Archive:Income poverty statistics

- Data from March 2013, most recent data: Further Eurostat information, Main tables and Database.

(%) - Source: Eurostat (ilc_li04)

(%) - Source: Eurostat (ilc_li02) and (ilc_li10)

(income quintile share ratio) - Source: Eurostat (ilc_di11)

(ratio of the median equivalised disposable income of people aged above 65 to the median equivalised disposable income of those aged below 65) - Source: Eurostat (ilc_pnp2)

This article analyses recent statistics on monetary poverty and income inequalities in the European Union (EU). Comparisons of standards of living between countries are frequently based on gross domestic product (GDP) per capita – which presents in monetary terms how rich one country is compared with another. However, this headline indicator says very little about the distribution of income within a country and also fails to provide information in relation to non-monetary factors that may play a significant role in determining the quality of life of a particular population. On the one hand, inequalities in income distribution may create incentives for people to improve their situation through work, innovation or acquiring new skills. On the other hand, such income inequalities are often viewed as being linked to crime, poverty and social exclusion.

Main statistical findings

At-risk-of-poverty rate and threshold

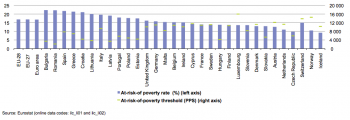

In 2011, 16.9 % of the EU-27 population was assessed to be at-risk-of-poverty after social transfers (see Figure 1). This share, calculated as a weighted average of national results, conceals considerable variations across the EU Member States. In five countries, namely Bulgaria (22.3 %), Romania (22.2 %), Spain (21.8 %), Greece (21.4 %) and Lithuania (20.0 %), one fifth or more of the population was viewed as being at-risk-of-poverty. The lowest proportions of persons at-risk-of-poverty were observed in the Netherlands (11.0 %) and the Czech Republic (9.8 %). Norway (10.5 %) and Iceland (9.2 %) also reported relatively low shares of their respective populations as being at-risk-of-poverty.

The at-risk-of-poverty threshold (also shown in Figure 1) is set at 60 % of the national median equivalised disposable income. It is often expressed in purchasing power standards (PPS) in order to take account of the differences in the cost of living across countries. This threshold varied considerably in 2011 among the EU Member States from PPS 2 134 in Romania, PPS 3 400 in Latvia and PPS 3 420 in Bulgaria to a level between PPS 11 000 and PPS 12 150 in Sweden, Denmark, the Netherlands, Cyprus and Austria, before peaking in Luxembourg at PPS 16 001; the poverty threshold was also relatively high in Norway and Switzerland (exceeding PPS 13 000 in both of these countries).

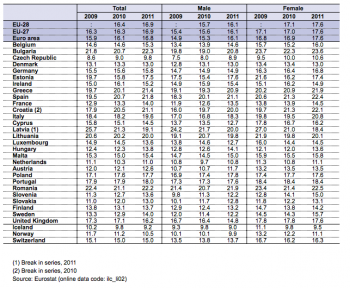

In general, the at-risk-of-poverty rate (after social transfers) has overall increased from one year to the next (see Table 1), with larger differences occurring between 2010 and 2011, compared to the differences occurring between 2009 and 2010 . The at-risk-of-poverty rate increased by at least 1.5 percentage points in Estonia, Bulgaria and Hungary between 2010 and 2011. On the other hand, the largest reduction has occurred in Latvia (by 2.2. percentage points), although this could be due to the reported break in series in 2011. Besides Latvia, also the United Kingdom, Luxembourg, Cyprus, Denmark and Lithuania reported a decrease in the at-risk-of-poverty rates between 2010 and 2011. Decreases have also been reported by Norway and Iceland. All the other countries have reported increases, ranging from 0.1 percentage points in Poland and Portugal to 1.7 percentage points in Estonia.

Different groups in society are more or less vulnerable to monetary poverty. There was a relatively small difference in the at-risk-of-poverty rate (after social transfers) between men and women in the EU-27 in 2011 (16.1 % compared with 17.6 %). The largest difference of 3.5 percentage points (12.6 % for men and 16.3 % for women) was observed in Cyprus (12.7 % for men and 16.2 % for women) and Sweden (12.2 % for men and 15.7 % for women). Furthermore, Bulgaria, the United Kingdom and Slovenia all reported that female at-risk-of-poverty rates were 2.8 percentage points higher than the corresponding rates for men in 2011. The same applies to Switzerland, with a difference of 2.6 percentage points between men and women. By contrast, there were four EU Member States where the at-risk-of-poverty rate was slightly higher among men than women, namely Latvia, Hungary, Estonia and Poland.

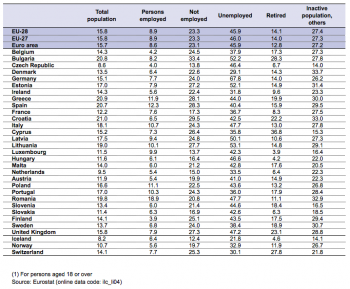

The differences in poverty rates were more notable when the population was classified according to activity status (see Table 2). The unemployed are a particularly vulnerable group: almost half (46.2 %) of unemployed persons in the EU-27 were at-risk-of-poverty in 2011, with by far the highest rates in Germany (67.8 %) and Lithuania (53.1 %), while three other Member States (Bulgaria, Estonia and Latvia) reported that slightly more than half of the unemployed were at-risk-of-poverty in 2011. One in seven of all retired persons in the EU-27 (14.1 %) were at-risk-of-poverty in 2011; rates were much higher in Cyprus (36.8 %), Bulgaria (28.3 %) and the United Kingdom (23.1 %). Those in employment were far less likely to be at-risk-of-poverty (an average of 8.9 % across the whole of the EU-27), although there were relatively high proportions of employed persons at-risk-of-poverty in Romania (18.9 %), Spain (12.3 %) and Greece (11.9 %), while Poland, Italy, Portugal and Lithuania each reported that in excess of one in ten of their respective workforces was at-risk-of-poverty in 2011.

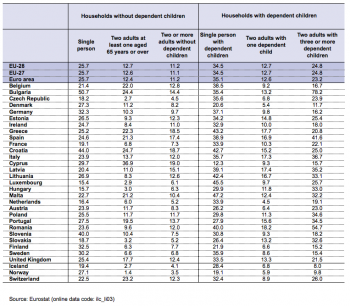

The at-risk-of-poverty rates are not uniformly distributed between the different household types. Table 3 shows how the at-risk-of-poverty rates vary between different household types. Overall at the EU-27 level, single person households with dependent children are the most vulnerable group to the risk of poverty (34.5 %) followed by single person households (25.7 %) and households with two adults and three or more dependent children (24.9 %). On the other hand, persons living in households with two or more adults without dependent children were overall the least affected (11.1 %), followed by those living in households with two adults with at least one aged over 65 and households with two adults and one dependent child (12.6 % and 12.7 %). Overall, the more the dependent children living in a household with two adults, the higher the risk of poverty. This is more or less the picture in most EU countries, although with some exceptions. In Bulgaria, Spain, Italy, Hungary, Poland, Portugal, Romania and Slovakia, the mostly affected are those living in households with two adults with three or more dependent children. Exceptionally, in Cyprus the mostly affected among those categories shown in the table are those living in households with elderly people (36.9 %). Moreover, in Bulgaria, Denmark, Cyprus, Slovenia and Finland, the percentage of the population that was found to be at risk of poverty in single person households was higher than the percentage of those found in single person households with dependent children. The same holds for Norway and Croatia.

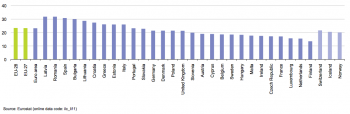

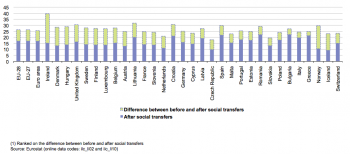

Social protection measures can be used as a means for reducing poverty and social exclusion. This may be achieved, for example, through the distribution of benefits. One way of evaluating the success of social protection measures is to compare at-risk-of-poverty indicators before and after social transfers (see Figure 2). In 2011, social transfers reduced the at-risk-of-poverty rate among the population of the EU-27 from 26.1 % before transfers to 16.9 % after transfers, thereby lifting 35.2 % of persons that would otherwise be at-risk-of-poverty above the poverty threshold. In relative terms, the impact of social benefits was lowest in Greece, Italy and Bulgaria. By contrast, more than half of all persons who were at-risk-of poverty in Denmark and Hungary moved above the threshold as a result of social transfers; this was also the case in Norway and Iceland.

Income inequalities

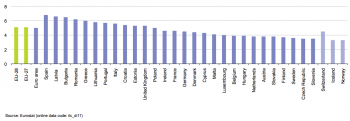

Governments, policymakers and society in general cannot combat poverty and social exclusion without analysing the inequalities within society, whether they are economic in nature or social. Data on economic inequality become particularly important for estimating relative poverty, because the distribution of economic resources may have a direct bearing on the extent and depth of poverty (see Figure 3). There were wide inequalities in the distribution of income among the population of the EU-27 in 2011: the 20 % of the population with the highest equivalised disposable income received 5.1 times as much income as the 20 % of the population with the lowest equivalised disposable income. This ratio varied considerably across the Member States, from 3.5 in Slovenia and the Czech Republic, to at least 6 in Greece, Romania, Bulgaria and Latvia, peaking at 6.8 in Spain.

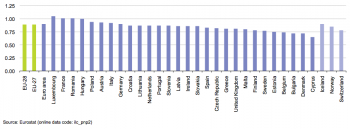

There is policy interest in the inequalities felt by many different groups in society. One group of particular interest is that of the elderly, in part reflecting the growing proportion of the EU’s population that is aged over 65 years. Pension systems can play an important role in addressing poverty among the elderly. In this respect, it is interesting to compare the incomes of the elderly with the rest of the population. Across the EU-27 as a whole, people aged 65 and above had a median income which in 2011 was equal to 89 % of the median income for the population under the age of 65 (see Figure 4). In four countries only (Luxembourg, France, Romania and Hungary) the income of the elderly was at least equal or higher than the income of persons under 65. In Poland, Austria, Italy and Germany the median income of the elderly was at least 90 % of that recorded for people under 65; this was also the case in Iceland. By contrast, the elderly in Cyprus had median incomes that were equal to 65 % of those recorded for people under 65. The ratios between 70 % and 80 % were recorded in Denmark, Bulgaria, Belgium, Estonia, Sweden and Finland; these relatively low ratios may broadly reflect pension entitlements.

The depth of poverty, which helps to quantify just how poor the poor are, can be measured by the relative median at-risk-of-poverty gap. The median income of persons at-risk-of-poverty in the EU-27 was, on average, 23.3 % below the 60 % poverty threshold in 2011. Among the countries shown in Figure 5, the relative median at-risk-of-poverty gap was widest in Latvia and Romania (both 31.8 %), Spain (both 30.8 %), Bulgaria (30.0 %) and Lithuania (28.7 %). The lowest gap among the EU Member States was observed in Finland (13.5 %), followed by the Netherlands (15.5 %) and Luxembourg (15.7 %).

Data sources and availability

EU statistics on income and living conditions (EU-SILC) were launched in 2003 on the basis of a gentlemen’s agreement between Eurostat, six EU Member States (Austria, Belgium, Denmark, Greece, Ireland, Luxembourg) and Norway. EU-SILC was implemented in order to provide underlying data for indicators relating to income and living conditions – the legislative basis for the data collection exercise is Regulation 1177/2003 of the European Parliament and of the Council. The collection of these statistics was formally launched in 2004 in 15 countries and expanded in 2005 to cover all of the remaining EU-25 Member States, together with Iceland and Norway. Bulgaria and Turkey launched EU-SILC in 2006, Romania in 2007, Switzerland in 2008, while Croatia introduced the survey in 2010 (2009 data for Croatia are based on a different data source – namely the household budget survey (HBS)). EU-SILC comprises both a cross-sectional dimension and a longitudinal dimension.

Household disposable income is established by summing up all monetary incomes received from any source by each member of the household (including income from work, investment and social benefits) – plus income received at the household level – and deducting taxes and social contributions paid. In order to reflect differences in household size and composition, this total is divided by the number of ‘equivalent adults’ using a standard (equivalence) scale, the so-called ‘modified OECD’ scale, which attributes a weight of 1 to the first adult in the household, a weight of 0.5 to each subsequent member of the household aged 14 and over, and a weight of 0.3 to household members aged less than 14. The resulting figure is called equivalised disposable income and is attributed to each member of the household. For the purpose of poverty indicators, the equivalised disposable income is calculated from the total disposable income of each household divided by the equivalised household size; consequently, each person in the household is considered to have the same equivalised income.

The income reference period is a fixed 12-month period (such as the previous calendar or tax year) for all countries except the United Kingdom for which the income reference period is the current year of the survey and Ireland for which the survey is continuous and income is collected for the 12 months prior to the survey.

The at-risk-of-poverty rate is defined as the share of people with an equivalised disposable income that is below the at-risk-of-poverty threshold (expressed in purchasing power standards – PPS), set at 60 % of the national median equivalised disposable income. In line with decisions of the European Council, the at-risk-of-poverty rate is measured relative to the situation in each EU Member State rather than applying a common threshold. The at-risk-of-poverty rate may be expressed before or after social transfers, with the difference measuring the hypothetical impact of national social transfers in reducing the risk of poverty. Retirement and survivors’ pensions are counted as income before transfers and not as social transfers. Various analyses of this indicator are available, for example by age, sex, activity status, household type, or education level. It should be noted that the indicator does not measure wealth but is instead a relative measure of low current income (in comparison with other people in the same country), which does not necessarily imply a low standard of living. The EU-27 aggregate is a population-weighted average of individual national figures.

Context

At the Laeken European Council in December 2001, European heads of state and government endorsed a first set of common statistical indicators for social exclusion and poverty that are subject to a continuing process of refinement by the indicators sub-group (ISG) of the social protection committee (SPC). These indicators are an essential element in the open method of coordination to monitor the progress made by the EU’s Member States in alleviating poverty and social exclusion.

EU-SILC is the reference source for EU statistics on income and living conditions and, in particular, for indicators concerning social inclusion. In the context of the Europe 2020 strategy, the European Council adopted in June 2010 a headline target for social inclusion – namely, that by 2020 there should be at least 20 million fewer people in the EU who are at-risk-of-poverty or social exclusion. EU-SILC is the source used to monitor progress towards this headline target, which is measured through an indicator that combines the at-risk-of-poverty rate, the severe material deprivation rate, and the proportion of people living in households with very low work intensity – see the article on social inclusion for more information.

Further Eurostat information

Publications

- Living standards falling in most Member States Statistics in focus 8/2013

- Children were the age group at the highest risk of poverty or social exclusion in 2011 Statistics in focus 4/2013

- In 2009 a 6.5 % rise in per capita social protection expenditure matched a 6.1 % drop in EU-27 GDP Statistics in focus 14/2012

- 23 % of EU citizens were at risk of poverty or social exclusion in 2010 Statistics in focus 9/2012

- 51 million young EU adults lived with their parent(s) in 2008 Statistics in focus 50/2010

- Combating poverty and social exclusion. A statistical portrait of the European Union 2010

- Income and living conditions in Europe (2010)

- Over-indebtedness of European households in 2008 Statistics in focus 61/2010

- The life of women and men in Europe – A statistical portrait (available in English, French and German)

- The Social Situation in the European Union 2009

- Living conditions in Europe (2002 – 2005) – statistical pocketbook

Main tables

- Living conditions and welfare (t_livcon), see:

Database

- Living conditions and welfare (livcon), see:

- Income and living conditions (ilc)

- Income distribution and monetary poverty (ilc_ip)

- Monetary poverty (ilc_li)

- Monetary poverty for elderly people (ilc_pn)

- Distribution of income (ilc_di)

- Income distribution and monetary poverty (ilc_ip)

Dedicated section

Methodology / Metadata

- Income and living conditions (ESMS metadata file - ilc_esms)

- Comparative EU Statistics on Income and Living Conditions: Issues and Challenges (Proceedings of the International Conference on EU Comparative Statistics on Income and Living Conditions, Helsinki, 6-8 November 2006 )

Source data for tables and figures (MS Excel)

Other information

- Regulation 1177/2003 of 16 June 2003 concerning Community statistics on income and living conditions (EU-SILC)

- Regulation 1553/2005 of 7 September 2005 amending Regulation 1177/2003 concerning Community statistics on income and living conditions (EU-SILC)

- Regulation 1791/2006 of 20 November 2006 adapting certain Regulations and Decisions in the fields of ... statistics, ..., by reason of the accession of Bulgaria and Romania

External links

- EU Employment and Social Situation Quarterly Review - March 2013

- Employment and Social Developments in Europe (2012)

- OECD - Better Life Initiative: Measuring Well-being and Progress