Archive:Social protection statistics

- Data extracted in June 2017. Most recent data: Further Eurostat information, Main tables and Database. Planned article update: May 2018.

(% of GDP)

Source: Eurostat (spr_net_ben)

(% of total expenditure)

Source: Eurostat (spr_exp_sum)

(EUR)

Source: Eurostat (spr_pns_ben) and (spr_exp_pens)

Source: Eurostat (spr_pns_ben) and (spr_exp_pens)

(% of total receipts)

Source: Eurostat (spr_rec_sumt)

This article analyses recent statistics on social protection in the European Union (EU). Social protection encompasses interventions from public or private bodies intended to relieve households and individuals of the burden of a defined set of risks or needs, provided that there is neither a simultaneous reciprocal nor an individual arrangement involved.

Main statistical findings

Recent developments in social protection expenditure

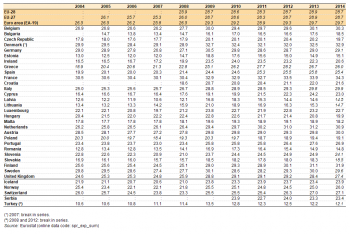

As the impact of the global financial and economic crisis was felt across the EU-28, expenditure on social protection relative to gross domestic product (GDP) increased by 2.8 percentage points between 2008 and 2009 (see Table 1). This increase reflected a 4.3 % increase in overall social protection expenditure (in current prices), combined with a fall in GDP (-5.7 %). In 2010 and 2011, the value of social protection expenditure increased by 3.8 % and 1.9 % respectively; current price GDP grew at a faster pace, resulting in the ratio of social protection expenditure to GDP falling by 0.1 and 0.3 percentage points in 2010 and 2011. In 2012, there was a change in developments, as social protection expenditure increased by 3.3 % compared with GDP growth of 1.9 %, resulting in a 0.4 percentage point increase in the ratio of social protection expenditure to GDP, such that it stood at 28.7 % in the EU-28; this was followed by a further expansion (0.2 percentage points) in the share of social protection expenditure relative to GDP in 2013 to 28.9 %.

The latest information available relates to 2014, when there was an overall increase of 2.6 % in the level of EU-28 social protection expenditure. However, this was counteracted by a somewhat faster pace of economic growth and therefore resulted in the share of social protection expenditure relative to GDP falling by 0.2 percentage points to 28.7 %. The ratio of social protection expenditure to GDP was 2.8 percentage points higher in 2014 than it had been in 2008, while social protection expenditure in the EU-28 grew overall by 18.5 % during the period under consideration (equivalent to an average of 2.9 % per annum).

Among the EU Member States, the level of social protection expenditure in relation to GDP in 2014 was highest in France (34.3 %) and Denmark (32.9 %), while Finland, the Netherlands, Belgium and Austria also reported ratios of at least 30.0 %. By contrast, social protection expenditure represented less than 20.0 % of GDP in Hungary, the Czech Republic, Poland, Bulgaria, Slovakia, Malta, Estonia, Romania, Lithuania and Latvia (where the lowest share was registered, at 14.5 %); Turkey recorded an even lower ratio, at 12.1 %.

In Finland, expenditure on social protection relative to GDP in 2014 remained 6.8 percentage points higher than it had been in 2008, which was the largest increase among any of the EU Members States during this period, ahead of a 5.4 point increase in Cyprus. The Netherlands, Denmark and Spain all recorded increases in the range of 4.0-5.0 percentage points during the period 2008-2014; this situation was repeated in Norway. By contrast, in Poland, Lithuania and Hungary the ratio of social protection expenditure to GDP was lower in 2014 than it had been in 2008.

Adjustment for price level differences

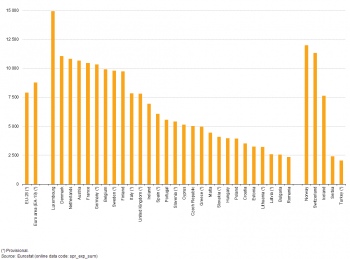

The use of a purchasing power standard (PPS) facilitates a comparison of the level of social protection expenditure per inhabitant between countries, taking account of differences in price levels (see Figure 1). The highest level of expenditure on social protection per inhabitant in 2014 was registered for Luxembourg [1] (14.9 thousand PPS per inhabitant), followed some way behind by Denmark, the Netherlands, Austria, France, Germany, Belgium, Sweden and Finland where social protection was more than 9.0 thousand PPS per inhabitant. By contrast, expenditure in Latvia, Bulgaria and Romania was 2.6 thousand PPS per inhabitant or less. These disparities between EU Member States are partly related to different levels of wealth, but may also reflect differences in social protection systems, demographic trends, unemployment rates and other social, institutional and economic factors.

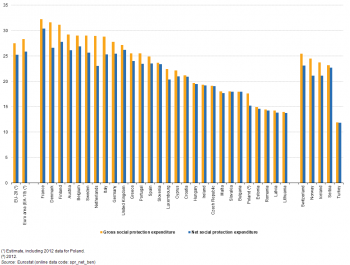

Comparison of gross and net benefits

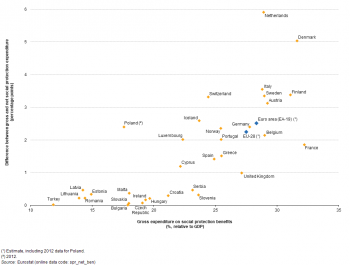

Differences in the ways in which tax and benefit systems interact have important implications for the comparability of social protection expenditure among the EU Member States. The difference between gross and net expenditure on social protection benefits in 2014 was estimated to be equivalent to 2.2 % of GDP in the EU-28, but there was a significant variation between Member States. The largest differences — as a percentage of GDP — tended to be concentrated in those Member States which generally had higher ratios of gross expenditure to GDP (see Figure 2). As such, a comparison of the ratio of net expenditure to GDP shows less disparity among Member States than an analysis based on gross expenditure.

When expenditure on social protection benefits is expressed in relation to GDP, the difference between the highest and lowest spending EU Member States was 18.3 percentage points for gross expenditure (France 32.2 % and Lithuania 14.0 %) compared with 16.6 percentage points for net expenditure (France 30.4 % and Lithuania 13.8 %); see Figure 3. The ranking order of Member States also varied significantly, depending on whether gross or net expenditure was being considered. For example, the Netherlands had the seventh highest level of gross expenditure (relative to GDP) among the Members States but moved to 14th place when the Member States were ranked on net expenditure.

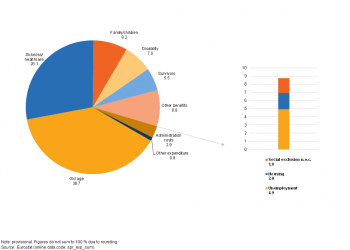

Analysis of benefits

Social protection benefits made up 96.3 % of the EU-28’s social protection expenditure in 2014; the remaining share covered administration costs and other expenditure (see Figure 4). Old age and sickness/healthcare benefits together accounted for 66.9 % of total social protection expenditure while benefits related to family/children, disability, survivors and unemployment ranged between 4.9 % and 8.2 % each; housing and social exclusion benefits not elsewhere classified accounted for the remaining 2.0 % and 1.8 % respectively.

Expenditure on pensions

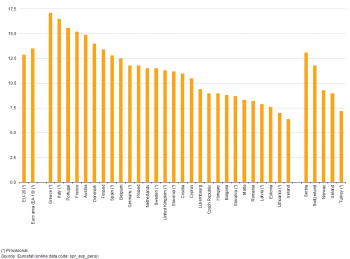

Expenditure on pensions across the EU-28 was equivalent to 12.9 % of GDP in 2014. Among the EU Member States the share of expenditure on pensions was particularly high in several of the southern EU Member States, including Portugal (15.6 %) and Italy (16.5 %), while the highest value was registered in Greece (17.1 %). At the other end of the range, ratios of 7.0 %-8.0 % were recorded in the three Baltic Member States of Lithuania, Estonia and Latvia, while the ratio was even lower in Ireland (6.4 %) — see Figure 5.

Pension expenditure per beneficiary (of at least one pension) varies between the different types of pensions (see Figure 6). The aggregate expenditure per beneficiary on pensions relating to old age was estimated to be EUR 13.7 thousand in the EU-28 in 2014. A higher average expenditure was recorded for anticipated old age pensions at EUR 14.0 thousand per beneficiary. This may appear counter-intuitive, given that benefits for early retirees are typically reduced to compensate for the extension of the period over which the pension is to be paid. Anticipated pensions are, however, more likely to be contribution-based pensions, which tend to offer higher levels of benefits than non-contributory pensions. Furthermore, it is possible that some individuals, who have made a higher total amount of contributions over their working lives and are thus entitled to relatively higher pensions, may be more likely to make a claim prior to reaching retirement age because they meet minimum contribution requirements (where applicable), and are therefore more likely to be willing to accept reduced benefits. By contrast, benefits for early retirement linked to a reduced capacity to work averaged EUR 11.0 thousand per beneficiary, somewhat lower than the average for old age pensions. Expenditure on partial pensions, meanwhile, averaged just EUR 3.1 thousand per beneficiary, lower than any other type of pension. This is to be expected, given that recipients of these types of pensions are still receiving some income from employment.

It is important to note that these figures on pension expenditure per beneficiary do not necessarily reflect the level or adequacy of individual old age pensions. The figures are based on aggregates of expenditure and the number of beneficiaries of a wide range of types of pensions available within each EU Member State, granted under different circumstances and serving various distinct purposes. Invariably, different pension schemes provide different levels of benefits. The typical combinations of pensions in each Member State will have a significant influence on the figures recorded at an aggregate level. Furthermore, the figures are based on gross expenditure and do not take into account the effect of taxes and social contributions (where relevant), which varies both between and within Member States. For example, while all pensions may be tax free in one Member State, taxes may be applied to particular types of pensions in another.

Pension expenditure per beneficiary (of at least one pension) for old age pensions (the most common type of pension) varied considerably between the EU Member States, ranging, in 2014, from EUR 1.7 thousand per year in Bulgaria to EUR 24.9 thousand in Luxembourg (see Figure 7). Comparing the data in terms of purchasing power standards (PPS) reduces somewhat the variance across EU Member States, although the average pension expenditure per beneficiary in Luxembourg was still 4.6 times as high as in Bulgaria.

Average (median) pension levels for 65 to 74 year-olds across the EU-28 were lower than average earnings for those aged 50 to 59 in 2015 (see Figure 8). The difference between these two averages was particularly broad in Ireland, where pensions represented 38 % of the average earnings among those aged 50 to 59, the lowest share recorded among the EU Member States. By contrast, this ratio — known as the aggregate replacement ratio — was particularly high in Luxembourg (80 %) and was also relatively high in France (69 %). Low aggregate replacement ratios may reflect low coverage and/or low income replacement from pension schemes within current pension systems, as well as incomplete careers or an under-declaration of earnings.

Expenditure on care for the elderly

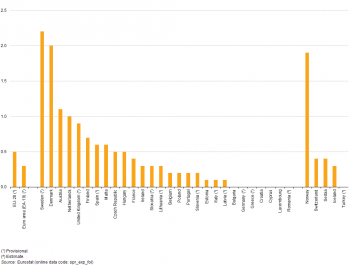

Social protection expenditure on care for the elderly covers care allowance, accommodation, and assistance in carrying out daily tasks. Across the EU-28, this expenditure accounted for 0.5 % of GDP in 2014. In Sweden and Denmark, the ratio for this type of expenditure to GDP was 2.2 % and 2.0 %, between four and five times as high as the EU-28 average. Social protection expenditure on care for the elderly was less than 0.1 % of GDP in Bulgaria, Germany, Greece, Croatia, Cyprus, Luxembourg and Romania (see Figure 9).

Social protection receipts

An analysis of social protection receipts across the EU-28 in 2014 shows that the majority of receipts could be attributed to general government contributions (40.5 %) and employers’ social contributions (34.7 %), while around one fifth (19.3 %) of social protection receipts in the EU-28 were social contributions paid by protected persons (see Figure 10).

Social protection receipts in the EU-28 grew from EUR 7.3 thousand per inhabitant to EUR 8.3 thousand per inhabitant between 2008 and 2014, as overall receipts rose by a total of 15.6 %. The biggest change in the structure of receipts over this period was in relation to general government contributions, whose share in total receipts grew from 38.3 % in 2008 to 40.5 % by 2014. By contrast, there was a reduction in the relative share of employers’ social contributions, from 36.5 % to 34.7 % during the same period.

The structure of receipts used to finance social protection varies: three groups of EU Member States can be identified (see Figure 11). A first group covers Member States in which government contributions were the largest component of receipts in 2014: Denmark, Ireland, Malta, Sweden, Cyprus, Romania, the United Kingdom and Portugal. In the first five of these, government contributions accounted for more than half of all receipts and they accounted for more than three fifths of total receipts in Ireland (60.5 %) and nearly four fifths in Denmark (79.8 %).

In the remaining EU Member States, social contributions — from employers and from the protected persons — represented the largest component of receipts. These can be divided between those where actual or imputed employers’ social contributions accounted for more than two thirds of all social contributions: the Czech Republic, Belgium, Poland, Slovakia, France, Italy, Latvia, Finland, Lithuania, Spain and Estonia (where the employers’ share peaked at 98.7 % of all social contributions). In the final group of Member States, employers’ social contributions accounted for less than two thirds of all social contributions: Bulgaria, Hungary, Greece, Austria, Germany, Luxembourg, the Netherlands, Croatia and Slovenia (in the last three, the employers’ share was less than half of all social contributions).

Note that in most of the EU Member States other receipts tended to be relatively insignificant: they only contributed more than 10 % of total social protection receipts in Luxembourg, the Netherlands, the United Kingdom and Poland.

Among non-member countries shown in Figure 11, government contributions were the largest component of receipts in Norway and Iceland. Social contributions accounted for more than half of total receipts in Switzerland, Serbia and Turkey, with employers’ social contributions accounting for less than two thirds of social contributions in all three cases.

Data sources and availability

Data on social protection expenditure and receipts are drawn up according to the European system of integrated social protection statistics (ESSPROS) methodology; this system has been designed to allow a comparison of social protection flows between EU Member States.

In April 2007, a legal basis was established for the provision of ESSPROS with the delivery of data to start from reference year 2006, as provided by the European Parliament and Regulation (EC) No 458/2007; this was later supplemented by four European Commission implementing Regulations: Regulation (EC) No 1322/2007, Regulation (EC) No 10/2008, Regulation (EU) No 110/2011 and Regulation (EU) No 263/2011.

In 2016, Eurostat released an updated version of the ESSPOS manual and user guidelines, which provides guidelines for compiling and using ESSPROS data correctly.

Social protection expenditure

Expenditure on social protection includes: social benefits, administration costs (which represent the costs charged to the scheme for its management and administration) and other expenditure (which consists of miscellaneous expenditure by social protection schemes, principally payment of property income).

Social protection benefits are direct transfers, in cash or in kind, by social protection schemes to households and individuals; the purpose of these transfers is to relieve recipients of the burden of one or more of the defined risks or needs. Social benefits are paid to households by social security funds, other government units, non-profit institutions serving households (NPISHs), employers administering unfunded social insurance schemes, insurance enterprises, or other institutional units administering privately funded social insurance schemes. Social benefits are recorded without deduction of taxes or other compulsory levies payable by recipients.

Social protection benefits are classified according to eight social protection functions (which represent a set of risks or needs):

- sickness/healthcare benefits — including paid sick leave, medical care and the provision of pharmaceutical products;

- disability benefits — including disability pensions and the provision of goods and services (other than medical care) to the disabled;

- old age benefits — including old age pensions and the provision of goods and services (other than medical care) to the elderly;

- survivors’ benefits — including income maintenance and support in connection with the death of a family member, such as a survivors’ pensions;

- family/children benefits — including support (except healthcare) in connection with the costs of pregnancy, childbirth, childbearing and caring for other family members;

- unemployment benefits — including full or partial unemployment benefits as well as vocational training financed by public agencies;

- housing benefits — including interventions by public authorities to help households meet the cost of housing;

- social exclusion benefits not elsewhere classified (n.e.c.) — including income support, rehabilitation of alcohol and drug abusers and other miscellaneous benefits (except healthcare).

The pensions aggregate comprises part of periodic cash benefits under the disability, old age, survivors and unemployment functions. It is defined as the sum of the following social benefits: disability pensions, early-retirement benefits due to reduced capacity to work, old age pensions, anticipated old age pensions, partial pensions, survivors’ pensions, and early-retirement benefits for labour market reasons (see Social protection statistics — pension expenditure and pension beneficiaries).

The first formal data collection for net social protection expenditure took place in 2012 for the reference year 2010. A so-called ‘restricted approach’ is used which means that it is strictly limited to measuring the impact of the fiscal system on the gross cash benefits reported in the ESSPROS core system (benefits in kind are not covered). It does not, therefore, take full account of tax reliefs for social purposes which reduce the amount of taxes paid on other (non-benefit) income or which may be granted to persons who do not receive any (cash) benefits. Such reliefs are taken into account only in relation to the extent to which they reduce the amount of taxes normally payable on cash benefits. Similarly, tax reliefs for social purposes which reduce indirect taxes are not accounted for. The full value of such tax reliefs would only be addressed by the ‘enlarged’ approach (enlarged because the population of beneficiaries is larger). More information is available in an article on Social protection statistics — net expenditure on benefits.

Aggregate replacement ratio

The aggregate replacement ratio is compiled as the ratio between gross retirement benefits and gross earnings. It is defined as median individual gross pension income of those aged 65-74 relative to median individual gross earnings from work of those aged 50-59; it is expressed in percentage terms. These data are not part of the European system of integrated social protection statistics and are collected as part of the EU’s statistics on income and living conditions (EU-SILC).

Social protection receipts

Schemes responsible for providing social protection are financed in a variety of different ways. Social protection receipts comprise social security contributions paid by employers and protected persons, contributions by general government, and other receipts from various sources (for example, interest, dividends, rent and claims against third parties). Social contributions by employers are all costs incurred by employers to secure entitlement to social benefits for their employees, former employees and their dependants; they can be paid by resident or non-resident employers. They include all payments by employers to social protection institutions (actual contributions) and social benefits paid directly by employers to employees (imputed contributions). Social contributions made by protected persons comprise contributions paid by employees, by the self-employed and by pensioners and other persons.

Implementation of ESA 2010

The European System of National and Regional Accounts (ESA 2010) replaced ESA 1995, the previous standard. This change had consequences in relation to ESSPROS results which were indirectly affected by the implementation of ESA 2010. The revision of ESSPROS data to take into account the new national accounts methodology took place for a large majority of EU Member States during the collection of data for the 2013 reference period.

Context

Social protection systems are generally well-developed in the EU: they are designed to protect people (to some degree) against the risks and needs associated with unemployment, parental responsibilities, sickness/healthcare and invalidity, the loss of a spouse or parent, old age, housing and social exclusion (not elsewhere classified).

Pension systems can play a role in allowing beneficiaries to maintain living standards they enjoyed in the later years of their working lives. However, as Europe’s population is becoming progressively older, the main challenge social protection systems are starting to face is related to their financing, as the proportion of older persons grows while the number of persons of working age decreases.

The organisation and financing of social protection systems is the responsibility of each of the EU Member States. The model used in each Member State is therefore somewhat different, while the EU plays a coordinating role to ensure that people who move across borders continue to receive adequate protection. The EU seeks to promote actions among the Member States to combat poverty and social exclusion, and to reform social protection systems on the basis of policy exchanges and mutual learning. This policy is known as the social protection and social inclusion process — it underpins the Europe 2020 strategy and will play an important role as the EU seeks to become a smart, sustainable and inclusive economy. The Europe 2020 strategy for smart, sustainable and inclusive growth sets targets (among others) to lift at least 20 million people out of the risk of poverty and social exclusion and to increase employment of the population aged 20–64 to 75 %. The European Commission provides support to help reach these targets through flagship initiatives, including the European platform against poverty and social exclusion and the New skills agenda for Europe. Furthermore the European Commission provides guidance to Member States to modernise their welfare systems through the social investment package.

The main policy framework in this domain concerns the open method of coordination for social protection and social inclusion, which aims to promote social cohesion and equality, through adequate, accessible and financially sustainable social protection systems and social inclusion policies. A Communication from the European Commission titled Working together, working better: a new framework for the open coordination of social protection and inclusion policies in the European Union (COM(2005) 706 final) outlines the objectives, which include:

- making a decisive impact on the eradication of poverty and social exclusion;

- providing adequate and sustainable pensions;

- ensuring accessible, high-quality and sustainable healthcare and long-term care.

The European Pillar of Social Rights sets out a number of key principles and rights to support fair and well-functioning labour markets and welfare systems; it forms part of the policy developments related to a deeper and fairer economic and monetary union (1 of 10 European Commission priorities for the period 2015-2019). The pillar contains three main categories for action, one of which concerns social protection and inclusion, which covers the following areas:

Childcare and support to children — children have the right to affordable early childhood education and care of good quality; children have the right to protection from poverty; children from disadvantaged backgrounds have the right to specific measures to enhance equal opportunities.

Social protection — regardless of the type and duration of their employment relationship, workers, and, under comparable conditions, the self-employed, have the right to adequate social protection.

Unemployment benefits — the unemployed have the right to adequate activation support from public employment services to (re)integrate in the labour market and adequate unemployment benefits of reasonable duration, in line with their contributions and national eligibility rules; such benefits shall not constitute a disincentive for a quick return to employment.

Minimum income — everyone lacking sufficient resources has the right to adequate minimum income benefits ensuring a life in dignity at all stages of life, and effective access to enabling goods and services; for those who can work, minimum income benefits should be combined with incentives to (re)integrate into the labour market.

Old age income and pensions — workers and the self-employed in retirement have the right to a pension commensurate to their contributions and ensuring an adequate income; women and men shall have equal opportunities to acquire pension rights; everyone in old age has the right to resources that ensure living in dignity.

Health care — everyone has the right to timely access to affordable, preventive and curative health care of good quality.

Inclusion of people with disabilities — people with disabilities have the right to income support that ensures living in dignity, services that enable them to participate in the labour market and in society, and a work environment adapted to their needs.

Long-term care — everyone has the right to affordable long-term care services of good quality, in particular home-care and community-based services.

Housing and assistance for the homeless — access to social housing or housing assistance of good quality shall be provided for those in need; vulnerable people have the right to appropriate assistance and protection against forced eviction; adequate shelter and services shall be provided to the homeless in order to promote their social inclusion.

Access to essential services — everyone has the right to access essential services of good quality, including water, sanitation, energy, transport, financial services and digital communications; support for access to such services shall be available for those in need.

A Eurostat scoreboard of key indicators is used to track the employment and social performances of participating EU Member States. The scoreboard serves as a reference to monitor progress and to detect employment and social challenges.

See also

- Social protection statistics — background

- Social protection statistics — financing

- Social protection statistics — main indicators

- Social protection statistics — net expenditure on benefits

- Social protection statistics — pension expenditure and pension beneficiaries

- Social protection statistics — social benefits

Further Eurostat information

Publications

- In 2009, a 6.5 % rise in per capita social protection expenditure matched a 6.1 % drop in EU GDP — Statistics in focus 14/2012

- 28.7 % of EU GDP spent on social protection — News release from 21 December 2016

Main tables

- Social protection (t_spr)

Database

- Social protection (spr), see:

- Social protection expenditure (spr_expend)

- Social protection receipts (spr_receipts)

- Pensions beneficiaries (spr_pension)

- Net social protection benefits (spr_net_ben)

Dedicated section

Methodology / Metadata

- ESSPROS Manual and user guidelines — 2016 edition

- Social protection methodology

- Social protection (ESMS metadata file — spr_esms)

Source data for tables, figures and maps (MS Excel)

Other information

- Regulation (EC) No 458/2007 of the European Parliament and of the Council of 25 April 2007 on the European system of integrated social protection statistics (ESSPROS).

- Commission Regulation (EC) No 1322/2007 of 12 November 2007 implementing Regulation (EC) No 458/2007 of the European Parliament and of the Council on the European system of integrated social protection statistics (ESSPROS) as regards the appropriate formats for transmission, results to be transmitted and criteria for measuring quality for the ESSPROS core system and the module on pension beneficiaries.

- Commission Regulation (EC) 10/2008 of 8 January 2008 implementing Regulation (EC) No 458/2007 of the European Parliament and of the Council on the European system of integrated social protection statistics (ESSPROS) as regards the definitions, detailed classifications and updating of the rules for dissemination for the ESSPROS core system and the module on pension beneficiaries.

- Commission Regulation (EU) No 110/2011 of 8 February 2011 concerning the appropriate formats for the transmission of data, the results to be transmitted and the criteria for measuring quality for the ESSPROS module on net social protection benefits.

- Commission Regulation (EU) No 263/2011 of 17 March 2011 concerning the launch of full data collection for the ESSPROS module on net social protection benefits.

- ↑ Social protection expenditure per inhabitant is calculated on the basis of the resident population; therefore, its value is particularly overestimated for Luxembourg (due to the presence of a high proportion of cross-border commuters), with a considerable proportion of benefits paid to persons living outside the country (primarily expenditure on health care, pensions and family benefits).