International trade in goods

Data extracted in September 2023 (part "The three largest global players for international trade: EU, China and the USA") and March 2024 (rest of the article).

Planned article updates: September 2024 (part "The three largest global players for international trade: EU, China and the USA") and March 2025 (rest of the article).

Highlights

This article discusses the development of the European Union's (EU) international trade in goods. It considers the EU's share in world import and export markets, intra-EU trade (trade between EU Member States), the EU's main trading partners, and the EU's most widely traded product categories.

The EU accounts for around 14 % of the world's trade in goods. The value of international trade in goods significantly exceeds that of services (by about three times), reflecting the nature of some services which makes them harder to trade across borders.

This article is part of an online publication providing recent statistics on international trade in goods, covering information on the EU's main partners, main products traded, specific characteristics of trade as well as background information.

Full article

EU imports decreased in 2023

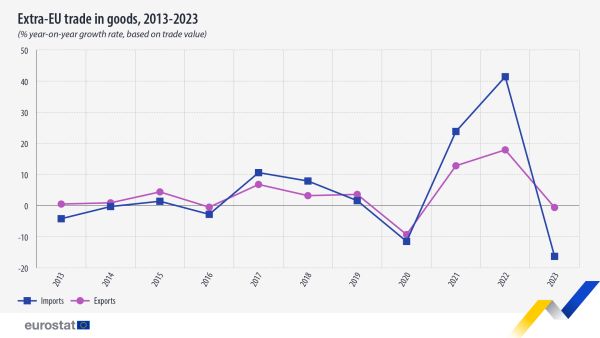

In 2020, EU trade was hit hard by the COVID-19 pandemic, with a significant fall observed for both exports (-9.3 %) and imports (-11.5 %) (see Figure 1). However, both recovered strongly in 2021 and 2022. In 2023 compared with 2022, exports remained stable but imports declined by 16 %, mainly due to falling prices of energy.

In 2023, the EU trade in goods balance registered a surplus of €38 billion. This marks a great contrast compared with 2022 when the EU reported a deficit of €436€ billion due to the high value of energy imports resulting from high prices for energy.

(€ billion and year to year growth rate)

Source: Eurostat - Comext DS-018995

A more detailed view of the is given in Figure 2. In 2022 compared with the same months in 2021, imports and exports grew in every month. In contrast, in 2023 compared with the same month in 2022, imports fell in every month since February 2022.Exports grew in the first three months of 2023 and in June but fell in all other months, most notably in September and December.

(% growth compared with same month previous year)

Source: Eurostat - Comext DS-018995

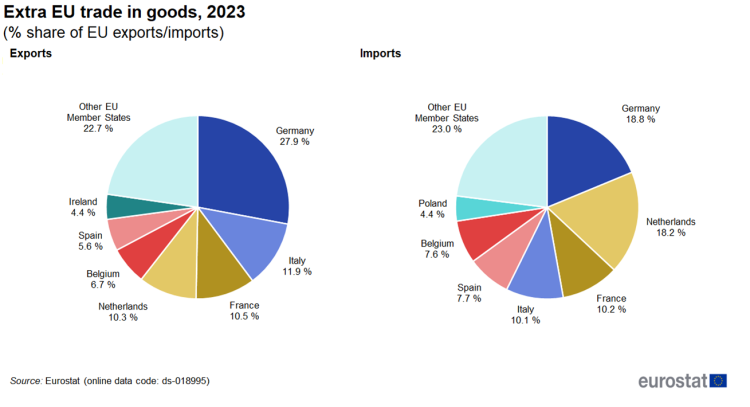

Among the EU Member States, Germany had by far the highest share of extra-EU trade in 2023, contributing 28 % of the EU's exports of goods to non-EU member countries and accounting for almost one-fifth (19 %) of the EU's imports (see Figure 3). The next three largest exporters, Italy (12 %), the Netherlands and France (both 10 %) were the only other EU Member States to account for a double-digit share of EU exports. The Netherlands (18 %), France and Italy (both 10 %) followed Germany as the largest importers of goods from non-member countries in 2023. The relatively high share for the Netherlands can, at least in part, be explained by the considerable amount of goods that flow into the EU through Rotterdam, which is the EU's leading sea port, the so called Rotterdam effect.

(% share of EU exports/imports)

Source: Eurostat - Comext DS-018995

The largest extra-EU trade surplus in goods, valued at €241.8 billion in 2023, was recorded by Germany, followed by Italy (€48.7 billion) and Ireland (€27.7 billion). The largest trade deficits for extra-EU trade in goods were €195.5 billion for the Netherlands, €49.8 billion for Spain and €21.8 billion for Poland (see Table B in the excel file attached below).

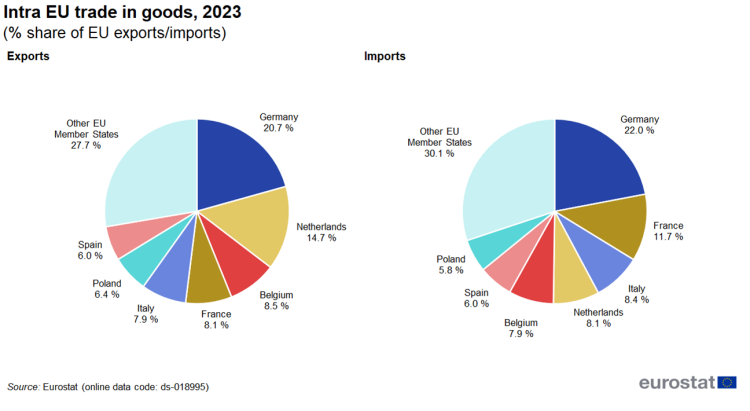

Trade in goods between EU Member States (intra-EU trade) was valued — in terms of exports — at €4 102 billion in 2023. This was 61 % higher than the level recorded for exports leaving the EU to non-EU member countries of €2 556 billion (extra-EU trade).

As with extra-EU trade, Germany was also the EU Member State with the highest level of intra-EU trade in 2023, contributing 21 % of the EU's exports of goods to other Member States and 22 % of the EU's imports of goods from other Member States (see Figure 4). The Netherlands (15 %) was the only other EU Member State to contribute more than one tenth of intra-EU exports, again a consequence of the Rotterdam effect, while France (12 %) was the only other EU Member State to account for more than one tenth of intra-EU imports.

(% share of EU exports/imports)

Source: Eurostat - Comext DS-018995

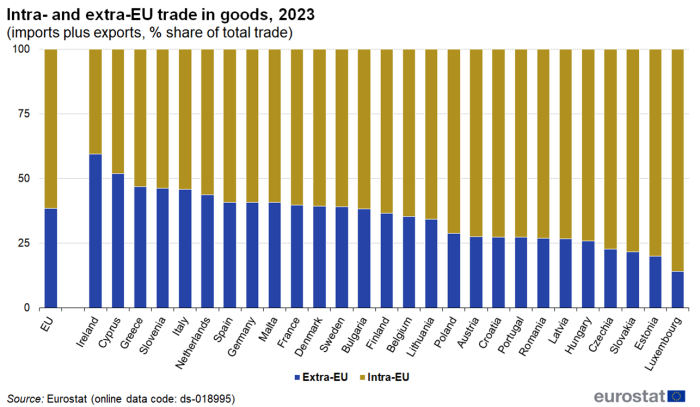

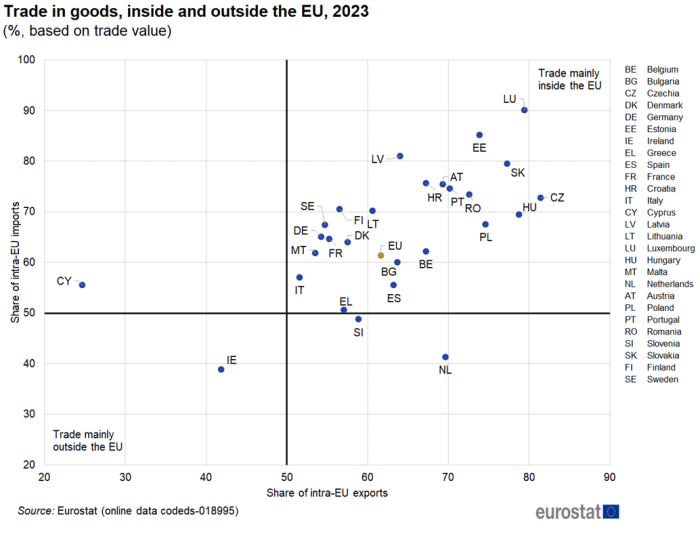

The significance of the EU's internal market is underlined by the fact that intra-EU trade in goods (exports and imports combined) was higher than extra-EU trade (exports and imports combined) for all EU Member States, except Ireland and Cyprus (see Figure 5). The proportion of total trade in goods that was accounted for by intra-EU and extra-EU flows varied considerably across the Member States, reflecting to some degree historical ties and geographical location. In 2023, the highest shares of intra-EU trade (above 75 % of total trade) were recorded for Czechia (77.3 %), Slovakia (78.4 %), Estonia (79.9 %) and Luxembourg (85.8 %) with this ratio falling to 48.0 % for Cyprus and 40.6 % for Ireland.

(imports plus exports, % share of total trade)

Source: Eurostat - Comext DS-018995

This finding is confirmed in Figure 6, which shows most EU Member States' exports as well as imports are with other EU Member States. The exceptions were Ireland (for both imports and exports), Cyprus (only for exports) and Slovenia and the Netherlands (only for imports).

(%, based on trade value)

Source: Eurostat - Comext DS-018995

United States largest partner for exports, China for imports

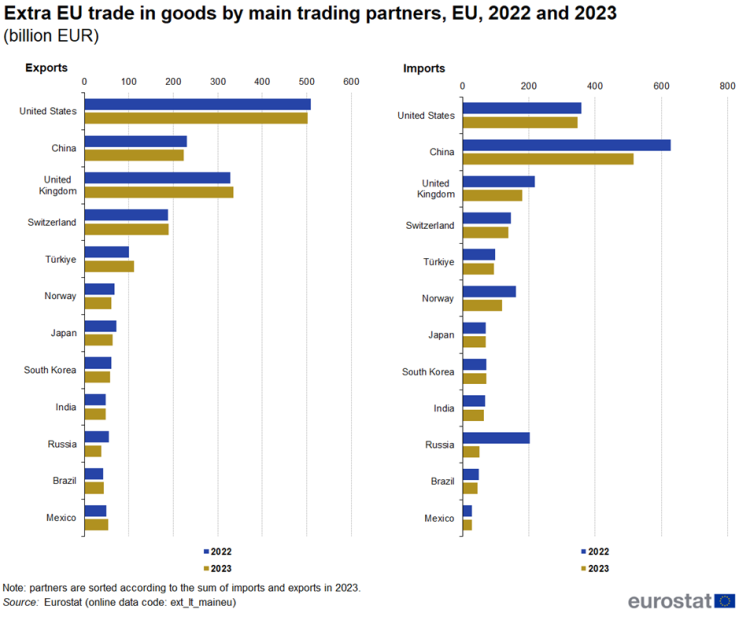

Between 2022 and 2023, among the main trading partners, the highest annual growth rate was recorded for exports to Türkiye (11.9 %) and Mexico (7.4 %) while exports to Russia (-30.3 %) and Japan (-10.3 %) dropped most (see Figure 7).

On the import side, between 2022 and 2023, imports of goods from all main partners fell except Mexico, South Korea and Japan. The largest drops were recorded for Russia (-75.0 %), Norway (-25.9 %), China (-17.8 %) and the United Kingdom (-17.2 %).

(€ billion)

Source: Eurostat - Comext ext_lt_maineu

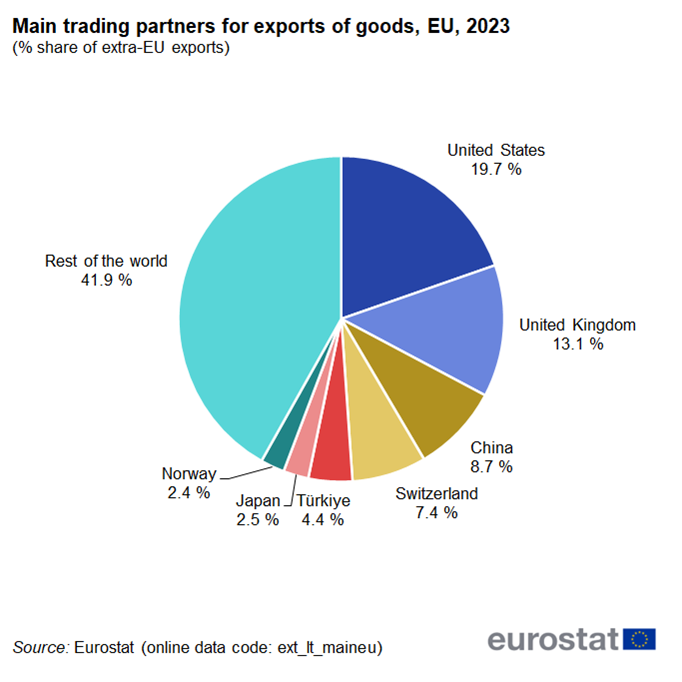

The United States remained the most common destination for goods exported from the EU in 2023 (see Figure 8) with a share of 20 %. The United Kingdom was the second largest destination for EU exports (13 % of the EU total), followed by China (9 %). The seven largest destination markets for EU exports of goods — the United States, the United Kingdom, China, Switzerland, Türkiye, Japan and Norway — accounted for almost three-fifths (58 %) of all EU exports of goods.

(% share of extra-EU exports)

Source: Eurostat - Comext ext_lt_maineu

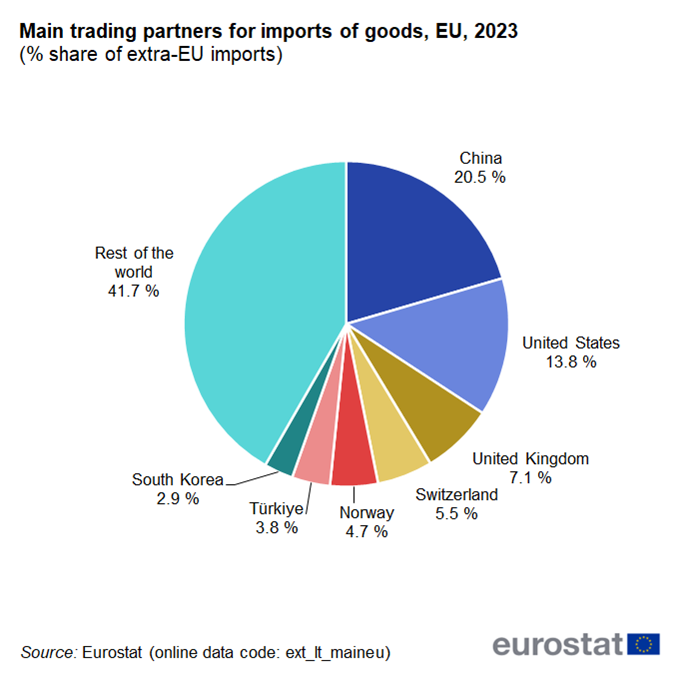

The seven largest suppliers of EU imports of goods were almost the same countries as the seven largest destination markets for EU exports, with South Korea replacing Japan (compare Figure 8 with Figure 9). These seven countries accounted for almost three-fifths (58 %) of all imports of goods into the EU. With one-fifth (20 %) of all imports, China was the largest supplier of goods into the EU in 2023. The United States (14 %) followed at some distance.

(% share of extra-EU imports)

Source: Eurostat - Comext ext_lt_maineu

Large trade surplus for machinery and vehicles and chemicals

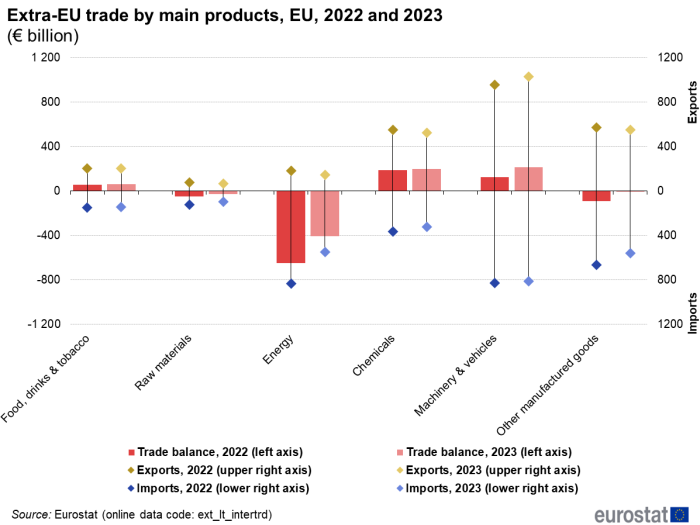

Between 2022 and 2023, the value of extra-EU exports decreased for all product groups shown in Figure 10, except machinery and vehicles. The largest drop was recorded for energy with an decrease of 20.9 % due to sharply decreasing prices. There was also a large drop for raw materials(-10.7 %).

On the import side, decreases were even higher. The largest drops were in the level of extra-EU imports of energy (-33.6 %) and raw materials (-22.6 %). Other manufactured goods (-15.2 %) and chemicals (-10.5 %) also dropped more than 10 %.

The extra-EU trade surplus for goods of €38.0 billion in 2023 was driven by large trade surpluses in chemicals (€198.0 billion) and machinery and vehicles (€210.6 billion) and a smaller surplus in food and drink (€59.8 billion). In contrast there was a large trade deficit for energy (€409.4 billion) and smaller deficits for raw materials (€28.9 billion) and other manufactured goods (€10.3 billion).

(€ billion)

Source: Eurostat - Comext ext_lt_intertrd

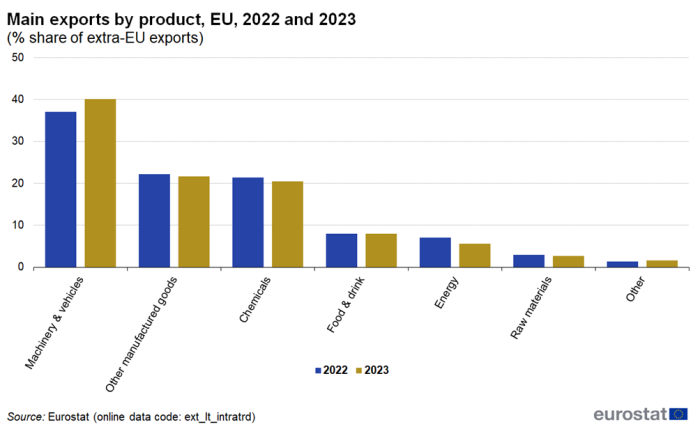

The shares by product of the EU's exports of goods did not change much between 2022 and 2023 (see Figure 11) apart from an decrease of 1.4 percentage points (pp) for energy and an increase for machinery and vehicles of 3.1 pp.

(% share of extra-EU exports)

Source: Eurostat - Comext ext_lt_intertrd

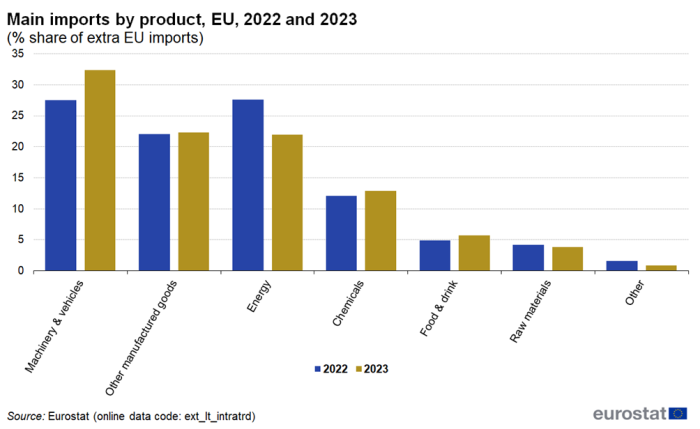

For the shares by product of the EU's imports, there was a large decrease for the share of energy (-5.7 pp) between 2022 and 2023 (see Figure 12). By contrast, over the same period the share of machinery and vehicles (+4.8 pp) increased.

(% share of extra-EU imports)

Source: Eurostat - Comext ext_lt_intertrd

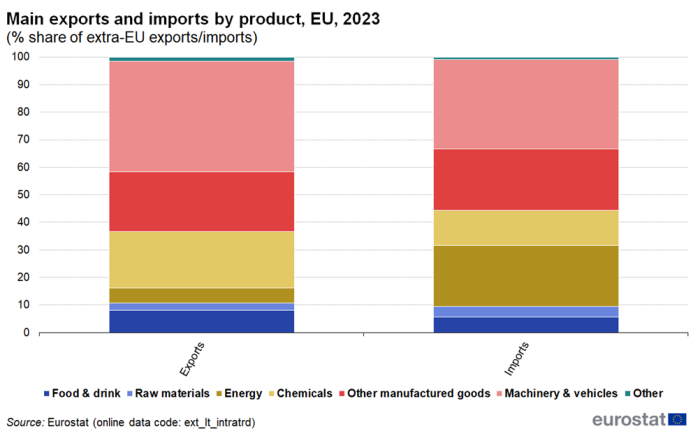

Figure 13 compares the structure of the EU's imports with exports in 2023. It should be noted that the overall level of exports was 1.5 % higher than the level of exports. The most notable difference is in the share of energy which was almost four times as high for imports as for exports. This was balanced by lower import shares for machinery and vehicles and chemicals compared with exports.

(% share of extra-EU exports/imports)

Source: Eurostat - Comext ext_lt_intertrd

The three largest global players of international trade: EU, China and the USA

The EU, China and the United States have been the three largest global players within international trade (see Figure 14) since 2004 when China surpassed Japan. In 2022, the total level of trade in goods (exports and imports) recorded for the EU was €5 575 billion (note this does not include intra-EU trade), which was €417 billion lower than the value for China and €414 billion above the level recorded for the United States.

(€ billion)

Source: Eurostat (ext_lt_introeu27_2020) and UNCTAD

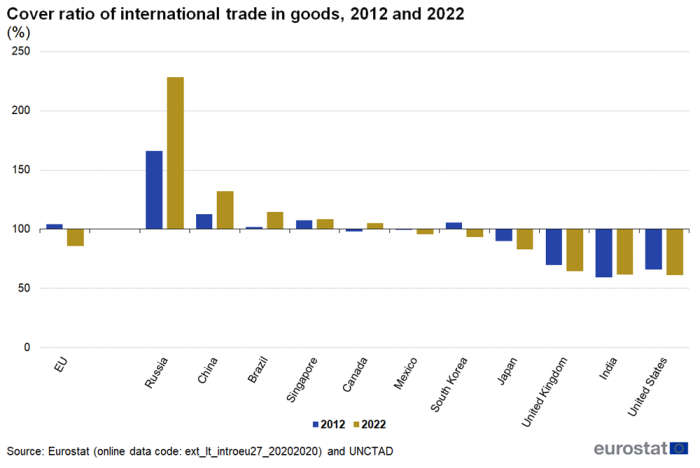

In 2022, the ratio of exports to imports (the cover ratio) was particularly high in favour of exports to Russia and China (see Figure 15), which in absolute terms also had the largest annual trade surpluses. The cover ratio was lowest for the United Kingdom, India and the United States.

(%)

Source: Eurostat (ext_lt_introeu27_2020) and UNCTAD

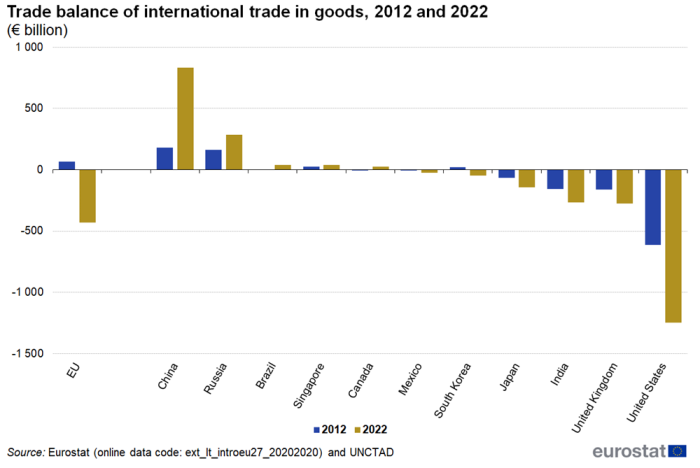

In 2022, the United States had the largest deficit (see Figure 16), continuing a pattern that has been apparent over the whole of the last decade for which data are available, while China had the largest surplus.

(€ billion)

Source: Eurostat (ext_lt_introeu27_2020) and UNCTAD

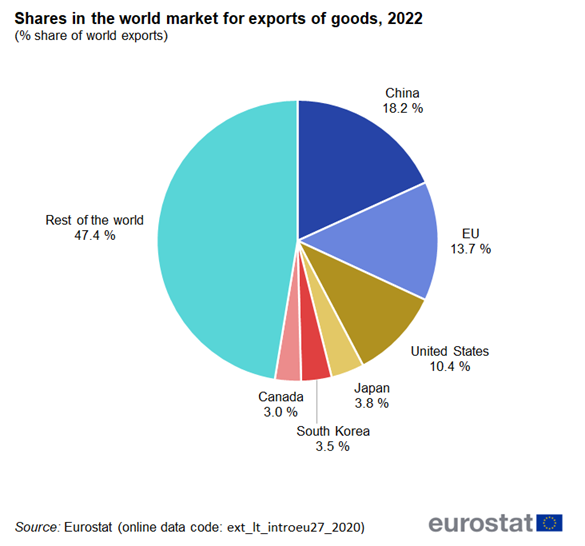

Looking at the flows of exports, the EU (13.7 %) had the second largest share of global exports of goods behind China (18.3 %) but before the United States (10.4 %), see Figure 17.

(% share of world exports)

Source: Eurostat (ext_lt_introeu27_2020)

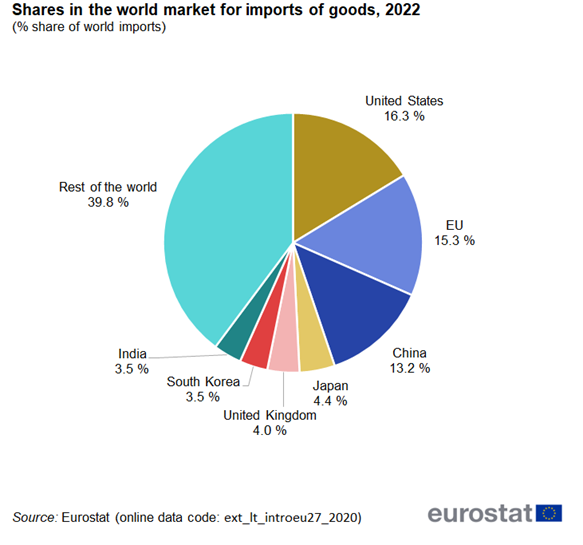

Looking at the flows of imports, the EU (15.3 %) also had the second largest share of global imports of goods behind the United States (16.3 %) but before China (13.2 %), see Figure 17.

(% share of world imports)

Source: Eurostat (ext_lt_introeu27_2020)

Source data for tables and graphs

Data sources

Statistics on the international trade of goods measure the value and quantity of goods traded between EU Member States (known as intra-EU trade) and goods traded by Member States with non-EU member countries (known as extra-EU trade). These statistics are the official source of information on imports, exports and the trade balance in the EU, its Member States and the euro area.

Statistics are published for each declaring country with respect to each partner country, for several product classifications. One of the most commonly used product classifications is the standard international trade classification (SITC Rev. 4) of the United Nations (UN); this allows a comparison of international trade statistics to be made on a worldwide basis.

In extra-EU trade statistics, the data shown for the EU treat this entity as a single trading block. In other words, the data for exports relate only to those exports from the EU that leave the trading block and are destined for the rest of the world, while extra-EU imports relate to imports from the rest of the world (non-EU member countries) coming into the EU. By contrast, when reporting data for individual EU Member States, international trade flows are generally presented in terms of world trade flows (including both intra-EU and extra-EU partners). Statistics on trade between the EU Member States (intra-EU trade) cover imports and exports of goods recorded by each Member State.

The statistical values of extra- and intra-EU trade are recorded at their free-on-board (FOB) value for exports and their cost, insurance and freight (CIF) value for imports. The values reported comprise only those subsidiary costs (freight and insurance) which relate, for exports, to the journey within the territory of the EU Member State from which the goods are exported and, for imports, to the journey outside the territory of the Member State into which the goods are imported.

EU data come from Eurostat's COMEXT database, the reference database for international trade in goods. It provides access not only to both recent and historical data from the EU Member States, but also to statistics for a significant number of non-EU member countries. Aggregated and detailed statistics for international trade in goods as disseminated through Eurostat's website are compiled from COMEXT each month. As COMEXT is updated on a daily basis, data published on the website may differ from the data found in COMEXT (in case of recent revisions).

Data for the non-EU major traders used in Figures 14 to 18 are taken from the UNCTAD database of the United Nations. For the calculation of shares the world trade is defined as the sum of EU trade with non-EU countries (source: Eurostat) plus the international trade of non-EU countries (source: UNCTAD).

Context

Statistics on the international trade of goods are used extensively by decision makers at an international, EU and national level. Businesses may use international trade data to carry out market research and define their commercial strategy. Statistics for international trade in goods are also used by EU institutions in their preparation of multilateral and bilateral trade negotiations, for defining and implementing anti-dumping policies, for the purposes of macroeconomic and monetary policies, and in evaluating the progress of the single market, or the integration of European economies.

The development of trade can be an opportunity for economic growth. The EU has a common trade policy, whereby the European Commission negotiates trade agreements and represents the EU's interests on behalf of its 27 Member States. The European Commission consults EU Member States through an advisory committee which discusses the full range of trade policy issues affecting the EU including multilateral, bilateral and unilateral instruments. As such, trade policy is an exclusive power of the EU — so only the EU, and not individual EU Member States, can legislate on trade matters and conclude international trade agreements. More recently, this scope has been extended beyond trade in goods, to cover trade in services, intellectual property and foreign direct investment (in chapter 4).

Globally, multilateral trade issues are dealt with under the auspices of the World Trade Organisation (WTO). The WTO has 164 members (in March 2020), with several candidate members in the process of joining. The WTO sets the global rules for trade, provides a forum for trade negotiations, and for settling disputes between members. The European Commission negotiates with its WTO partners and participated in the latest round of WTO multilateral trade negotiations, known as the Doha Development Agenda (DDA).

Direct access to