Archive:Government finance statistics - revenue and expenditure by subsector of general government

- Data extracted on 10 March 2017. Most recent data: Further Eurostat information, Main tables and Database. Planned article update: November 2017.

In the European Union (EU-28) as well as Iceland, Norway and Switzerland, the compilation of government revenue and expenditure data is well established by reference to the European system of national and regional accounts (ESA2010).

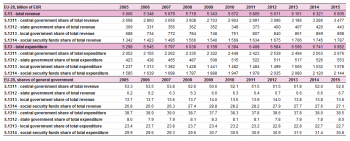

This article focuses exclusively on the relative importance of the subsectors of general government in their total revenue and total expenditure. It uses an alternative presentation by considering only revenue and expenditure from other sectors of the economy but not from other subsectors of general government.

The sector general government (S.13) is divided into four subsectors:

Central government (S.1311) State government (S.1312) Local government (S.1313) Social security funds (S.1314)

State government data exist only in federally structured countries, i.e. Belgium, Germany, Spain, Austria and Switzerland. Hence, in these five countries, expenditure and revenue for a state or regional level is distinguished – this concerns the three regions in Belgium, the Bundesländer in Germany and Austria, the comunidades autónomas in Spain as well as the Kantone in Switzerland.

For social security funds data, Ireland, Malta, the United Kingdom and Norway do not have institutional units meeting the definition of social security funds according to Regulation (EU) No 549/2013 (ESA 2010).

Total expenditure (TE) is examined at subsector level as an aggregate as well as by category of expenditure in each subsector (please see Data sources and availability). The development of the weight of the subsectors over time is also analysed.

Source: Eurostat (gov_10a_main)

Source: Eurostat (gov_10a_main)

Source: Eurostat (gov_10a_main)

Main statistical findings

Source: Eurostat (gov_10a_main)

Source: Eurostat (gov_10a_main)

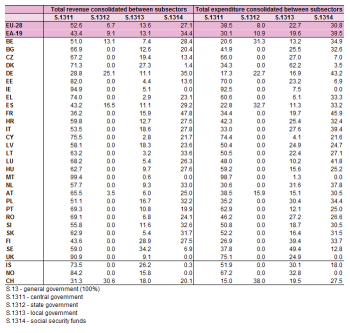

In 2015 in the EU-28, total expenditure at general government level was equal to 56.9 % of GDP. Central government accounted for 46.2 % of general government total expenditure (TE) or 26.3 % of GDP. State government accounted for 8.1 % of TE or 4.6 % of GDP, local government for 19.4 % of TE and 11.1 % of GDP, with social security funds making up the remainder – 26.2 % of TE or 14.9 % of GDP.

Central government has the most important weight in general government expenditure

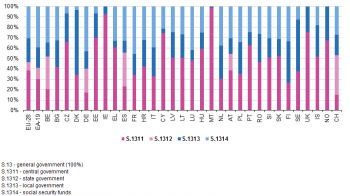

Figure 1 and 2 show that the importance of the subsectors varies between countries. In the EU-28 as a whole, central government is the largest subsector in terms of both revenue and expenditure. The same applies for euro area countries, where central government accounts for the biggest part of general government expenditure (38.6 % of TE).

In four countries – Ireland, Malta, the United Kingdom and Norway – the social security funds subsector is not separated from central government data. In Germany, France and Luxembourg the social security funds subsector had a share of more than 40 % of total general government expenditure in 2015.

Central government accounts for Ireland and Malta, by far, the largest part of total general government expenditure in 2015. A high share in central government expenditure is also observed in the Cyprus (74.4 % of TE in 2015), the United Kingdom (75.1 %), Estonia (70.0 %), Norway (67.2 %) and Czech Republic (66.0 %)

A high share of local government expenditure is observed in Denmark (62.2 % of TE in 2015), Sweden (49.4 %), Finland (39.4 %), Norway (32.8%), Poland (30.4 %), the Netherlands (31.6 %), and Iceland (30.1 %).

For the countries that do report state government data, the importance of this subsector tends to be relatively high. In 2015, the share in total expenditure ranged between 15.9 % in Austria and 32.7 % (2015, latest year available) in Spain.

Conversely, the smallest shares for central government expenditure can also be found among these federally structured countries. Central government expenditure accounted for 15.0 % of general government expenditure in Switzerland, 17.3 % in Germany , 20.6 % in Belgium, 22.8 % in Spain and 38.5 % in Austria.

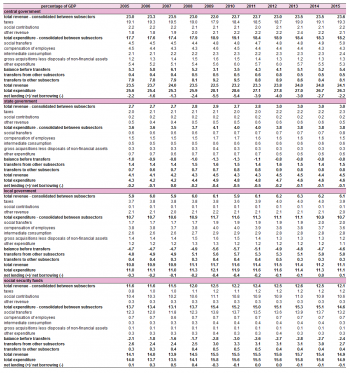

Social transfers form the largest category of government expenditure

Table 2 shows the importance of social transfers (social benefits in cash or in kind) in general government expenditure and the predominant role of social security funds in ensuring this distributive role of government. Indeed, the majority of social security funds expenditure is classified into this transaction, with the only other notable expenditure in this subsector being 'intermediate consumption' (P.2) and compensation of employees (D.1PAY) – both of which could be characterised as 'operating costs'. Nevertheless, another large share of social transfers is distributed by central government. It needs to be taken into account that since Malta, the United Kingdom, Norway and Ireland do not separately show the subsector social security funds, social transfers are mainly paid by central government in these countries. In the case of the United Kingdom, this influences the EU aggregate.

The largest share of 'intermediate consumption' and 'compensation of employees' is incurred by central and local government, although these are also two important transactions for state government. A large part of 'compensation of employees', when classified by function (COFOG), is attributed to the divisions 'education', 'defence' and 'public order and safety'.

For general government as a whole in the EU-28, capital transfers (D.9PAY) to sectors other than general government decreased from 2014 to 2015; remaining just below pre-crisis levels.

From Table 3 it can also be seen that transfers within general government mainly come from central government and add a sizeable amount to central governments' total expenditure, if measured on a non-consolidated basis.

The evolution of social transfers is linked to the crisis

As a share of GDP, total expenditure by subsectors decreased from 2014 to 2015, leaving EU-28 general government total expenditure at 56.9 % of GDP (2014: 58.1 % of GDP). The shift is strongest in central government (from 26,7 % of GDP in 2014 to 26.3 % in 2015). EU-28 state government total expenditure as % of GDP remained the same while in EU-28 local government total expenditure decreased by about 0.2 pp. of GDP from 2014 to 2015, while social security funds' total expenditure decreased sharply by about 0.7 pp. of GDP.

The striking increase in social security funds expenditure and the more moderate increase in spending in the other government subsectors from 2008 to 2009 were largely due to an absolute increase in social transfers in the context of the crisis – these are known to act as automatic stabilisers in a recession.

Data sources and availability

This section gives some background information on the data sources used in the preparation of this publication as well as on the methodological concepts and technical terms and codes used.

Reporting of data to Eurostat

Annual government finance statistics (GFS) data are collected by Eurostat on the basis of the European System of Accounts (ESA2010) transmission programme spilt in three tables:

Table 2 'Main aggregates of general government' Table 9 'Detailed taxes and social contributions' Table 11 'General government expenditure by function'.

In this publication, data transmitted in ESA table 2 is used.

As all GFS data are compiled within the ESA2010 framework, they follow the methodological guidelines set out in ESA2010 and the common rules adopted for national accounts. The legal requirement for transmission of table 0200 data is at t+3 and at t+9 months after the end of the reference period. In this publication data corresponds to the end-September/ October 2016 transmissions of table 2 have been used. A number of countries have since updated this table on a voluntary basis - such updates are taken into account in this article.

Time of recording

In the ESA2010 system, recording is on an accrual basis, meaning that the flow will be recorded at the moment when the economic value is created,transformed or extinguished, or when claims and obligations arise, are transformed or are cancelled.'

Consolidation

General government data reported in ESA tables 2and 11 must be consolidated, meaning that specific transactions between institutional units within the general government sector precisely: D.4 property income D.7 other current transfers D.9 capitial transfers are eliminated. Subsector data should be consolidated within each subsector but not between subsectors. Thus data at sector level should equal the sum of subsector data, except for items D.4, D.7 and D.9 as they are consolidated. For these latter items and consequently total revenue and total expenditure, the sum of subsecotrs should be equal or exceed the expenditure the value of the sectors. For the purpose of calculating the share of each subsector in general government total expenditure in this publication but not for data published on Eurobase, flows in transactions D.4, D.7 and D.9 to other subsectors of general government (flows within the sector S.13) are not considered in the expenditure of each subsector. Thus any expenditure shown in these transactions refer to transfers not within the general government sector of the economy. The advantage of this approach is that total expenditure of general government is equal to total expenditure of the sum of subsectors of general government. Similarly, for total revenue, only D.4, D.7 and D.9 revenue from other sectors of the economy (thus excluding other subsectors of general government) are considered.

Any other intra-government flows are not consolidated in accordance with ESA2010. They refer to the distributive transactions D.29PAY, D.5 , and D.39REC. In addition, in the GFS framework established under ESA2010, the production account is not consolidated. The level of intra-government sales/ intermediate consumption is known to vary substantially between countries.

Definition of general government and its subsectors

The data relate to the general government sector of the economy, as defined in ESA2010, paragraph 2.68: 'All institutional units which are other non-market producers (institutional units whose sales do not cover more than the 50 % of the production costs, see ESA2010 paragraph 3.26) whose output is intended for individual and collective consumption, and mainly financed by compulsory payments made by units belonging to other sectors, and/or all institutional units principally engaged in the redistribution of national income and wealth. General government comprises the subsectors central government (S.1311), state government (S.1312 - where applicable), local government (S.1313), and social security funds (S.1314). State government data is reported for BE, DE, ES, AT and CH -please see country codes). Data for social security funds is not reported for IE, MT, UK and NO, for the latter two S.1314 data is included in S.1311.

Definition of general government expenditure

Government expenditure is defined in Commission Regulation 1500/2000 and uses as reference a list of ESA2010 categories: Government expenditure comprises the following categories:

- P.2, 'intermediate consumption': the purchase of goods and services by government;

- P.5, 'gross capital formation' consisting of:

- gross fixed capital formation (P.51g);

- consumption of fixed capital(P.51c);

- changes in inventories (P.52);

- acquisitions less disposals of valuables (P.53);

- where P.51g, 'gross fixed capital formation': consists of acquisitions, less disposals, of fixed assets during a given period plus certain additions to the value of non-produced assets realised by the productive activity of producer or institutional units (fixed assets are tangible or intangible assets produced as outputs from processes of production that are themselves used repeatedly, or continuously, in processes of production for more than one year);

- D.1, 'compensation of employees': the wages of government employees plus non-wage costs such as social contributions;

- D.29, 'other taxes on production, payable',

- D.3, 'subsidies, payable',

- D.4, 'property income, payable', consisting of :

- 'interest, payable (D.41) and

- 'other property income, payable (D.42+D.43+D.44+D.45),

- D.5, 'current taxes on income, wealth, etc, payable';

- D.62, social payments: cover social benefits and pensions paid in cash;

- D.632, 'Social transfers in kind - purchased market production';

- D.7, 'other current transfers, payable';

- D.8, 'adjustment for the change in net equity of households in pension fund reserves' ;

- D.9, 'capital transfers payable' ;

- NP, 'acquisitions less disposals of non-financial non-produced assets'

- public investment spending

- Non-financial non-produced assets consist of land and other tangible non-produced assets that may be used in the production of goods and services, and intangible non-produced assets.

Gross domestic product

Throughout this article nominal GDP, i.e. GDP at current prices, is used.

Abbreviations

- pp: percentage points

More data and information

More data can be found in Eurostat's online database under the theme economy and finance. Users might also like to refer to the integrated GFS data publications, which present GFS data in a user-friendly fashion are published shortly after transmissions of annual and quarterly data. For country-specific notes, including on missing data, please refer to the metadata published on Eurobase. In case of questions the authors can be contacted at ESTAT-GFS@ec.europa.eu. The GFS tables are also compiled as an Excel publication by subsector of general government, please see Annual GFS tables - Excel publications.

Context

In the European Union (EU-28) as well as Iceland, Norway and Switzerland, the compilation of government revenue and expenditure data is established by reference to the European System of Accounts (ESA2010). This article focuses on the relative importance of the subsectors of general government, i.e. central government, state government, local government and social security funds, in total expenditure of general government. Total expenditure is examined at subsector level both at aggregate level as well as looking at the predominant nature of transactions in each subsector and the development of the weight of the subsectors over time.

See also

- Government finance statistics

- Government finance statistics - quarterly data

- Integrated government finance statistics presentation

- Government expenditure by function – COFOG

- Structure of government debt

- Tax revenue statistics

Further Eurostat information

Publications

- Excel publications

- Publications

- Government finance statistics — Summary tables, Data 1995-2015 — 2016/2 edition

Main tables

- Annual government finance statistics (t_gov_10a)

- Government deficit and debt (t_gov_10dd)

- Quarterly government finance indicators (t_gov_10q)

Database

- Annual government finance statistics (gov_10a)

- Government deficit and debt (gov_10dd)

- Quarterly government finance statistics (gov_10q)

Dedicated section

Methodology / Metadata

- General government expenditure by function (COFOG) (ESMS metadata file — gov_10a_exp_esms)

- Government deficit and debt (ESMS metadata file — gov_10dd_esms)

- Government revenue, expenditure and main aggregates (ESMS metadata file — gov_10a_main_esms)

- Quarterly financial accounts for general government (ESMS metadata file — gov_10q_ggfa_esms)

- Quarterly government debt (ESMS metadata file — gov_10q_ggdebt_esms)

- Quarterly non-financial accounts for general government (ESMS metadata file — gov_10q_ggnfa_esms)

- Structure of government debt (ESMS metadata file — gov_10dd_sgd_esms)