Archive:Enlargement countries - finance statistics

Data from February 2019.

Planned article update: April 2020.

Highlights

Three of the EU enlargement countries — Albania, Montenegro and North Macedonia — recorded government budget deficits every year between 2008 and 2017.

During recent years, the highest annual consumer price increases among the EU enlargement countries were recorded in Turkey.

EU enlargement countries - harmonised indices of consumer prices, 2008-2018

This article is part of an online publication and provides information on a range of financial statistics for the European Union (EU) enlargement countries, in other words the candidate countries and potential candidates. Montenegro, North Macedonia, Albania, Serbia and Turkey currently have candidate status, while Bosnia and Herzegovina and Kosovo [1] are potential candidates.

The article provides finance statistics in relation to a range of topics, including government finance (such as the general government deficit/surplus and government debt relative to gross domestic product (GDP)), foreign direct investment (FDI), the money supply, consumer price indices, interest and exchange rates.

Full article

Government deficit and debt

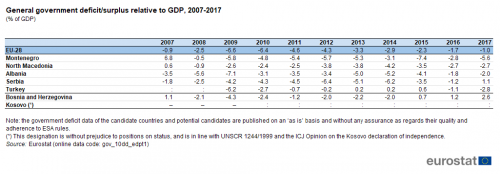

The general government deficit of the EU-28 recovered from the global financial and economic crisis, such that it stood at 1.0 % of GDP in 2017

The global financial and economic crisis triggered a sharp downturn in public finances across Europe and some countries continue to struggle to reduce their public deficits. The average general government deficit across the EU-28 increased to 6.6 % of GDP at the height of the crisis in 2009, but thereafter contracted during eight consecutive years to reach 1.0 % of GDP by 2017. This was a similar level to the deficit recorded in 2007 (0.9 % of GDP) before the crisis and was the fourth consecutive year that the deficit was smaller than 3.0 % of GDP; before this series of four deficits under 3.0 %, the 2.5 % deficit in 2008 was the next most recent one that was under 3.0 %(see Table 1).

(% of GDP)

Source: Eurostat (gov_10dd_edpt1)

Three of the enlargement countries recorded government deficits every year during the period 2008-2017

Prior to the crisis, in 2007, two of the enlargement countries — Albania and Serbia — ran a government deficit, while the other three enlargement countries for which data are available (no information for Turkey or Kosovo) posted surpluses of between 0.6 % of GDP in North Macedonia and 6.8 % of GDP in Montenegro.

This situation changed abruptly in 2008 with the onset of the financial and economic crisis: all of the enlargement countries recorded a government deficit in 2008 and this pattern continued with the deficit (relative to GDP) of each enlargement country widening in 2009. Between 2009 and 2012, the enlargement countries continued to record government deficits. In 2013 and 2014, the situation changed slightly as Turkey reported surpluses (0.2 % relative to GDP in both years). In 2015, Turkey again reported a surplus, as did Bosnia and Herzegovina. In 2016, Bosnia and Herzegovina maintained its surplus while Turkey returned to a deficit (1.1 %) and the other four enlargement countries for which data are available continued to report deficits, ranging from 1.2 % in Serbia to 2.8 % in Montenegro. In 2017, a similar situation was repeated, with Bosnia and Herzegovina maintaining its surplus and most of the other countries maintaining their deficits, although Serbia recorded a surplus for the first time during the period under consideration in Table 1. As such, Montenegro, North Macedonia and Albania reported deficits every year between 2008 and 2017. North Macedonia was the only enlargement country to report that its latest deficit was wider than that reported in 2009, although its deficit had narrowed in both 2015 and 2016 and remained stable in 2017.

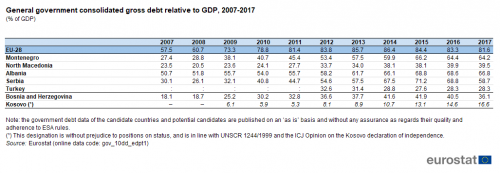

General government debt across the EU-28 stood at 57.5 % in 2007 and rose each year to a peak of 86.4 % in 2014, before falling to 81.6 % in 2017 (see Table 2).

(% of GDP)

Source: Eurostat (gov_10dd_edpt1)

Government debt among the enlargement countries represented between one sixth and two thirds of GDP, a lower proportion than in the EU-28

In 2007, prior to the onset of the financial and economic crisis, the ratio of general government debt-to-GDP in the enlargement countries ranged from 18.1 % in Bosnia and Herzegovina to 50.7 % in Albania; note that Kosovo reported no debt prior to 2009 and that the time series available for Turkey starts in 2012.

Following the onset of the crisis in 2008, government debt (relative to GDP) increased in three of the enlargement countries and in 2009 increases were recorded in all of the enlargement countries. Developments thereafter were more mixed. The latest data available for 2017 show that government debt-to-GDP ratios were lower — sometimes considerably so — across the enlargement countries than in the EU-28: Kosovo had the lowest ratio (16.6 %); Turkey had a ratio just above a quarter (28.3 %); Bosnia and Herzegovina and North Macedonia and had ratios between one third and two fifths (36.1 % and 39.5 % respectively); Serbia had a ratio below three fifths (58.7 %); and Montenegro and Albania had ratios around two thirds (64.2 % and 66.8 % respectively).

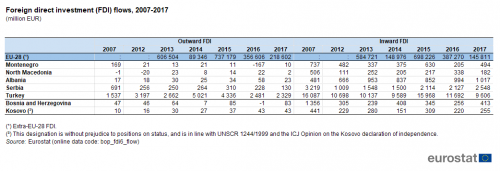

Foreign direct investment

Flows of foreign direct investment (FDI) result from investors building up or reducing their assets abroad by investing in or disinvesting from foreign companies. Flows of FDI are notoriously erratic (with big changes from one year to the next as investment decisions are often lumpy).

Looking at the most recent period for which data are available, outward investment from the EU-28 (into non-member countries) stood at EUR 219 billion in 2017, while inward investment was valued at EUR 146 billion. The value of FDI flows coming into the EU-28 from non-member countries was lower than the value of outward FDI in 2013, 2015 and 2017, while the reverse was true in 2014 and 2016 (see Table 3).

(million EUR)

Source: Eurostat (bop_fdi6_flow)

The level of outward FDI from enlargement countries was considerably lower than that recorded for the EU-28. Furthermore, some of the enlargement countries recorded negative flows of outward FDI, in other words, disinvestment, which occurs when previous investments are withdrawn from foreign enterprises (perhaps to consolidate operations in domestic markets). For example, this occurred in Montenegro in 2016.

Inward foreign direct investment played a considerable role in some of the enlargement countries

Each of the enlargement countries (for which data are available) had a higher level of FDI inflows than outflows; in other words, each of these countries was a net recipient of FDI. This was the case not just in 2017, but in all years shown in Table 3. Together the enlargement countries had a combined level of inward FDI valued at EUR 14.5 billion in 2017, down from EUR 15.8 billion in 2016 and EUR 20.4 billion in 2015. Turkey was the largest beneficiary of inward FDI among the enlargement countries in absolute terms, accounting for two thirds of the total in 2017.

There was growth in the value of inward FDI in Albania between 2007 and 2017, as an overall increase of 111 % was observed. All other enlargement countries recorded lower inward FDI in 2017 than in 2007, down overall by 64 % in North Macedonia and 70 % in Bosnia and Herzegovina.

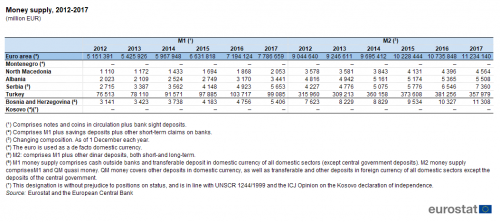

Money supply

The money supply may be simply described as the circulation of money within an economy. There are various measures of money supply and these are differentiated by the liquidity of the assets under consideration (see Table 4). The narrowest definition is M1, which measures the cash and coins in circulation, plus the value of current accounts. M2 is a somewhat broader concept, including M1, plus savings deposits, money market mutual funds and other time deposits — which are less liquid — but may nevertheless be converted relatively quickly into cash or sight deposits.

As may be expected, the amount of money in circulation varies according to the size of each economy, with the money supply in Turkey considerably larger than in any of the other enlargement countries. Serbia recorded the fastest expansion in its money supply (as measured by M1) between 2012 and 2017, increasing overall by 108 %. Turkey recorded the slowest rate of expansion, as the money supply increased by 30 %, less than the increase recorded in the euro area (51 %). Note that there are no data for the money supply covering recent reference periods in Montenegro or Kosovo; both use the euro as their de facto domestic currency.

Generally, if the money supply rises faster than economic growth, then inflationary pressures will be added to the economy. However, in the aftermath of the global financial and economic crisis, the process of quantitative easing was used by several central banks in order to inject additional quantities of money into their banking systems with the goal of encouraging growth; evidence suggests that this process did not result in inflationary pressures (see Table 5 for more information on price developments).

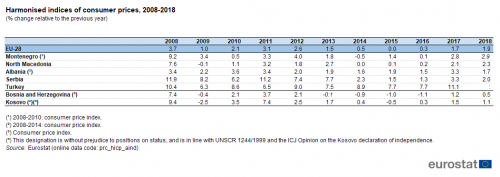

Consumer prices

Consumer price growth within the EU-28 was below 1.0 % between 2014 and 2016, but rose to 1.7 % in 2017 and 1.9 % in 2018

The all-items harmonised index of consumer prices remained at relatively low levels across the EU during the period 2008-2018. The rate of annual price increases in the EU-28 peaked at 3.7 % in 2008, although the effects of the global financial and economic crisis caused a rapid slowdown in price increases in 2009 when a relative low of 1.0 % was recorded. Thereafter, prices in the EU-28 rose by 2.1 % in 2010 and by 3.1 % in 2011, before the pace of price increases slowed in 2012, 2013 and 2014 and came to a halt in 2015 when there was no overall change in consumer prices (see Table 5). In 2016, consumer prices in the EU-28 rose slightly (0.3 %) before increasing by 1.7 % in 2017 and 1.9 % in 2018.

(% change relative to the previous year)

Source: Eurostat (prc_hicp_aind)

The highest price increases among the enlargement countries were recorded in Turkey

Consumer price increases in the enlargement countries over the period 2008-2018 were generally higher than those recorded across the EU, although this was not the case in Bosnia and Herzegovina; this could, at least in part, be attributed to the deregulation of prices which formed part of the liberalisation process undertaken in several enlargement economies. Following a relative peak in 2008, prices fell or rose at a relatively slow pace in 2009 in most of the enlargement countries, before accelerating somewhat in 2010 and 2011 and then returning to more modest increases or price falls between 2013 and 2016. As in the EU-28, prices rose more strongly in 2017 and 2018. Turkey was generally an exception to these developments over the last decade, as it recorded relatively high inflation rates throughout the period under consideration, with annual price increases ranging between 6.3 % and 11.1 %; Serbia was initially also an exception but to a lesser extent, with relatively high inflation rates between 2007 and 2013, after which more subdued rates were recorded. Several enlargement countries experienced deflation in recent years, namely Montenegro in 2014, Bosnia and Herzegovina between 2013 and 2016, and Kosovo in 2015.

The latest information available for each of the enlargement countries shows that consumer price increases in 2018 remained relatively low (no 2018 data for Turkey). Price increases peaked at 2.9 % in Montenegro, while inflation rates were below 2.0 % in Albania, Kosovo, and in Bosnia and Herzegovina.Interest rates

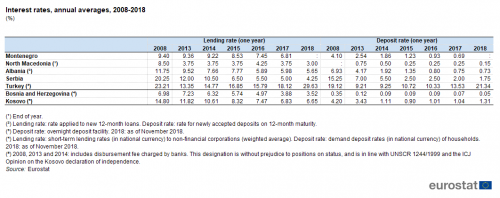

Interest rates equate to the cost charged/paid for the use of money; they are generally expressed as an annual percentage rate (APR). The lending rate is the rate charged by banks on loans to their prime customers: if the borrower is a low-risk party, they will usually be charged a lower interest rate. The deposit rate is the rate paid by commercial or similar banks for demand, time, or savings deposits: larger deposits or deposits for lengthier periods of time will generally attract higher interest payments.

Table 6 shows the variation in lending rates between the enlargement countries; it is important to note that different definitions apply to some of the countries. The latest information available shows that lending rates ranged from 3.00 % in North Macedonia to 6.65 % in Kosovo, with the 29.63 % rate in Turkey far above this range. During the period 2008-2018 there was generally a pattern of falling lending rates. Indeed, most of the enlargement countries recorded their lowest lending rate for the most recent period for which data are available, the exception being Turkey.

This pattern was reproduced when analysing the development of deposit rates, as these rates also fell through to 2018 in most of the enlargement countries. The main exception to this development was again Turkey, where the deposit rate alternated between increases and decreases in most of the recent years, although the latest rate was considerably higher than in earlier years. Deposit rates in 2018 varied from 0.05 % in Bosnia and Herzegovina to 1.75 % in Serbia, with the latest rate for Turkey well above this range, at 21.34 %. The spread in rates (the difference between lending rates and deposit rates) ranged in 2018 between 2.50 percentage points and 6.12 points in most of the enlargement countries, with the spread exceeding this range only in Turkey, where it was 8.3 points.

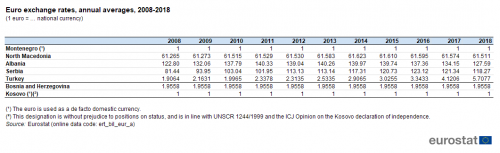

Exchange rates

Market-based exchange rates reflect the rate at which one currency is exchanged for another. Table 7 presents exchange rates for the enlargement countries in relation to the euro; note that while Montenegro and Kosovo are neither EU Member States, nor members of the euro area, they do use the euro as their de facto domestic currency (and as such their exchange rates are set in the table at parity). Note also that Bosnia and Herzegovina maintains a unilaterally fixed exchange rate against the euro and that North Macedonia has pegged its domestic currency to the euro (explaining the low or lack of fluctuation in their exchange rates).

(1 euro = … national currency)

Source: Eurostat (ert_bil_eur_a)

As such, there were only three enlargement countries which had floating exchange rates against the euro during the period 2008-2018. Each of these saw the value of their currency depreciate: the Albanian lek depreciated by 3.8 %, while exchange rate fluctuations against the euro were more marked for Serbia and Turkey, as the Serbian dinar depreciated by 31.1 % and the Turkish lira by 66.7 %.

Source data for tables and graphs

Data sources

Data for the enlargement countries are collected for a wide range of indicators each year through a questionnaire that is sent by Eurostat to partner countries which have either the status of being candidate countries or potential candidates. A network of contacts in each country has been established for updating these questionnaires, generally within the national statistical offices, but potentially including representatives of other data-producing organisations (for example, central banks or government ministries). The statistics shown in this article are made available free-of-charge on Eurostat’s website, together with a wide range of other socio-economic indicators collected as part of this initiative.

The European system of national and regional accounts (ESA) provides the methodology for national accounts and government statistics in the EU. Under the terms of the excessive deficit procedure (EDP), EU Member States are required to provide the European Commission with their government deficit and debt statistics before 1 April and 1 October of each year. From October 2014 onwards, candidate countries (but not potential candidates) were asked to report EDP-related data to Eurostat with the same frequency as EU Member States.

The general government sector includes all institutional units whose output is intended for individual and collective consumption and mainly financed by compulsory payments made by units belonging to other sectors, and/or all institutional units principally engaged in the redistribution of national income and wealth. The public balance is defined as general government net borrowing/net lending reported for the excessive deficit procedure and is expressed in relation to GDP. Government debt is the gross debt outstanding at the end of the year of the general government sector measured at nominal (face) value and consolidated.

Tables in this article use the following notation:

| Value in italics | data value is forecasted, provisional or estimated and is therefore likely to change; |

| : | not available. |

Context

The global financial and economic crisis resulted in serious challenges being posed to many European governments. The main concerns were linked to the ability of national administrations to be able to service their debt repayments, take the necessary action to ensure that their public spending was brought under control, while at the same time trying to promote economic growth.

Within the EU, multilateral economic surveillance was introduced through the stability and growth pact (SGP) which provides for the coordination of fiscal policies. Under the terms of the SGP, Member States pledged that their government deficit would not exceed 3 % of gross domestic product (GDP), while their debt would not exceed 60 % of GDP. Indeed, the disciplines of the SGP are intended to keep economic developments in the EU, and the euro area countries in particular, broadly synchronised. Furthermore, the SGP is designed to prevent EU Member States from taking policy measures which would unduly benefit their own economies at the expense of others. The latest revision of the integrated economic and employment guidelines (revised as part of the Europe 2020 strategy) includes a guideline to ensure the quality and the sustainability of public finances.

Economic and financial statistics have become one of the cornerstones of governance at a global and European level, for example, to analyse national economies during the financial and economic crisis or to put in place EU initiatives such as the European semester or macroeconomic imbalance procedures (MIP). Indeed, these policies are central to the Europe 2020 strategy which seeks to turn the EU into a smart, sustainable and inclusive economy.

While basic principles and institutional frameworks for producing statistics are already in place, the enlargement countries are expected to increase progressively the volume and quality of their data and to transmit these data to Eurostat in the context of the EU enlargement process. EU standards in the field of statistics require the existence of a statistical infrastructure based on principles such as professional independence, impartiality, relevance, confidentiality of individual data and easy access to official statistics; they cover methodology, classifications and standards for production.

Eurostat has the responsibility to ensure that statistical production of the enlargement countries complies with the EU acquis in the field of statistics. To do so, Eurostat supports the national statistical offices and other producers of official statistics through a range of initiatives, such as pilot surveys, training courses, traineeships, study visits, workshops and seminars, and participation in meetings within the European Statistical System (ESS). The ultimate goal is the provision of harmonised, high-quality data that conforms to European and international standards.

Additional information on statistical cooperation with the enlargement countries is provided here.

Notes

- ↑ This designation is without prejudice to positions on status, and is in line with UNSCR 1244/1999 and the ICJ Opinion on the Kosovo declaration of independence

Direct access to

- Enlargement countries — statistical overview — online publication

- Statistical cooperation — online publication

- Statistical books/pocketbooks

- Key figures on enlargement countries — 2019 edition

- Key figures on enlargement countries — 2017 edition

- Key figures on the enlargement countries — 2014 edition

- Leaflets

- Basic figures on enlargement countries — 2019 edition

- Basic figures on enlargement countries — 2018 edition

- Basic figures on enlargement countries — 2016 edition

- Enlargement countries — Economic developments — 2013 edition

- Economy and finance (cpc_ec)

- Government finance statistics (EDP and ESA2010) (gov_gfs10)

- Annual government finance statistics (gov_10a)

- Government deficit and debt (gov_10dd)

- HICP (2015 = 100) - annual data (average index and rate of change) (prc_hicp_aind)

- European Union direct investments (bop_fdi)

- European Union direct investments (BPM6) (bop_fdi6)

- Candidate countries and potential candidates (ESMS metadata file — cpc_esms)

- Europe 2020

- European Commission — Economic and Financial Affairs

- European Commission — European Neighbourhood Policy and Enlargement Negotiations

- European Commission — Priorities — Jobs, growth and investment

- European Commission — Stability and growth pact

- IMF: sixth edition of the balance of payments manual