Archive:Enlargement countries - industry and service statistics

Data extracted in June 2021.

Planned article update: April 2022.

Highlights

Industrial output in the candidate countries and potential candidates grew between 3.3% and 67.5% from 2010 to 2020.

Domestic output prices increased in the candidate countries and potential candidates between 12.1% and 195.3% from 2010 to 2020.

Construction costs for new residential buildings more than trebled in Turkey between 2010 and 2020.

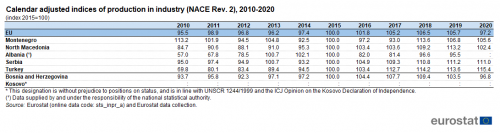

Calendar adjusted indices of production in industry (NACE Rev. 2), 2010-2020

This article is part of an online publication and provides information on a range of business statistics for the European Union (EU) enlargement countries, in other words the candidate countries and potential candidates. Montenegro, North Macedonia, Albania, Serbia and Turkey currently have candidate status, while Bosnia and Herzegovina and Kosovo* are potential candidates.

The article provides statistics for several business cycle indicators, including: the industrial production index, the industrial domestic output price index, construction production and costs indices, and the volume of sales index for retail trade.

Full article

Industrial production index

At the onset of the global financial and economic crisis in 2009, there was a sharp contraction in industrial activity. However, by 2011 the industrial production index had returned to growth in the EU and also in most of the candidate countries and potential candidates (see Table 1).

(index 2015=100)

Source: Eurostat (sts_inpr_a) and from annual data collection cycle – see Data Sources

Most of the candidate countries and potential candidates for which data are available (no data for Kosovo) recorded growth in industrial output in 2011, the exception being Montenegro where output contracted by 10.0 %. It is possible to evaluate the extent of the recovery from the crisis by comparing the levels of output in 2010 with the most recent data available for industrial production indices, either 2019 or 2020 depending on the economy; note that no comparison is available for Kosovo. Industrial output in Montenegro was 1.8 % higher in 2020 than in 2010 while in Bosnia and Herzegovina it was 3.3 % higher, in Serbia it was 16.8 % higher and in North Macedonia it was 20.9 % higher. Two of the countries stood out in terms of the growth of their industrial output during the last decade: in Turkey, output was 65.3 % higher in 2020 than in 2010, despite a slight fall in 2019 (the first since the crisis); in Albania, output went up 67.5 % between 2010 and 2019, which was the highest growth in the candidate countries and potential candidates, despite falls in 2015, 2016, 2017 and 2019.

The growth seen in the EU (up 3.6 % in 2011) turned into decline in 2012 (down 2.1 %) and in 2013 (down 0.6 %). Thereafter, there were five consecutive years of growth for EU industrial output, ranging between 1.2 % in 2014 and 3.3 % in 2017. This recovery was short-lived as further reductions in output followed in 2019 (down 0.8 %) and in 2020 (down 8.0 %). The Covid-19 pandemic caused all countries to experience a slowdown in activity as output fell either in 2019, 2020, or both.

Production changes by main industrial grouping

Figure 1 presents the changes in the volume of output according to industrial groups. These groups include intermediate goods, capital goods, durable consumer goods, non-durable consumer goods and electricity.

(index 2015=100)

Source: Eurostat (sts_inpr_a)

Among the candidate countries and potential candidates for which data is available (no data for Albania and Kosovo), Montenegro had the highest growth in the production of intermediate goods (up 38.0 %) and durable consumer goods (up 85.9 %) in 2020 compared to 2015. In contrast, it also was the country for which capital goods (down 44.6 %) and non-durable consumer goods (-30.9 %) decreased the most. North Macedonia had the highest growth in the output of capital goods with +44.9 % over the same period. The highest increase in the output of non-durable consumer goods and electricity, gas, steam and air conditioning supply were reported in Turkey, with +19.6 % and +16.2 %, respectively. In contrast, Serbia was the only country showing a fall between 2015 and 2020 for electricity, gas, steam and air conditioning supply (down 1.2 %). Finally, Bosnia and Herzegovina showed, in 2020, the highest falls in the output of intermediate goods (down 3.6 %) and durable consumer goods (down 7.7 %).

The change in the production levels of the EU between 2015 and 2020 were more moderate than in most of the candidate countries and potential candidates. The highest fall was observed for capital goods (down 6.7 %), while the largest increase was for non-durable consumer goods (up 3.7 %).

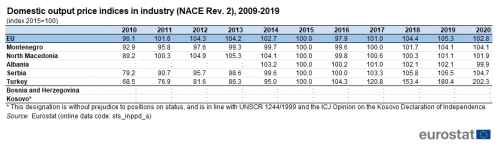

Domestic output price indices

The development of domestic output price indices — also known as domestic producer price indices (PPIs) — for industry reflects price changes in goods that are sold by manufacturers; they provide an early indication of inflation, and can be found in Table 2. One of the key drivers in the development of output price indices is global demand for energy resources, in particular, crude oil. Indeed, in recent years the price of oil has fluctuated far more than the price of many other goods. This has had a direct impact on costs faced by manufacturers in a range of industrial activities, with oil price fluctuations often being passed down the production chain between interlinked activities.

(index 2015=100)

Source: Eurostat (sts_inppd_a)

Among the candidate countries and potential candidates (no data available for Bosnia and Herzegovina and Kosovo), the overall change of domestic industrial output prices over the latest 10-year period was positive, except in Albania where there was a slight fall (down 3.2 %) between 2014 and 2020. Montenegro recorded an increase of 12.1 % between 2010 and 2020. Increases of 14.2 % and 32.2 % were reported for North Macedonia and Serbia respectively, while a much larger increase was reported between 2010 and 2020 for Turkey (195.3 %).

In 2011 and 2012, EU industrial output prices rose by 5.7 % and 2.7 % as they recovered from the fall experienced during the global financial and economic crisis. Thereafter, price falls were observed each year between 2013 and 2016. In 2017, 2018 and 2019, domestic industrial output prices increased again by 3.2 %, 3.4 % and 0.9 %. Most recently, in 2020, domestic industrial output prices declined by 2.4 %. Overall, EU industrial output prices in 2020 were 7.0 % higher than they had been at the mid-point of the crisis in 2010.

Construction production and cost indices

Figure 2 presents the production index for construction in the candidate countries and potential candidates, and the EU.

(index 2015=100)

Source: Eurostat (sts_copr_a) and from annual data collection cycle – see Data Sources

Among the candidate countries and potential candidates, the effects of the global financial and economic crisis on construction were most significantly apparent in Bosnia and Herzegovina and in Albania. Indeed, these two countries’ production index for construction fell each and every year during the period 2010-2013. However, from their level in 2010, Albania’s production index increased by almost a third (35.3 %) by 2020, while Bosnia and Herzegovina’s index declined by 10.9 %. The time series for Turkey is shorter and shows an increase of 30.4 % between 2010 and 2016. Serbia more than doubled (104.3 %) its index between 2010 and 2020, even though it experienced a large decline in 2013 and a smaller one in 2020. Between 2010 and 2014, North Macedonia had considerably lower levels of construction output compared to other countries, but reported an increase of 106.8 % in 2020 compared to 2010. Montenegro’s index of production in construction, with 189.9 %, was the highest growth during the period covered.

The EU had a similar development to Bosnia and Herzegovina and Albania, that is, a negative growth each year during the period 2010-2013, returning to annual growth only in 2014. From its post-crisis level in 2010, the EU index of production for construction fell by 2.0 % in 2020. Between 2014 and 2019, construction output grew each year, with the overall growth in this five-year period totalling 11.1 %.

Over the period 2010-2020, there were generally modest increases each year in the construction cost index for new residential buildings (see Figure 3) in Albania (up 3.6 % overall; 2010-2018) and North Macedonia (up 20.2 % overall; 2010-2020), while there were much stronger increases in Turkey (up 213.6 % overall; 2010-2020), in particular in 2018, 2019 and 2020. By contrast, the gross index of costs for residential buildings in Montenegro fell during several years and declined by 8.7 % overall between 2010 and 2019. In the EU, there was an overall growth of 16.9 % over the period 2010-2020.

(index 2015=100)

Source: Eurostat (sts_copi_a) and from annual data collection cycle – see Data Sources

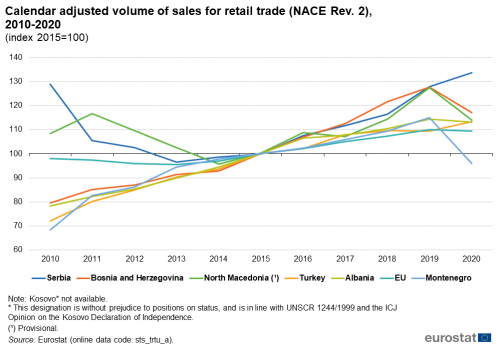

Volume of sales index for retail trade

The volume of sales index is a measure of turnover in the retail trade sector, adjusted to remove price changes (inflation). Figure 4 provides data for this indicator over the period 2010-2020 and shows that the volume of sales index among all candidate countries and potential candidates for which data are available increased in 2020 as compared to 2010 levels. There are no data for Kosovo.

(index 2015 = 100)

Source: Eurostat (sts_trtu_a)

Serbia had the lowest change in the volume of sales index between 2010 and 2020, up 3.7 % overall, with falls between 2011 and 2013 and growth in the other years. The second lowest overall growth between 2010 and 2020 was 5.2 % in North Macedonia, where sales fell in half of the years. In contrast, the volume of sales indices in Montenegro, Bosnia and Herzegovina and Albania, showed uninterrupted growth during the period 2010-2019 (68.3 %, 60.8 % and 46.4 % overall, respectively) only to fall in 2020. Turkey’s volume of sales index rose by 57.4 % between 2010 and 2020, with only a slight 0.1 % fall in 2019.

During the period under consideration, there were often much greater fluctuations in the candidate countries and potential candidates’ volume of sales indices than the developments seen in the EU. The volume of sales index in the EU fell by a relatively small margin during most of the early years shown in the figure, with an overall increase of 11.7 % between 2010 with 2020.

Source data for tables and graphs

Data sources

Data for the candidate countries and potential candidates are collected for a wide range of indicators each year through a questionnaire that is sent by Eurostat to candidate countries or potential candidates. A network of contacts has been established for updating these questionnaires, generally within the national statistical offices, but potentially including representatives of other data-producing organisations (for example, central banks or government ministries). The statistics shown in this article are made available free-of-charge on Eurostat’s website, together with a wide range of other socio-economic indicators collected as part of this initiative.

Traditionally, short-term business statistics (STS) were concentrated on industrial and construction activities, and to a lesser extent retail trade. Since the middle of the 1990s, major developments in official statistics within the EU have seen short-term data collection efforts focus increasingly on services. These data are provided in the form of indices that allow the most rapid assessment of the economic climate within industry, construction and services, providing an early evaluation of recent developments for a range of activities. STS show developments over time, and so may be used to calculate rates of change, typically showing comparisons with the month or quarter before, or the same period of the previous year: the data presented here are annual series derived from monthly or quarterly series. Retail trade indices have particular importance because of the role of retail trade as an interface between producers and final customers, allowing retail sales turnover and volume of sales indices to be used as short-term indicators for final domestic demand by households.

Tables in this article use the following notation:

| Value in italics | data value is forecasted, provisional or estimated and is therefore likely to change; |

| : | not available. |

Context

The profile and use of Short-term business statistics (STS) has expanded, as information flows have become global and the latest news release for an indicator may have significant effects on financial markets or on decisions taken by central banks and business leaders. STS are a key resource for those who follow developments in the business cycle, or for those who wish to trace recent developments within a particular industrial, construction or service activity. Some of the most important STS indicators are included within the principal European economic indicators (PEEIs) that are essential to the European Central Bank for conducting monetary policy within the euro area. Three PEEIs concern industrial short-term business statistics (the production index, output prices of the domestic market and import prices), a further two PEEIs concern construction short-term business statistics (the production index and building permits), while three more concern services short-term business statistics (the volume of sales in retail trade, turnover in other services and services producer prices).

While basic principles and institutional frameworks for producing statistics are already in place, the candidate countries and potential candidates are expected to increase progressively the quantity and quality of their data and to transmit these data to Eurostat in the context of the EU enlargement process. EU standards in the field of statistics require the existence of a statistical infrastructure based on principles such as professional independence, impartiality, relevance, confidentiality of individual data and easy access to official statistics; they cover methodology, classifications and standards for production.

Eurostat has the responsibility to ensure that statistical production of the candidate countries and potential candidates complies with the EU acquis in the field of statistics. To do so, Eurostat supports the national statistical offices and other producers of official statistics through a range of initiatives, such as pilot surveys, training courses, traineeships, study visits, workshops and seminars, and participation in meetings within the European Statistical System (ESS). The ultimate goal is the provision of harmonised, high-quality data that conforms to European and international standards.

Additional information on statistical cooperation with the candidate countries and potential candidates is provided here.

Notes

* This designation is without prejudice to positions on status, and is in line with UNSCR 1244/1999 and the ICJ Opinion on the Kosovo Declaration of Independence.

Direct access to

- All articles on non-EU countries

- Statistical cooperation — online publication

- Enlargement countries — statistical overview — online publication

- All articles on Short-term business statistics

- Short-term business statistics — online publication

- Short-term business statistics introduced

- Statistical books/pocketbooks

- Key figures on enlargement countries — 2019 edition

- Key figures on enlargement countries — 2017 edition

- Key figures on the enlargement countries — 2014 edition

- Leaflets

- Basic figures on enlargement countries — 2019 edition

- Basic figures on enlargement countries — 2018 edition

- Basic figures on enlargement countries — 2016 edition

- Factsheets

- Basic figures on enlargement countries - Factsheets — 2021 edition

Database

- Industry (sts_ind)

- Production in industry (sts_ind_prod)

- Producer prices in industry (sts_ind_pric)

- Construction, building and civil engineering (sts_cons)

- Production in construction (sts_cons_pro)

- Construction cost (or producer prices), new residential buildings (sts_cons_pri)

- Trade and services (sts_ts)

- Wholesale and retail trade (NACE G) (sts_wrt)

- Regulation (EU) 2019/2152 of the European Parliament and of the Council of 27 November 2019 on European business statistics, repealing 10 legal acts in the field of business statistics (Text with EEA relevance)

- Commission Implementing Regulation (EU) 2020/1197 of 30 July 2020 laying down technical specifications and arrangements pursuant to Regulation (EU) 2019/2152 of the European Parliament and of the Council on European business statistics repealing 10 legal acts in the field of business statistics (Text with EEA relevance)