World trade in goods

Data extracted in June 2023.

Planned update: 5 August 2024.

Highlights

The EU accounted for 14.7 % of world exports and 13.9 % of world imports in goods in 2021.

The EU was the world's leading exporter of food, drinks and tobacco as well as of chemical products in 2021 but was highly dependent upon imports of mineral fuels.

In 2021, the United States was the principal destination for goods exported from the EU and China the main source of goods imported into the EU.

(%)

Source: Eurostat (ext_lt_introeu27_2020), United Nations (Comtrade) and International Monetary Fund (Direction of Trade Statistics)

Globalisation patterns in EU trade and investment is an online Eurostat publication presenting a summary of recent European Union (EU) statistics on economic aspects of globalisation, focusing on patterns of EU trade and investment.

Patterns of international trade in goods have seen wide-ranging changes in recent decades reflecting, among others: trade liberalisation, the introduction of new technologies, different methods of industrial organisation and the development of global production chains. The relocation of some manufacturing activities has led to a shift in the composition of international trade, reflected in a higher share of total trade for intermediate goods (processed materials, parts and components), and lower shares for final (consumer) goods.

Statistics on international trade in goods

Note that the information presented in the overview article is based on statistics from the balance of payments (BOP) domain, while the statistics presented in this article are based on international trade in goods statistics (ITGS). There are a number of differences between the recommendations for international trade in goods statistics and the goods account of the balance of payments, for example in terms of coverage, the time of recording, or methods of valuation. These differences and adjustments may have a substantial effect on the final reporting of figures for these two distinct sources. Moreover, the data collection exercise for international trade in goods statistics is far more detailed, literally covering thousands of individual products. That said, in many countries one of the most important uses of international trade in goods statistics is as a data source for estimating components of the balance of payments and national accounts.

It is also important to note that changes in business models have implications for the collection and the reliability of international trade in goods statistics. For example, new forms of industrial organisation have led to an increasing share of intermediate goods being traded within and between enterprises as part of global value chains: these flows continue to be assessed as gross measures, which may appear to 'inflate' trade values, especially when intermediate goods are counted several times as they cross borders as part of intricate production chains (for example, as in the aerospace or motor vehicles industry).

Full article

World trade in goods: developments between 2010 and 2021

In 2021, extra-EU trade accounted for 14.7 % of world exports and 13.9 % of world imports in goods

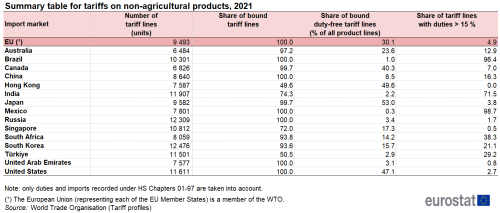

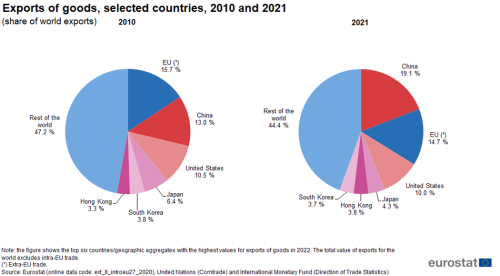

Figures 1 and 2 provide information on the share of world exports and imports of goods, showing developments between 2010 and 2021. The biggest change in the structure of global exports of goods was an expansion in the share of Chinese exports, which rose from 13.0 % of the total value in 2010 to 19.1 % by 2021.

While China was the leading exporter of goods in 2021 (€3.4 trillion), the United States was the largest importer of goods (€2.5 trillion); the EU occupied the second position for exports of goods, valued at €2.2 trillion and the third position for imports of goods, valued at €2.1 trillion. The EU, China and the United States have been the three largest global players for international trade in goods since 2004 (when China passed Japan). In 2007, China surpassed the United States as the second largest exporter of goods in the world and in 2014 China overtook the EU to record the highest share of exported goods, a position that it has since maintained.

The EU's share of the global exports of goods decreased from 15.7 % in 2010 to 14.7 % by 2021, while the share of the United States dropped slightly from 10.5 % to 10.0 %. There was a contrasting pattern to developments in three other Asian economies as the shares of exported goods from Japan and South Korea contracted, while the share recorded by Hong Kong increased.

(%)

Source: Eurostat (ext_lt_introeu27_2020), United Nations (Comtrade) and International Monetary Fund (Direction of Trade Statistics)

Between 2010 and 2021 there was rapid growth in the share of global trade for China

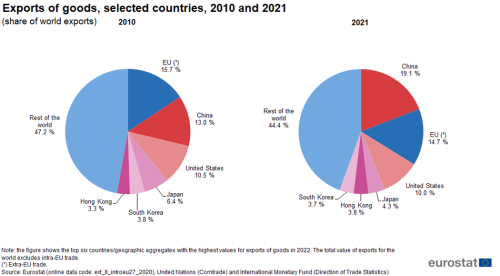

Although a large volume of literature exists concerning the rapid growth in the value of goods exported by China, less has been written about Chinese imports. These also rose at a very rapid pace, in part fueled by increasing demand for consumer goods from an emerging middle class, but also reflecting the role played by China in global production chains, whereby some goods may be imported for processing or assembly before being re-exported as intermediate or finished goods.

The Chinese share of world imports for trade in goods rose from 11.2 % in 2010 to 14.8 % in 2021 (a gain of 3.6 percentage points (pp). The import shares for the United States (+ 0.4 pp) and Hong Kong (+0.4 pp) also increased. By contrast, the imports of the EU declined by 1.8 pp from 15.7 % in 2010 to 13.9 % in 2021. There was also a contraction in the shares of Japan (-1.3 pp) and the United Kingdom (-1.2 pp).

(%)

Source: Eurostat (ext_lt_introeu27_2020), United Nations (Comtrade) and International Monetary Fund (Direction of Trade Statistics)

In 2021, the Chinese trade surplus for goods was €573 billion

Table 1 compares the trade balance and cover ratio for international trade in goods in 2010 with 2021. Seven countries had a trade surplus both in 2010 and 2021: Australia, Brazil, China, Russia, Singapore, South Korea and United Arab Emirates. For six of those the surplus increased over this period, with the largest increase of €434 billion for China. The second largest increase of the trade balance was recorded by the EU who turned a deficit of €35 billion into a surplus of €55 billion, thus improving its balance by €90 billion. Canada and South Africa also turned their deficits into surpluses. Finally, Hong Kong, India, Mexico, Türkiye, the United Kingdom and the United States had deficits in both years.

While the trade balance provides information on the absolute value of trading positions, the cover ratio provides a relative measure that is based on the ratio (expressed in percentage terms) between the value of exports and the value of imports; when exports are higher than imports then the cover ratio is above 100 %. In 2021, the highest cover ratios for international trade in goods were recorded for Russia (167.7 %), South Africa (129.8 %) and China (125.3 %). Cover ratios for these South Africa and China were higher in 2021 than they had been in 2011, confirming that their trade surplus for trade in goods were continuing to expand not only in absolute terms but also in relative terms, as export growth outstripped import growth.

By contrast, the lowest cover ratios for international trade in goods were recorded in India (69.2 %), the United Kingdom (68.4 %) and the United States (59.8 %); all three had a higher cover ratio in 2021 than in 2010.

Source: Eurostat (ext_lt_introeu27_2020) and United Nations (Comtrade)

The global financial and economic crisis had a considerable impact on the level of international trade in goods; this was in contrast to the pattern of development for trade in services which was less affected by the crisis. In this context, it is important to remember that the global value of trade in goods is approximately three times as high as that for services.

The downturn in the value of international trade in goods in 2009 was followed by a rebound the following year and subsequent growth through to 2012. Thereafter, the global value of world exports and imports was somewhat irregular: there was relatively little change in trade levels in 2013 and 2014; strong growth was observed in 2015 followed by a downturn in 2016; further growth was observed between 2017 and 2019, followed by a sharp drop in 2020.

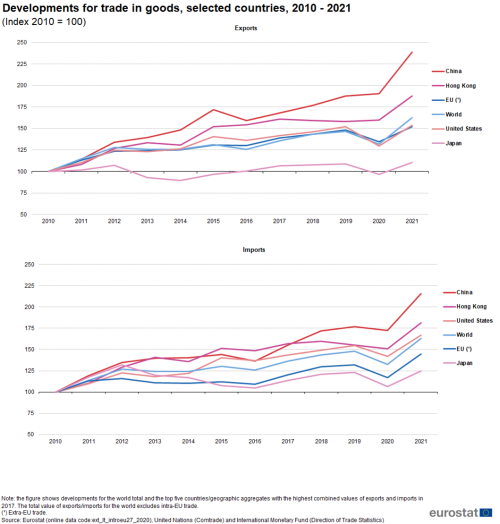

Aside from the impact of the global financial and economic crisis on levels of trade in 2009 and the subsequent rebound, another striking aspect of the information shown in Figure 3 is the rapid pace to the development of China's trade in goods. Although Chinese exports and imports rose at a much faster pace than for any of the other leading trading nations, there was some evidence of a slowdown in the growth of Chinese trading activity between 2012 and 2015 with an actual fall in 2016, a year in which the main five countries/geographical aggregates recorded contractions with the exception of exports from Japan. These downturns were short-lived, as the value of exports and imports increased between 2017 and 2019 in all of the countries. In 2020, exports from the EU, the United States and Japan and imports into all economies shown dropped. However, in 2021 there was a sharp increase in both exports and imports for all of them.

(2010 = 100)

Source: Eurostat (ext_lt_introeu27_2020), United Nations (Comtrade) and International Monetary Fund (Direction of Trade Statistics)

International trade in goods by product

In 2021, the EU was the world's leading exporter of food, drinks and tobacco as well as of chemical products …

Table 2 details the leading global exporters and importers for a range of different product groups (based on the standard international trade classification (SITC Rev. 4) of the United Nations). In 2021, the EU had the highest value of exports for food, drinks and tobacco as well as for chemicals and related products, whereas China was the leading exporter for machinery and transport equipment and for other manufactured goods, whilst the United States was the leading exporter for mineral fuels and lubricants, Australia for raw materials.

… but was highly dependent upon imports of mineral fuels.

The EU had the second highest level of imports for mineral fuels and lubricants and second highest for raw materials, reflecting its high level of dependency for these goods with China having the second highest level of imports for mineral fuels and lubricants and highest for raw materials. The United States had the highest share of global imports for the other five categories.

(€ billion)

Source: Eurostat (ext_lt_intertrd) and United Nations (Comtrade)

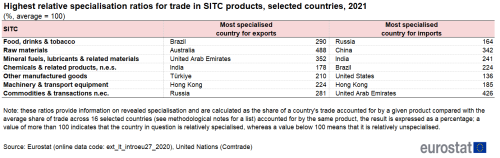

While the leading global exporters and importers in absolute terms are unsurprisingly some of the largest economies, Table 3 provides an alternative analysis focusing on relative specialisation ratios. These are based on the share of total exports/imports accounted for by a particular product, comparing the shares of one country with the average share for all 16 reporting countries/geographical aggregates analysed in this article (see Table 1 for the list). For example, the share of raw materials in the total value of goods exported by Australia in 2021 was 4.9 times as high as the average share for the 16 reporting countries, while the share of raw materials in the total value of goods imported by China was 3.4 times as high as the average.

The results based on this relative measure show a greater variation than the absolute levels of trade shown in Table 1. It shows Brazil being the most specialised country for exporting food, drinks and tobacco, Australia for raw materials, the United Arab Emirates for mineral fuels and lubricants, India for chemicals and related products, Türkiye for other manufactured goods and Hong Kong for machinery and transport equipment.

On the import side it shows Russia being the most specialised country for food, drinks and tobacco, China for raw materials, India for mineral fuels and lubricants, Brazil for chemicals and related products, the United States for other manufactured goods and Hong Kong for machinery and transport equipment.

(%, average = 100)

Source: Eurostat (ext_lt_intertrd) and United Nations (Comtrade)

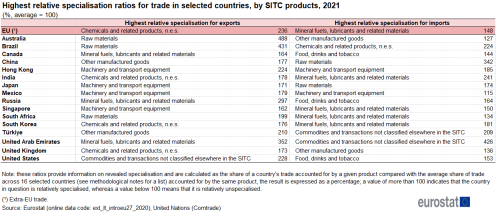

Developed economies often specialise in exporting high value goods, while emerging economies tend to focus on exporting natural resource endowments or lower value goods

Table 4 reverses the focus of the analysis, detailing for each country where its relative trade specialisation lies. The information presented confirms the role played by the natural endowments of particular goods. For example, Australia, Brazil and South Africa were all relatively specialised in exporting raw materials, whereas these products accounted for the highest import specialisation ratio in China. It is also interesting to note that while several developed economies were relatively specialised in exporting high value goods (chemicals and related products, machinery and transport equipment and other manufactured goods), their highest import specialisation ratios were recorded for more basic goods (mineral fuels and lubricants, food, drinks and tobacco and raw materials).

(%, average = 100)

Source: Eurostat (ext_lt_maineu) and United Nations (Comtrade)

International trade in goods by partner

Traditionally, trade in high value goods was relatively concentrated between developed economies, while international trade flows between the developing and developed world were largely concentrated on the supply of raw materials and basic goods (such as food). However, globalisation has resulted in some changes to the geographical orientation of trade, through the emergence of new trading relationships, often at the expense of trade with more developed economies.

The rapid growth of China in terms of its integration into the global economy during the last couple of decades was given added impetus by China's accession to the World Trade Organisation (WTO) in 2001. Within the context of globalisation, it is important to note that China often plays a role as a 'hub' for global production chains, often importing semi-finished (intermediate) goods before assembling finished goods for re-export. As such, trade flows with China may in some cases be interpreted as flows that represent a wider Asian region, insofar as China sources many of its intermediate parts/components from its surrounding economies.

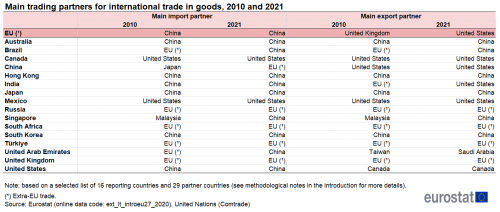

In 2021, the United States remained the principal destination for goods exported by the EU

Table 5 shows bilateral trade relationships for goods in 2010 and 2021 and confirms the rise of China as a trading power. In 2010 it already appeared six times as main export partner and four times as main import partner for the countries in the table. By 2021 this had grown to nine top positions for exports and six for imports. By contrast, the EU lost its top position as main export partner for Brazil and the United Arab Emirates to China. For imports the EU appeared six times as top partner in 2010. In 2021 two of those, namely Brazil and India were lost to China and the United States respectively. Apart from the size of an economy, the position of top import or export partner is also influenced by the proximity of countries. Examples of this are the United States - Mexico - Canada; the EU - United Kingdom - Russia; and Singapore - Malaysia - China.

Source: Eurostat (ext_lt_intertrd) and United Nations (Comtrade)

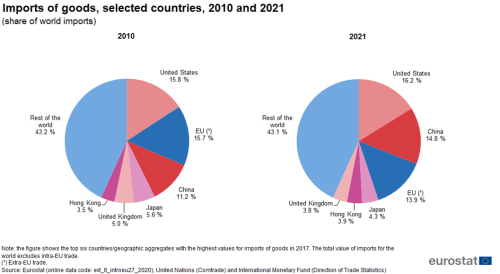

The EU economy is one of the most 'open' global economies with import tariffs on industrial products among some of the lowest in the world. For example, in 2021 only 4.9 % of non-agricultural products faced import duties in excess of 15 % (see Table 6). The EU also has a comprehensive network of arrangements for preferential trade that goes beyond more general WTO rules, for example, giving many developing countries preferential access to its markets for 'everything but arms'.

Source data for tables, figures and maps (MS Excel)

Direct access to

- Globalisation patterns in EU trade and investment (Chapters 2 and 6)

- International trade in goods (t_ext_go), see:

- International trade in goods - long-term indicators (t_ext_go_lti)

- Comext database

- International trade in goods (ext_go), see:

- International trade in goods - aggregated data (ext_go_agg)

- International trade in goods - long-term indicators (ext_go_lti)

- International trade in goods (ESMS metadata file — ext_go_agg_esms)

- International trade in goods