Data extracted in June 2025.

Planned article update: June 2026.

Highlights

Source: Eurostat (bop_c6_a) and (nasq_10_nf_tr)

In 2014, the methodological standards for compiling European national accounts (NA) and balance of payments statistics (BOP) were harmonised. Hence, in applying both methodologies, the European System of Accounts 2010 (ESA2010) and the Balance of Payments and International Investment Position Manual in its 6th edition (BPM6) suggest a high degree of comparability and consistency between the rest-of-the-world sector (ROW) in NA and BOP statistics [1], eliminating methodological discrepancies which existed in the previous editions of both manuals. Consequently, the economic activities that are captured in both statistics should lead the user to the same conclusions, because for example, an export of goods or services from the compiling economy to the rest of the world should be recorded by both statistics as the same phenomenon of economic activity. Where this is not the case, the economic reading of data becomes difficult and challenges the reliability of both statistics. Such discrepancies could arise from, for example, the lack of synchronised revision practices, different data sources used in the compilation, the insufficient coordination of compilation practices or different readings of the methodological standards by the respective compilers. In regard to national peculiarities in organising statistical compilation processes, some countries could be more concerned than others; in regard to complexity, some data components could be more exposed than others.

Since 2015, Eurostat together with the ECB systematically has analysed inconsistencies, based on annual quality reports, compiler surveys and regular monitoring exercises and emphasises the importance of comparable statistics in Europe, both at national and EU level. In the report below, Eurostat gives an updated view on the current state of consistency in the accounts of the EU Member States. This comparison is based on annualised quarterly balance of payments and quarterly sector accounts statistics and was carried out by using publicly available data in Eurostat’s dissemination database for both BOP and NA of the EU Member States.

The international accounts (BOP) correspond to the rest of the world (ROW) accounts of the NA, however, with different viewpoints

The BOP accounts correspond to the rest of the world (ROW) accounts of the NA. They differ, however, in that the balance of payments is expressed from the perspective of the resident sectors, whereas national accounts data for the rest of the world are expressed from the perspective of non-residents. In other words, the BOP entries are the mirror image of the NA entries relating to the rest of the world. Thus, the corresponding sign of non-financial accounts balances of the ROW sector have to be switched for the purposes of a direct comparison with BOP data. The sub-items of the accounts itself are directly comparable in both statistics, and the overall balance in BOP regarding the current and capital account should resemble in NA the sign adjusted value of net lending/net borrowing of the ROW sector account (Table 1).

A cursory look at the (annualised) data from the statistics of the BOP and NA (ROW sector account) reveals that, indeed, the data sets appear similar, as they describe the same economic phenomena (Table 2). The statistics of the EU aggregate, which is compiled by Eurostat, show high similarities in their non-financial components, while the country statistics of the EU countries record in some cases deviating figures[2]. With this reasoning, consistency measures are consulted in order to assess the size of deviations.

Source: Eurostat (bop_c6_a) and (nasq_10_nf_tr)

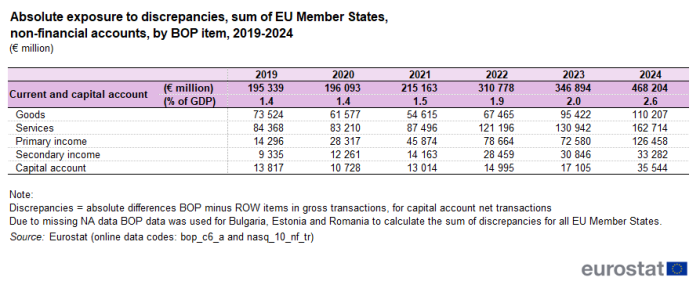

Services transactions are most exposed to discrepancies

The current analysis confirmed a continued existence of inconsistencies between BOP and NA within the country statistics of EU countries and with differing exposure to specific components of the non-financial accounts. According to Table 3, absolute aggregated discrepancies among EU countries are summed up to an EU total. For analytical purposes this helps to monitor developments in the underlying data seen from a European rather than a national perspective. For the current and capital account this figure increased from a total of €195.3 billion in 2019 (i.e. 1.4% of EU GDP) to €468.2 billion in 2024 (i.e. 2.6% of EU GDP).

During the observed period, the services account reported the highest absolute discrepancies, followed by the goods account for the reference years 2019, 2020, 2021, 2023 and primary income for 2022 and 2024. By taking into account the absolute transaction values for goods, the detected inconsistencies for this current account component can still be considered as moderate if measured on a relative basis, however, an increase in absolute discrepancies from 2019 to 2024 is also visible. The absolute inconsistencies in secondary income and for the capital account balance are, compared to other current account items rather small. However remarkable increases between 2019 to 2024 from €9.3 billion to €33.3 billion respectively from €13.8 billion to €35.5 billion are visible as well.

Source: Eurostat (bop_c6_a) and (nasq_10_nf_tr)

3 EU countries are the main contributors in absolute terms

A look at the underlying individual country data revealed a highly diversified picture of existing discrepancies in each EU country in absolute terms (Figure 1). France, Germany, and Ireland showed the highest absolute discrepancies within the EU, contributing together almost 78% of all measured discrepancies during the observed period from 2022 to 2024. On the other side a considerable number of EU countries such as Denmark, Spain, Latvia, the Netherlands and Finland displayed no or only very low absolute inconsistencies in their non-financial accounts.

The detected average absolute discrepancies in the three countries which were responsible for most of the absolute inconsistencies are related to different components of the non-financial accounts. Among the EU countries, France showed the highest discrepancies for goods, services and primary income transactions while Germany displayed the largest absolute inconsistencies for secondary income transactions and the capital account balance. Ireland exhibited the second highest absolute inconsistencies for services. In addition to these three countries considerable absolute discrepancies were also detected for Sweden concerning services, for Luxembourg regarding services and primary income transactions and for Czechia in particular for the primary income account.

When measuring discrepancies as a relative share of the underlying transactions, the goods account showed the highest level of consistency among most EU countries. Exceptions for not exhibiting a high consistency in relative terms for goods were France, Malta and Luxembourg.

Source: Eurostat (bop_c6_a) and (nasq_10_nf_tr)

9 EU countries indicated high relative inconsistencies in some of their current account components and in the capital account

If inconsistencies that are calculated by taking the absolute difference between BOP and NA on the credit side plus the one on the debit side are measured as a relative share of GDP, small and open economies like Luxembourg and Malta exhibited the highest discrepancies in relative terms. Huge EU economies, like Germany that showed very large absolute inconsistencies, displayed considerably lower relative discrepancies. The highest relative inconsistencies were observed for primary income followed by services. According to Figure 2, Luxembourg exhibited the most significant relative difference for primary income (13.5%) and services (12.6%), followed by Malta with (8.4%) for services and Ireland (6.8%) also for services. Furthermore, considerable relative inconsistencies of at least 1.0% of GDP or more were reported by Czechia (1.8% for primary income), Greece (1.4% for the capital account balance), France (2.0% for goods, 2.0% for services and 1.3% for primary income), Cyprus (2.4% for services and 3.9% for primary income), Slovakia (1.3% for the capital account balance) and Sweden (2.0% for services).

Source: Eurostat (bop_c6_a) and (nasq_10_nf_tr)

Inconsistencies in the financial account

The financial account complements the current and capital account, and provides information on how economic transactions of the non-financial accounts are financed. In order to give a complete picture of cross border transactions, the BOP financial account is compared with mirror financial account figures published by NA. Technically, the transactions for net acquisition of assets and net incurrence of liabilities recorded in BOP should match the corresponding liabilities and assets of the ROW sector account in NA. Only the sign of the financial account balance of the NA ROW data has to be switched for the purposes of a direct comparison with BOP data. As there are some implicit complexities in this comparison with distorting effects[3], the comparison of total net values can give an approximate indication on the consistency in the financial account. In contrast to the non-financial accounts, where a more detailed comparison especially for the current account is feasible, a more detailed breakdown of the financial account components appears difficult due to different concepts applying to the financial statistics of the BOP and the ROW sector (functional versus instrument categorisation)[4].

By taking a look at aggregated discrepancies for total net financial account transactions, Malta (22.8% of GDP), Luxembourg (12.8% of GDP) and Ireland (11.9% of GDP) exhibited the highest mean relative inconsistencies in their net financial account value for the studied period 2022-2024. Figure 3 also discloses that for a total number of 20 EU countries relative differences were below 1.0% of their GDP. The highest average absolute discrepancies between BOP and NA were reported by Ireland (€62.1 billion), Germany (€57.1 billion) and Greece (€14.1 billion).

Source: Eurostat (bop_c6_a) and (nasq_10_f_tr)

Detected contradictory balances - severe limitations to statistical comparability

Contradictory balances arise when BOP and NA release statistics, where the nominal balance for the same current account or capital account component has an opposite sign. They reflect the most unfortunate feature of inconsistent statistics, because contradicting messages are communicated to the user. Reported net surpluses or deficits in BOP should be equally reflected by the corresponding balances of the ROW sector in NA. Positive balances or surpluses represent higher international transactions on the credit than on the debit side in this context, while negative balances indicate deficits resulting from higher values on the debit than on the credit side.

Table 4 informs that 6 EU countries had contradictory balances in their non-financial accounts during the studied period from 2022 to 2024. Greece for the secondary income account (2022 and 2023) and the capital account (2024), Croatia for the primary income account (2024), Cyprus for the capital account (2023 and 2024), Lithuania for the primary income account (2024), Slovenia for the capital account (2023) and Slovakia for the secondary income (2023 and 2024) as well as for the capital account (2022, 2023 and 2024).

Source: Eurostat (bop_c6_a) and (nasq_10_nf_tr)

Likewise, in the financial accounts the total net value of BOP assets minus liabilities (including net financial derivatives and monetary gold as part of reserve assets) and the mirror sign adjusted total net value of assets minus liabilities of the ROW sector should exhibit the same sign in NA. If the total net value is positive, it shows in net terms, the economy supplies funds to the rest of the world taking into account acquisition and disposal of financial assets and incurrence and repayment of liabilities. A net borrowing towards the rest of the world is indicated by a negative net value in the financial account.

Table 5 exhibits inconsistent reported net values in BOP and NA concerning the financial account during the period from 2022 to 2024. Greece (2022 and 2024), Luxembourg (2022 and 2023), Malta (2024) and Sweden (2024) showed different signs in their total net financial transactions. Contradictory balances concerning financial positions were displayed by France (2024), Italy (2022) and Lithuania (2024).

Source: Eurostat (bop_c6_a), (bop_iip6_q), (nasq_10_f_tr) and (nasq_10_f_bs)

Source data for tables and graphs

Data sources

Eurostat monitors developments in consistency between BOP and National Accounts statistics with regular data comparisons of quarterly BOP (QBOP) and quarterly and annual sector accounts (SA) from NA for the ROW sector. According to the methodological standards, these data are comparable and should be reconciled with little or no inconsistencies. The time span of the analysis (2019-2024) was chosen due to the broad availability of BOP time series, which were compiled according to the BPM6 standard, and the reduced risk for revision effects coming from historical data due to different revision practices. The analysis focuses on gross transactions data in the current account, allowing discrepancies to be identified in regard to BOP credit/NA payables and BOP debit/NA receivables, respectively. With the lack of underlying gross transactions in one component (acquisition less disposals of non-financial, non-produced assets) for the capital account, net transactions are compared. From the financial account, total net values (assets minus liabilities) are compared between BOP/IIP with corresponding transactions/positions of the ROW sector accounts (financial transactions and balance sheets) in NA. Few data gaps challenge the analysis, as some Member States have not delivered comparable NA data; therefore, Greece and Romania were excluded from this analysis due to missing NA data.

The results of this report are based on data available in Eurobase in June 2025 and it is implicitly assumed that the published time series are directly comparable in all Member States. Quarterly and annual NA data usually become available three weeks after the corresponding QBOP data release. Due to the different publication calendars and revision practices, revision and vintage effects in some Member States cannot be entirely excluded.

Context

Although the methodological standards are closely aligned, discrepancies between BOP and NA data still persist and have drawn the attention of researchers. Eurostat, in close cooperation with the European Central Bank (ECB), has identified the major causes for inconsistencies in the non-financial accounts as follows:

- The organisational setting of national compilation processes plays a prominent role in explaining the occurrence of inconsistencies particularly in the non-financial accounts. In many Member States data compilation is decentralised, i.e., both the national statistical institute and the national central bank share parts of the compilation processes. Data inconsistencies can arise when there is a lack of cooperation or coordination regarding data exchange, and different interpretations of methodological standards.

- Different access to (micro) data sources or source statistics generates discrepancies, in particular for items that can be measured from a heterogeneous spectrum of data sources. It has been further shown that “contagion effects” arising from different (vintages of) source data, could import inconsistencies into the final statistical product (e.g. financial data for the calculation of investment income).

- Items difficult to measure through surveys or administrative data sources are naturally subject to estimations or extrapolations (e.g. Financial Intermediation Services, Indirectly Measured [FISIM]). This paves the way for discrepancies, when applied by more than one institution and without coordination.

- Due to the specific objectives in each set of statistics and the foregone investment in IT infrastructure, compilation systems are less flexible for being redesigned or adapted to new needs. Further, manipulation of underlying compilation processes requires back data revisions, which challenge data stability of longer time series. Consequently, national counterparts generally appear less inclined to challenge already established and effectively working operational processes, even when their statistical products diverge from each other to some extent. It has also been recently emphasised by some Member States that in the above context balancing practices of NA on the ROW sector can hardly be reconciled with the BOP.

- Institutional peculiarities foster discrepancies arising from different delineations of economic sectors (e.g. captive financial institutions, government sector). International organisations play an important role in clarifying identified issues in a coordinated manner.

- International recommendations have so far focused on the consistent treatment of data in BOP and NA, but abstracted from the dilemma that through their recommendations the consistency to other macroeconomic statistics (e.g. Input-Output tables) is challenged in specific cases. This exposes the compiler to the dilemma of choosing between conflicting priorities.

- Revision and vintage effects persist as “statistical noise” due to different publication calendars and revision practices, which hamper full consistency. Consequently, zero absolute discrepancies appear achievable only from fully integrated production systems or systems with a high degree of coordination. It has also been emphasised by some Member States that coordination of production processes for the most recent quarterly data is not so common, because most of the coordination for the statistical products occur during the annual revision cycles.

Eurostat maintains its ambitions to reduce overall discrepancies in the EU Member States' NA and BOP statistics and has supported investigations to the fundamental reasons for inconsistencies. National compilers are encouraged to increase comparability of their statistical products with high priority, in abolishing directional inconsistencies in their statistics (i.e. contradictory signs in the account balances and net values). The overall aim is a full reconciliation of BOP and NA in all EU Member States. At the same time, Eurostat is aware that statistical comparability is not alone guaranteed by fully consistent national data, but also by symmetric data with its major international partners. Currently, European statistics still show high asymmetries both among the EU Member States and with some prominent external trading partners. This poses an additional challenge to the comparability and the reputation of European statistics. The European Statistical System and the European System of Central Banks as a supranational network effectively address these issues and as a coordination body thus can contribute to better quality of data of European statistics, both for the EU/EA aggregates and national data.

Footnotes

- BPM6 Appendix 7, ESA2010 Chapter 18 ↑

- ROW sector accounts figures for Bulgaria, Estonia and Romania were not available and therefore these countries were excluded from this analysis. ↑

- BOP financial derivatives are, consequently, recorded only as net values and thus can only be compared with the corresponding net values of the national sector accounts ↑

- Obrzut R. (2016), in: EURONA, p. 112 ↑

Explore further

Other articles

Database

- Balance of payments statistics and International investment positions (BPM6) (bop_q6)

- National accounts (ESA 2010), see:

Publications

Methodology

External links

Legislation

- Regulation (EC) No 184/2005 of the European Parliament and of the Council of 12 January 2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment.

- Summaries of EU Legislation: EU statistics — balance of payments, trade in services and foreign direct investment

- Commission Regulation (EU) No 555/2012 of 22 June 2012 amending Regulation (EC) No 184/2005 of the European Parliament and of the Council on Community statistics concerning balance of payments, international trade in services and foreign direct investment, as regards the update of data requirements and definitions.

- Regulation (EU) No 2016/1013 of the European Parliament and of the Council of 8 June 2016 amending Regulation (EC) No 184/2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment (Text with EEA relevance)

- Regulation (EU) No 549/2013 of the European Parliament and of the Council of 21 May 2013 on the European system of national and regional accounts in the European Union

- Summaries of EU Legislation: European Union system of national and regional accounts