EuroGroups Register and industry concentration

Data extracted in April 2024

Planned article update: June 2025

Highlights

In the EU, some industries showed large levels of concentration, this was the case, for example, of manufacturing of coke and refined petroleum products, with concentration around 50 % in 2022.

This article gives an overview of industry concentration in the European Union (EU) calculated on the basis of the EuroGroups Register (EGR) data. Industry concentration indices measure the extent to which industry sales are dominated by one or more businesses.

EGR data and the information on the structure of the multinational enterprise (MNE) groups make it possible to calculate concentration indices for the groups in the EU.

This article presents the concentration indices using information on employment, as a proxy for sales (or net turnover), for fifteen NACE industries.

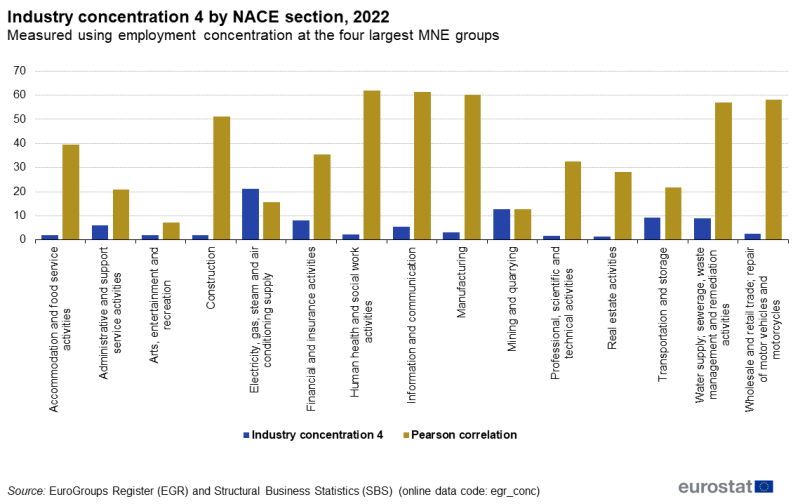

The highest values of industry concentration in 2022 in the EU were recorded in the following five NACE sections: electricity, gas, steam and air conditioning supply (21 %), mining and quarrying (13 %), transportation and storage (9 %) water supply; sewerage, waste management and remediation activities (9 %), and financial and insurance activities (8 %).

Source: EuroGroups Register (EGR) and Structural Business Statistics (SBS) - (egr_conc)

Full article

Introduction

Industry concentration is an interesting topic from the policymaker's point of view. The EuroGroups Register (EGR) offers a unique approach to measure concentration as it contains the group structure of multinational enterprise (MNE) groups that operate within the European Union (EU) and the European Free Trade Association (EFTA) territory. With this information, enterprises that could appear to compete in a certain industry as independent agents, can be identified as working under the umbrella of the same MNE group and thus, operating towards the same objective of group level profit maximisation. This means that when the enterprises of the same MNE group are treated together, the concentration could increase.

Data are released as experimental statistics because they are still under development using the EuroGroups Register as primary data source and because the calculation of the concentration indices is based on employment and not on sales (or net turnover).

The industry concentration is defined as a measure of the extent to which industry sales are dominated by one or more businesses. Concentration can be analysed at different geographical levels, e.g. national, European, or global. In this article, an industry is defined at the level of the statistical classification of economic activities in the European Community (NACE) and the concentration is analysed at EU level.

A high concentration is identified when a small number of companies control a large share of the industry, and it can be captured by, for example, calculating the 4-firm concentration ratio, which includes the total sales of the largest four MNE groups in the industry.[1]

Methodology

The industry concentration can be computed using data on sales and reflects how much an industry is dominated by one or more businesses. However, the EGR does not contain data on sales and, as net turnover is not available with sufficient coverage yet, data on employment have been used as a proxy. For many industries, there exists a strong correlation between employment and sales. However, this is not the case for all industries, and, because of that, the concentration presented in the article has to be taken under consideration with caution. Furthermore, the statistics using employment figures should be understood as employment concentration indices.

The concentration ratio can be compiled using data for enterprises within the largest MNE groups. For each NACE activity (section or division), the employment of individual enterprises within that activity which belong to a single MNE group can be combined. By selecting, within each activity, the 4 MNE groups with the highest combined employment of their enterprises in that activity, the concentration can be measured as a share of the total employment (data of all enterprises available from structural business statistics (SBS)) in the same activity.

The defined methodology presents some limitations in the computation of the industry concentration. It is important to mention them and to take them into account for any analysis:

- The most important limitation is the use of employment as a proxy for net turnover. This is mitigated for the industries in which employment and net turnover have a high correlation coefficient.

- Industry concentration refers to the concentration of the production side, i.e. some multinational enterprise groups will be more focused on exports and the link between the production and the market side of the concentration is not always straightforward.

- The results presented below show the industry concentration at EU level. However, it is important to mention that there can be heterogeneity between the different Member States. This means that although concentration might not be observed at EU level for some industries, it could be possible to have concentration in some industries if only one Member State would be considered.

Industry concentration indices in the EU

To measure the concentration ratio, one can use the 4-firm concentration ratio for the EU by NACE activity:

Source: EuroGroups Register (EGR) and Structural Business Statistics (SBS) - (egr_conc)

Higher industry concentration values can be observed in mining and quarrying, and in electricity, gas, steam and air conditioning supply. On the other hand, lower concentration can be observed in construction, accommodation and food service activities, real estate activities, manufacturing, etc.

In Figure 2, The Pearson correlation is represented, as the measure which provides evidence of how good the use of employment as a proxy is when measuring concentration. One can see, for instance, that the correlation is relatively low for mining and quarrying, while it is much higher for manufacturing.

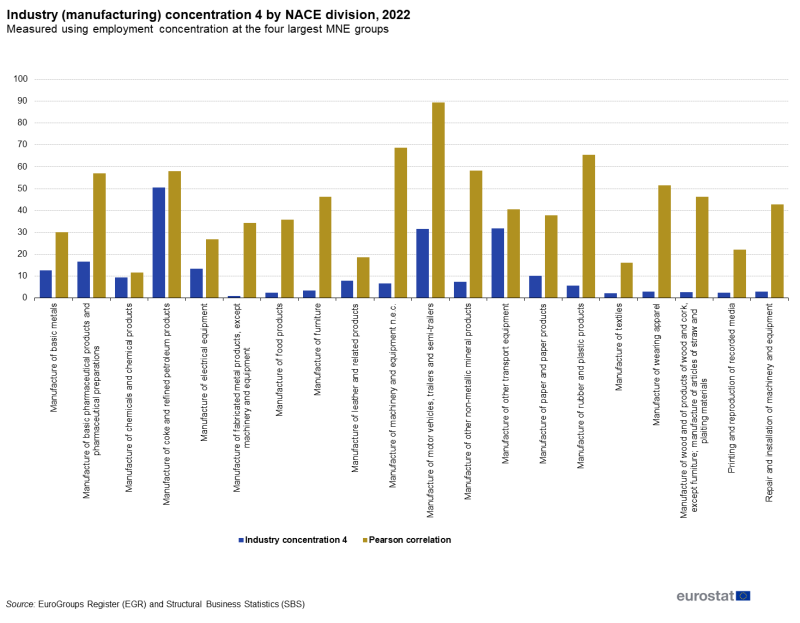

It is also interesting to notice that at high level of aggregation, an industry can present a low concentration ratio, which is the case, for example, of the manufacturing sector. However, it could be the case that at a more disaggregated level, the concentration is higher. This can be seen in Figure 3, in which the manufacturing sector is disaggregated:

In most of the industries presented in Figure 3, the concentration ratio is below 10 %. However, one can observe three clear cases of higher concentration. These are the manufacture of coke and refined petroleum products (50 %), the manufacture of motor vehicles, trailers and semi-trailers (32 %), and the manufacture of other transport equipment (32 %). This is an interesting fact that justifies the value of disaggregating the industries into more granular cases whenever possible.

Moreover, the Pearson correlation is also presented in Figure 3, and for two out of the three cases mentioned above, the correlation is above 50 %.

Other measures of concentration

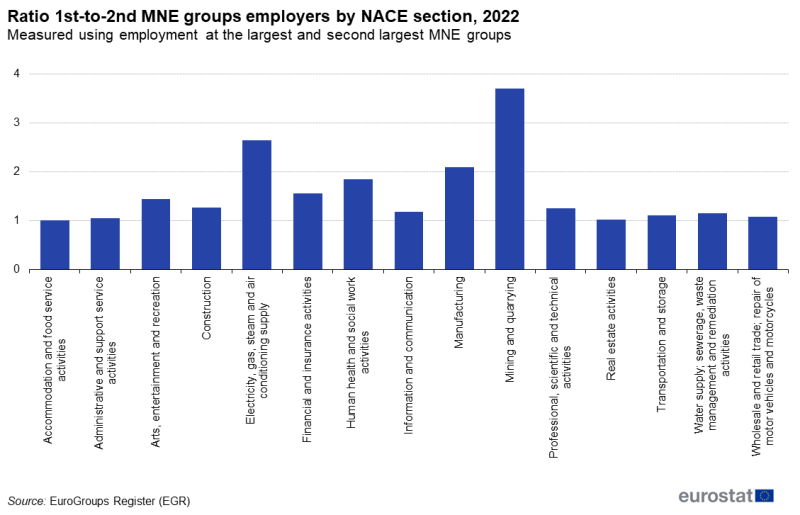

The 4-firm concentration ratio is not the only measure one can compute. Additionally, and as a complement to the results presented above, one can also observe how the largest and the second largest employers in each industry compare with each other and can compute the ratio between them. This ratio, which is always greater or equal to one, shows the relative size of the dominant company of the industry compared with the second one. This can be seen in Figure 4.

One can observe that for the two industries for which there is the highest concentration (i.e. mining and quarrying and electricity, gas, steam and air conditioning supply), the largest employer of the industry is 3.5 and 2.5 times larger respectively than the second largest employer. This not only gives an idea of the concentration of the industry, but also gives evidence of how dominant a single multinational enterprise group can be.

Feedback

To help Eurostat improve these experimental statistics, users and researchers are kindly invited to give their feedback by email at feedback by email

Data sources

The EGR is the main source of the computation. The EGR is the statistical business register of the EU and EFTA countries for MNE groups. It produces data in yearly cycles and covers microdata on the groups and their enterprises and legal units.

The EGR aims to register all MNE groups that have enterprises in EU Member States or EFTA countries, including European and non-European groups. The EGR does not cover all-resident enterprise groups – those with enterprises only in one country, and independent enterprises.

The EGR microdata help to explore the structure and impact of multinational enterprise groups in Europe. One can analyse group size, complexity, and employment patterns in European countries, together with their European influence.

The main value added of the EGR is the possibility to link different enterprises that work under the umbrella of the same multinational group. While in other domains, enterprises are usually treated separately, and thus, as competing players in the industry, with EGR, it is possible to treat them together as working as one instead of competing.

The EGR is a statistical business register that serves statistical purposes only. Access to EGR data is restricted to national statistical institutes and national central banks that produce official statistics in the EU Member States and EFTA countries.

Because enterprises that are active in only one country are out of the scope of the EGR database, a complementary dataset is necessary to calculate market concentration indices. Eurostat's structural business statistics was the perfect candidate.

Structural business statistics (SBS) describe the business economy[2] through the observation of units engaged in an economic activity; the unit in structural business statistics is generally the enterprise. An enterprise carries out one or more activities, at one or more locations, and it may comprise one or more legal units. Enterprises that are active in more than one economic activity (plus the value added and turnover they generate, the people they employ, etc.) are classified under the NACE heading corresponding to their principal activity; this is normally the one which generates the largest amount of value added.

Structural business statistics contain a comprehensive set of basic variables describing business demographics and employment characteristics, as well as monetary variables (mainly concerning operating income and expenditure, or investment).

Context

Indicators of industry concentration can give policymakers and competition regulators a broad idea on whether an industry is competitive or not. High industry concentration could be an indicator of market failures and trigger some monitoring of the situation. To provide a comprehensive view to the public, Eurostat uses data available from several domains to better understand the industry situation in the European Union.

Direct access to

- Multinational enterprise groups methodological note

- Methodology on enterprise groups and registers is available in the Business registers Recommendations manual

- EuroGroups Register metadata (ESMS metadata file — egr_esms)

- Structural business statistics metadata (ESMS metadata file — sbs_esms)

- Regulation (EEC) No 696/1993 of 15 March 1993 on the statistical units for the observation and analysis of the production system in the Community (Summary)

- Regulation (EU) 2019/2152 of the European Parliament and of the Council of 27 November 2019 on European business statistics, repealing 10 legal acts in the field of business statistics

- Implementing Regulation (EU) 2020/1197 of 30 July 2020 laying down technical specifications and arrangements pursuant to Regulation (EU) 2019/2152 of the European Parliament and of the Council on European business statistics repealing 10 legal acts in the field of business statistics

Notes

- ↑ The 4-firm concentration ratio presented in this article is one of the most common indicators in use. Similar measures regularly mentioned in the literature include the ten or twenty – firm concentration ratios.

- ↑ After the entry into force of the European Business Statistics (EBS) Regulation, SBS cover the 'business economy' (NACE Rev. 2 sections B to N, P to R as well as divisions S95 and S96) which includes: industry, construction, distributive trades and services.