International trade in goods for the EU - an overview

Data extracted in June 2024

Planned article update: no update planned

Highlights

The value of intra-EU trade in goods was 1.6 times as high as the value of extra-EU trade in goods in 2023.

Extra-EU imports decreased in 2023, after strong increases in 2021 and 2022 .

Globalisation patterns in EU trade and investment: Extra-EU trade in goods, 2002-2022

Globalisation patterns in EU trade and investment is an online Eurostat publication presenting a summary of recent European Union (EU) statistics on economic aspects of globalisation, focusing on patterns of EU trade and investment.

The EU has a relatively open trade regime, which has provided a stimulus for developing relationships with a wide range of trading partners. Indeed, the EU is deeply integrated into global markets and this pattern may be expected to continue, as modern transport and communication developments provide a further stimulus for producers to exchange goods (and services) around the world.

This article provides an overview of trade developments across the EU, detailing patterns of growth (in value and volume terms), the split between intra-EU trade and extra-EU trade, the performance of individual EU countries, and developments for the terms of trade.

Statistics on international trade in goods

Statistics on international trade in goods distinguish between intra-EU and extra-EU trade.

Intra-EU statistics concern transactions that occur within the EU, in other words, exports of goods leaving one EU Member State that are destined to arrive in another. The advent of the single market on 1 January 1993 and the removal of customs formalities between EU Member States resulted in a loss of information and required the establishment of a new data collection system — Intrastat — which is closely linked to VAT systems and is based on collecting data directly from taxable persons (traders).

Extra-EU statistics record flows of goods exported and imported between the EU and non-member countries; note that goods ‘in transit’ through an EU Member State are excluded. Extra-EU trade statistics are collected through a different system — Extrastat — which uses records of trade transactions for customs declarations that are gathered by customs authorities.

The trade balance is the difference between exports and imports. When exports are higher than imports, the balance is positive and this is called a trade surplus. In contrast, if exports are lower than imports, the balance is negative and this is called a trade deficit.

Full article

International trade in goods - an overview

EU policymakers see the promotion of international trade (and investment) with the rest of the world as a key driver of economic growth and job creation. The EU is one of the world’s biggest players in global trade: in 2022, it was the second largest exporter and importer of goods in the world, since extra-EU trade accounted for 13.2% of global exports and 14.8% of global imports. China exported more goods (17.6% of the world total) than the EU, while the United States imported more goods (15.8% of the world total) — see article on World trade in goods and this table for more details. The EU has achieved this position, at least in part, by acting in a united way with a single voice, rather than having 27 national trade strategies: the EU Member States share a single market, a single external border and a single external trade policy within the World Trade Organisation (WTO), where the rules of international trade are agreed and enforced.

Since 2008 the value of goods exported outside the EU has risen at a faster pace than the value of goods imported into the EU

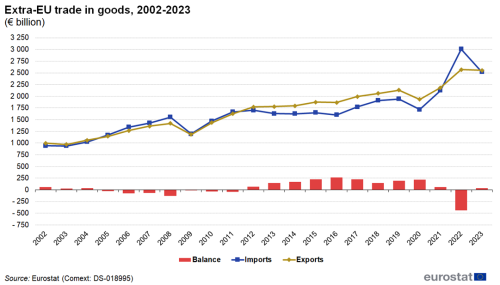

EU international trade in goods reached a relative peak in 2008 (see Figure 1), when imports were valued at €1 555 billion and the value of exports was somewhat lower, €1 421 billion; as such the EU had a trade deficit of €134 billion. The impact of the global financial and economic crisis resulted in a rapid decline in the EU’s international trade in goods; the value of extra-EU exports fell by 16.7% in 2009, while there was an even greater reduction (-23.2%) in the value of extra-EU imports. However, there was a swift recovery in trade activity, as EU exports had already risen above their pre-crisis value in 2010, while the same pattern was observed for EU imports by 2011; both EU imports and exports continued to grow in 2012.

The downturn in the value of EU imports starting in 2012 may be linked to the fall in the price of oil

Thereafter, somewhat different patterns of development were observed for EU exports and imports — reflecting, at least in part, the development of oil prices. Between 2012 and 2016 the value of extra-EU imports fell, while the value of EU exports continued to grow. After 2016, imports also started to grow again, reaching €1 941 billion in 2019. In that same year exports reached €2 132. In 2020, due in large part to the COVID-19 pandemic both imports (-11.6%) and exports (-9.4%) fell sharply. However, since then they have more than recovered, with exports reaching €2 570 billion and imports reaching €3 006 billion in 2022. In 2023 exports dropped slightly to €2 554 billion while there was a much larger drop of imports to €2 519 billion due in large part to falling energy prices.

Between 2008 and 2020, the value of EU exports of goods has generally expanded at a faster pace than the value of EU imports; this has led to a significant change in the EU’s trade balance for goods (the difference between exports and imports). The EU had a trade deficit for goods of €134 billion in 2008, although this was reversed by 2012 when a surplus of €68 billion was recorded. The surplus peaked in 2016 at €264 billion, dropped to €191 billion in 2019 before increasing to €217 billion in 2020. In 2021, due to large growth in imports the surplus decreased to €57 billion. Due to sharply increasing energy price the trade surplus turned into a trade deficit of €436 billion. In 2023, when energy prices fell, the deficit turned into a surplus of €35 billion.

Variations by EU countries

During the period 2002-2023, the fastest growth rates for trade in goods were recorded among those countries that joined the EU in 2004 or more recently

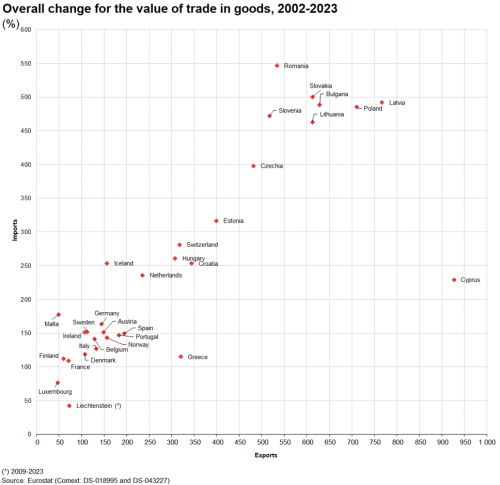

Looking at developments within the individual EU countries, Figure 2 shows the overall rate of change in the value of imports and exports between 2002 and 2023; note that these statistics relate to total trade flows (in other words, both intra-EU and extra-EU trade). It is interesting to note that those countries with the highest overall growth in total trade (the sum of imports and exports) tended to be characterised by higher rates of export growth (when compared with import growth rates), while those countries with relatively low overall growth in total trade tended to report higher rates of import growth.

Growth rates of more than 200% in total trade between 2002 and 2023 were recorded in twelve of the thirteen countries that joined the EU in 2004 or more recently (Latvia, Lithuania, Bulgaria, Poland, Romania, Slovakia, Slovenia, Czechia, Estonia, Croatia, Hungary and Cyprus) which may, at least in part, be explained by their process of integration into both global markets and (in particular) the European single market, following reforms which led to switching from centrally-planned to market-based economic models. In the Netherlands the growth rate was also larger than 200%. There were eleven countries (Spain, Greece, Portugal, Germany, Austria, Belgium, Sweden, Italy, Ireland, Malta and Denmark) that recorded growth rates between 100% and 200%. In France, Finland and Luxembourg growth rates were below 100%.

Cyprus recorded the highest overall growth in its value of exported goods between 2002 and 2023 (an increase of 927%), while Latviva, Poland, Bulgaria, Lithuania and Slovakia also recorded increases of more than 600%. By contrast, growth rates for exports were below 100% in France, Finland, Malta and Luxembourg.

Romania (546%) recorded the highest growth rates for imported goods, during the same period. Slovakia, Latvia, Bulgaria, Poland, Slovenia and Lithuania also recorded growth rates above 400%. By contrast, growth rates for imports below 100% were registered only in Luxembourg.

(%)

Source: Eurostat (ext_lt_intratrd) and (ext_lt_intercc)

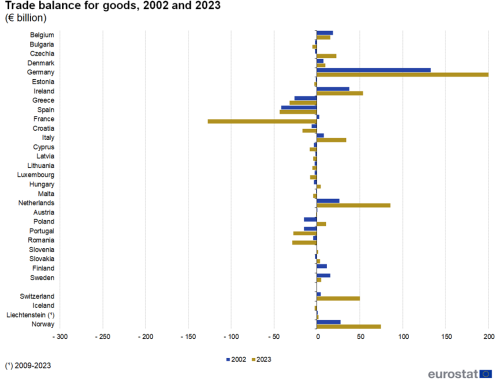

Germany had the highest trade surplus for goods in 2023

Figure 3 presents a comparison between 2002 and 2023 for the trade balance for goods. In 2023, Germany had the highest trade surplus in goods (€224 billion). This was followed at some distance by the surpluses recorded in the Netherlands (€86 billion) and Ireland (€54 billion). At the other end of the range, the trade deficit for trade in goods in France amounted to €127 billion in 2023, which was much higher than the next largest deficit, recorded in Spain (€44 billion).

Between 2002 and 2023, five EU countries — Poland, Czechia, Hungary, Slovakia and Slovenia — moved from the position of having a trade deficit for goods to having a trade surplus. By contrast, France, Austria and Finland saw the opposite development, namely their trade position for goods moved from a surplus to a deficit. Belgium, Denmark, Germany, Ireland, Italy, the Netherlands and Sweden had a trade surplus both in 2002 and 2023. The other twelve countries had a trade deficit in both years.

Between 2002 and 2023, the trade surplus for goods increased most in Germany (+€91 billion), followed by the Netherlands (+€60 billion). France's trade balance (-€130 billion) dropped the most in this period. Romania (-€25 billion) was the only other country whose trade balance dropped by more than €20 billion.

(€ billion)

Source: Eurostat (ext_lt_intratrd) and (ext_lt_intercc)

The value of intra-EU trade in goods was 1.6 times as high as the value of extra-EU trade in goods in 2023

Although trade flows within the single market may not appear (at first sight) to be particularly ‘global’ in nature and could be considered by some as ‘protectionist’ or ‘inward-looking’, it is important to note that some of these intra-EU flows result from the activities of European or multinational enterprises producing goods on foreign territories; for example, German or Japanese cars manufactured in Slovakia or Romania, from where they may be exported tariff-free to other parts of the single market.

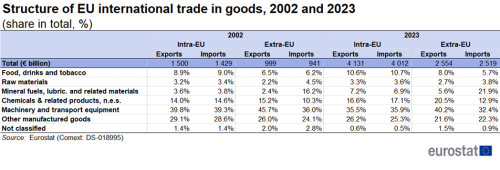

A comparison between intra-EU trade (between EU countries ) and extra-EU trade (between EU Member States and non-member countries) reveals that the former was 1.5 times as high as the latter in 2002; this comparison is made on the basis of total trade (in other words, the sum of imports and exports). This ratio was slightly higher in 2023 when intra-EU trade was 1.6 times as high as extra-EU trade (see Table 1).

The relative significance of different products

A high proportion of the goods imported into the EU are primary goods

Table 1 provides more detailed information — based on the Standard International Trade Classification (SITC) — concerning the relative significance of different products within intra-EU and extra-EU trade. The intrinsic nature of different goods means that some are largely restricted to national markets or trade within the single market (intra-EU trade), whereas others are more openly traded on global markets. For example, the perishable nature of some food products may, at least in part, explain why food, drinks and tobacco accounted for almost one tenth (10.6%) of all intra-EU exports in 2023, while their share of extra-EU exports was somewhat lower, at 8.0%. On the other hand, the scarcity or a complete lack of natural resource endowments may explain, at least to some degree, why some goods are imported from extra-EU partners; this is the case for mineral fuels and related materials, which accounted for 21.9% of all extra-EU imports, compared with a 6.9% share of intra-EU imports.

(share in total, %)

Source: Eurostat (ext_lt_intratrd)

International trade in goods - intra-EU and extra-EU flows

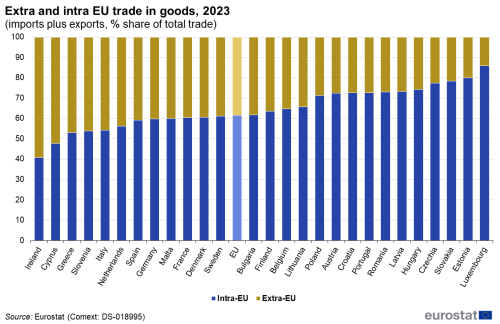

In 2023 Ireland and Cyprus were the only EU countries that had a higher share of their trade in goods with non-member countries

Figure 4 provides an analysis at an aggregate level for total trade in goods showing which EU countries had a higher propensity to trade within the single market (intra-EU trade) and which had a higher proportion of their total trade with non-member countries (extra-EU trade). The proportion of total trade in goods that was accounted for by intra-EU and extra-EU flows varied considerably across the countries, reflecting to some degree historical ties and geographical location. In 2023, more than three quarters of the trade conducted by Luxembourg (85.8%), Estonia (79.9%), Slovakia (78.4%) and Czechia (77.3%) was with intra-EU partners; there were fifteen additional countries where the share of intra-EU trade in total trade was within the range of 60-75%. In seven countries the share was between 50% and 60%, while only Ireland and Cyprus reported more extra-EU rather than intra-EU trade.

(imports plus exports, % share of total trade)

Source: Eurostat (ext_lt_intratrd)

Volume of goods

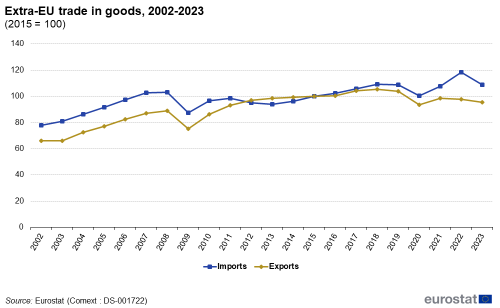

Imports (+30.8 percentage points) and exports (+29.4 percentage points) of goods grew between 2002 and 2023 despite setbacks in 2009 and 2020

Figure 5 extends the analysis of international trade developments to cover extra-EU volume indices for trade in goods. The patterns of development for EU trade were broadly similar to those in value terms (see Figure 1) during the period 2002-2008. Thereafter, there was a sizeable contraction in the volume of goods traded in 2009, as the global financial and economic crisis impacted on the level of trade with non-member countries; extra-EU exports were reduced by 13.6 percentage points while the corresponding reduction for extra-EU imports was 15.3 percentage points. Between 2009 and 2023 extra-EU imports increased by 21.2 percentage points while exports increased by 20.1 percentage points despite decreases for both imports (-8.4 percentage points) and exports (-10.5 percentage points) between 2019 and 2020 due in large part to the COVID-19 pandemic.

(2015 = 100)

Source: Eurostat (ext_lt_intertrd)

EU Terms of trade

Terms of trade

Unit value indices provide a proxy for the price of imports and exports: changes in the (relative) price of specific products/goods can have a major impact on the trade performance and the structure of trade in individual EU countries. For example, if the price of oil doubles then it is possible that some countries (with a high degree of energy dependency) may see their trade position move from a surplus to a deficit.

The terms of trade index presents, for an individual country or geographical aggregate, the ratio between the unit value indices for exports and imports; if the terms of trade are higher than 100%, then the relative price of exports is greater than the relative price of imports. If a country’s terms of trade improve, then for every unit of exports that it sells abroad, it is able to purchase more units of imported goods. That said, an improvement in the terms of trade may also mean that the price of a country’s exports becomes relatively more expensive on global markets and depending upon the scarcity of these goods (and the availability of possible substitutes), such an increase may have a direct impact on the volume of goods that are exported and could reduce a country’s trade balance.

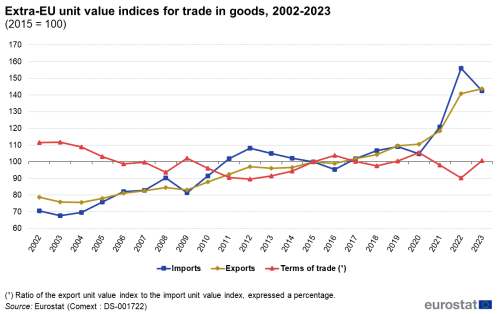

Between 2002 and 2023 the EU’s terms of trade declined …

Figure 6 shows the development of extra-EU unit value indices during the period 2002-2023. The unit values of EU imports and exports rose during this period. The overall change for imports was 72.1 percentage points, while that for exports was lower, at 65.1 percentage points. As a result, the EU terms of trade index fell overall by 10.7 percentage points.

(2015 = 100)

Source: Eurostat (ext_lt_intertrd)

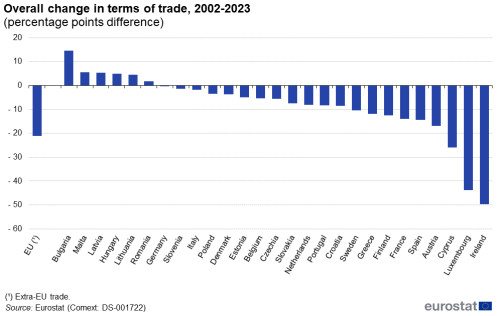

The information presented in Figure 7 extends the analysis of terms of trade to the individual EU countries; note the data concerns trade flows with the rest of the world (in other words, both intra-EU and extra-EU trade). In 2023, there were nine countries (Malta, Latvia, Hungary, Lithuania, Germany, Slovenia, Italy, Poland and Estonia) that had terms of trade indices that were above parity (in other words, their unit value indices for exports were higher than their unit value indices for imports) while the lowest terms of trade were recorded in Ireland. Between 2002 and 2023, Bulgaria (+14.6 percentage points) had the biggest improvement in its terms of trade. Twenty-two countries saw their terms of trade deteriorate between 2002 and 2023, with declines of more than 20.0 percentage points recorded for Ireland, Luxembourg and Cyprus.

(percentage points difference)

Source: Eurostat (ext_lt_intertrd)

EU terms of trade deteriorated with a number of countries from which it imports a relatively large amount of raw materials, minerals and energy-related goods

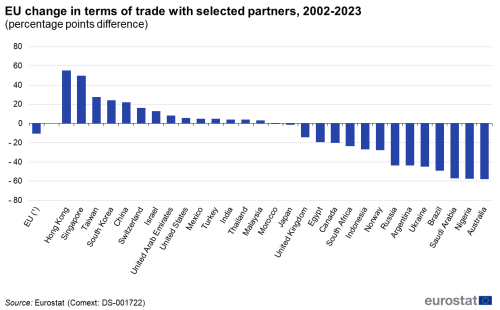

EU terms of trade indices can also be analysed on the basis of bilateral indices for selected trade partners. Given that for extra-EU partners as a whole the terms of trade fell by 21.2 percentage points between 2002 and 2023, it is perhaps unsurprising to find that the terms of trade with a majority of the selected partners shown in Figure 8 also deteriorated. This was particularly the case for a number of trade partners from which the EU imports a relatively large amount of raw materials, minerals and energy-related goods such as Russia, Saudi Arabia, Australia, Nigeria, Brazil, Australia, Argentina, Norway and Ukraine. By contrast, EU terms of trade with the United States (+5.7 points) and China (+22.1 points) improved. There were also double-digit improvements recorded for the EU’s terms of trade with South Korea (+24.2 points) Taiwan (+27.7 points) and Singapore (+49.8 points), while the biggest improvement was for the terms of trade with Hong Kong a gain of 55.2 points.

(percentage points difference)

Source: Eurostat (DS-001722)

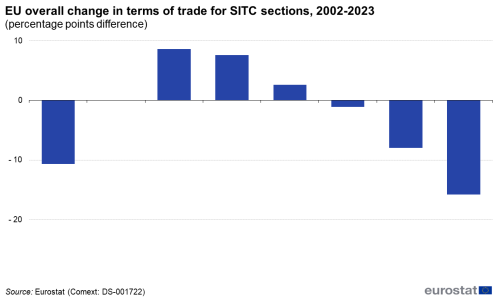

The final analysis in this article presents information on the overall change in EU terms of trade for a number of selected products (based on the SITC) between 2002 and 2023 as shown in Figure 9. At the start of this period, terms of trade indices were below parity for only two products — mineral fuels, lubricants and related materials and machinery and transport equipment. By 2023, this situation had changed and all product groupings had terms of trade above parity with the exception of raw materials. The largest improvement in this period was for machinery and transport equipment (+8.6 points) while raw materials (-15.8 points) had the largest decrease.

(percentage points difference)

Source: Eurostat (DS-001722)

Source data for tables and graphs

Direct access to