Archive:Construction statistics - NACE Rev. 1.1

- Data from January 2009, most recent data: Further Eurostat information, Main tables and Database

This article introduces a set of statistical articles which analyse the structure, development and characteristics of the economic activities in the construction sector in the European Union (EU). According to the statistical classification of economic activities in the EU (NACE Rev 1.1), this sector covers NACE Section F (which is the same as NACE Division 45). Its activities are treated in more depth in five further articles, each corresponding to a different NACE group and covering a different chronological stage of the construction process:

- demolition and site preparation (NACE Group 45.1);

- general construction activities (NACE Group 45.2);

- installation work (NACE Group 45.3);

- completion work (NACE Group 45.4);

- renting of construction equipment (NACE Group 45.5).

Some technical activities related to the construction sector, although not formally part of it, such as architectural services or landscaping, are classified in the business services sector (see Business services statistics). Some providers of real estate services, such as property developers, are closely related to construction and these are covered in the article on Real estate statistics.

Main statistical findings

Structural profile

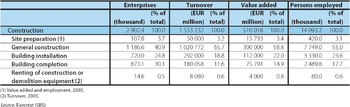

The construction sector (NACE Section F) had around 2.9 million enterprises that together generated a combined value added of EUR 510.0 billion in the EU-27 in 2006 and employed 14.1 million persons, equivalent to 9.0 % of the non-financial business economy’s (NACE Sections C to I and K) value added and 10.9 % of its employment. Among this workforce the proportion of paid employees was 82.2 % in the EU-27 in 2006, below the non-financial business economy average of 86.5 %, which reflected the relatively high levels of self-employment in certain areas within this sector.

The largest of the five subsectors (NACE groups) in the EU-27, both in employment and value added terms, was the building of complete constructions or parts thereof and civil engineering (NACE Group 45.2, hereafter referred to as general construction). This subsector alone accounted for more than half of the value added (58.8 %) and employment (55.0 %) in the EU-27's construction sector in 2006. Building installation (NACE Group 45.3) and building completion (NACE Group 45.4) were the next largest subsectors, with 22.0 % and 14.9 % respectively of the EU-27's value added in construction, and slightly larger shares of employment. The two smallest subsectors were site preparation (NACE Group 45.1) and the renting of construction or demolition equipment with an operator (NACE Group 45.5) which contributed 3.4 % and 0.8 % of the construction sector’s value added in the EU-27 in 2006.

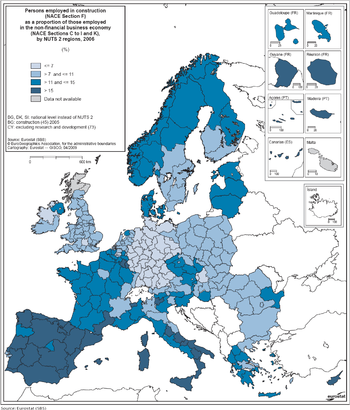

In value added terms, the United Kingdom had the largest construction sector in the EU-27 with a 19.1 % share of the EU-27 total in 2006. The Spanish construction sector was also significant, with the second highest contribution to value added (18.5 % of the EU-27 total) and the largest workforce, some 2.8 million persons employed (19.9 % of the EU-27 total). The construction sector contributed 17.6 % to Spanish value added in the non-financial business economy and 20.1 % of its employment, making Spain the most specialised Member State. In value added terms, the next most specialised[1] countries were Cyprus, Lithuania and Portugal, while the least specialised included Germany, Slovakia, Hungary and Poland (2005) – which all reported that the construction sector accounted for less than 6.0 % of the value added generated in their respective non-financial business economies.

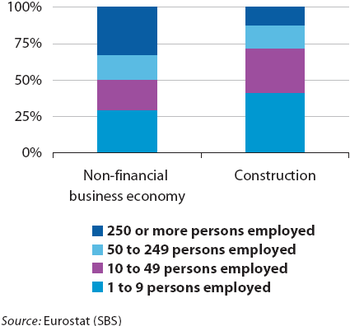

The contribution of the construction sector to regional employment within the non-financial business economy is shown in the map. The importance of construction in several southern and south-western Member States is clear. Spanish regions occupied 14 of the top 15 places in a ranking of the most specialised regions, and many regions in southern France, Italy and Portugal, as well as the island of Cyprus registered 15.0 % or more of their non-financial business economy employment within the construction sector. The only regions outside of southern Europe to record such a high degree of specialisation were Luxembourg, and the neighbouring Belgian province of Luxembourg. In contrast 36 of the 40 regions where less than 6.0 % of non-financial business economy employment was in construction were German. Most construction enterprises serve a local market and, consequently, the construction sector is characterised by a large number of small enterprises, and relatively few large ones. Micro and small enterprises (with less than 50 persons employed) together employed 72.1 % of the EU-27's workforce in the construction sector in 2006, a higher share than in the activities covered by any of the other structural business statistics sectors: the average for the non-financial business economy was just 50.4 %. Large enterprises (with more than 250 persons employed) employed just over one tenth of the EU-27’s workforce (12.0 %) in construction, compared with a non-financial business economy average of one third (32.6 %). Most Member States[2] displayed a similar pattern, as in 2006 the combination of micro and small enterprises employed at least two fifths of the construction sector's workforce in all Member States, and more than half of the workforce in the majority of them. The largest contribution by large enterprises was 25.4 % of the workforce in Romania.

Developments in output, costs and prices

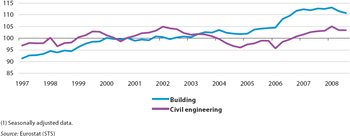

The development of construction output in the EU-27 and some of the larger Member States – based on the 'classification of constructions' (rather than NACE) shows that building work followed an upward trend for several years through to the first quarter of 2008. The most recent data (at the time of writing) shows a sharp fall in output, with building production down 1.4 % in the second quarter and by a further 0.7 % in the third quarter of 2008. The fall in the second quarter of 2008 was the biggest quarter on quarter reduction in EU-27 output in more than a decade.

The long-term development for civil engineering in the EU-27 was somewhat different, with short cyclical movements since the mid-1990s. However, between the first quarters of 2006 and 2008 there was a period of sustained growth, with output increasing overall by 9.8 %. After the first quarter of 2008 the situation reversed and negative rates of change were recorded for civil engineering, -1.5 % in the second quarter of 2008 and -0.1 % in the third quarter.

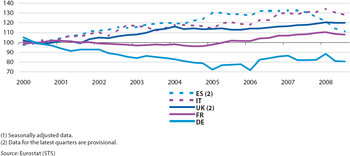

There were contrasting developments in construction output in the five largest Member States. Spain recorded almost uninterrupted quarter on quarter growth in construction output until the second quarter of 2007, since when output contracted by 16.1 % overall in the ensuing five quarters. Between 2000 and 2007, Italy recorded a relatively similar level of overall growth as Spain, with short periods of strong growth followed by periods of more gentle contraction. Although Italian construction output also recorded a fall in the second and third quarters of 2008 this was considerably less than that seen in Spain. The United Kingdom also showed a clear upward trend in construction output from the turn of the century, less pronounced than in Spain or Italy, but more regular. In contrast to the other large economies, construction output in the United Kingdom was stable in the middle half of 2008 rather than contracting. After several years of gently falling output, French construction activity grew steadily from the end of 2004 to the beginning of 2008. In the second and third quarters of 2008 French construction output fell, although less sharply than in Italy or Spain. Over much of the previous decade, German construction activity also recorded sustained periods of falling output, often more severe than in France. Nevertheless, between the second quarter of 2006 and the first quarter of 2008 German construction output increased every quarter except one, before it too recorded a contraction in the second and third quarters of 2008.

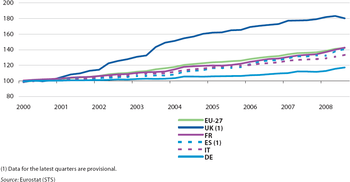

Construction cost indices for residential buildings for the same Member States show that growth was lowest in Germany and highest in the United Kingdom between 2000 and the middle of 2008, with the other three economies recording cost increases that were slightly below the EU-27 average.

Employment characteristics

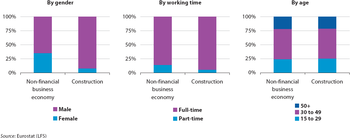

An analysis of the EU-27's construction workforce, based on Labour Force Survey data, shows that the male proportion of the construction sector's workforce was relatively high, at 92.1 % in the EU-27 in 2007. This share was 27.2 percentage points higher than the non financial business economy average, and the highest of all of the non financial business economy NACE divisions for which data are available. In all Member States, the proportion of men in the construction labour force was at least 22 percentage points higher than the national non-financial business economy average.

In the construction sector, 94.3 % of persons were employed on a full-time basis in the EU-27 in 2007 compared with 85.7 % in the non-financial business economy as a whole. Only in Romania was the part-time employment rate for construction lower than the national non-financial business economy average.

Expenditure, productivity and profitability

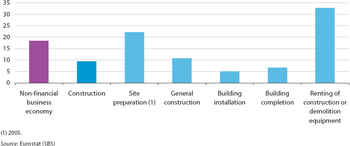

The level of tangible investment made by the construction sector in 2006 reached EUR 47.8 billion in the EU-27, equivalent to 4.6 % of all tangible investment made in the non-financial business economy. The investment rate shows the ratio between investment and value added: in 2006 this was 9.4 % for the EU-27's construction sector, approximately half the average for the non-financial business economy (18.4 %). Building installation and completion recorded the lowest investment rate among the construction subsectors. The capital-intensive subsector of renting of construction or demolition equipment had, unsurprisingly, the highest investment rate, reaching 32.8 %.

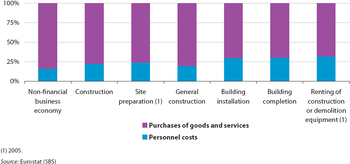

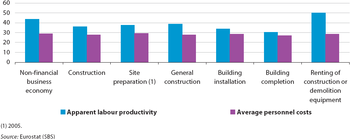

Turning from capital to operating expenditure, the share of personnel costs was relatively high in the construction sector, 22.8 % in the EU-27 in 2006. This high share reflected the labour-intensive nature of these activities, and was around 40 % above the non-financial business economy average of 16.1 %. Furthermore, each of the five construction subsectors recorded a share above the non-financial business economy average, with general construction (19.5 %) appearing as the least labour-intensive.

Apparent labour productivity in the EU-27's construction sector in 2006 was EUR 36.2 thousand per person employed and average personnel costs were EUR 27.9 thousand per employee. Both of these were below the equivalent averages for the non-financial business economy, particularly the apparent labour productivity. The relatively low levels of these two ratios in the construction sector are all the more notable given the small proportion of part-time employment within this sector (part-time employment has the effect of making these ratios lower). Indeed, most of the other activities that recorded particularly low values for these two indicators, for example, retail trade or accommodation and food services, were characterised by considerably higher levels of part-time employment. The wage-adjusted labour productivity ratio combines the two previous ratios, and shows the extent to which value added per person employed covers average personnel costs per employee. This composite indicator is less affected by issues of part-time employment and so facilitates analysis between activities. In the EU-27's construction sector in 2006, this ratio was 129.7 %, indicating that value added per person employed was 29.7 % higher than average personnel costs per employee. This was conspicuously lower than the average for the non-financial business economy which was 151.1 %. Four of the five NACE groups that make up the construction sector recorded a wage-adjusted labour productivity ratio in the EU-27 below the average for the non-financial business economy. The exception was the renting of construction or demolition equipment, which recorded a ratio of 175.0 %.

Unlike the productivity indicators, the gross operating rate (the relation between the gross operating surplus and turnover) in the construction sector in the EU-27 in 2006 was above the average for the non-financial business economy. This is partly an effect of the relatively high share of self-employment in construction, as working owners and other unpaid persons employed contribute to the value added but are recompensed through a share of profits but not in the form of personnel costs, so boosting the gross operating surplus. The gross operating rate in the EU-27's construction sector was 12.0 % in 2006, ranging from 11.0 % for general construction activities to 16.6 % for building completion, with the renting of construction or demolition equipment with an operator posting a gross operating rate well above this range, at 23.2 % (in 2005).

Data sources and availability

The main part of the analysis in this article is derived from structural business statistics (SBS), including core, business statistics which are disseminated regularly, as well as information compiled on a multi-yearly basis, and the latest results from development projects.

Other data sources include short-term statistics(STS), the Labour force survey(LFS) and the Directorate-General for Economic and Financial Affairs.

Context

Building and civil engineering projects typically take much longer from conception to completion than in many other sectors, and often involve a large number of sub-contracting enterprises with various specialisations. Construction projects are often a key factor in urban regeneration, and also in maintaining or developing transport and communication infrastructure. Nevertheless, construction projects impact upon the environment in a number of ways, notably the change in land use, the consumption of materials and fuel, the production of waste, as well as noise and air emissions.

Another characteristic of construction activity is that it is particularly cyclical, influenced by business and consumer confidence, interest rates and government programmes. The level of confidence among construction enterprises, according to the European Commission's Directorate-General for Economic and Financial Affairs is presented in terms of a balance of positive compared with negative responses. This measure turned positive in July 2006 for the first time since June 1990, peaked in September 2006 and then became negative again in November 2007. During 2008, the fall in construction confidence accelerated and fell particularly strongly in the final quarter of 2008, such that by December 2008 the balance was down to -32.3 %. At the time of writing, with overall economic activity declining in many Member States, major public sector funding for infrastructure projects has been proposed by a number of governments as one means of stimulating activity and creating jobs.

Further Eurostat information

Publications

Main tables

Database

Dedicated section

External links

See also

- Construction site preparation statistics

- General construction statistics

- Building installation statistics

- Building completion statistics

- Renting of construction equipment statistics