Data extracted in October 2023.

No planned article update.

Highlights

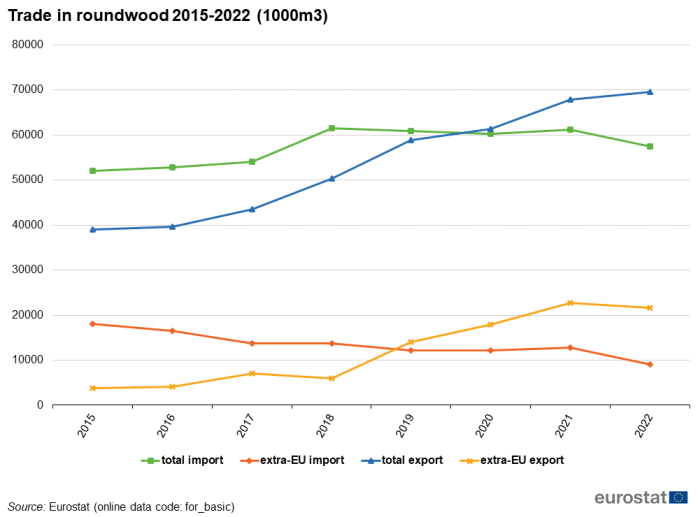

EU has been a net exporter of roundwood in the past four years, exports to non-EU countries surpassing imports by 12.5 million m3 in 2022.

25% of the EU’s roundwood production in 2022 was used as fuelwood; the rest was used for sawnwood and veneers, pulp and paper production.

Change in roundwood production in the EU, 2000–2022

This article is part of a set of statistical articles that the Eurostat online publication "Agriculture, forestry and fishery statistics" is based on. It presents statistics on production and trade in wood products in the European Union (EU).

The EU accounts for approximately 5 % of the world's forests. Apart from the forests' ecological value, their role as an essential element in the European landscape and their importance for some non-economic uses, such as recreation, forests are also an economic resource. This article presents indicators on the volume of roundwood production, production of selected primary and secondary wood products, as well as on the performance and employment of the EU's wood-based industries.

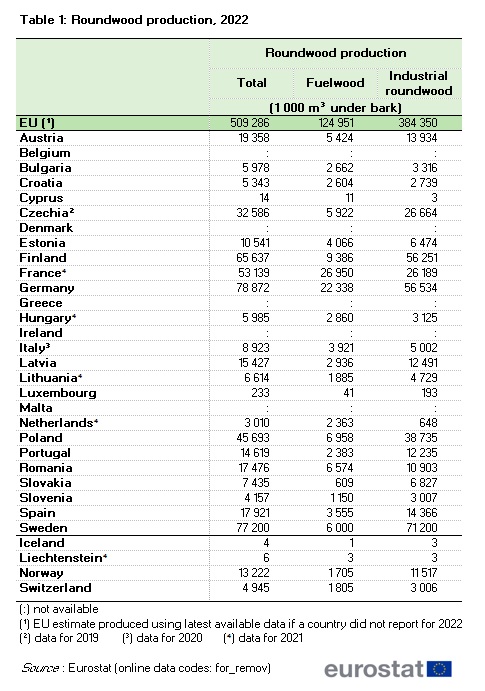

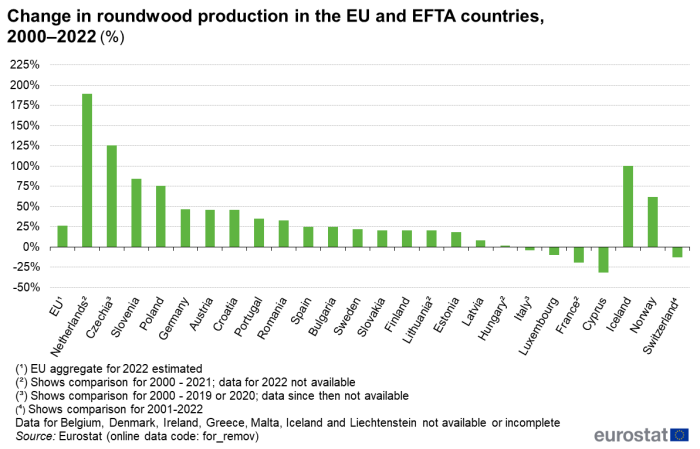

Roundwood production

After the temporary decrease in 2020, roundwood production increased by 3.8 % in 2021 and stabilised in 2022 (0.04 % increase). In 2022, it reached an estimated 510 million m3. This is 26 % more than at the beginning of the millennium. With the exception of four Member States where roundwood production decreased and further four Member States where data are unavailable, all EU countries recorded an increase in roundwood production in the period of 2000–2022. The largest relative increase during the two decades in the amount of harvested wood took place in the Netherlands (190 %), Czechia (126 %), Slovenia and Poland (85 and 76 % respectively). Just as last year, in 2022 Germany was still the largest producer of roundwood in the European Union (79 million m3), followed by Sweden and Finland (each producing between ca 66 and 77 million m3) (Table 1 and Figure 1).

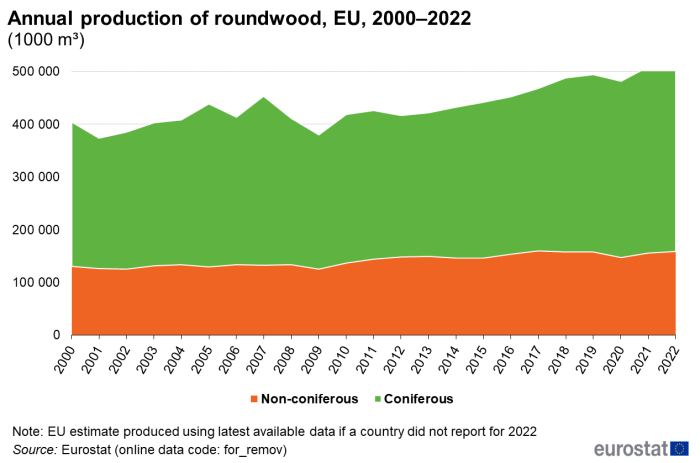

Traditionally, the output of roundwood in the EU has been dominated by coniferous trees. Their share in 2022 accounted for 69 % of all roundwood harvested in the forests of EU countries. Although the output of coniferous roundwood shows minor fluctuations, the output of non-coniferous roundwood has been steady over the past 20 years. Overall, the share of coniferous roundwood has remained stable during the period 2000–2022 (Figure 2).

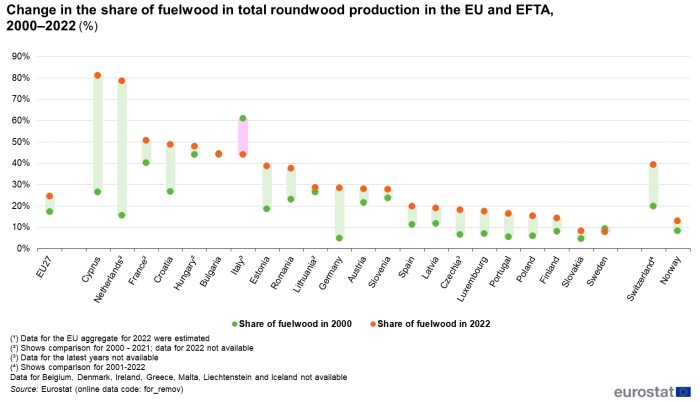

Primary wood products

Wood has been increasingly used as a source of renewable energy. Almost a quarter (24 %) of the EU's roundwood production in 2022 was used as fuelwood, while the remainder was industrial roundwood mostly used for sawnwood and veneers or for pulp and paper production. Fuelwood production has slightly increased in 2022 (3.6 %), and industrial roundwood production has decreased by 1%. Their ratio has been stable around 24:76. This represents an increase of 7 percentage points (pp) compared with 2000, when fuelwood accounted for 17 % of the total roundwood production.In some EU Member States, specifically Cyprus, fuelwood represented the majority of roundwood production (more than 80 %) in 2022. On the other hand, Slovakia and Sweden reported that over 90 % of their total roundwood production was industrial roundwood (Table 1). While the share of fuelwood in roundwood production differs across EU countries, most Member States reported its increase since 2000. The largest increase was recorded for the Netherlands and Cyprus (63 % and 55 % respectively) as shown in Figure 3.

Source: Eurostat (for_remov)

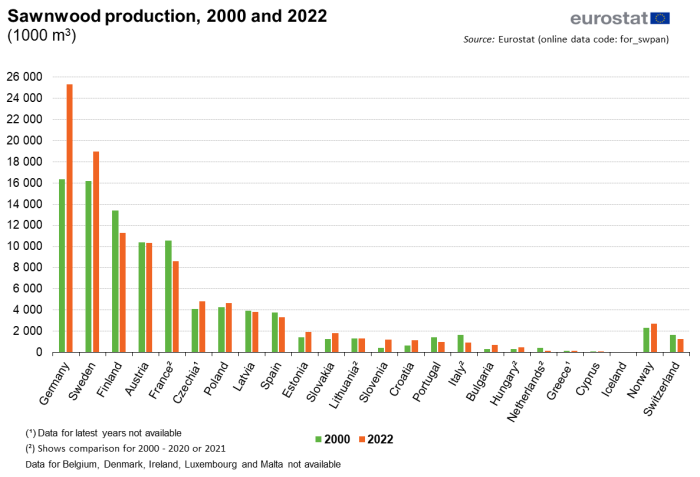

In 2022 Germany and Sweden were the EU's leading sawnwood producers, accounting for approximately 24 % and 18 % of the EU total sawnwood output, respectively (Figure 4). For both countries, their share has increased during last year by 1 %.

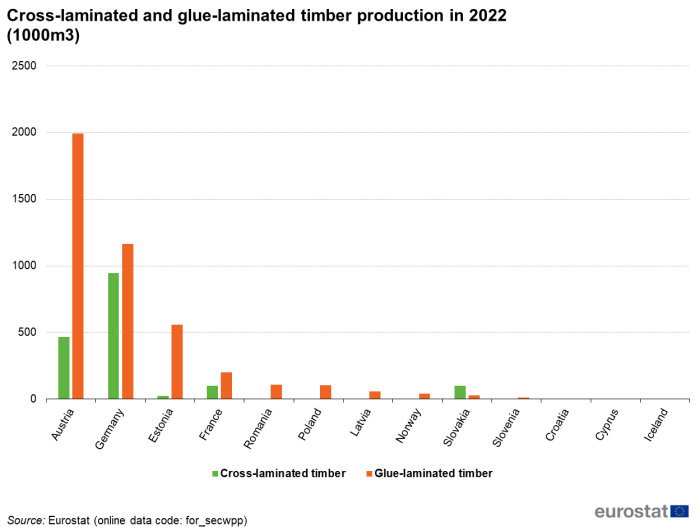

Secondary wood products

Secondary products include further processed wood and paper products (e.g. further processed sawnwood, wooden wrapping and packaging material, wooden furniture, etc.). As a new item, Eurostat and its partner institutions have started to collect data on the production of glue-laminated timber, cross-laminated timber and I-beam. Only 13 countries reported provisional production data for 2022. Austria and Germany are the main producers of these two items in Europe, reaching a total of 2.5 and 2.1 million m3 in 2022.

(1 000 m3)

Source: Eurostat (for_swpan)

Trade in roundwood and fuelwood

Trade of roundwood presents for the EU in 2022 a net balance of 12 billion m3 (Figure 6). Total exports have steadily increased since 2015 by 77% over the seven years, while total imports have declined since 2018 by 7.4%. The net balance is driven by the extra-EU trade of roundwood and represents 12.5 million m3. 31% of all roundwood exports go outside the EU, whereas 16% of roundwood imports come from outside the EU.

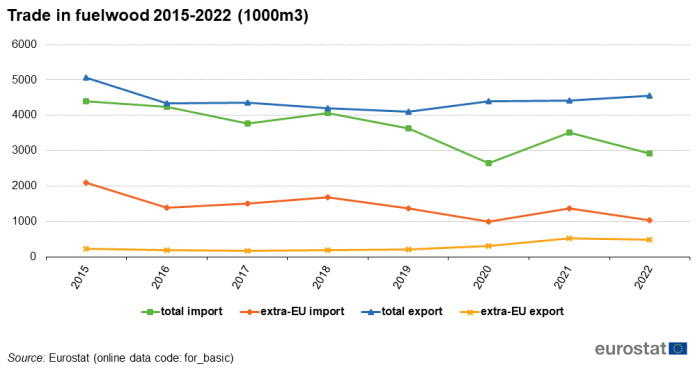

Trade of fuelwood shows a different picture (see Figure 7). Total imports have been declining since 2015 reaching 2.9 million m3 in 2022, whereas imports coming from non-EU states reached slightly more than 1 million m3. The rise in fuelwood export however is mild over the past three years, still not reaching the 2015 level. In 2022, exports of fuelwood account for 4.6 million m3 including exports to non-EU countries of 481 thousand m3. During the past 7 years the EU imported more fuelwood from non-EU states than exported outside the EU. The trade balance has been narrowing, but imports are still twice as high as exports.

Wood-based industries

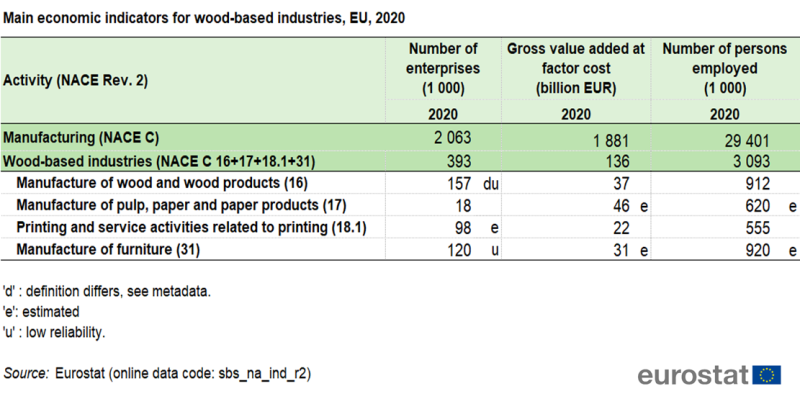

The EU's wood-based industries cover a range of downstream activities, including woodworking industries, large parts of the furniture industry, pulp and paper manufacturing and converting industries and the printing industry. Together, some 393 000 enterprises were active in wood-based industries across the EU in 2020; they represented one in five (19 %) manufacturing enterprises across the EU, highlighting that - with the exception of pulp and paper manufacturing that is characterised by economies of scale - many wood-based industries had a relatively high number of small or medium-sized enterprises.

The economic importance of an industry can be measured by the share of its gross value added (GVA) in the economy. In 2020, the GVA of wood-based industries in the EU was €136 billion or 7.2 % of the total manufacturing industry. The distribution of GVA across each of the four wood-based activities in 2020 is presented in Table 2. Within the EU's wood-based industries, the largest GVA was recorded for pulp, paper and paper products manufacturing (34 % or €46 billion). With regard to the other three sectors, printing and service activities related to printing amounted to 16 % of the GVA of wood based industries, while the manufacture of furniture and manufacturing of wood and wood products each made up between 23 % and 27 %.

Source: Eurostat (sbs_na_ind_r2)

The wood-based industries employed 3.1 million persons across the EU in 2020 or 10.5 % of the manufacturing total. There were more than 900 000 persons employed within both the manufacture of wood and wood products and the manufacture of furniture, whereas an employment of 555 000 persons was recorded for printing and service activities related to printing, representing the lowest employment of the four activities (Table 2).

Source data for tables and graphs

Data sources

Eurostat, the Timber Committee of the United Nations Economic Commission for Europe (UNECE), Forestry Section of the United Nations Food and Agriculture Organisation (FAO) and the International Tropical Timber Organisation (ITTO) collect and collate statistics on the production and trade of wood through their Joint Forest Sector Questionnaire. Each partner collects data from a different part of the world, Eurostat is responsible for the data collection exercise pertaining to the EU Member States and EFTA countries.

Eurostat produces annual data on forestry using two questionnaires:

- The Joint Forest Sector Questionnaire (JFSQ) on production and trade in wood and wood products;

- European Forest Accounts (EFA), forming part of the environmental satellite accounts initiative that started in the late 1990s.

The JFSQ provides data for supply balances of timber used for wood products and for energy and for estimating the carbon contained in harvested wood products.)

Context

A broad array of EU policies and initiatives has a bearing on forests. For several decades, environmental forest functions have attracted increasing attention — for example, in relation to the protection of biodiversity and, more recently, in the context of climate change impacts and energy policies. Apart from the traditional production of wood and other forest-based products, forests are increasingly valued for their environmental role and as a public amenity. The EU promotes sustainable forest management, aiming to

- create and preserve jobs and otherwise contribute to rural livelihoods;

- protect the environment by preserving the soil, minimising erosion, purifying water, protecting aquifers, improving air quality, absorbing carbon, mitigating climate change and preserving biodiversity;

- monitor the state of forests to meet environmental agreements;

- improve the competitiveness of forest-based industries in the internal market;

- promote the use of wood and other forest products as environmentally friendly products;

- reduce poverty in developing countries by furthering forest law enforcement, fair trade conditions and halting deforestation and illegal logging.

The European Community and its Member States have been members of the International Tropical Timber Agreement (ITTA) since 1994. A new ITTA was concluded in 2006 and signed by the European Community, see 2007/648/EC: Council Decision of 26 September 2007. Annex 1 is a list of ITTA's members that produce tropical wood, comprising both FLEGT and non-FLEGT countries. Annex 2 is a list of ITTA's members that are consumers of tropical wood. All EU Member States are presently members of ITTA. Article 27 on statistics, studies and information states:

- 1. The Council shall authorise the Executive Director to establish and maintain close relationships with relevant intergovernmental, governmental and non-governmental organisations in order to help ensure the availability of recent and reliable data and information, including on production and trade in tropical timber, trends and data discrepancies, as well as relevant information on non-tropical timber and on the management of timber producing forests. As deemed necessary for the operation of this Agreement, the Organisation, in cooperation with such organisations, shall compile, collate, analyse and publish such information.

- 2. The Organisation shall contribute to efforts to standardise and harmonise international reporting on forest-related matters, avoiding overlapping and duplication in data collection from different organisations.

The European Commission presented a new EU forest strategy (COM(2013) 659) for forests and the forest-based sector in 2013 in response to the increasing demands put on forests and to significant societal and political changes that have affected forests over the last decades. The strategy is a framework for forest-related measures and is used to coordinate EU initiatives with the forest policies of the EU Member States. A new forest strategy is under preparation as of 2020 with a view for its adoption in 2021. In March 2010, the European Commission adopted a Green paper on forest protection and information in the EU: preparing forests for climate change (COM(2010) 66 final). The paper aimed to stimulate debate concerning the way climate change modifies the terms of forest management and protection and how EU policy should develop as a consequence.

Explore further

Database

- Forestry (for), see:

- Removals, production and trade (for_rpt)

- Roundwood removals (for_rptr)

- Roundwood production and trade (for_rptt)

- Production and trade in primary products (for_rptp)

- Trade in secondary processed products (for_rpts)

- Economics (for_eaf)

- Economic aggregates of forestry (for_eco_cp)

- Supply and use of products within forestry (for_sup_cp)

- Monetary supply and use of wood in the rough (for_emsuw)

- Physical supply and use of wood in the rough over bark (for_epsuw)

- Output of forestry by type (for_eoutput)

- Economic accounts for forestry -historical data (until 2005) (for_eafh)

- Employment (for_emp)

- Forest resources (for_fsm)

- Environmental functions (for_fsmen)

Thematic section

Publications

- Agriculture, forestry and fishery statistics — 2020 edition (Statistical book)

- Energy, transport and environment indicators — 2020 edition (Pocketbook)

- Environmental statistics and accounts in Europe — 2010 edition (Statistical book)

- Forestry in the EU and the world — 2011 edition (Statistical book)