Data extracted in June 2024

Planned article update: no update planned

Highlights

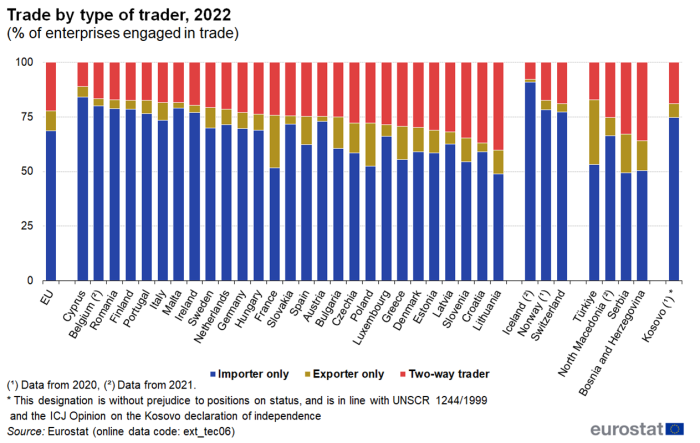

In 2022, 69 % of the EU enterprises engaged in trade were importers only.

(% of enterprises engaged in trade)

Source: Eurostat (ext_tec06)

Over the last few decades, there has been a rapid expansion in the level of international trade in goods. Trade in goods is viewed as one of the most important drivers of globalisation as demonstrated by Globalisation patterns in EU trade and investment, an online Eurostat publication presenting a summary of recent European Union (EU) statistics on economic aspects of globalisation, focusing on patterns of EU trade and investment. Yet, aside from a range of studies on relatively large, foreign-owned enterprises, little is published regarding the characteristics of enterprises trading across international borders - this subject is covered in more detail within this article.

Traditionally, international trade statistics have shown movements of goods between countries and by goods category, they have not provided explicit information as to the characteristics of those enterprises behind such trade flows. In a globalised world, this information is of particular interest to policymakers as they attempt to understand how economies are becoming increasingly interconnected.

Statistics on international trade in goods by enterprise characteristics

Statisticians have looked at using international trade in goods statistics in conjunction with business statistics to provide an enriched analysis of the characteristics of enterprises engaged in international trade, for example, providing information as to their economic activity, their size or the concentration of trade. This can help identify differences between enterprises that trade internationally and those that do not. This has been made possible by linking microdata concerning international trade with business register information. Note that only aggregated results are presented thereby protecting the confidential nature of this information.

The statistics used in this article were initially divided between enterprises which trade internationally and those enterprises which are active only within their domestic market as research has shown that international traders differ considerably from enterprises that operate solely within their domestic market. The group of international traders was then further subdivided into importers, exporters and two-way traders (enterprises which both imported and exported).

Trade in goods by enterprise characteristics

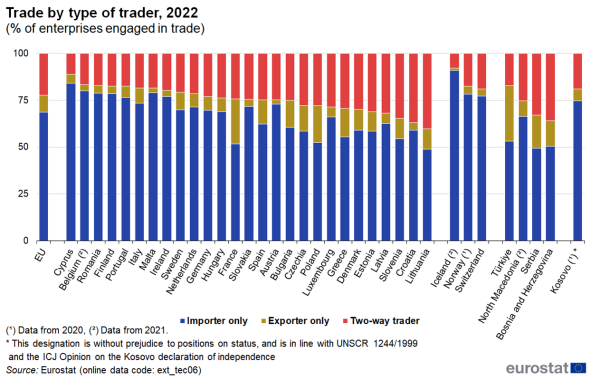

In 2022, 69 % of the EU enterprises engaged in trade were importers only

Figure 1 presents aggregated information for the EU countries detailing the composition of those enterprises that were engaged in trade. In 2022, 68.5 % of EU enterprises engaged in trade were only importers, while 22.3 % were two-way traders, the remaining 9.1 % were only exporters. Importers are of interest to policymakers insofar as they facilitate access to new goods and services that were otherwise not easily available, whereas exporters are of interest due to their potential for job creation (that may be linked to economic growth that results from expanding into new markets).

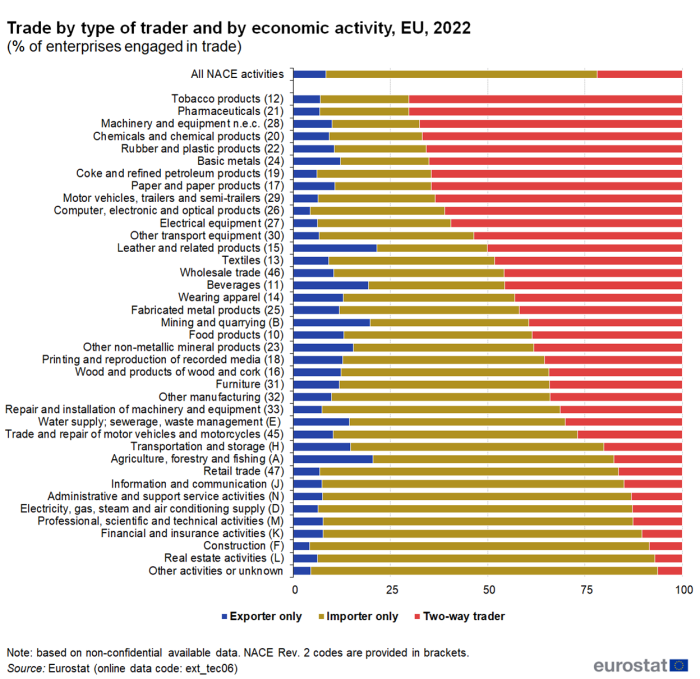

The highest proportions of two-way traders were recorded for a range of different manufacturing activities that were often characterised by their global production chains

An analysis by NACE divisions reveals that there were considerable differences with respect to the make-up of those enterprises engaged in trade across different economic activities. Within the EU, the highest proportions of two-way traders were recorded for a wide range of different manufacturing activities. Whereas, for most services it was more commonplace to find that the largest proportion of enterprises engaged in trade were importers only. For example, there was a high share of two-way traders in 2022 within the highly competitive and globalised activities of pharmaceuticals (69.5 % of those enterprises engaged in trade were two-way traders), machinery and equipment n.e.c. (66.7 %), chemicals and chemical products (65.9 %) and motor vehicles, trailers and semi-trailers (63.8 %).

(% of enterprises engaged in trade)

Source: Eurostat (ext_tec06)

Figure 2 provides a similar set of information, but for the individual EU countries. Among EU countries, the highest share of two-way traders was recorded in Lithuania (where 40.3 % of all enterprises engaged in trade in 2022 were two-way traders). While two-way traders accounted for over one-third of all enterprises engaged in trade in Slovenia (34.5 %) and Croatia (36.9 %). By contrast, Cyprus (11.2 %) and Belgium (16.6 %) recorded the lowest proportions of two-way traders, as around four-fifths of their enterprises engaged in trade were importers only. The highest share of exporters only was found in France (24.0 %).

(% of enterprises engaged in trade)

Source: Eurostat (ext_tec06)

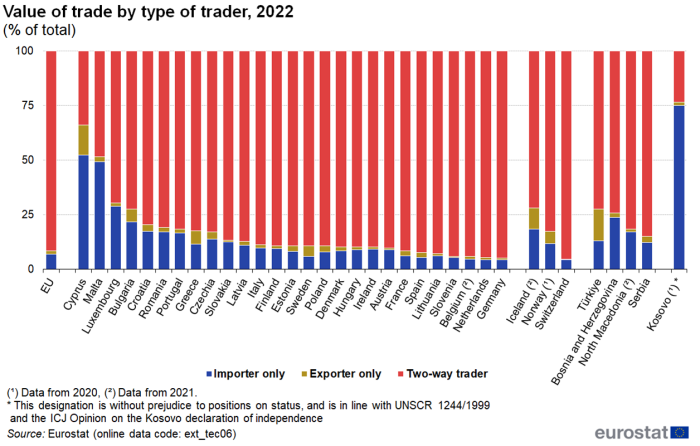

Two-way traders account for an overwhelming share of the EU's total trade in value terms

The information presented so far has related to an analysis of the number of enterprises engaged in trade and is extended in Figure 3 to cover an analysis based on the total value of trade. The results are quite different and reveal that two-way traders accounted for the vast majority of total trade in value terms: across the EU, two-way traders accounted for 91.5 % of all goods traded in 2022. This would tend to suggest that a high proportion of importers only and exporters only tend to trade with relatively few countries and/or relatively few (low value) transactions, whereas two-way traders were more inclined to have a larger number of transactions and a wider range of trade partners.

A large majority (22) of the individual EU countries reported that in excess of 80 % of their total trade was accounted for by two-way traders, with the highest shares recorded in Germany (94.8 %), the Netherlands (94.7 %), Belgium and Slovenia (both 94.2 %). At the other end of the range, in Cyprus (33.8 %) and Malta (48.4 %) the relative importance of two-way traders was much lower than in the other EU countries and, once again, the share of total trade accounted for by importers only was considerably higher than in other countries

Concentration of international trade

A relatively high proportion of trade is concentrated in relatively few enterprises

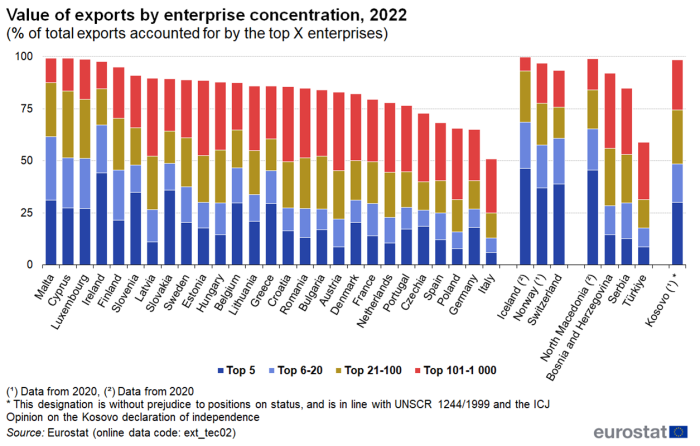

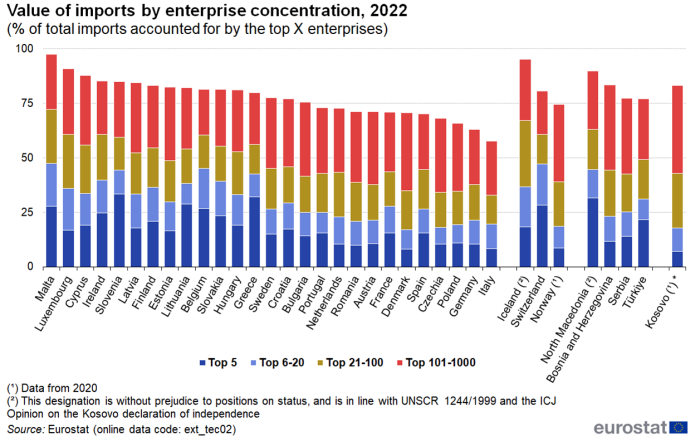

Figures 4 and 5 examine the proposition that a relatively high share of total trade might be accounted for by a small number of traders. Within this context, trade concentration is measured by the share of the top X traders in the value of total exports or imports.

As may be expected for some of the smaller EU countries, almost the entirety (more than 98 %) of the total value of exports from Luxembourg, Malta and Cyprus could be attributed to the top 1 000 enterprises. By contrast, the concentration of trade was more diluted in several of the larger EU countries. For example, the top 1 000 enterprises in Italy (51.0 %), accounted for just over half of the total value of export and in Germany (65.1 %), Poland (65.7 %) and Spain (68.2 %) they accounted for approximately two-thirds of the total value of exports. This may reflect, among others, a high number of small and medium-sized enterprises (SMEs) within the enterprise population, or a relatively high propensity to trade in goods.

(% of total exports accounted for by the top X enterprises)

Source: Eurostat (ext_tec02)

(% of total imports accounted for by the top X enterprises)

Source: Eurostat (ext_tec02)

International trade by enterprise ownership

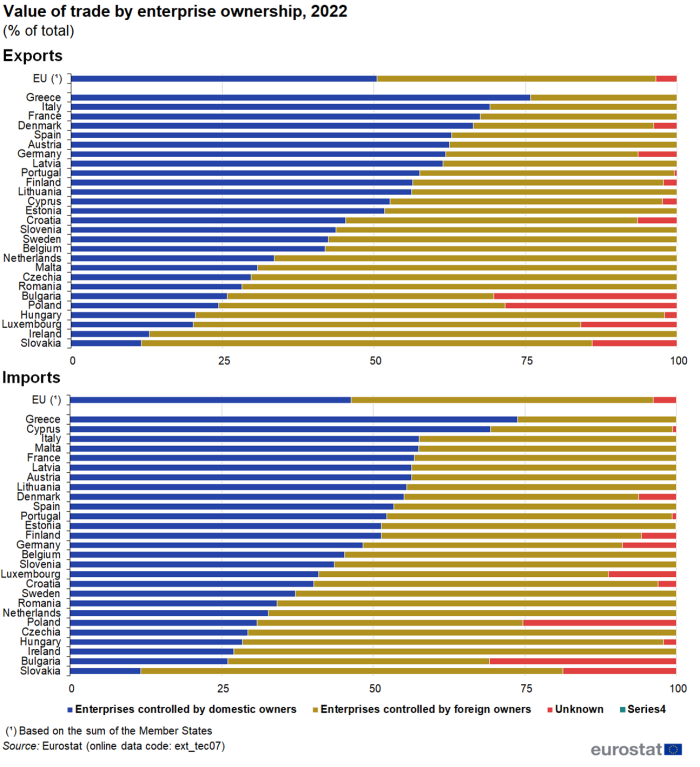

In 2022, domestic enterprises accounted for 6 percentage points more of all EU exports than foreign-owned enterprises

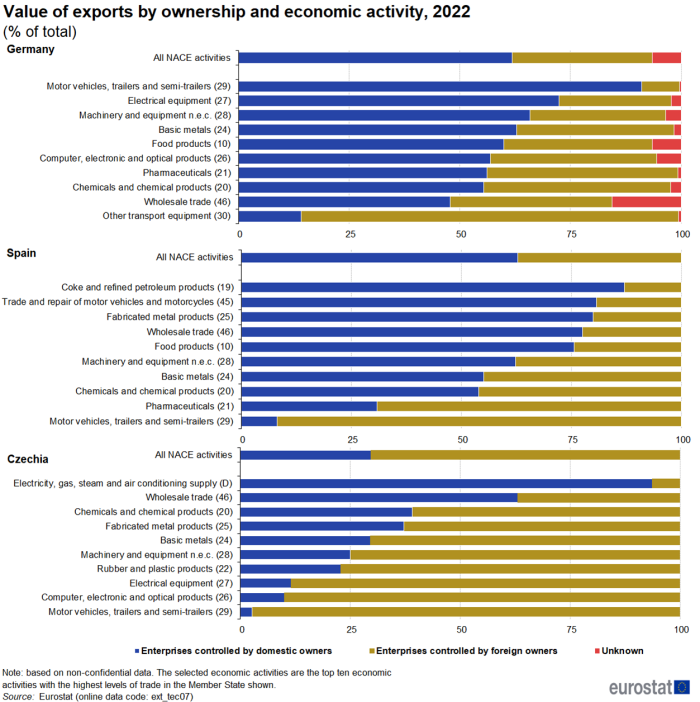

The final section of this article analyses the share of international trade by enterprise ownership, an area that is of considerable interest to policymakers when trying to establish the impact of globalisation on economic performance. When interpreting the figures below, readers should be aware that it was not possible to determine the type of ownership for all enterprises. Across the EU countries (see Figure 6 for details of data coverage), domestically owned enterprises accounted for 50.5 % of the total value of exports in 2022, which was approximately 4 percentage points (pp) higher than the share accounted for by foreign-owned enterprises (46.0 %). The situation was quite different for imports, as enterprises controlled by domestic owners accounted for 46.3 % of the total value of exports, which was approximately 3 pp lower the share accounted for by foreign-owned enterprises (49.8 %).

It is possible to extend this analysis by looking in more detail at those economic activities where foreign-owned enterprises tend to have a higher/lower share of total trade. Figure 7 shows some selected results for exports from three of the larger EU countries — Germany, Spain and Czechia. The most striking aspect is the relatively high share of the total value of exports in Germany (61.8 %) and Spain (62.8 %) for domestically owned enterprises contrasted with Czechia where the share is only 29.7 %. Even larger differences can be found in the sector 'motor vehicles, trailers and semi-trailers' between Germany, where domestically owned enterprises accounted for most of the exports, and Czechia and Spain, where foreign owned enterprises accounted for most of the exports.

(% of total)

Source: Eurostat (ext_tec07)