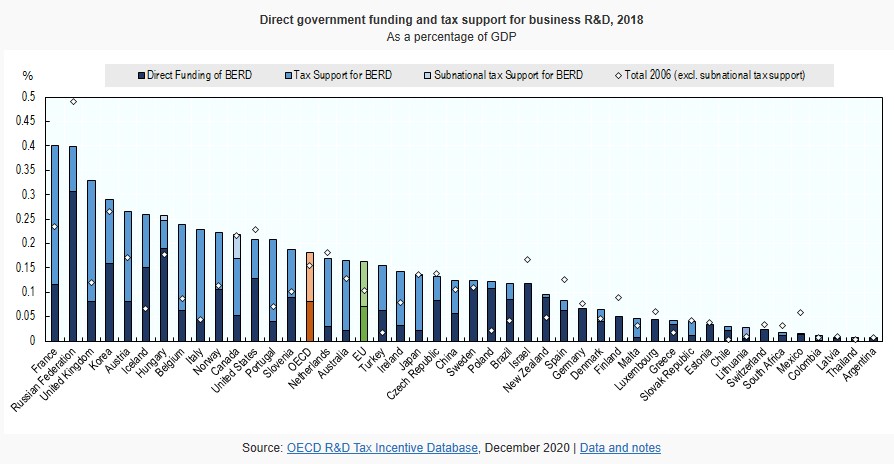

According to the report, as of 2020, 33 of the 37 OECD countries, 21 of 27 EU countries and a number of other economies (Argentina, Brazil, China the Russia, South Africa and Thailand) offered tax relief for R&D expenditure at central or subnational government level.

Many countries have reformed their R&D tax relief systems in 2020 as a crisis response measure following the outbreak of the COVID-19 pandemic.

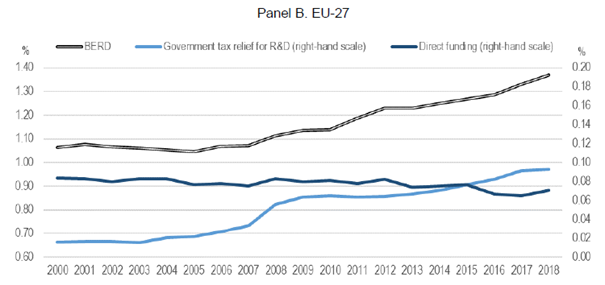

As a percentage of GDP, tax relief for R&D expenditures in 2018 was largest for France, the United Kingdom and Italy, followed by Austria and Belgium. In the EU, government tax relief for R&D increased from 0.02% of GDP in 2000 to 0.09% in 2018. R&D tax incentives in the EU surpassed direct funding in terms of value as percentage of GDP in 2015.

Source: OECD R&D Tax Incentives Database, http://www.oecd.org/sti/rd-tax-stats.htm, December 2020.

More information.