Archive:Statistics on small and medium-sized enterprises

Data extracted in May 2018

Planned article update: May 2019

Authors: George Papadopoulos, Samuli Rikama, Pekka Alajääskö, Ziade Salah-Eddine (Eurostat, Structural business statistics), Aarno Airaksinen, Henri Luomaranta (Statistics Finland)

Highlights

Dependent and independent SMEs and large enterprises

Small and medium-sized enterprises (SMEs) are a focal point in shaping enterprise policy in the European Union (EU). The European Commission considers SMEs and entrepreneurship as key to ensuring economic growth, innovation, job creation, and social integration in the EU. However, in official statistics SMEs can currently only be identified by employment size as enterprises with fewer than 250 persons employed. This is a big category and encompasses enterprises with different ownership structures and varying numbers of employees and levels of economic activity. To facilitate better analysis and understanding of the heterogeneity of SMEs, the 2016 microdata linking (MDL) project linked data from structural business statistics (SBS), international trade in goods statistics (ITGS), business demography (BD) and business registers (BRs). This article presents results of the 2016 MDL project for reference year 2015, based on results from twelve countries.

This article is part of an online publication on Microdata linking in business statistics.

Full article

General overview

- Enterprises employing fewer than 250 persons are a very important part of the economy, as they represent around 99 % of all enterprises and employ an increasing number of persons.

- Most of these enterprises (about 94 %) are independent; they are neither controlled by another enterprise nor control themselves another enterprise and thus do not belong to an enterprise group;

- Dependent enterprises (those that are controlled by another enterprise and/or control themselves another enterprise, and thus belong to an enterprise group) are important in terms of employment and turnover, especially in Denmark, Estonia, Latvia, Finland, Sweden and Norway. Therefore, a large proportion of total growth created by SMEs can be attributed to dependent enterprises.

- About 0.5 % of the enterprises that employ fewer than 250 persons belong to a group that employs 250 or more persons. Therefore, these enterprises are large enterprises according to the SME definition. They contribute significantly to employment and turnover, especially in Croatia, Finland and Sweden.

- 1.6 % of the enterprises were dependent enterprises belonging to an international group for which it was not possible to know the total number of persons employed by the group. These enterprises contribute highly in terms of employment and turnover especially in Estonia, Latvia, Netherlands, Portugal, and Romania.

Basic structures: employment size class breakdown in Structural Business Statistics

Table 2 shows the number of enterprises, turnover and persons employed for 2015 and the share of enterprises with fewer than 250 persons employed. In the non-financial business economy (NACE Rev.2 Sections B to J and L to N and Division S95) enterprises employing fewer than 250 persons make up over 99 % of all enterprises in all EU countries, Norway and Switzerland. They account for around two-thirds of total employment in the EU, ranging from 47 % in the United Kingdom to 85 % in Malta. Enterprises with fewer than 250 persons employed contribute about 56 % of the total turnover in the EU.

Source: Eurostat (sbs_sc_sca_r2)

SME profiling — independent or dependent enterprises?

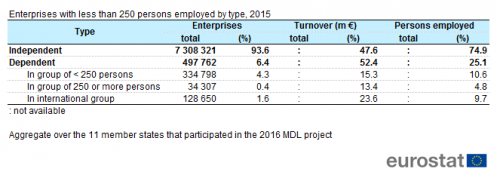

Table 3 presents the number of enterprises, turnover and employment aggregated result of the 2016 MDL project on enterprises with fewer than 250 persons employed for the eleven participating Member States. The majority of these enterprises are independent (93.6 %). In these 11 Member States, only about 500,000 (6.4 %) of the enterprises with fewer than 250 persons employed are dependent (i.e. belong to a domestic or international group). However, these dependent enterprises have a disproportionately large contribution to turnover and employment: they account for more than half of the turnover (52.4 %) and about a quarter of the employment. The 2016 MDL project also provided a further split of the dependent enterprises: if the number of persons employed by the entire group exceeds the threshold of 250 persons employed then the dependent enterprise should be regarded as a large enterprise following SME definition. Those cases are grouped separately (dependent - in group of 250 or more persons).

Most of the dependent enterprises (about 335,000 enterprises or 4.3 % of the total number) belong to a group which employs fewer than 250 people. Therefore, these enterprises may still be considered as SMEs, based on the employment criterion.

About 34,000 dependent enterprises (0.4 % of the total) belong to a group which employs more than 250 people. Therefore, these 34,000 enterprises are in fact large enterprises; they account for 13.4 % of the total turnover and about 5 % of the total employment.

The last group of dependent enterprises (about 129,000 enterprises or 1.6 % of the total) are those belonging to international groups. As it is not always possible to know the size of the foreign part of the group, enterprises belonging to international groups cannot be split into those that belong to a group of fewer or more than 250 persons (unless the domestic part of the group already employs 250 or more persons). It can be assumed that many of those enterprises (be it foreign controlled enterprises or international group heads) will actually be large enterprises. As shown in Table 3, enterprises with fewer than 250 persons employed and belonging to international groups account for about 23.6 % of the total turnover and 9.7 % of the total employment. These numbers highlight the importance of enterprises belonging to international groups. As a conclusion, taking into account the control criterion (independent/dependent) is important when analysing data of enterprises with fewer than 250 persons employed; dependent enterprises behave in a different way than independent ones.

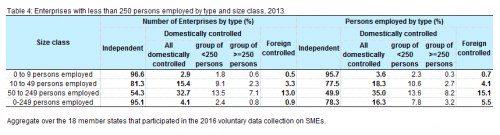

Similar results were found in a previous study – the voluntary data collection on SMEs - in which 18 countries participated. Table 4 shows the aggregate results over the 18 countries that provided data in the 2016 voluntary data collection: Belgium, Bulgaria, Germany, Spain, France, Croatia, Italy, Latvia, Lithuania, Hungary, the Netherlands, Poland, Portugal, Romania, Slovenia, Finland, Sweden and the United Kingdom.

That study included also a size class analysis of the enterprises with fewer than 250 persons employed by splitting them into enterprises with 0 to 9 persons employed, 10 to 49 persons employed, and 50 to 249 persons employed.

The results of the voluntary data collection on SMEs show that the vast majority of enterprises with 0 to 9 persons employed (96.6 %) are independent. Only 0.6 % of these enterprises belong to a group that employs 250 persons or more.

More than half (54.3 %) of enterprises with 50 to 249 persons employed are independent, while 7 % are actually large ones, since they belong to a group that employs 250 or more persons.

Country by country analysis

Table 5 presents the results for each participating country. The totals in this table may not exactly agree with official SBS data, due to the innovative, non-standard methods used in the MDL project. However, Table 5 provides insight into the breakdown of three SBS characteristics according to the control situation of the enterprise (independent vs. dependent enterprises).

Although the share of dependent enterprises is relatively low in most countries their contribution to turnover and employment is significant. In particular, the share of dependent enterprises belonging to international groups is very low (ranging from 0.5 % in Croatia to 5.9 % in Romania). However, the contribution of the same group of enterprises in terms of turnover and employment is much more significant, typically above 10 % in all cases. The only exceptions are Croatia (3 % turnover and 1.6 % of the employment), Bulgaria, Italy and Finland (respectively about 5.5 %, 5.2 % and 8.3 % of the employment of enterprises with fewer than 250 persons is due to the enterprises in international group).

The biggest shares of dependent enterprises with fewer than 250 persons employed are found in Denmark (25.7 %), Norway (22.8 %) and Sweden (16 %). The biggest contribution by dependent enterprises of fewer than 250 persons employed to the total turnover is noted in Norway (73.7 %), Sweden (71.5 %) and Denmark (69.2 %). The biggest contribution by dependent enterprises with fewer than 250 persons employed to the total employment is noted again in the same three countries (Norway 55.9 %, Sweden 54.8 % and Denmark 57.7 %).

Contribution of independent enterprises

Figure 1 presents the contribution of independent enterprises (as a share of all enterprises with fewer than 250 persons employed) in terms of number of enterprises, employment and turnover, for the 12 countries participating in the 2016 MDL project.

In seven out of the twelve countries, at least 90 % of enterprises employing fewer than 250 persons are independent. In Denmark, Norway, Sweden, Estonia and Latvia, the share of independent enterprises was lower than 90 % but more than 70 %. The highest shares of independent enterprises among enterprises with fewer than 250 persons were recorded in the Netherlands (97.9 %) and Portugal (97.4 %).

As regards the employment contribution, the share of independent enterprises ranges between 42.3 % for Denmark and 83.5 % for Portugal. In the majority of countries, independent enterprises with fewer than 250 persons employed accounted for around 70 % to 80 % of the total employment of enterprises in this size class. The employment share of independent enterprises was considerably lower, around 40 % to 45 %, in Denmark, Norway and Sweden.

As regards turnover, independent enterprises with fewer than 250 persons employed account for around 25 % to 30 % of total turnover by all enterprises of fewer than 250 persons in Denmark, Norway and Sweden. In Estonia, Latvia and Finland the contribution of independent enterprises to turnover is in the range 40 % to 45 %. The highest turnover shares for independent enterprises with fewer than 250 persons employed are recorded for Bulgaria (61 %), Croatia (60 %) and Romania (58 %). Even though there are differences across studied countries, the data suggest that, in terms of turnover generation, both dependent and independent enterprises with fewer than 250 persons are roughly equal in importance.

Contribution of dependent enterprises

Figure 2 presents the employment share of dependent enterprises with fewer than 250 persons employed broken down by the three groups studied:

- Enterprises belonging to a group of fewer than 250 persons employed;

- Enterprises belonging to a group of 250 or more persons employed; and

- Enterprises belonging to an international group.

In some countries enterprises belonging to an international group have considerable contribution to employment. This is valid particularly for the Netherlands (18.7 %) and Estonia (22.5). The significant employment contribution of dependent enterprises with fewer than 250 persons are also noted in Latvia, Romania, Portugal, Denmark, Sweden and Norway, ranging between 10 % to 15 %. The most significant employment shares of enterprises belonging to a group of fewer than 250 persons employed were noted in Sweden (28.4 %), Norway (33 %) and Denmark (37.9 %). The contribution of enterprises belonging to groups with 250 or more persons were highest in Sweden (13.3 %) Finland (11 %) and Norway (10 %).

Figure 3 presents the results as regards the turnover share of dependent enterprises with fewer than 250 persons employed. The turnover contribution of enterprises with fewer than 250 persons employed belonging to international groups is even more pronounced than their contribution to employment. The largest turnover share for these enterprises were observed in the Netherlands (44.8 %), Estonia (40.3 %), Portugal (35.9 %), Latvia (35.7 %) and Romania (34.2 %).

Typically approximately 10 % to 20 % of the total turnover can be allocated to enterprises that belong to a group with fewer than 250 persons employed. In Denmark and Norway the corresponding share was higher at around 35 % and in Sweden it reached 24 %. The turnover share of enterprises with fewer than 250 persons employed belonging to large groups (and thus not fulfilling the criteria to be considered as SMEs) was larger in Sweden (24 %), Finland (23.1 %), Croatia (22.6 %) and Italy (17 %).

SME definition

The European Commission defines SMEs as those enterprises employing fewer than 250 persons that have a turnover of less than 50 million euros and/or a balance sheet total of less than 43 million euros (see Commission Recommendation 2003/361/EC). SMEs are further broken down into micro, small and medium enterprises (see table 1 for details). According to the SME definition, the SME status of an enterprise which is part of an enterprise group may need to be determined on the basis of data on persons employed, turnover and the balance sheet from the whole group, and not only on data of the enterprise itself. The SME recommendation contains detailed guidelines on how much of the group’s figures should be included to determine the SME status of an individual enterprise. These guidelines are relatively complex to be fully implemented in statistical systems; additionally, for example, Structural Business Statistics or other data sources of the project contain no information on the balance sheet total of the enterprises.

For these reasons, statistics often use size class information based only on the number of persons employed in the enterprise itself, without looking at the employment, turnover or balance sheet data from the group that the enterprise belongs to. However, doing this has consequences for statistics, since enterprises belonging to a domestic or international enterprise group may be in a different position from independent enterprises, for example, in their ability to access finance, their bargaining power, possibilities to expand to foreign markets, and various other aspects of doing business.

Why is the 'SME vs large enterprise' discussion relevant?

The growth-generating potential of SMEs has been the subject of many academic studies[1]. Although there is no general agreement in the literature on whether SMEs generate more growth than large enterprises, some recent studies[2] suggest that large enterprises are more pro-cyclical, which means that they are more affected by international business cycles than SMEs are. This fact may have implications for how different business sectors, and therefore national economies, behave in times of economic depression.

Recently, economic literature [3] has shifted towards analysing the role of the largest enterprises in understanding aggregate fluctuations. Trade integration, globalisation and industry consolidation have the potential to make large enterprises ever larger and thus more significant in explaining business cycles and economic developments. Large enterprises can account for a sizeable portion of a country’s economic output. Therefore, if global demand for even one product falls, a country can face severe consequences that show in the aggregated measures of economic activity. This has been the case for example in Finland[4]. These microeconomic shocks may also affect the large enterprises’ networks[5]; a fall in demand can have an adverse impact on the whole supply chain, across industries and countries[6].

Breaking down the population into independent and dependent enterprises

In order to facilitate better analysis and understanding of the heterogeneity of enterprises, Eurostat's 2016 microdata linking (MDL) project linked enterprise level data for reference year 2015 from the following sources: structural business statistics (SBS), international trade in goods statistics (ITGS), business demography (BD) and business registers (BRs). One important aim of this work was to provide results broken down by the control criterion i.e. separate results for independent vs. dependent enterprises. Similar results are provided also in the exercise "voluntary data collection on SMEs". The voluntary data collection took place in 2016 (for 2013 reference year) and will be repeated during 2018.

Twelve EU Member States and two EFTA countries participated in the 2016 MDL project. Out of these, eleven Member States and one EFTA country participated in the module exploring the control dimension. These twelve countries are: Bulgaria, Denmark, Estonia, Finland, Croatia, Italy, Latvia, the Netherlands, Portugal, Romania, Sweden and Norway.

This article presents results from the above eleven Member States and Norway broken down into dependent and independent enterprises. Dependent enterprises are further split (where possible) into those enterprises that would still be considered as SMEs based on the employment criterion (because the entire group to which they belong employs fewer than 250 people) and those enterprises that are actually large ones. In the latter case, while the enterprise itself employs fewer than 250 persons, the group to which the enterprise belongs employs 250 persons or more. This means that the statistics still do not completely reflect the recommended SME definition, but they do make it possible to distinguish between independent and dependent enterprises as well as those dependent enterprises that are actually large enterprises (on the basis of persons employed by the whole group).

Aggregate results from the 2016 voluntary data collection on SMEs are also analysed in this article. These two projects demonstrate that statistics which are closer to the European Commission's SME definition can be produced by microdata linking, and provide useful insight on the economic behavior of SMEs.

In this article, the following terms are used to distinguish between the different categories of enterprises:

- Enterprise with fewer than 250 persons employed: this is an enterprise which employs 0 to 249 persons. We do not call these enterprises ‘SME’ as there is no information on whether they also fulfill the remaining criteria of the SME definition;

- Large enterprise: an enterprise that employs at least 250 persons;

- Independent Enterprise: an enterprise which, according to the business register (BR), is not controlled by another enterprise (neither domestic nor foreign), and at the same time, it does not itself control another enterprise (neither in the country of residence nor abroad);

- Dependent enterprise: an enterprise which, according to the BR, is controlled by another enterprise (either domestic or foreign), and/or, it controls itself another enterprise (either in the country of residence or abroad). Dependent enterprises belong to an enterprise group;

- Domestic enterprise group: a group containing enterprises which are all resident in the same country;

- International enterprise group: a group containing at least two enterprises which are all resident in two different countries.

In this article dependent enterprises were further broken down into three subgroups:

- Enterprises belonging to a group of fewer than 250 persons employed. The total number of persons employed by all the enterprises in the group is fewer than 250;

- Enterprises belonging to a group of 250 or more persons employed. The total number of persons employed by all the enterprises in the group is 250 or more (therefore, the dependent enterprise is not an SME, according to the SME definition) and

- Enterprises belonging to an international enterprise group. For these enterprises it may not be possible to know the number of persons employed by the entire group, e.g. because the employment in the non-resident part of the group is unknown. These enterprises are grouped separately as enterprises belonging to an international group.

Source data for tables and graphs

Data sources and availability

In this article enterprises that employ fewer than 250 persons are split into those who do not belong to a group (either domestic or international) and those whodo belong to a group. Data are available for twelve countries that participated in the 2016 microdata linking project.

New statistics on enterprises have traditionally been produced by carrying out surveys. Microdata linking presents an innovative approach to obtaining new information on the economic performance of enterprises by linking different existing statistical sources at individual enterprise level (microdata level). This approach does not require new surveys to be carried out and thus does not increase the burden placed on enterprises. Eurostat will continue to publish results based on microdata analysis.

Context

Small and medium-sized enterprises (SMEs) are the backbone of Europe’s economy, providing the majority of all new jobs. The European Commission aims to promote entrepreneurship and improve the business environment for SMEs to allow them to realise their full potential in today’s global economy. The new Programme for the Competitiveness of Small and Medium-sized Enterprises (COSME) will run from 2014 to 2020, with a planned budget of EUR 2.5 billion.

Direct access to

Notes

- ↑ One early contribution was the Gibrat study (GIBRAT, R.(1931): Les Inegalites Economiques, Sirey. Paris.

- ↑ An empirical example with US data: Moscarini, Giuseppe, and Fabien Postel-Vinay. 2012. ‘The Contribution of Large and Small Employers to Job Creation in Times of High and Low Unemployment.’ American Economic Review, 102(6): 2509-39.

- ↑ An example: Xavier Gabaix. The granular origins of aggregate fluctuations, Econometrica, 79(3):733–772, 05 2011.

- ↑ See the discussion in: Jyrki Ali-Yrkkö (Ed.): Nokia and Finland in a Sea of Change. ETLA B244, pp. 37–67, Taloustieto Oy, Helsinki, Finland, 2010.

- ↑ This is closely related to the discussion on dependent enterprises.

- ↑ A theoretical discussion can be found at: Acemoglu, Daron, Vasco M Carvalho, Asuman Ozdaglar, and Alireza Tahbaz-Salehi (2012), ‘The Network Origins of Aggregate Fluctuations’, Econometrica.