Educational expenditure statistics

Data extracted in August 2023.

Planned article update: September 2024.

Highlights

In 2020, public spending on education relative to GDP was highest in Sweden (7.3 %) and Denmark (6.9 %), while it was lowest in Romania (3.1 %).

In 2020, the share of public education expenditure used for financial aid to households and students ranged from 0.2 % in Greece (2019 data) to 16.0 % in Denmark.

This article presents statistics on education finance in the European Union (EU) based on the joint UNESCO/OECD/Eurostat (UOE) data collection and forms part of an online publication titled Education and training in the EU - facts and figures. Expenditure on education may help foster economic growth, enhance productivity, contribute to people's personal and social development, and help reduce social inequalities.

Within the EU, the proportion of financial resources devoted to education is one of the key choices made by national governments. In a similar manner, enterprises, students and their families also make decisions on the financial resources that they are able or willing to set aside for education.

This article presents various aspects of education finance, namely different sources of funding (such as by the government or by households), as well as education expenditure by educational institutions. It covers pre-primary to tertiary levels of education, in other words expenditure on all levels of education except for early childhood educational development (the latter defined by the International standard classification of education (ISCED) level 0, category 010).

Full article

Overall educational expenditure

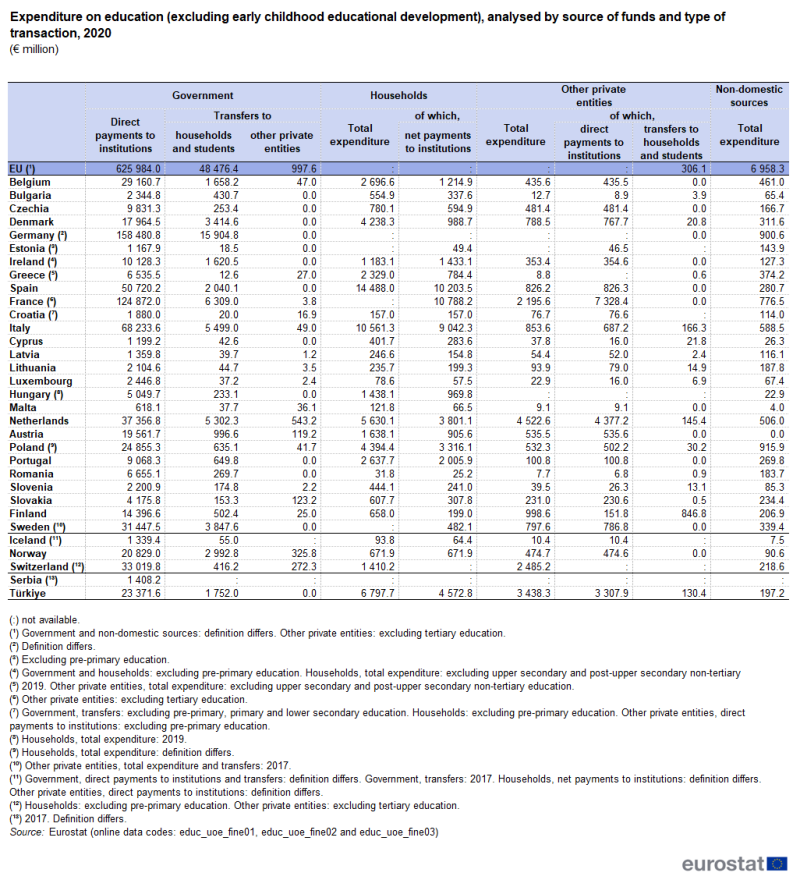

(€ million)

Source: Eurostat (educ_uoe_fine01), (educ_uoe_fine02) and (educ_uoe_fine03)

Among EU Member States, the funding of education mainly comes from government, with a smaller role for private sources (including households, enterprises, non-profit organisations and religious institutions), while an even smaller role is generally played by non-domestic sources (including international organisations such as the United Nations or the World Bank).

- The share of total spending on education in 2020 coming from governments ranged among the EU Member States from 71 % in Greece to 97 % in Romania. It should be noted that some government expenditure relates to payments and transfers for education to the non-educational private sector – this includes subsidies to households and students, as well as payments to other non-educational private entities. As such, this part is counted twice, once in government expenditure and a second time in the expenditure of households and other non-educational private entities.

- The share of non-educational private sources was within the range of 20–25 % in Portugal, Spain, Hungary and Greece, and was highest at 25.1 % in Greece.

- The share of expenditure on education that came from non-domestic sources was highest in Lithuania (7.0 %) and Latvia (6.4 %); elsewhere its share was at most 5.0 % and often below 3.0 %.

The highest overall levels of government expenditure on educational institutions were unsurprisingly recorded in the most populous EU Member States: in 2020, expenditure peaked at €158.5 billion in Germany, followed by €124.9 billion in France. Figure 2 provides more information on public expenditure on education, while Table 2 as well as Figures 3 and 4 provide more information on expenditure on educational institutions, not just from government but also from other sources.

The share of public education expenditure that was used for financial aid to households and students was 7.2 % across the EU in 2020; see also Figures 5 to 7 later.

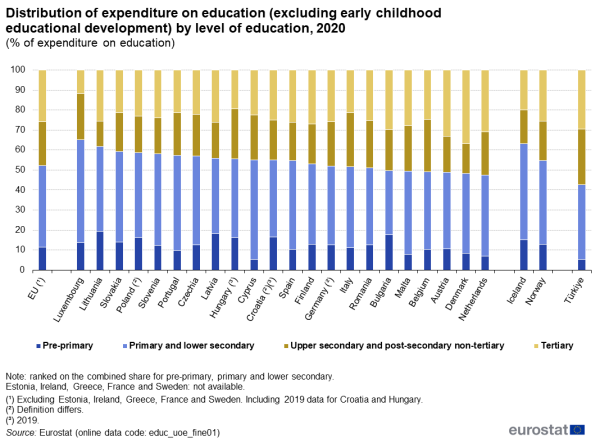

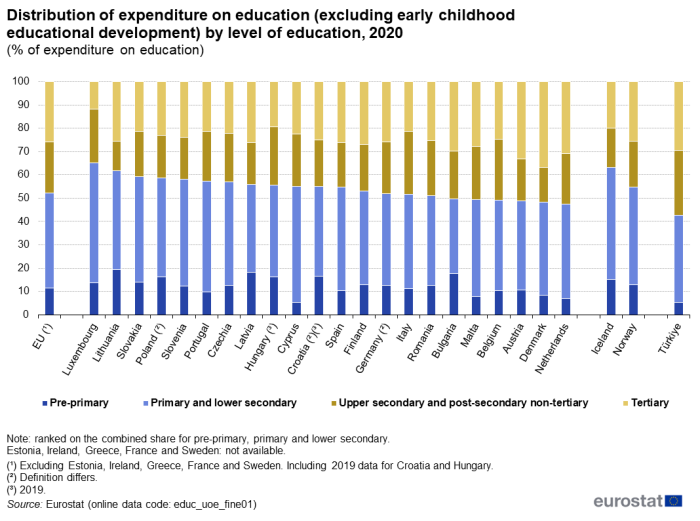

(% of expenditure on education)

Source: Eurostat (educ_uoe_fine01)

In 2020, the highest share of total expenditure on education in the EU (excluding Estonia, Ireland, Greece, France and Sweden; including 2019 data for Croatia and Hungary) was allocated to primary and lower secondary education, around two-fifths (40.8 %). The next largest share was for tertiary education, which accounted for approximately one-quarter (25.9 %) of total expenditure on education. The third largest share was for upper secondary and post-secondary non-tertiary education, which accounted for just over one-fifth (21.8 %) of the total in the EU. The smallest share of total expenditure on education was recorded for pre-primary education, just over one-tenth (11.5 %) of the total in the EU.

In 2020, primary and lower secondary education accounted for the largest share of total expenditure on education in all EU Member States for which data are available (see Figure 1). This share ranged from 32.0 % in Bulgaria to 51.5 % in Luxembourg (the only Member State to record an absolute majority of its expenditure dedicated to primary and lower secondary education).

Expenditure on tertiary education in 2020 was generally the second highest share recorded in the EU Member States, although there were five Member States where the second highest share was recorded for upper secondary and post-secondary non-tertiary education: Cyprus (where the difference was very small), Belgium, Hungary (2019 data), Italy and Luxembourg (where tertiary education had the smallest share of the education levels shown in Figure 1). Tertiary education accounted for one-fifth to one-third of total educational expenditure in nearly all of the EU Member States for which data are available, the exceptions being Luxembourg (11.8 %) and Hungary (19.5 %; 2019 data) below this range and Denmark (36.8 %) above it.

Across the EU Member States, upper secondary and post-secondary non-tertiary education typically accounted for one-sixth to one-quarter of total educational expenditure in 2020, with lower shares recorded in Lithuania and Denmark and higher shares registered in Belgium and Italy.

The share for pre-primary education ranged from 5.3 % in Cyprus – and less than 10.0 % in the Netherlands, Malta, Denmark and Portugal – to close to one-fifth of total education expenditure in Latvia (18.3 %) and Lithuania (19.2 %). Three EU Member States were atypical insofar as pre-primary education did not account for the lowest share of their education expenditure:

- in Latvia and Lithuania, spending on upper secondary and post-secondary non-tertiary education was lower than on pre-primary education;

- in Luxembourg, expenditure on tertiary education was lower than on pre-primary education.

Public expenditure

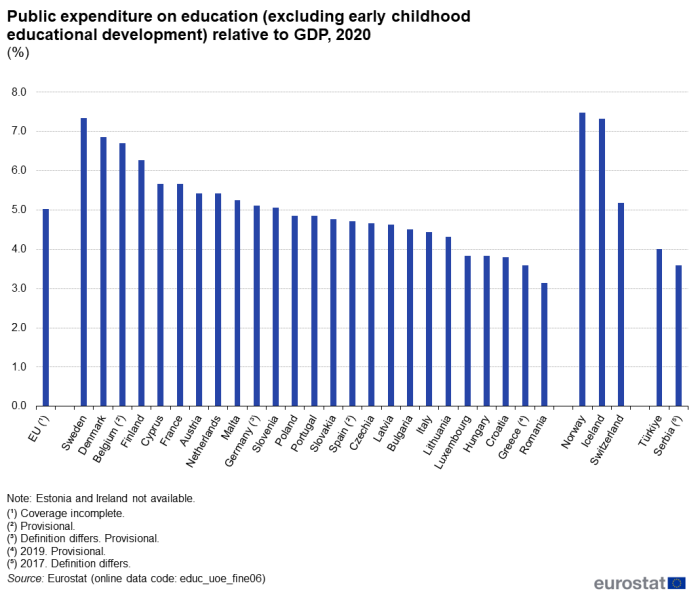

(%)

Source: Eurostat (educ_uoe_fine06)

In 2020, the highest level of public expenditure on education relative to gross domestic product (GDP) among the EU Member States was observed in Sweden (7.3 %), followed by Denmark (6.9 %), Belgium (6.7 %) and Finland (6.3 %) – see Figure 2. Among the remaining Member States, ratios of public expenditure on education relative to GDP ranged between 3.6 % and 5.7 %, with only Romania below this range (3.1 %). Relatively high ratios were also recorded among the northern EFTA members, Norway (7.5 %) and Iceland (7.3 %).

Expenditure of educational institutions

Source: Eurostat (educ_uoe_fini01)

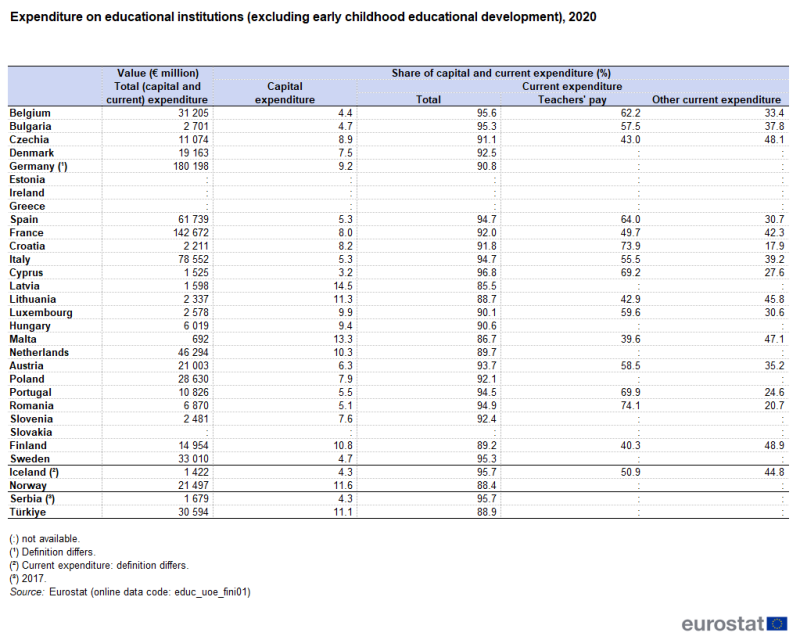

Table 2 presents an analysis for 2020 of expenditure on educational institutions (either expenditure made directly by the institutions themselves or that made by government on behalf of institutions); no data are available for Estonia, Ireland, Greece or Slovakia.

- In Latvia, Malta, Lithuania, Finland and the Netherlands, capital expenditure exceeded 10.0 % of total capital and current expenditure on educational institutions; in Luxembourg the share was almost at this level (9.9 %).

- By contrast, capital expenditure accounted for less than 5.0 % of current and capital expenditure in Bulgaria, Sweden, Belgium and Cyprus.

In most of the EU Member States for which data are available (10 out of 15), a majority of expenditure on educational institutions in 2020 was on teachers' pay. However, such pay accounted for a lower share, 40–50 % of the total expenditure in France, Czechia, Lithuania and Finland and for a share just below this range in Malta (39.6 %).

(€ per pupil/student in full-time equivalents)

Source: Eurostat (educ_uoe_fini04)

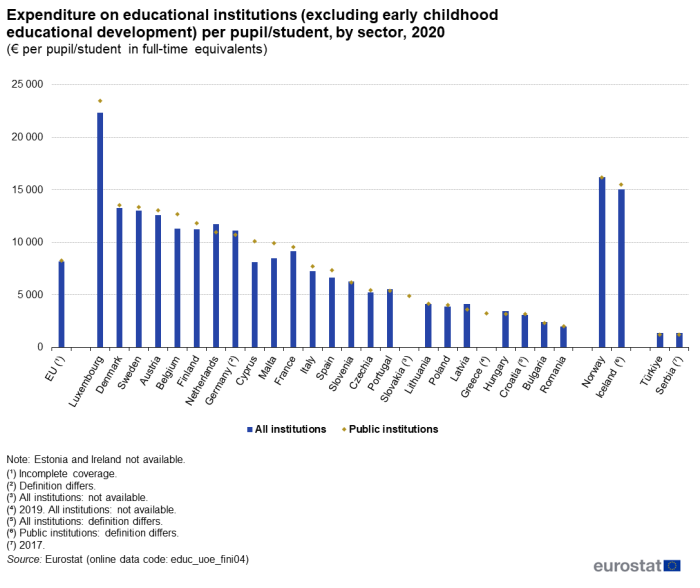

Declining birth rates and shifts in population structures are projected to result in reduced school age populations in many EU Member States. In turn, this may well have an impact on ratios such as the average educational expenditure per pupil (for example if expenditure is held constant). This ratio may also be impacted by other factors, such as the participation rate of young children in education. For most Member States, average annual expenditure (from public and private sources) on all educational institutions per pupil/student ranged from €3 078 in Croatia to €13 287 in Denmark. Outside this range were:

- Luxembourg – had a considerably higher average educational expenditure per pupil/student at €22 331;

- Romania at €1 987 and Bulgaria at €2 435 – with lower averages.

In a majority of the 23 EU Member States for which data are available, average expenditure per pupil/student was higher in public institutions than in all institutions.

(€ per pupil/student in full-time equivalents)

Source: Eurostat (educ_uoe_fini04)

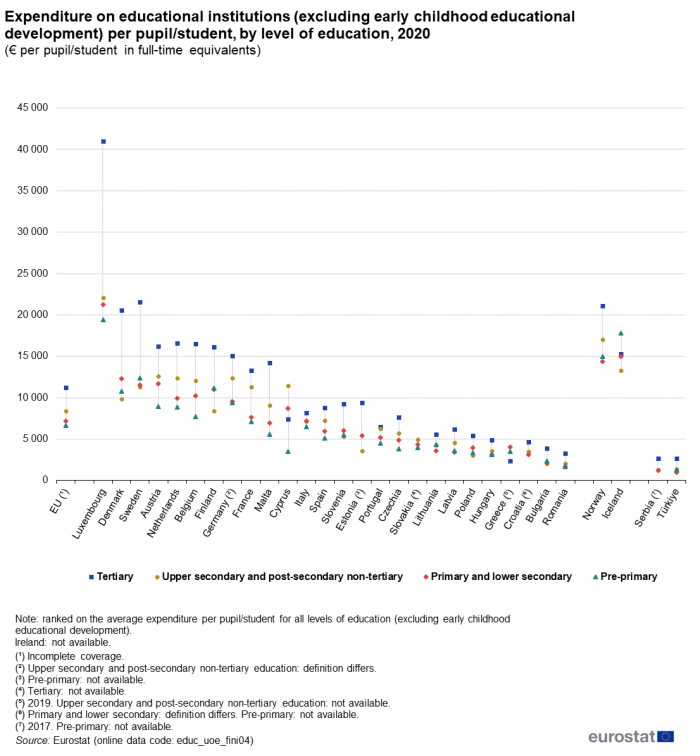

With the exceptions of Greece (2019 data; incomplete) and Cyprus, expenditure on educational institutions per pupil/student was highest among tertiary education institutions (no data for expenditure on tertiary students for Ireland or Slovakia). The general pattern observed was one whereby expenditure per pupil/student increased from the lowest to the highest level of education (see Figure 4).

- Just over half of the EU Member States for which data are available reported that their lowest average expenditure per pupil was for pre-primary education (no data available for Estonia, Ireland or Croatia).

- The lowest average expenditure per pupil was recorded for primary and lower secondary education in Croatia (among the three education levels for which Croatian data are available), Latvia, Lithuania, Hungary and Romania.

- The lowest average expenditure per pupil was recorded for upper secondary and post-secondary non-tertiary education in Bulgaria, Denmark, Estonia (among the three education levels for which Estonian data are available), Poland, Slovenia, Finland and Sweden.

- Greece (2019 data) was an exception in that its lowest average expenditure per pupil/student (among the three education levels for which Greek data are available) was for tertiary education.

Financial aid to households and students

(€ per pupil/student)

Source: Eurostat (educ_uoe_fine02) and (educ_uoe_fine10)

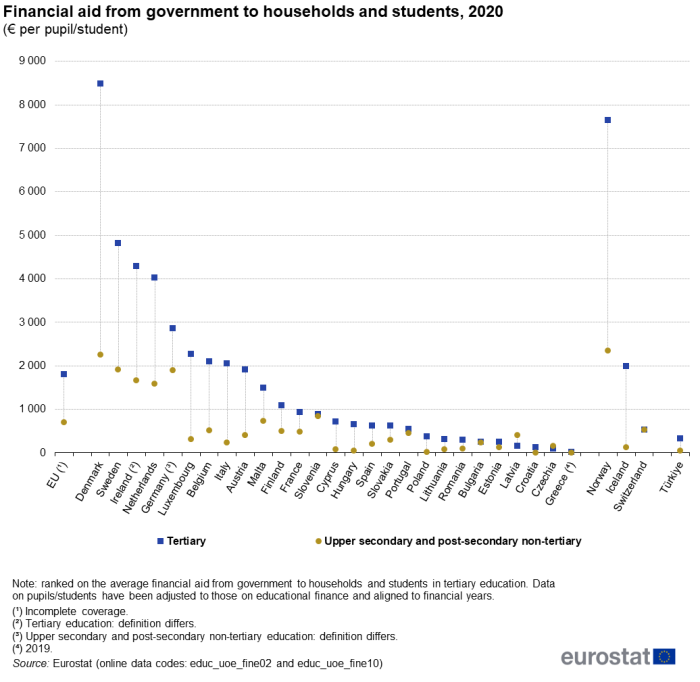

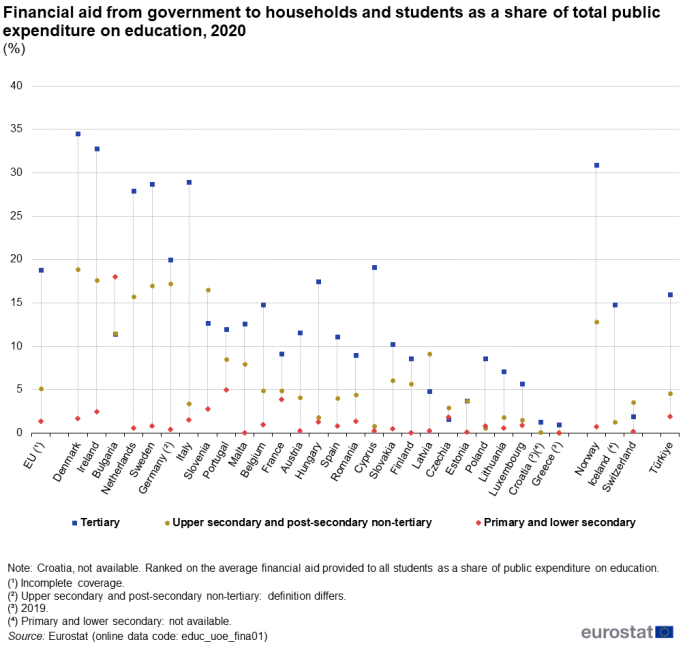

Financial assistance for education to households or students may take a variety of different forms, including scholarships, public loans and allowances contingent on a student's status. The relative importance of financial support may also depend on the education level being analysed as compulsory education is generally free to all pupils/students, while tertiary education might or might not be free.

Figure 5 shows information pertaining to the financial aid given to households and students; note that these data reflect to some degree the national organisation of education systems. They also reflect the various methods that are used to fund education systems and to provide welfare support and other forms of financial aid to encourage students to remain within the education system. As primary and lower secondary education are largely compulsory and tend to be provided free of charge, these levels are excluded from the information presented in Figure 5.

With the exceptions of Czechia and Latvia, the level of financial aid to households and students in 2020 was higher for tertiary education than for upper secondary and post-secondary non-tertiary education. Note that in some countries the capacity of the tertiary education sector is relatively low; this may lead to support being provided to students so that they may study abroad. Financial support to outward degree mobility is not covered by the data shown.

The level of financial aid for upper secondary and post-secondary non-tertiary education averaged €699 per pupil across the EU (incomplete coverage of EU Member States) in 2020. Among the EU Member States, this peaked at €2 254 per pupil in Denmark and also exceeded €1 500 per pupil in Sweden, Germany, Ireland and the Netherlands. For tertiary education, the EU average was €1 796 per student. The highest average was (again) observed in Denmark (€8 485 per student), while averages above €4 000 per student were also observed in Sweden, Ireland and the Netherlands. For both of these levels of education, the lowest average financial support per pupil/student was recorded in Greece (2019 data).

(%)

Source: Eurostat (educ_uoe_fina01)

- In 2020, the share of public expenditure on tertiary education used for financial aid to households and students exceeded 25.0 % in the Netherlands, Sweden and Italy, stood at around one-third in Ireland (32.8 %) and peaked at 34.5 % in Denmark.

- For upper secondary and post-secondary non-tertiary education, shares of more than 15.0 % were reported for the Netherlands, Slovenia, Sweden, Germany, Ireland and Denmark (with the peak of 18.9 %).

- For primary and lower secondary education, shares were below 1.0 % in the majority of EU Member States; the share was only above 5.0 % in Bulgaria, where it was 18.0 % – see Figure 6.

(%)

Source: Eurostat (educ_uoe_fine02)

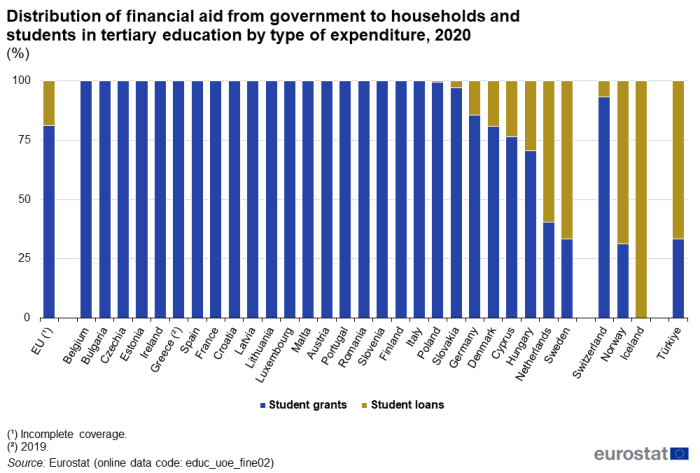

Student fees and financial support can play an important role in facilitating (or impeding) access to tertiary education. While fees may impose a financial burden, various support measures may be used to alleviate obstacles to study. Figure 7 focuses on direct financial support to students in the form of grants and loans; note that indirect support may be available to students (and their families) through allowances or tax incentives.

Almost all of the EU Member States offer at least one type of direct financial aid (a grant or a loan) to students in tertiary education. In some of the Member States, grants and loans both exist; as such, students may have to apply through separate procedures to receive one or both forms of aid. Figure 7 shows the distribution of financial aid to households and students in tertiary education; note there were 20 Member States where student loans either did not exist or where student loans accounted for a very small share of the total financial aid provided (less than 1.0 %). Therefore, there were only seven Member States (detailed below) where the division in aid between student grants and student loans was not almost entirely weighted in favour of student grants:

- in Slovakia, Germany, Denmark, Cyprus and Hungary, a majority of the financial aid from government to tertiary students was provided in the form of student grants;

- by contrast, in the Netherlands and Sweden a majority of the financial aid for tertiary students was provided in the form of student loans.

Source data for tables and graphs

Data sources

Source

The source of data used in this article is a joint UNESCO/OECD/Eurostat (UOE) data collection on education statistics and this is the basis for the core components of Eurostat's database on education statistics; in combination with the joint data collection Eurostat also collects data on regional enrolments and foreign language learning.

More information about the joint data collection is available in an article on the UOE methodology.

Classification

The international standard classification of education (ISCED) is the basis for international education statistics, describing nine different levels of education.

Key concepts

Education expenditure refer to the financial year of the EU Member State, as defined nationally (for year t).

Note that in the following concepts the expression 'expenditure by or on (…) institutions' is used for:

- expenditure by the institutions themselves – for example, salaries paid by a fiscally autonomous university;

- expenditure by governments on, or on behalf of, the institutions – for example, salaries paid by a national education ministry directly to individual teachers/lecturers who are employed in public or private schools/universities and other educational institutions.

Expenditure for all levels of education combined encompasses the expenditure for all education programmes from pre-primary (ISCED level 0, category 020) to a doctoral or equivalent level of tertiary education (ISCED level 8).

Total expenditure comprises current and capital expenditure. Current expenditure comprises personnel expenditure and other current expenditure; the latter includes, for example, services provided by outside providers (such as maintenance of school buildings) as well as purchases of teaching materials, electricity and telecommunications.

Total public expenditure on education includes:

- direct public funding for educational institutions, and;

- transfers to households and enterprises (including non-profit organisations).

Generally, the public sector funds education either by:

- bearing directly the current and capital expenses of educational institutions – direct expenditure for educational institutions;

- supporting students and their families with scholarships and public loans, as well as by transferring public subsidies for educational activities to private enterprises or non-profit organisations (transfers to private households and enterprises).

Expenditure on institutions is not limited to that made on instructional services, but also includes expenditure on ancillary services for students and families, where these services are provided through educational institutions. At the tertiary education level, spending on research and development can be significant and this is included in the data presented to the extent that any such research is performed by educational institutions. As such, expenditure on educational institutions includes expenditure on core educational goods and services, such as teaching staff, school buildings, or schoolbooks and teaching materials, and peripheral educational goods and services such as ancillary services, general administration and other activities. Education expenditure on institutions covers all types of public or private schools/universities and other educational institutions that are involved in delivering or supporting educational services.

Expenditure on educational institutions from public sources corresponds to direct expenditure on educational institutions from public sources. It may take one of two forms:

- direct purchases by government of educational resources to be used by educational institutions (such as the payment of teachers' salaries by a central or regional education ministry);

- payments made by government agencies to educational institutions that have responsibility for purchasing educational resources themselves (for example, a government appropriation or block grant to a university, which the university then uses to compensate staff and/or to purchase other resources).

Direct expenditure by a government agency excludes tuition payments to an institution that have been received from students (or their families) enrolled in public schools under that agency's jurisdiction, even if such tuition payments flow, in the first instance, to the government agency rather than to the institution in question.

Expenditure on educational institutions from private sources comprises the following: school fees; materials (such as textbooks and teaching equipment); transport to school (if organised by the school); meals (if provided by the school); boarding fees, and; expenditure by employers on initial vocational training.

Public financial aid to students refers to direct public assistance to pupils/students in the form of scholarships, public loans and family allowances contingent on student status. This is not a full measure of the level of assistance students may receive as for instance, students (or their families) may also get financial support indirectly, for example through ancillary services (in other words student welfare services such as meals, transportation, healthcare or dormitories) or tax reductions.

Accounting conventions

Data on educational expenditure are compiled on a cash accounting rather than an accrual accounting basis. As such, expenditure is recorded in the year in which the payments occurred. This means in particular that:

- capital acquisitions are counted fully in the year in which the expenditure occurs;

- depreciation of capital assets is not recorded as expenditure, though expenditure on repair and maintenance is recorded in the year it occurs.

Expenditure on student loans is recorded as the gross loan outlays in the year in which the loans are made, without netting-off repayments from existing borrowers.

| Tables in this article use the following notation: | |

| Value in italics | data value is forecasted, provisional or estimated and is therefore likely to change; |

| : | not available, confidential or unreliable value. |

Context

Education accounts for a significant proportion of total public expenditure in all of the EU Member States. The largest education budget item is usually expenditure for staff. The cost of teaching usually increases substantially as a young person moves through the education system, with expenditure per pupil/student considerably higher in universities than in primary schools. Although tertiary education generally costs more per pupil/student, the highest share of total education spending is normally allocated to secondary education, as this level teaches a larger share of the total number of pupils/students.

There is a policy debate in many EU Member States regarding how to increase or maintain funding for education, improve efficiency and promote equity. This challenge became harder in the context of the global financial and economic crisis, subsequent sovereign debt crises, COVID-19 pandemic and cost-of-living crisis. The debate is not purely about the levels and sources of finance, but also concerns proposals for reforms of education policies and systems and raises questions as to the development of labour force skills for the future, for the benefit of individuals and society. Possible approaches to funding include tuition fees, administrative or examination charges. Another potential fundraising source is partnerships between business and higher educational establishments.

Education costs may be balanced by needs-based or merit-based support:

- merit-based support includes support awarded on the basis of academic performance;

- needs-based support includes income-contingent grants, loans or other support to try to stimulate enrolment rates in higher education, in particular among the less well-off and disadvantaged members of society, thereby promoting equal opportunities as well as social mobility and inclusion.

An analysis of national student fees and support systems in European higher education is available in a report produced by the European Commission, the Education, Audiovisual and Culture Executive Agency and Eurydice.

Direct access to

- A guide to educational expenditure statistics – 2005 edition

- Education finance (educ_uoe_fin)

Metadata

- Pupils and students - enrolments (ESMS metadata file – educ_uoe_enr_esms)

Manuals and other methodological information

- Classification of learning activities – Manual – 2016 edition

- International Standard Classification of Education (ISCED) 2011

- ISCED 2011 Operational Manual – Guidelines for classifying national education programmes and related qualifications

- UOE data collection on formal education – Manual on concepts, definitions and classifications – 2022 edition

- UNESCO OECD Eurostat (UOE) joint data collection – methodology

- Regulation (EC) No 452/2008 of 23 April 2008 concerning the production and development of statistics on education and lifelong learning

- Commission Regulation (EU) No 912/2013 of 23 September 2013 as regards statistics on education and training systems

- Summaries of EU Legislation: statistics on education and lifelong learning