EU trade with Russia - latest developments

Data extracted in February 2023

Planned article update: 27 May 2024

Highlights

This article provides a picture of the international trade of main product groups exchanged between the European Union (EU) and Russia. More general information on trade with Russia is available in ![]() this excel file. This article is part of an online publication providing recent statistics on international trade in goods, covering information on the EU's main partners, main goods traded, specific characteristics of trade as well as background information.

this excel file. This article is part of an online publication providing recent statistics on international trade in goods, covering information on the EU's main partners, main goods traded, specific characteristics of trade as well as background information.

Full article

Latest developments

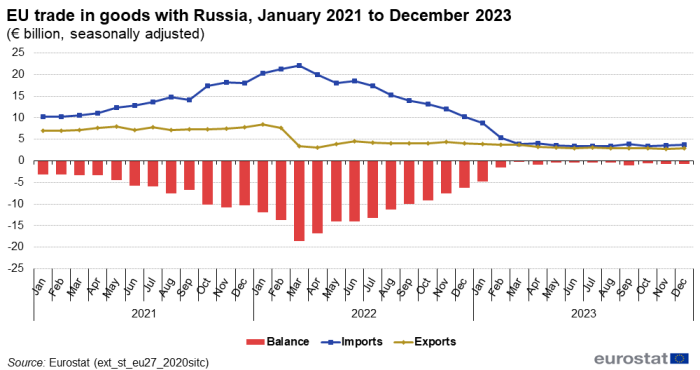

EU trade with Russia has been strongly affected since the start of Russia's invasion of Ukraine. The EU has imposed a number of import and export restrictions on several products, with more visible effects in the latest months. The value of exports to Russia fell by 61 % between February 2022 and September 2023, while imports from Russia fell by 82 % in this period (see Figure 1). These developments caused the EU's trade deficit with Russia which peaked at €18.6 billion in March 2022 to fall to €0.8 billion in December 2023.

(€ billion, seasonally adjusted)

Source: Eurostat (ext_st_eu27_2020sitc)

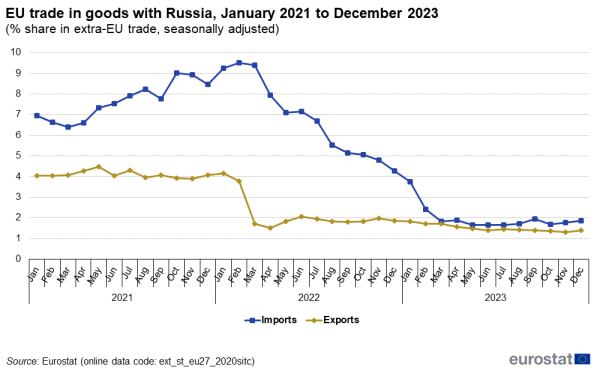

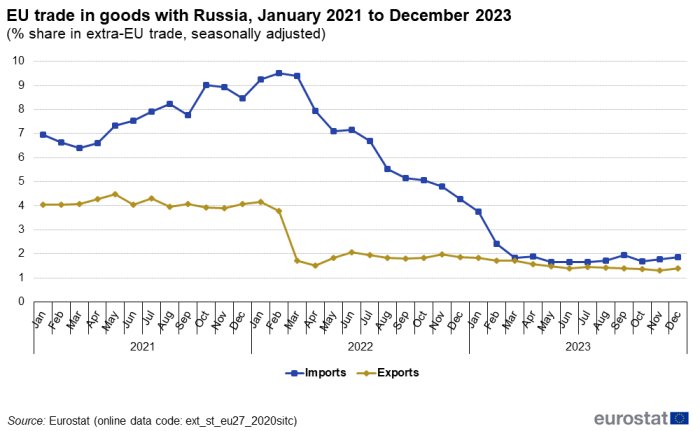

When looking at the changes in Russia's shares in extra-EU trade, both exports and imports dropped considerably below the levels prior to Russia's invasion. Figure 2 shows that Russia's share in the extra-EU exports fell from 3.8 % in February 2022 to 1.4 % in December 2023. Over the same period, the share of extra-EU imports from Russia fell from 9.5 % to 1.9 %.

(% share in extra-EU trade, seasonally adjusted)

Source: Eurostat (ext_st_eu27_2020sitc)

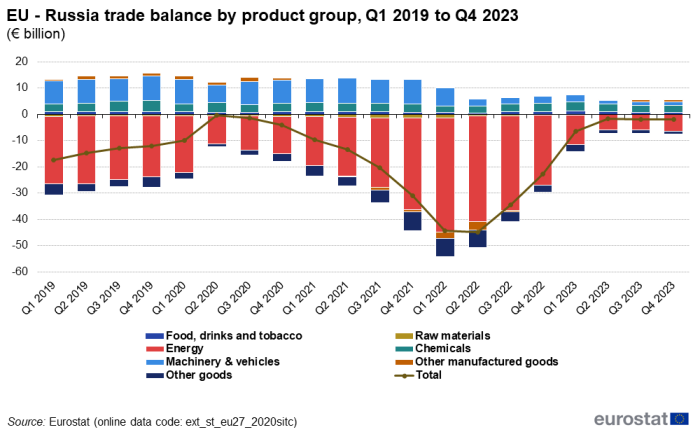

When looking at quarterly data, the EU's total trade balance with Russia is strongly correlated with the balance for energy products. High prices for energy products in 2021 and 2022 caused a considerable trade deficit, peaking at €44.9 billion in the second quarter of 2022. However, import restrictions and falling energy prices significantly reduced the trade deficit, which stood at €2.1 billion in the fourth quarter of 2023.

(%)

Source: Eurostat (ds-059322)

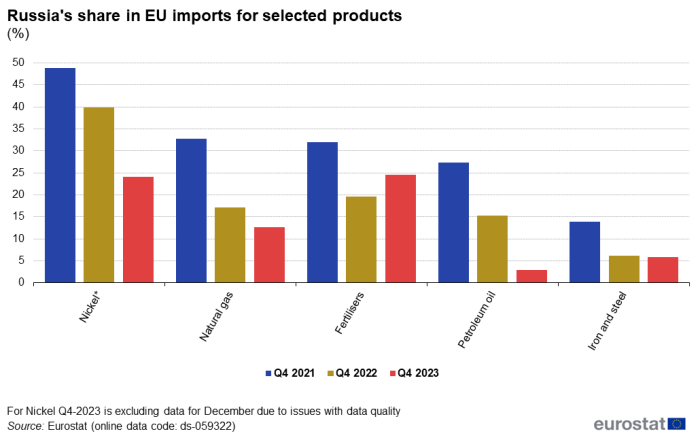

Key product groups imported by the EU from Russia

Figure 4 focuses on five product groups imported from Russia, selected because of their relevance with respect to total extra-EU imports in terms of share or in terms of their absolute value. These products accounted for more than 60 % of all EU imports from Russia. There were import restrictions for natural gas, coal and petroleum oils with derogations. There were also restrictions for iron and steel and fertilisers, but not for all products in these product groups. These restrictions caused large drops in the imports of these products, although other factors could also have played a role. For imports of nickel there were no restrictions but here too, imports decreased considerably. Comparing the fourth quarter of 2021 with the fourth quarter of 2023 drops for nickel (-25 percentage points (pp)), petroleum oil (-24 pp) and natural gas (-20 pp) were larger than for iron and steel (-8 pp) and fertilisers (-7 pp).

For each of these products, the development of value, volume and unit value for imports since January 2021 is shown in the following section. In addition, the shares in imports by partner are shown for the fourth quarters of 2021, 2022 and 2023. This section uses non-seasonally adjusted data.

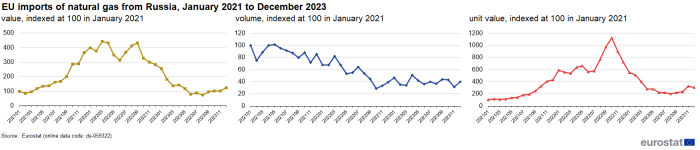

EU imports natural gas

In December 2023, the volume of natural gas imported from Russia was 40 % of what it had been in January 2021 (see Figure 5). However, due to rising price its value in this period increased by 23 %. The value of EU imports of natural gas from Russia increased considerably between January 2021 and March 2022 as prices increased sharply. In the light of several packages of sanctions imposed by the European Union, the supply of natural gas from Russia steadily decreased with a significant drop from April to June 2022. The increase of imports between July to September 2022 due to the increase in prices was temporary.

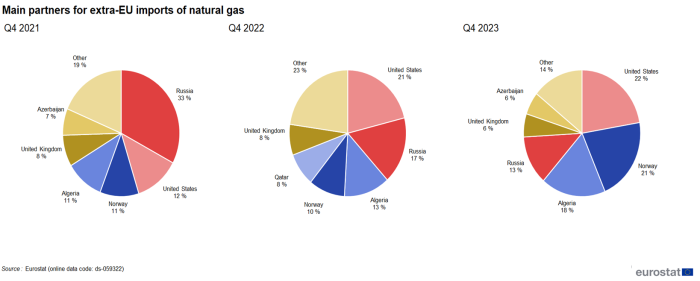

Russia's share in EU imports of natural gas dropped from 33 % in the fourth quarter of 2021 to 13 % in the fourth quarter of 2023 (see Figure 6). The highest share in the fourth quarter of 2023 was observed for the United States (22 %). Shares for Algeria and Norway also increased between the fourth quarters of 2021 and 2023.

value, indexed at 100 in January 2021

Source: Eurostat (ds-059322)

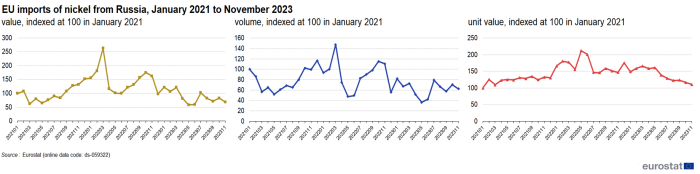

EU imports of nickel

In November 2023, the volume of nickel imported from Russia was 63 % of what it had been in January 2021 (see Figure 7) while its value had dropped to 69 % in the same period. Imports of nickel were not affected by a specific ban. Measured in value, EU imports of nickel from Russia increased strongly between January 2021 and March 2022 due to increasing demand and prices. In the following months they dropped considerably.

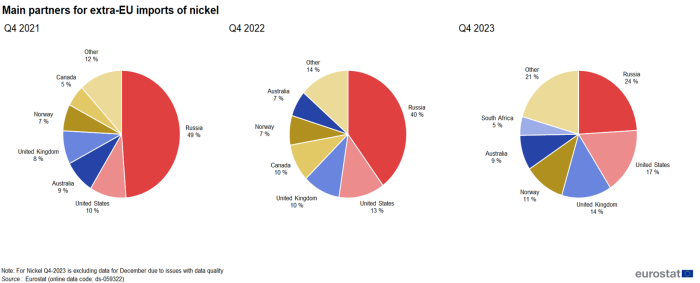

Russia's share in EU imports of nickel fell by 25 pp between the fourth quarters of 2021 and 2023 (see Figure 8). The shares of the United States (+8 pp), United Kingdom (+5 pp), and Norway (+4 pp) increased in this period.

value, indexed at 100 in January 2021

Source: Eurostat (ds-059322)

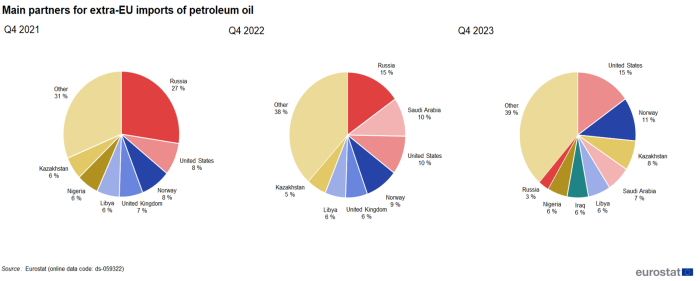

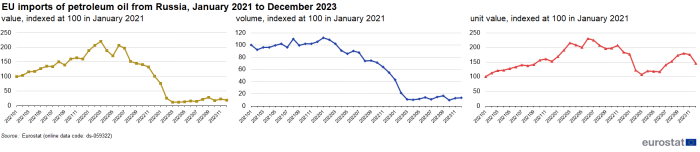

EU imports of petroleum oil

In December 2023, the volume of petroleum oil imported from Russia was 13 % of what it had been in January 2021 (see Figure 9) while its value had dropped to 19 % in the same period. EU imports of petroleum oil (combined crude and non-crude) from Russia in trade value more than doubled between January 2021 and February 2022 due to increasing prices. Russia was the largest provider of petroleum oils to the EU in 2021. After Russia's invasion, a major diversion in the trade of petroleum oil took place. Evidence of this became visible in the second and especially in the third and fourth quarters of 2022 and continued in 2023.

The share of petroleum oil imports from Russia dropped from 28 % in the fourth quarter of 2021 to 3 % in the fourth quarter of 2023 (see Figure 10). The shares of the United States (+7 pp), Norway (+4 pp) and Kazakhstan (+2 pp) increased in this period.

value, indexed at 100 in January 2021

Source: Eurostat (ds-059322)

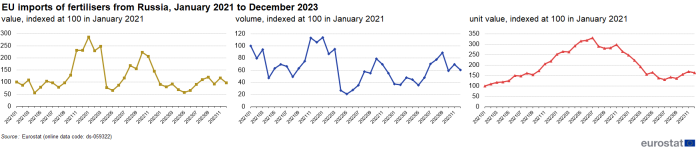

EU imports of fertilisers

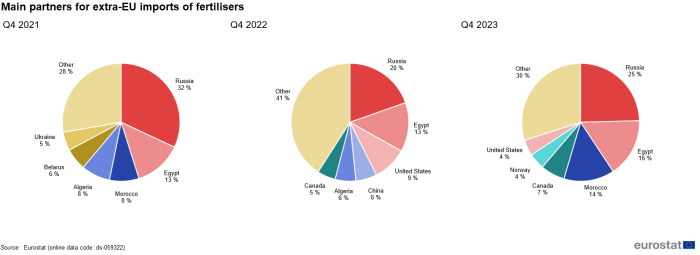

In December 2023 compared with January 2021, the value index for imports of fertilisers from Russia decreased by 2 pp while the volume index had fallen 40 pp (see Figure 11). The value of the EU's imports of fertilisers from Russia almost tripled between January 2021 and January 2022, mostly as a result of rising prices. Between February 2022 and March 2023 there were strong fluctuations in imports.

Russia's share in extra-EU imports of fertilisers dropped from 32 % in the fourth quarter of 2021 to 20 % in the fourth quarter of 2022 but bounced back to 25 % in the fourth quarter of 2023 (see Figure 12).

value, indexed at 100 in January 2021

Source: Eurostat (ds-059322)

(%)

Source: Eurostat (ds-059322)

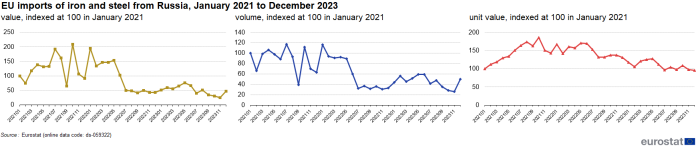

EU imports of iron and steel In December 2023, both the value and volume of iron and steel imported from Russia was around a half of what it had been in January 2021 (see Figure 13). The value of the EU's imports of iron and steel from Russia increased by 35 pp between January 2021 and February 2022 due to rising prices. Subsequently, a drop in volume was observed in June and July of 2022 because of the sanctions on several products.

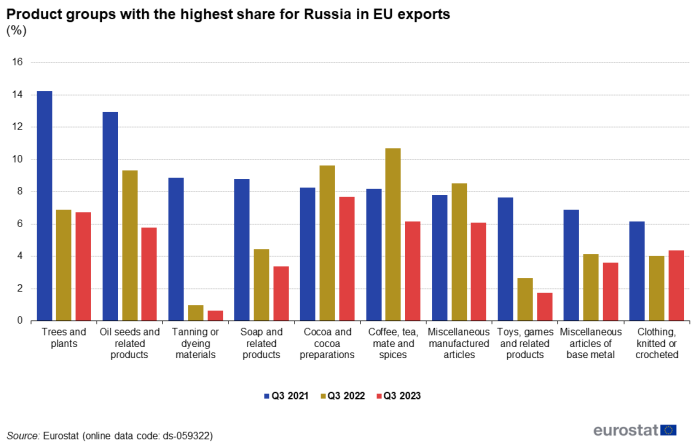

Russia's share in extra-EU imports of iron and steel dropped significantly (-8 pp) in the fourth quarter of 2023 compared with the fourth quarter of 2021 when it was still the largest import partner (see Figure 14). China became the largest origin for EU imports of iron and steel with a share of 11 %, while South Korea, the United Kingdom, India and Turkey also had higher shares than Russia in the fourth quarter of 2023.

value, indexed at 100 in January 2021

Source: Eurostat (ds-059322)

(%)

Source: Eurostat (ds-059322)

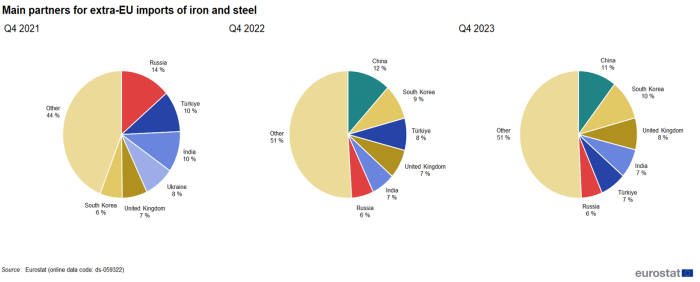

Main product groups in EU exports to Russia

Russia was an important partner for EU exports of a number of products. Figure 15 shows the product groups with the highest share for Russia in EU exports in 2021. For all these ten products, this share dropped in 2023 compared with the fourth quarter of 2021.

Source: Eurostat (ds-059322)

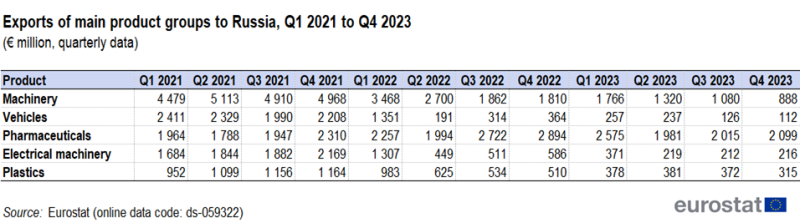

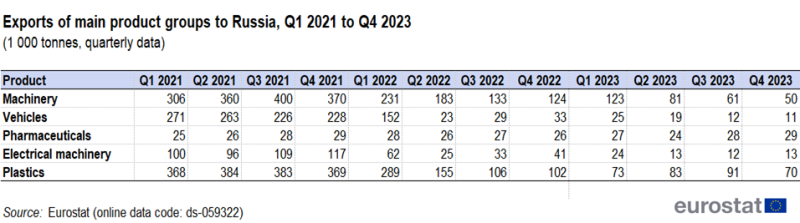

The EU also exported a wide range of products to Russia. In value terms, the largest product groups exported to Russia in the first quarter of 2021 were machinery, vehicles, pharmaceuticals, electrical machinery and plastics. The weight of these exports is shown in Table 2. Between the first quarter of 2021 and the third quarter of 2023 exports for four of these five product groups had dropped considerably, the exception being pharmaceuticals which stood at €2 099 million in the fourth quarter of 2023, after having peaked at €2 894 million in the fourth quarter of 2022.

(€ million, quarterly data)

Source: Eurostat (ds-059322)

(1 000 tonnes, quarterly data)

Source: Eurostat (ds-059322)

Source data for tables and graphs

Data sources

EU data is taken from Eurostat's COMEXT database. COMEXT is the reference database for international trade in goods. It provides access not only to both recent and historical data from the EU Member States but also to statistics of a significant number of non-EU countries. International trade aggregated and detailed statistics disseminated via the Eurostat website are compiled from COMEXT data according to a monthly process.

Data are collected by the competent national authorities of the EU Member States and compiled according to a harmonised methodology established by EU regulations before transmission to Eurostat. For extra-EU trade, the statistical information is mainly provided by the traders on the basis of customs declarations.

EU data are compiled according to EU guidelines and may, therefore, differ from national data published by the Member States. Statistics on extra-EU trade are calculated as the sum of trade of each of the 27 EU Member States with countries outside the EU. In other words, the EU is considered as a single trading entity and trade flows are measured into and out of the area, but not within it.

Methodology

According to EU concepts and definitions, extra-EU trade statistics (trade between EU Member States and non-EU countries) do not record exchanges involving goods in transit, placed in a customs warehouse or given temporary admission (for trade fairs, temporary exhibitions, tests, etc.). This is known as 'special trade'. The partner is the country of final destination of the goods for exports and the country of origin for imports.

Product classification

Information on commodities exported and imported is presented according to the Harmonised System for product classification. A full description is available from Eurostat's classification server [1].

Unit of measure

Trade values are expressed in millions or billions (109) of euros. They correspond to the statistical value, i.e. to the amount which would be invoiced in case of sale or purchase at the national border of the reporting country. It is called an FOB value (free on board) for exports and a CIF value (cost, insurance, freight) for imports.

Context

Trade is an important indicator of Europe's prosperity and place in the world. The bloc is deeply integrated into global markets both for the products it sources and the exports it sells. The EU trade policy is one of the main pillars of the EU's relations with the rest of the world.

Because the 27 EU Member States share a single market and a single external border, they also have a single trade policy. EU Member States speak and negotiate collectively, both in the World Trade Organisation, where the rules of international trade are agreed and enforced and with individual trading partners. This common policy enables them to speak with one voice in trade negotiations, maximising their impact in such negotiations. This is even more important in a globalised world in which economies tend to cluster together in regional groups.

The openness of the EU's trade regime has meant that the EU is the largest player on the global trading scene and remains a good region to do business with. Thanks to the ease of modern transport and communications, it is now easier to produce, buy and sell goods around the world which gives European companies of every size the potential to trade outside Europe.

Direct access to