Data extracted in March 2025

Planned article update: March 2026

Highlights

Sea transport was the biggest contributor to EU international trade in transport services between 2010 and 2023, accounting for about half of the total transport services, for both exports and imports.

The United States was the EU's main trading partner in transport services in 2023, accounting for about 17.6% of EU exports and 15.3% of EU imports.

EU trade in transport services with extra-EU, 2010-2022

The role of trade in services in EU international trade has been growing steadily over the last decade and plays a major role in modern economies in an increasingly interlinked and globalised world. International trade in services flows show the transactions between residents and non-residents according to 12 main service categories of the extended balance of payments services classification (EBOPS 2010). In 2023, 'Transport services' was the third largest contributor to EU trade in services with extra-EU accounting for 17.2% of total services exports and the second largest contributor accounting for 16.6% of total services imports from non-EU countries. The largest service category is 'Other business services', presented in a separate article.

This article focuses on the structure and evolution of the EU's international trade in transport services with extra-EU. 'Transport services' can be further divided into 4 sub-categories[1] , namely 'Sea transport', 'Air transport', 'Other modes of transport' and 'Postal and courier services'. These sub-categories are presented in this article.

General overview

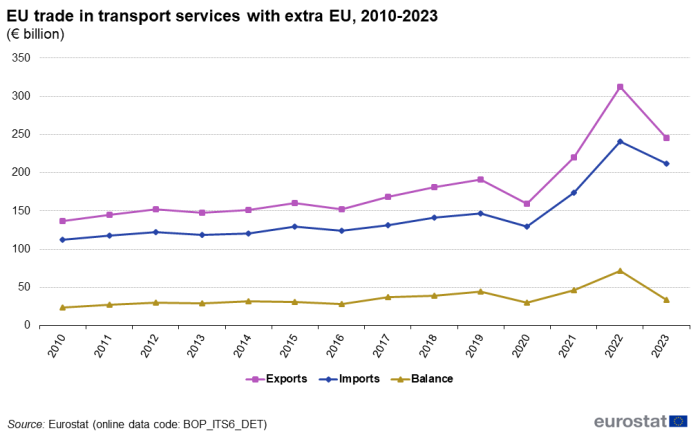

Figure 1 shows the time series for the evolution of international trade in transport services from 2010 to 2023. Exports of transport services exceeded imports during the entire period, resulting in a constant surplus for the EU. During the period 2010 to 2019 exports of transport services decreased only in 2013 (-3.1% compared with the previous year) and 2016 (-5.2%). Exports continuously increased for each year in the period 2017 to 2019. Exports of transport services decreased by 16.6% in 2020. In 2021, the sector managed to recover, increasing by 38.0% compared with 2020. In 2022, transport services exports reached the highest level for the observed period (€313 billion) increasing by 42.2%. Exports decreased in 2023 by 21.5% but still had the second highest level since 2010. The decrease in exports in 2023 is due to a decrease in exports of sea transport.

Imports fluctuated in a similar manner as exports. In 2020, the decrease in imports was smaller when compared with exports (11.9%). In 2021, imports increased by 34.3% and in 2022 by 38.7%, reaching their highest level for the entire period (€241 billion). Imports also decreased in 2023 but less than exports (-12.1%), reaching the second highest value in the observed period. As with exports, the decrease of imports in 2023 was due to a decrease in sea transport imports. The sharp decrease in 2020 of both exports and imports of transport services was due to the COVID-19 pandemic and associated restrictive measures.

Source: Eurostat (bop_its6_det)

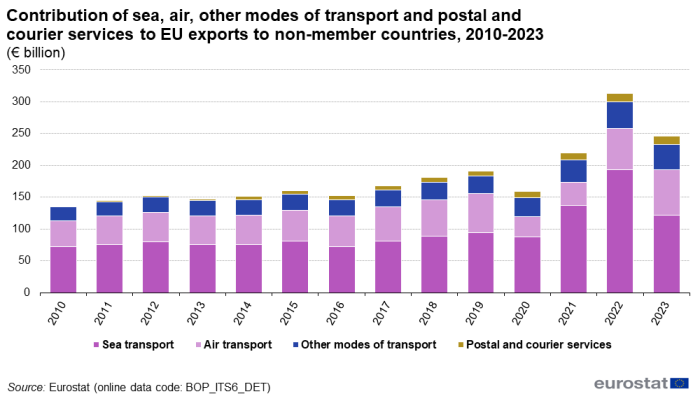

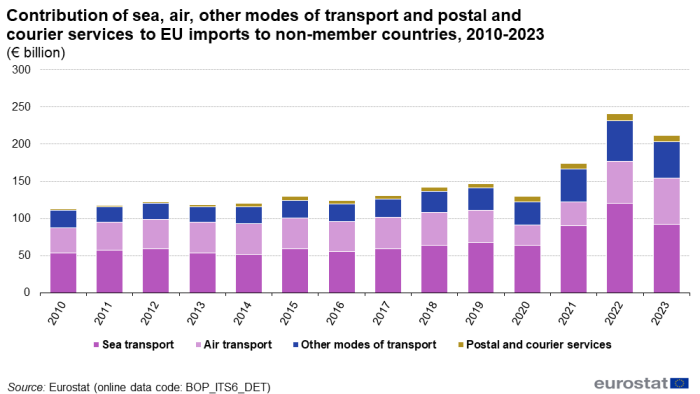

Figures 2 and 3 show the contributions of the 4 sub-categories of transport services to exports and imports for the years 2010 to 2023. Sea transport provided the biggest contribution to both exports and imports accounting for about 49.7% of exports and 43.6% of imports in 2023. For exports, air transport was the second biggest category in 2023 (28.8%), followed by other modes of transport (16.5%), and postal and courier services (5.0%). For imports, the second biggest category was air transport with 29.2%, followed by other modes of transport (23.0%) and postal and courier services (4.2%).

Source: Eurostat (bop_its6_det)

Source: Eurostat (bop_its6_det)

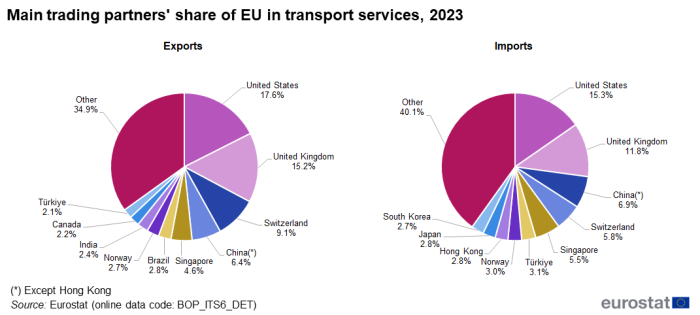

In 2023, the United States was the EU's main trading partner for exports of transport services, accounting for 17.6% of EU exports, followed by the United Kingdom with 15.2% and by Switzerland with 9.1%. As far as imports are concerned, the United States again had the leading role with 15.3%; the United Kingdom following with 11.8% and then China (except Hong Kong) with 6.9%(see Figure 4).

Source: Eurostat (bop_its6_det)

Sea transport

Sea transport[2] covers all international freight and passenger transport services undertaken by seagoing vessels, except cruise fares (included in 'Travel'). It does not include transport by underwater pipelines (included in 'Pipeline transport').

The evolution of the time series for sea transport services is shown in Figure 5. Exports of sea transport were higher than imports during the observed period, resulting in a continuous trade surplus. A big decrease both in exports and imports was observed in 2016 (11.1% and 6.0% respectively). During the following three years both flows continuously increased. In 2020, there was a decrease of 6.7% for exports and 5.7% for imports. In 2021 and 2022 both exports and imports increased significantly (in 2021 by 55.1% and 41.3% respectively, and in 2022 by 41.3% and 34.5%) followed by a decrease in 2023 (by 36.8% for exports and 23.5% for imports) when the values of transactions fell back to near 2021 levels.

Source: Eurostat (bop_its6_det)

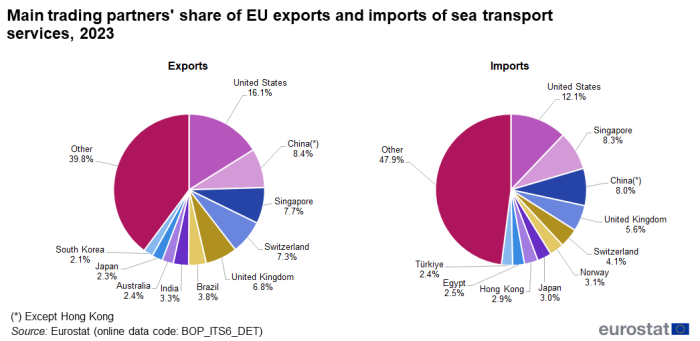

In 2023, the EU's largest trade partner for sea transport services was again the United States with 16.1% of exports and 12.1% of imports. For exports, China (except Hong Kong) was the second largest partner with 8.4%, followed by Singapore with 7.7%. For imports, the second biggest partner was Singapore with 8.3%, followed by China (except Hong Kong) with 8.0% (see Figure 6).

Source: Eurostat (bop_its6_det)

Air transport

Air transport[3] covers all international freight and passenger transport services provided by aircraft.

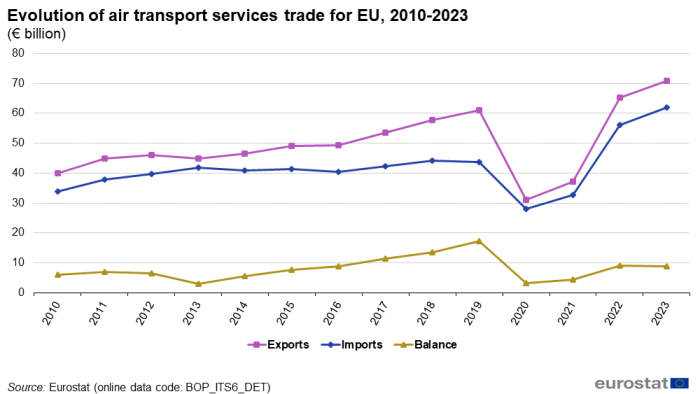

EU exports of air transport services has consistently exceeded imports during the period 2010 to 2023, resulting in a positive balance for all years in the observed period. Exports increased almost constantly up to 2020 when a sharp drop of 49.0% was recorded. In the same period, imports exhibited small fluctuations until 2019, when they remained practically stable. In 2020, imports exhibited a sharp decline of 36.2% (see Figure 7). The significant drop in both exports and imports of air transport in 2020 is due to the movement restriction measures associated with the COVID-19 pandemic. The 2020 exports and imports of air transport services are the lowest ever recorded in the period 2010-2023. In 2021, both exports and imports increased, by 19.2% and 17.4% respectively, but still remained well below pre-pandemic levels. In 2022, both exports and imports increased significantly (exports by 76.1% and imports by 71.2%) and surpassed the values of 2019, before the COVID-19 pandemic. In 2023, air transport maintained the positive trend as the only sub-category of transport services still increasing, by 8.5% for exports and 10.4% for imports.

Source: Eurostat (bop_its6_det)

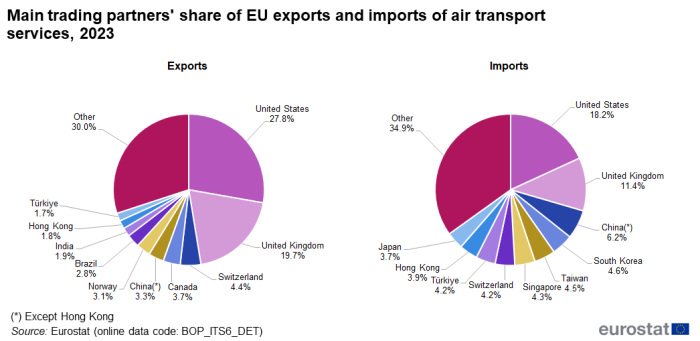

In 2023, the United States was again the largest partner for air transport services, accounting for 27.8% of EU exports and 18.2% of imports. The second largest partner was the United Kingdom with 19.7% of exports and 11.4% of imports. The third largest partners were Switzerland for exports with 4.4% and China (except Hong Kong) for imports with 6.2% (see Figure 8).

Source: Eurostat (bop_its6_det)

Other modes of transport

Other modes of transport services include all other modes of transport besides sea and air. They can be disaggregated to: space transport, rail transport, road transport, inland waterway transport, pipeline transport, electricity transmission and other supporting and auxiliary transport services (i.e. all other transport services that cannot be allocated to any of the components of transport services previously described).

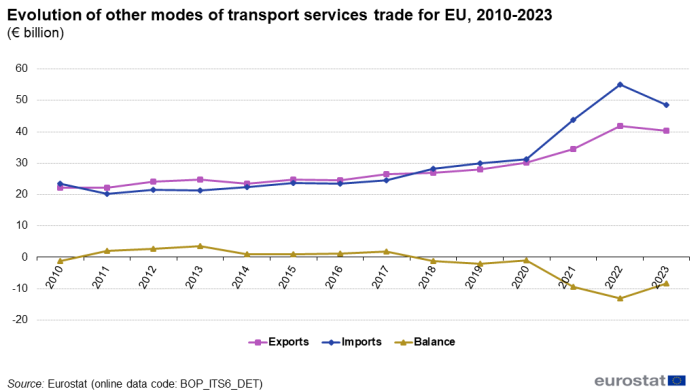

The time series for trade in other modes of transport for the period 2010-2023 is shown in Figure 9. Imports and exports have fluctuated for the observed period, resulting in higher imports for some of the years and to a negative balance in 2010, and all years after 2017. The COVID-19 pandemic does not seem to have significantly affected these modes of transport (a modest increase by 8.4% for exports and 4.0% for imports was recorded in 2020). The highest increase for exports during this period was observed in 2022 (21.4%) and in 2021 for imports (40.4%). In 2023, exports decreased slightly by 3.5% and imports by 11.6%, however, both exports and imports reached the second highest value in the observed period.

Source: Eurostat (bop_its6_det)

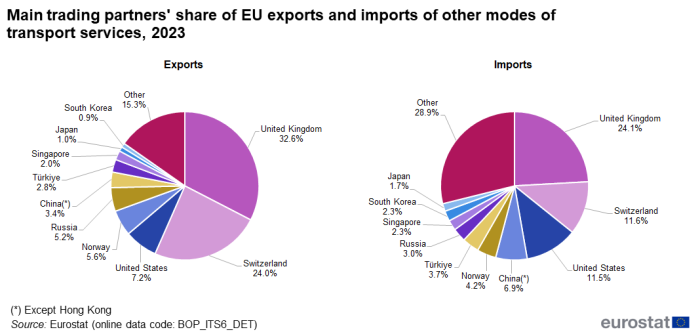

Regarding the EU's main trading partners for other modes of transport in 2023, the United Kingdom was the largest partner with 32.6% of the EU exports and 24.1% imports; Switzerland was the second largest partner with 24.0% exports and 11.6% imports. The third largest partner was the United States with 7.2% for exports and 11.5% for imports (see Figure 10).

Source: Eurostat (bop_its6_det)

Postal and courier services

Postal and courier services[4] cover the pick-up, transport and delivery of letters, newspapers, periodicals, brochures, other printed matter, parcels, and packages, including post office courier and mailbox rental services.

Figure 11 shows the evolution of postal and courier services for the period 2010 to 2023. During the period 2010-2013, EU exports and imports of postal and courier services were largely stable. Both exports and imports of postal and courier services recorded a sharp increase in 2014 (exports by 188% and imports by 89.8%). Between 2014 and 2019, export and import transactions were fairly stable again and increased significantly between 2020 and 2022. In 2023, the values decreased slightly, by 3.3% for exports and by 3.8% for imports. The balance of postal and courier services was negative until 2013 and has been positive since 2014.

Source: Eurostat (bop_its6_det)

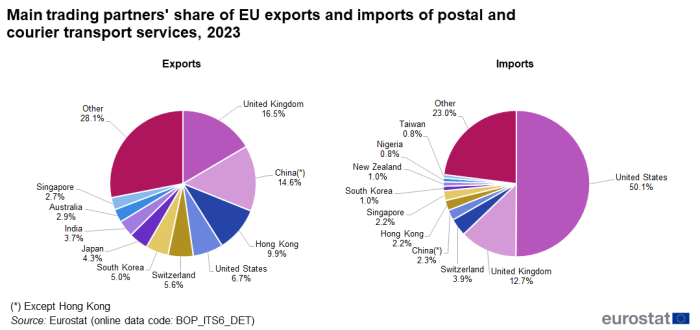

For postal and courier services, the EU's main trading partner for exports in 2023 was the United Kingdom with 16.5%, followed by China (except Hong Kong) with 14.6% and Hong Kong with 9.9%. Regarding imports, the main partner in 2023 was the United States with a share of 50.1%, followed by the United Kingdom with 12.7% and Switzerland with 3.9% (see Figure 12).

Source: Eurostat (bop_its6_det)

Source data for tables and graphs

Data sources

EU data on transport services trade come from the Eurostat reference database on international trade in services and are prepared in accordance with BPM6, the current balance of payments methodology. The data are updated annually. They are available since 2010 for EU aggregates, all EU Member States and non-EU countries (EFTA, candidate countries and other countries). Pre-2010 data are also available in the Eurostat reference database but are prepared in accordance with the previous balance of payments methodology (BPM5). Statistics on EU trade with extra-EU are calculated as the sum of trade conducted by the 27 Member States and the European Union institutions (except the European Central Bank and European Stability Mechanism) with the countries outside the EU (no flows within the EU are taken into account).

Transport[5] is the process of carriage of people and objects from one location to another as well as related supporting and auxiliary services.

Transport can be classified according to:

- (i) mode of transport and

- (ii) what is carried. The transport services category can be further divided into 4 sub-categories[6] , namely:

- Sea transport

- Air transport

- Other modes of transport

- Postal and courier services.

For instance, in the case of passenger transport, international trade in transport services covers all services provided to non-residents by resident carriers and to residents by non-resident carriers. Nevertheless, the transport of travellers (non-residents) is not included in transport. In international services trade it is classified under travel services. In the case of freight, transport services include all the international transport of the economy's exports and imports of goods. Moreover, it includes freight services provided by resident operators on the compiling economy's imports inside the customs frontier of the exporting economy (exports of freight services). Accordingly it also comprises transport services provided by non-resident operators of the compiling economy, inside the customs frontier of the compiling economy, on the compiling economy exports (imports of freight services).

Context

International trade in services makes up part of the current account of the balance of payments and covers the transactions between the residents and non-residents of a country during a given period. International trade in services follows the BPM6 methodology, which uses 12 main service categories, one of which is transport services. EU trade in services with non EU countries has been on an increasing trend from 2010 to 2023 for both imports and exports.

Footnotes

- ↑ As defined by the Balance of Payments Manual 6 (BPM6) par. 10.74

- ↑ According to MSITS par. 3.83

- ↑ According to MSITS par. 3.84

- ↑ According to the Balance of Payments Manual 6 (BPM6) par. 10.82

- ↑ As defined by the Balance of Payments Manual 6 (BPM6) par. 10.74

- ↑ As defined by the Balance of Payments Manual 6 (BPM6) par. 10.74

Explore further

Other articles

- All articles on balance of payments

- Balance of payments and international investment position manual (BPM6)

- Measuring international trade in services - from BPM5 to BPM6

- Services trade by enterprise characteristics - STEC

- EU international trade in other business services

- International trade in services

- Services trade statistics by modes of supply

- International Trade in Services statistics - background

Thematic section

Methodology

- Balance of payments - International transactions (BPM6) (ESMS metadata file — bop_6_esms)

- International trade in services, geographical breakdown (BPM6) (ESMS metadata file — bop_its6_esms)

External links

- European Commission — Trade

- International Monetary Fund (IMF) — International Trade in Services: Recent Methodological Developments

- Newsletter of the Interagency Task Force on Statistics of International Trade in Services

- OECD — Services trade

- United Nations Conference on Trade and Development (UNCTAD) — Manual on Statistics of International Trade in Services 2010 (MSITS 2010)

Legislation

- Regulation (EC) No 184/2005 of 12 January 2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment. (Summary)

- Regulation (EU) No 555/2012 of 22 June 2012 amending Regulation (EC) No 184/2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment, as regards the update of data requirements and definitions.

- Regulation (EU) No 2016/1013 of 8 June 2016 amending Regulation (EC) No 184/2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment.