Archive:Chemicals manufacturing at regional level

- Data from March 2008, most recent data: Further Eurostat information, Main tables and Database.

What effects do the economic and regional policies of the European Union (EU) have on the business structure of the regions? Which sectors are growing, which sectors are contracting and which regions are likely to be most affected? What are the differences in investment levels and wages and what effects will this have on growth and the future location of business?

A detailed analysis of the structure of the European economy can only be made at regional level. Regional Structural business statistics (SBS) provide data with a detailed activity breakdown which can be used for this kind of analysis. This article analyses the activity of chemicals manufacturing in detail.

Main statistical findings

The article focuses on chemicals manufacturing (NACE division 24), where raw materials, particularly oils and minerals, are transformed into a wide variety of substances which are used as inputs by many downstream economic sectors and in a wide variety of consumer products. Chemicals manufacturing, dominated by the manufacturing of pharmaceuticals and basic chemicals (see Graph 1), was the fifth-largest manufacturing activity (NACE division) in terms of employment in the EU-27 in 2005. It also had the second-highest labour productivity (value added per person employed). While employment in chemicals manufacturing has decreased steadily in the EU-27 over the last decade, production has increased steadily (respectively – 8 % and + 22 % in total between 2000 and 2007, according to short-term statistics), indicating a considerable increase in productivity. Chemicals manufacturing is a sector dominated by large enterprises. Small and medium-sized enterprises (SMEs), with fewer than 250 persons employed, accounted for only one third of the workforce in the EU-27 in 2005, compared with close to 60 % in manufacturing as a whole and around two thirds in the total non-financial business economy. The European enterprises within this sector account for about 30 % of global chemicals sales and include many of the world’s largest enterprises (groups) [1].

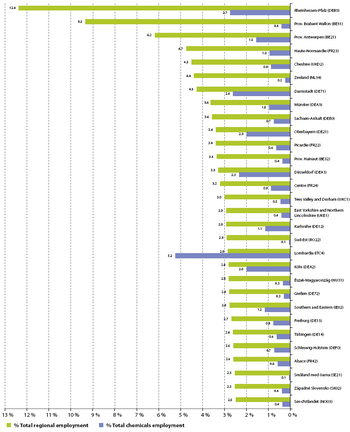

Graph 2 shows the 30 regions most specialised in chemicals manufacturing in 2005, in terms of this activity’s share of total non-financial business economy employment. The most specialised region was Rheinhessen-Pfalz (Germany), where 12.4 % of the total persons employed worked in chemicals manufacturing. Five of the 10 most specialised regions in chemicals manufacturing were in Germany, two of the top four were in Belgium, and there were also several highly specialised regions in France and the United Kingdom. Only three of the 30 most specialised regions were in Member States that joined the EU in 2004 or 2007, namely Sud-Est in Romania, Észak- Magyarország in Hungary and Západné Slovensko in Slovakia. Graph 2 also shows the share accounted for by these regions in total chemicals employment in the EU-27 and Norway.

Many of the regions shown were also among those with the largest workforces, including 15 of the 30 largest regions in terms of employment in 2005, including nine of the 14 regions with a workforce over 20 000 people. This includes Lombardia in Italy, the region with the largest workforce of all, alone accounting for 5.2 % of total chemicals employment in the EU-27 and Norway in 2005. However, the figure also includes several smallersized regions where chemicals manufacturing accounted for a large proportion of regional employment, but where the region’s actual share of total chemicals employment was rather small.

By far the largest difference in relative terms concerned the second and sixth most specialised regions: Prov. Brabant Wallon in Belgium and Zeeland in the Netherlands, where chemicals manufacturing accounted for 9.3 % and 4.4 % respectively of regional employment in 2005, which was respectively 23 and 18 times their contribution to total chemicals employment in the EU-27 and Norway (0.4 % and 0.2 %).

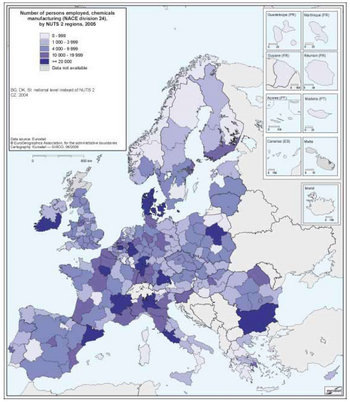

Map 1 shows the size of the chemicals manufacturing workforce in the regions of the EU-27 and Norway in 2005. As can be seen, this activity was relatively dispersed throughout the EU, but with a sizeable part located in central Europe: particularly in western Germany, northern Italy, France, Belgium and the Netherlands. The regions with the largest chemicals manufacturing workforces in 2005 were Lombardia in northern Italy (with 96 000 persons employed), Île-de-France (81 000) and Cataluña in Spain (62 000), followed by five regions in southern and western Germany: Rheinhessen- Pfalz (50 000), Darmstadt (48 000), Düsseldorf (43 000), Köln (37 000) and Oberbayern (36 000).

Between 2004 and 2005, employment in chemicals manufacturing increased in 105 regions, decreased in 156 regions and was unchanged in four regions (see Map 2). In total, employment among the regions shown decreased by 20 600 persons employed, or 1.1 %. There is some evidence of an increase in the regional concentration of employment in chemicals manufacturing. In France and Italy, employment has risen substantially in the regions with the largest workforce while, at the same time, it has fallen in almost every other region. As a consequence, the leading regions have significantly increased their share of total national employment: from 23.5 % in 2004 to 30.9 % in 2005 in the capital region of France, and from 45.7 % to 48.8 % in Lombardia in Italy. In addition, an analysis of the employment trend based on the employment size-classes used in Map 1 shows that employment decreased in all classes, except the one containing the regions with the largest workforces. The 16 regions with a chemicals workforce of over 20 000 persons employed in 2005 recorded a total net increase of 19 300 persons employed, or + 3.0 %, between 2004 and 2005.

Employment in regions with a workforce of between 10 000 and 19 999 decreased by 3.2 %, with a decrease of 2.4 % in regions with a workforce between 4 000 and 9 999. The largest relative decline in chemicals employment occurred in regions with the smallest workforces: 1 000 to 3 999 persons employed (– 5.7 %) and below 1 000 persons employed (– 5.0 %). Five of the eight regions with an increase in employment of more than 1 000 people were among the regions with the largest workforces in 2005: Île-de-France (Paris region) with an increase of 21 000 persons employed, Lombardia in Italy (+ 5 300), Düsseldorf (+ 2 100) and Oberbayern (+ 1 300) in Germany and Southern and Eastern in Ireland (+ 1 200). The other three regions had a relatively small chemicals workforce in 2005, despite growth of between 15 % and 25 %: Prov. Brabant Wallon in Belgium (+ 1 900), Lorraine in north-eastern France (+ 1 300) and Sør-Østlandet in southern Norway (+ 1 100).

Chemicals employment decreased by over 1 000 people in 19 regions: five of these were in the United Kingdom, four in France, three each in Germany and Italy, one each in Belgium, Hungary and Romania, and also Denmark (considered here as one region). The largest decrease was recorded in Picardie in north-western France (– 3 400 people), followed by Köln in Germany (– 3 000) and Région de Bruxelles-Capitale/Brussels Hoofdstedelijk Gewest in Belgium (– 2 600).

Investment and growth are correlated at the macro level, but not necessarily in terms of employment creation, as investments in new machinery and equipment could reduce the need for labour input. Map 3 shows how much was invested, on average, per person employed in chemicals manufacturing in 2005 in each region, with regions classified in one of two categories according to the size of the chemicals workforce: below 4 000 persons employed, or 4 000 and above. It should be noted that data have not been adjusted to take into account differences in purchasing power between regions, which generally are significantly lower in the Member States that joined the EU in 2004 and 2007.

The highest investments relative to the size of the workforce in chemicals manufacturing were recorded in Åland (Finland) and in Ionia Nisia (Greece), but these were among the regions with the smallest workforces, which means that, in euro terms, investments were actually among the smallest of all the regions. Among the regions with over 4 000 people working in chemicals manufacturing the highest investment rate was recorded in Sør-Østlandet in Norway, EUR 42 100 per person employed, followed by Észak-Magyarország in Hungary with EUR 38 400 and Cheshire in the United Kingdom with EUR 36 800. Five of the 16 regions with over 20 000 persons employed in chemicals manufacturing had an investment rate of over EUR 15 000 per person employed: these were Southern and Eastern in Ireland (EUR 33 800), Oberbayern in Germany (EUR 20 800), Denmark (EUR 19 700), Köln in Germany (EUR 16 300) and Prov. Antwerpen in Belgium (EUR 15 300).

The investment rate tended to be higher on average in regions which experienced an increase in employment. Regions where employment decreased in 2005 recorded an investment rate of EUR 12 900 per person employed on average. This is somewhat lower than the investment rate in regions where employment increased (EUR 13 300). The difference is greater between the 20 regions with the largest increase and decrease in employment — EUR 14 700 and EUR 12 500 respectively.

Furthermore, the averages for both sets of regions with an increase in employment are strongly affected by the relatively moderate investments per person employed in the two regions with the largest workforces: Lombardia in Italy (EUR 11 900) and the French capital region (EUR 10 200). If these two regions are excluded, the average investments per person employed for regions with an increase in employment would be EUR 14 000, while the average for the top 20 regions would be as high as EUR 17 500.

Data sources and availability

Regional structural business statistics (SBS) are collected within the framework of a Council and Parliament regulation, according to the definitions and breakdowns specified in the Commission regulations implementing it. The data cover all the EU Member States and Norway. (Data for Bulgaria are only presented at the national level as, at the time of writing, data are only available according to pre-accession regional breakdowns.) These and other SBS data sets are available on the Eurostat website under the theme ‘Industry, trade and services’ (select ‘Data’/‘Industry, trade and services’/‘Horizontal view’/‘Structural Business Statistics’). Selected publications, data and background information are available in the section of the Eurostat website dedicated to European business, located directly under the theme ‘Industry, trade and services’ — see special topic regional structural business statistics. Most data series are continuously updated and revised where necessary. This chapter reflects the data situation in March 2007.

Structural business statistics are presented by sectors of activity according to the NACE Rev. 1.1 classification, with a breakdown down to the two-digit level (NACE divisions). The data presented here are restricted to the non-financial business economy. The non-financial business economy includes sections C (Mining and quarrying), D (Manufacturing), E (Electricity, gas and water supply), F (Construction), G (Wholesale and retail trade), H (Hotels and restaurants), I (Transport, storage and communication) and K (Real estate, renting and business activities). It excludes agricultural, forestry and fishing activities and public administration and other non-market services (such as education and health, which are currently not covered by the SBS), as well as financial services (NACE section J), which for the time being are collected on a voluntary basis only. These activities together accounted for around 30 % of the total EU-27 value added and 38 % of employment in 2005, according to national accounts. They could, however, represent a substantially larger share in certain regions. The observation unit for the regional SBS data is the local unit, which is an enterprise or part of an enterprise situated in one geographically identified place. Local units are classified into sectors (by NACE) according to their main activity. At national level, the statistical unit is the enterprise. An enterprise can consist of several local units. It is possible for the principal activity of a local unit to differ from that of the enterprise to which it belongs. Hence, national and regional structural business statistics are not entirely comparable. It should be noted that in some countries the activity code assigned is based on the principal activity of the enterprise in question.

Regional data are available at the NUTS 2 level for a limited set of variables: the number of local units, wages and salaries, the number of persons employed and investments in tangible goods. The latter variable is collected on an optional basis, except for Industry (NACE sections C to E), which results in a more limited availability of data than for the other variables. Below is a summary of the definitions of the variables presented in this publication:

Number of persons employed: The total number of persons who work (paid or unpaid) in the observation unit, as well as persons who work outside the unit who belong to it and are paid by it. It includes working proprietors, unpaid family workers, part-time workers, seasonal workers, etc.

Gross investment in tangible goods: All new and existing tangible capital goods, whether bought from third parties or produced for own use, having a useful life of more than one year, including non-produced tangible goods such as land. Also included are all additions, alterations, improvements and renovations which prolong the service life or increase the productive capacity of capital goods.

Wages and salaries: The total remuneration, in cash or in kind, payable to all persons on the payroll (including home workers) in return for work done during the accounting year. Wages and salaries include the value of any social contributions, income taxes, etc. payable by the employee, even if they are paid directly by the employer. Wages and salaries do not include social contributions payable by the employer.

Context

Regional structural business statistics offer a detailed, harmonised data source for users who want to know more about the structure and development of the regional business economy. This chapter has shown how some of these data can be used to analyse different regional business characteristics. These are just some examples. As more time series become available, it will be possible to study changes in specialisation or concentration patterns, for example. Further horizontal studies can also be carried out where regional structural business statistics are used in combination with other sources to increase the understanding of the factors affecting the regional business economy and the driving forces behind structural changes.

Further Eurostat information

Publications

- International Sourcing in Europe - Statistics in Focus 4/2009

- European business – facts and figures – 2007 edition

- Quarterly panorama of European business statistics

- Key figures on European business – with a special feature section on SMEs

Main tables

- Structural Business Statistics (Industry, Construction, Trade and Services)

- Special topics of structural business statistics

Database

Dedicated section

Other information

- Business register – recommendations manual

- Use of administrative sources for business statistics purposes

- Handbook on the design and implementation of business surveys

- Structural business statistics – national methodologies

- Glossary of business statistics

External links

- CEFIC - European Chemical Industry Council website

- C&EN Chemical and engineering news in European business

- Lisbon Strategy

See also

Notes

- ↑ Source: CEFIC and Chemical and engineering news in European business: facts and figures, 2007 edition, Eurostat (2008).