Building the System of National Accounts - measuring quarterly GDP

This article is part of a set of background articles explaining in some detail how statistics producers, such as national or international statistical institutes, may build a coherent system of national accounts (SNA), especially in developing countries. The articles are based on the official Eurostat handbook Essential SNA - Building the basics and they focus particularly on the early stages of the implementation.

The 2008 SNA implementation represents a complex process with several phases. One of the milestones of the 2008 SNA implementation’s six phases calls for the compilation of quarterly national accounts. In addition, the recent economic and political context has brought about an increase in the demand for accurate indicators that provide timely, comprehensive information about the evolution of the economy on a short-term basis. Users obtain this information from quarterly national accounts. In keeping with the objective of the handbook, the present chapter describes the main methodological aspects of quarterly national accounts implementation and development, focusing on quarterly GDP (QGDP). The data sources and methods used for its compilation each quarter, based on two approaches (production and expenditure), are presented, along with numerical examples of estimation procedures. This handbook omits the income approach to calculating quarterly GDP due to a widespread lack of availability of data sources.

Full article

What are quarterly national accounts and why do we need them?

General scope

Quarterly national accounts (QNA) serve two main purposes; namely, to provide information about the evolution of the economy in a more timely manner than annual data, and more comprehensively than individual short-term indicators. Timely, coherent, accurate, comprehensive and reasonably detailed quarterly national accounts serve as a framework for assessing, analysing and monitoring current economic developments.

Compilation of quarterly national accounts is based on the 2008 SNA and other manuals devoted to this task. The 2008 SNA contains no chapter specifically addressing quarterly national accounts issues, but the same principles, classifications, definitions and overall coverage as for annual national accounts apply. The European System of Accounts (ESA 2010) includes a chapter dedicated to this issue.

There are two important requirements for quarterly national accounts. Quarterly national accounts must be: available as soon as possible after the end of the reference period; and as accurate as is feasible to require as little subsequent revision as possible.

A conflict between the two requirements thus arises, as more timely quarterly estimates may require greater subsequent revision. A balance between timeliness and accuracy must therefore be struck, depending on the interests of users of the national accounts data in each country.

The main characteristics of quarterly national accounts are the following.

- Their purpose is to present the short-term movements of the economy, providing a coherent measure of such movements within the methodological framework of national accounts. In contrast with annual estimates, quarterly data focuses on growth rates and their temporal characteristics such as acceleration, deceleration or changes in sign.

- In quarterly accounts, the same standard classification as in annual accounts applies, albeit at a higher level of aggregation. This is because the purpose of quarterly accounts is to give an overall picture of the short-term macroeconomic situation and evolution, rather than to provide the structural details about the economy, which is the domain of annual accounts.

- Due to variations in the intensity of economic activity throughout the year, quarterly indicators are compiled in raw (non-seasonally adjusted) and in seasonally adjusted forms.

- Quarterly national accounts have to be reconciled to annual accounts values (i.e. annual estimates and the sum of the four quarterly estimates should be equal).

- Quarterly national accounts revisions are more substantial and occur more frequently than for annual accounts because of the characteristics of data sources and compilation methods.

Countries all around the world are interested in setting up a system of quarterly national accounts, or in improving their existing systems, to take advantage of the benefits of having such a system in place. These benefits include the following. Quarterly national accounts:

- Provide a timelier picture of the economy in a coherent accounting framework, and offer a means of detecting the phase of the economic cycle, highlighting peaks and troughs. Business cycle fluctuations are successfully captured by quarterly national accounts because the average period of the cycle generally coincides with quarters.

- Incorporate into a common framework the available short-term indicators—which are often incomplete and cover only a specific aspect or sector of economic activity—using a range of classifications, and disseminate these indicators in various ways.

- Supply a pool of useful information for monitoring the economy and suggesting directions for policies concerning the main short-term target variables. Monitoring the short-term movements of major economic flows is possible based on quarterly national accounts data, using indicators such as the output, GDP, private consumption, government consumption, gross fixed capital formation, change in stocks, exports, imports, wages, profits, taxes, and lending and borrowing of the main institutional sectors, with an emphasis on the government sector. Quarterly national accounts record the flows of goods and services at both current and constant prices, which provides insight into the growth dimension of the flows.

- Support on-going economic policy decisions, which require prompt information about the economy over the short term.

- Offer information for other purposes such as econometric modelling, including structural econometric models and multivariate time series models. These models represent a tool for economic policymaking and business cycle evaluation, and an instrument for structural economic analysis and forecasting.

- Offer the framework for further improvements to the entire statistical system. Quarterly national accounts provide a coordinated conceptual framework for designing surveys and collecting economic and social statistical data, as well as a framework for identifying major gaps in the range of available short-term statistics.

Coverage

Quarterly national accounts adopt the same principles, definitions and structure of annual national accounts, and cover, in principle, the entire sequence of accounts and corresponding aggregates, as well as the supply-and-use framework based on the methodology of the 2008 SNA.

The progress of the 2008 SNA implementation in each country is evaluated at the international level against the Standard Minimum Requirement Data Set (MRDS) and the milestones set out by the United Nations.

The section entitled The SNA implementation strategy, in the article Building the System of National Accounts - strategy presents the scope and content of MRDS for annual accounts.

The set of data required to meet the criteria for SNA implementation in the field of quarterly national accounts is presented in Figure 2.

Note: Minimum requirement: adequate implementation of the 2008 SNA, where relevant.

Recommended: recommended for compilation by all countries.

Desirable: Useful statistics that should be compiled, if possible. Tables shown without a number are not included in the annual United Nations Questionnaire (NAQ).

For the institutional sector accounts, the household accounts and the non-profit institutions serving households may be presented together.

Source: Report of the Inter Secretariat Working Group on National Accounts (ISWGNA) to the forty-second session (2011) of the United Nations Statistical Commission

In practice, not all the requested data are compiled; the availability of data sources, the coverage of annual accounts, and the lack of human resources reduces the scope and the coverage for quarterly national accounts. Many countries therefore only provide the main aggregate and the GDP, along with some details from the production and expenditures approaches.

The section 2, Accounts and main aggregates, in the article Building the system of National Accounts - basic concepts presents the three approaches of annual GDP compilation.

Some conceptual issues

Some compilation considerations are particularly important for quarterly estimates; namely, the point at which transactions are recorded, their consistency and the meaningfulness of the estimates.

1. Time of recording

The 2008 SNA defines the time of recording of flows in national accounts and the systems used to do so. Examples of such systems are:

- cash accounting system: transactions are recorded when ‘cash’ (the payment) is received or tendered;

- full accrual accounting system: transactions are recorded when the underlying economic events occur, regardless of the timing of the related payments;

- due for payment: transactions are recorded when a commitment—a liability to make a payment—occurs (e.g. pension liabilities in the public sector, tax payment).

More information concerning the recording of the transactions in national accounts is presented in Chapter 3: Basic concepts, Section 1.4.2: Time of recording.

The choice of system may affect results, especially when the recording period is shorter than one year, as is the case with quarterly accounts. To obtain a record of flows on an accrual basis, as required by the 2008 SNA, some data adjustments are necessary. The process starts with an in-depth analysis of the sources, to gain an understanding of the recording time of the transactions, and continues with adjustments for the current period. For example, if VAT declarations are used for the output estimation, adjustments should be made, taking into account that quarterly data from tax authorities do not refer to the production of the quarter; instead, this data usually has a one-month lag. This means that the value of turnover declared for VAT purposes in April represents the results of the activity carried out in March, thereby requiring adjustments to the data.

2. Consistency in recording and work-in-progress

The main issues, especially for quarterly accounts, are to ensure consistency in the records for:

- Production of goods or services produced over lengthy periods. Unfinished production from one quarter is recorded as inventory of a work-in-progress so as to ensure consistency with the compensation earned by the employees for this production.

- Services produced over lengthy periods. At present, there is growing evidence of producers with activity in the business and financial services industries producing services over lengthy periods. In this respect, quarterly business surveys need to capture incomplete service production, such as inventories of work-in-progress at the end of each quarter, as these surveys would for goods.

- Data for the variables that appear in the accounts by different institutional sectors, and within or between components of the three GDP approaches.

3. The meaningfulness of the quarterly data

In the compilation process of quarterly GDP, a specific issue that needs addressing is meaningful estimation using data from production, expenditure and, possibly, incomes. Some examples of problems that may arise are the following:

- interest payments may occur twice a year or annually;

- payments of taxes on operating surplus may be concentrated in one or two quarters of the year;

- taxes on land and buildings, which may be seen as an annual tax, may be paid irregularly over the course of the year.

Solutions to these problems should be based on the analysis of the phenomena and annual data. For example, to determine the quarterly profile of non-seasonally adjusted data for taxes on operating surplus, an appropriate tax rate from the annual estimates should be applied to the corresponding series of the operating surplus.

Data sources and methods used for QGDP compilation

Data sources

The link between available data sources and methods used for GDP compilation is obvious. Ideally, the three GDP approaches should also be applied for compiling quarterly data, starting from the very preliminary phase of compilation. In reality, however, very few data sources are timely enough for this purpose. In these circumstances, it is necessary to make maximum use of available sources, and establish suitable methods to compile quarterly GDP. In general, none of the three approaches is more reliable than any other because the quality of the sources and the institutional context have an important impact on the accuracy of the estimates. In many countries, the estimates of QGDP by the production approach are considered to have the highest reliability, although good estimates from the income side are only available in a few countries. One of the compilation process steps involves determining the most reliable sources, the appropriate approach or approaches for the estimates based on available sources and, ultimately, the optimal method for reliable QGDP compilation.

In very few cases, a data source is available in a form that enables its direct use for QGDP estimation with little or no adjustment. In most cases, the indicators offered by the existing data sources differ from user needs in some way, and so require adjustments. These adjustments may typically be established for one or a small number of main benchmark years for which additional sources, such as the results of more comprehensive and detailed surveys or censuses, may be available. In these cases, the annual and quarterly time series are anchored to these main benchmark years and the regular source data are used as indicators to update the benchmark estimates. As the annual estimates provide the benchmarks for quarterly indicators, they should be the starting point in selecting and developing quarterly data sources.

Statistical and administrative data sources used for QGDP compilation differ from one country to another, due to:

- the capacity of the statistical system to provide short-term indicators that cover the main economic activities;

- the availability of administrative data, their coverage and the access of national accountants to this data;

- the structure and size of the economy.

Chapter 5 Statistical sources and Chapter 6: Administrative Sources present information about data sources used for annual GDP compilation.

The statistical data sources cover a variety of economic fields that should be integrated into the QGDP compilation process. At the international level, however, it is necessary to harmonise the basic statistics in order to facilitate theoretical and practical comparability. Thus, the greater the degree of harmonisation in classifications, prices, and so forth in different countries’ statistical systems, the more comparable the corresponding national accounts statistics (both annual and quarterly) between nations will be.

For QGDP compilation, the most important statistical sources available within the national statistical system are the following (they are part of the ‘ideal’ data set).

- Short term business surveys, which provide:

- appropriate general information on: sales/turnover; purchases from market, GFCF by principal assets type, inventories by types, foreign trade in services, compensation of employees and employment;

- specific information on: monthly index of production and the monthly (or quarterly) index of retail sales, quantity indicators for hotels and restaurants (overnight stays), transport (tonne km, passenger km), etc.

- Household budget survey (HBS), offering information on household income and expenditures on goods and services. In order to be used for quarterly estimates, it is essential to have an appropriate sample, representative for the period of time, that is sufficiently large to ensure accurate estimates.

- Price statistics, covering the consumer price indices (CPI), producer price indices (PPI) for goods (including agriculture), producer price indices for services, export and import price indices and the construction cost index.

- Foreign trade statistics providing data on imports and exports of goods and services.

The administrative sources generally used for QGDP compilation provided by public authorities or institutions are the following:

- government expenditures and revenues, available on a monthly basis;

- financial statements of financial and non-financial enterprises, which may be available quarterly or twice a year;

- tax declarations, which provide information concerning the turnover and the value of VAT paid;

- balance of payments (BoPs), available monthly;

- building permit issued (data taken from an identifiable public authority);

- registration of vehicles (data taken from an identifiable public authority);

- employment data (e.g. employment register, social security system, etc.).

In the absence of statistical or administrative data, other sources should be sought and used for the compilation of quarterly national accounts indicators. Data from industry associations, industry experts, or leading enterprises in a particular industry may help with the calculation of quarterly indicators. These can be grouped as follows:

- data from research institutes, news agencies, etc. (e.g. opinion surveys and other qualitative data);

- data from professional unions and industry bodies (e.g. information relating to doctors, dentists, lawyers and pharmacists);

- quarterly company reports or special, tailored surveys of a few very large private and public corporations (e.g. utilities and transport usage).

One of the objectives of quarterly national accounts is to provide as much accurate data as possible following the annual methodology and data. For this reason, national accountants should ensure an adequate use of all available sources. It is crucial that they have a good understanding of the indicators these sources provide, their definitions and coverage, how the data are derived, their accuracy, and possible biases. Establishing the ways in which the data sources are used is an on-going exercise. Basic data need continuous monitoring because new issues may emerge at any time. In this respect, national accounts compilers should endeavour to develop a good working relationship with their data suppliers to get the best possible support from these agents and to avoid complications in the compilation process.

The data sources should be assessed for accuracy, reliability and timeliness for several reasons:

- to determine whether a specific data source is suitable for QGDP compilation;

- where more than one data source is available for a particular indicator, the selection of one source should be based on coverage, content, etc.;

- when data from different sources are in conflict, this assessment will lead to a choice on where to make adjustments;

- to identify areas for data source improvement;

- to allow national accountants to inform data users about the quality of the estimates and expected future revisions of the quarterly time series.

In practice, in many cases, there will be little or no choice about sources in the short term. Nonetheless, it is still necessary to assess the data sources and the indicators that may be used based on information from the data providers.

The most important criterion for the assessment of the accuracy of quarterly sources is the extent to which they are able to indicate annual movements. This follows the main requirement of keeping QGDP consistent with annual accounts. The accuracy of the short-term source statistics as indicators of the annual movements depends on definitions and specifications of the variables, and on issues such as coverage, units and classifications. The timeliness of the quarterly source data also has considerable implications for how early QGDP estimates can be disseminated. Usually, the first estimates are based on an incomplete set of data; for some indicators, only two months of the last quarter may be available, while data for other series may be missing completely. In this situation, provisional estimates of QGDP are made based on a simple trend extrapolation, or on alternative indicators that are more timely but less accurate.

It is important to underline that the assessment of the source data may also help identify areas for improvement, both for the quarterly and annual national accounts, with respect to coverage, definitions, units, sources, methods, and so on. In establishing priorities for improvements, the relative importance of an indicator is a key consideration. For many components, the basic data are so poor that refinement of methods would be of doubtful benefit.

The development of QNA methods, including QGDP compilation, also leads to improvements in annual accounts. The regular process of reviewing quarterly estimates brings to light outdated or unrealistic methods and assumptions used for annual accounts, and can contribute to a better compilation of annual data.

Methods for QGDP compilation

As stressed above, QGDP must be closely linked to annual estimates to ensure consistency between short-term and long-term movements. Through the quarterly figures, national accounts seek to provide accurate estimates of unknown future annual GDP. Thus, because in quarterly accounts the emphasis is on relative movements rather than absolute levels, the selection of indicators for quarterly estimates is based on how well these reflect changes in annual national accounts.

The strategy for establishing QGDP compilation and dissemination is based on several steps.

- Consultation with the data users in order to identify their needs, the coverage and details of quarterly data, and the dissemination deadline.

- Performing an inventory of data sources and methods in the statistical system, such as:

- analysis of available annual and quarterly data sources;

- assessment of annual compilation methods;

- identification of the possible links between quarterly and annual data sources and methods.

- Assessment of indicators provided by quarterly data sources, concerning:

- definition (coverage, units, classifications);

- accuracy in indicating quarterly movements;

- revision of sub-annual indicators;

- timeliness (available within at least one month after the end of the quarter).

- Designing compilation methods and procedures based on:

- availability of sources and relevance of indicators on a quarterly basis;

- relations between sources and methods used in annual and quarterly estimates;

- coverage of quarterly estimates, including which parts of the 2008 SNA will be implemented;

- the level of detail of the compilation (two or three digits of the product and industry classifications);

- selection of the integrated or separate annual and quarterly national accounts compilation system;

- the compilation schedule, including dissemination and revision policy.

- Reviewing the quality of data sources and methods of compilation:

- analysing the correlation between annual and quarterly data;

- analysing the revisions of quarterly national accounts aggregates, based on historical data;

- revisions to the quarterly compilation methods based on new data sources or improvements in annual accounts estimation methods.

- Generating time series of QGDP data for past years (‘back series’) and benchmarking them to the time series of annual data. This should be done:

- for a sufficiently long time series;

- at the most detailed compilation level.

- Revision of quarterly national accounts in line with annual results so as to keep data up to date and include new or improved information when available.

- Compilation of the current quarterly GDP based on available data sources by:

- linking monthly and quarterly source data for the current quarters with estimates for the back series;

- extrapolating with indicators;

- benchmarking the time series of quarterly source data to the time series of annual data;

- filling the information gaps.

- Dissemination of the results: first release and revised data.

An important step of the implementation strategy is to decide on the compilation method (Step 4). The QGDP compilation system may be separate from the annual accounts compilation system or integrated into it. Separate systems are commonly found in countries with a comprehensive, detailed annual system that includes annual SUTs, which involve a cross-sectional reconciliation of national accounts indicators. Integrated annual and quarterly accounts compilation systems are typically found in countries not using the SUTs framework for their annual data, which makes it easier to use the same system for annual accounts and QGDP. In an integrated system, the data storage and calculation functions for both annual and quarterly data are carried out within the same processing system, although the level of detail differs (i.e. more details for annual accounts). In this situation, QGDP sources and compilation methods may be benchmarked to annual sources and methods.

The choice of the compilation method depends on the conditions in each country and the specifics of annual and quarterly national accounts, bearing in mind that:

- annual data are subject to a detailed reconciliation process that cannot be applied each quarter;

- quarterly data have a time series dimension; the annual system follows a year-by-year calculation method.

Another important aspect that should be taken into consideration when the methods of product and industry for quarterly national accounts compilation are defined is the recommendation to compile them simultaneously in current and constant prices, and at the most detailed level possible. For this procedure, three options exist:

- to obtain the value at constant prices, and then to inflate the result to obtain the value at current prices;

- to obtain the value at current prices, and then to deflate the result to obtain the value at constant prices;

- to produce independent estimates of the indicators in current and constant prices.

Ideally, the quarterly data sources and the methods should be the same as for annual accounts. In reality, however, this is usually unfeasible. Therefore, simpler methods that differ from those for annual NA compilation are developed to produce QGDP. In general, there are two main approaches for QGDP compilation:

- the direct approach, which is based on the assumption that the basic quarterly data and the corresponding data from the annual accounts are quite consistent, at least in terms of growth rates;

- the indirect approach, which employs statistical techniques to quantify the relationship between a time series of annual data (from the annual accounts) and the available quarterly indicators in order to generate quarterly estimates of the national accounts variables.

As the methods used for the estimation of national accounts are determined by the availability of data, the recommended approach for the compilation of quarterly national accounts aggregates is based on the best use of the existing data sources. This may be described as a ‘pragmatic’ approach. The vast majority of countries use a combination of direct and indirect methods, depending on the availability of source data. For example, when no quarterly indicator is available, national accountants fill gaps in the QNA by looking at the available alternatives to ensure comprehensive estimates of the national accounts aggregates. After choosing a suitable alternative, compilers can use historical patterns in the annual data for the chosen variable as a guide. If a series is volatile and relates to the economic cycle, growth rates of the rest of the economy may be a suitable indicator. Extrapolation on the basis of past trends is generally undesirable, as this approach tends to mask current trends. In the absence of a suitable indicator, a simple, transparent method may be more appropriate than one that is time-consuming and complicated without necessarily providing clear benefits.

Figure 4 shows a schematic representation of the main approaches to estimate QGDP based on the available data sources. The figure depicts the thought process that national accountants should follow to find the most appropriate method for estimating national accounts variables.

Stages 1 to 5 apply when working with some available data that are conceptually related to the QGDP variable.

Stage 1: The basic data are used directly with no amendments required for measurement or for coverage of indicators, although some classification changes for the level of disaggregation of indicators may be admissible. This is most commonly the case when the quarterly data sources meet the national accounts requirements.

Stage 2: If the data fails to meet the SNA requirements, some adjustments are necessary, such as conversion from cash to accruals or adjustments, or amendments regarding the coverage. These techniques are not mathematical nor use a statistical model, but instead are based on the basic data being close to the definition given by the 2008 SNA. The adjustments are relatively small and have a methodological foundation.

Stage 3: Data from sources fail to meet national accounts requirements, but serve a purpose as indicators in a statistical model to estimate the QGDP variables.

Stage 4: Applying some other (non-mathematical and non-statistical) approach, often qualitative, to estimate the path of the QGDP variable using knowledge of the series and of the principal influences upon its level and growth.

Stage 5: In some instances, data sources for quarterly estimates are unavailable, and the only information comes from annual national accounts. In this case, quarterly estimates are derived either by a weighted disaggregation of the available annual data according to some purely mathematical criterion or by using time series models. These methods are not recommended—they are a last resort—and national accountants should do their utmost to obtain and use quarterly sources for the estimates.

The general objective of quarterly national accounts implementation is to be able to apply an estimation method that fits into the first or second stage of the process. Movements among stages depend on availability, quality and timeliness of data sources, the degree of adherence to the 2008 SNA methodological requirements, and the philosophy upon which a country bases its accounts compilation.

The basic national accounts relationships between supply, use and income categories are supposed to hold at the quarterly level, too. Nevertheless, the QGDP is often compiled using an indirect approach at a much higher aggregate level than the annual estimates. This approach may generate divergent results for related values of the aggregate, and, for this reason, it is advisable to check the consistency for the following metrics at least: value added in construction versus gross fixed capital formation (GFCF), investment versus imports of capital goods, production of general government versus final consumption of government, value added of the retail trade versus VAT in volume, and the QGDP deflator versus household consumption deflator.

Benchmarking

Quarterly national accounts estimates, including QGDP, should be consistent with annual national accounts data estimates, where the annual data provide the benchmarks. This consistency is obtained by a separate process of so-called ‘benchmarking’. Generally, the annual indicators provide the most reliable information at the overall level and long-term movements in the series, while the quarterly estimates provide information about the short-term movements in the series. Benchmarking issues also arise in annual data (e.g. for the estimation of SUTs when a special survey is only conducted every few years).

The benchmarking process is seen as a way of improving the quality of the quarterly data and of the accounts overall, through what might be termed ‘retrospective’ alignment. In other words, a set of quarterly accounts has been established at a given moment in the past, with these estimates being consistent with the corresponding annual set of figures at the time of compilation. When the annual figures are improved by integrating more information from data sources that become available later, the quarterly accounts have to be aligned with the new annual data.

Discrepancies between quarterly and annual estimates should be corrected in order to ensure consistency. Such discrepancies are removed by benchmarking the quarterly data against the annual estimates, which, due to the accuracy of data sources and methodology, provide more reliable data. As a result, the time series of quarterly and annual data for the same phenomenon are consistent, while accuracy and quality of the quarterly estimates improve (so they may form the basis for forecasts of annual data).

The benchmarking procedure must simultaneously:

- preserve, as much as possible, the short-term movements in the quarterly data source under the restrictions provided by the annual data;

- ensure, for the forward series, that the sum of the four quarters of the current year is as close as possible to the unknown real future annual data.

It is important to preserve the short-term movements in the source data because the short-term movements in the series are the QNA’s key contribution, with the indicator providing the only available explicit information on these movements.

Benchmarking has two main uses for quarterly estimates:

- quarterisation of annual data to construct time series of historical QGDP estimates (‘back series’) and revise preliminary QGDP estimates to align them with new annual data when they become available;

- extrapolation to update the series from movements in the indicator for the most current period (‘forward series’).

To understand the relationship between the corresponding annual and quarterly data, it is useful to analyse the ratio between the annual benchmark and the sum of the four quarters of the indicator (referred to as the annual benchmarking indicator ratio), which highlights any inconsistencies between the long-term movements of the indicator in the annual and quarterly data. These inconsistencies can help identify areas for improvement in the annual and quarterly data sources. The standard, basic method for benchmarking, at least for most variables, is the uniform proportional adjustment (i.e. taking the difference and allocating it proportionally over the four quarters), a method that may sometimes be unsuitable. For this reason, various other approaches may be more appropriate for benchmarking.

1. Manual approach

The simplest approach is to adjust the quarterly data manually; that is, ‘by eye’. This procedure involves combining direct knowledge of the series with an ability to smooth the series manually. This may be appropriate when the differences between the annual and quarterly data are small, and when few series require adjusting.

2. Ratio approach

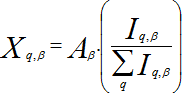

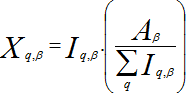

The pro rata distribution refers to the allocation of an annual total of a flow series to its four quarters. A pro rata distribution splits the annual total according to the proportions indicated by the four quarterly observations. Below, two algebraically equivalent equations, presented differently, are shown:

1. Distribution presentation:

2. Benchmark-to-indicator (B-I) presentation:

Where, in both cases:

is the level of the QNA estimate for quarter q of year β;is the level of the indicator in quarter q of year β; and

is the level of the annual national accounts estimate for year β.

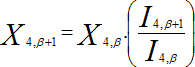

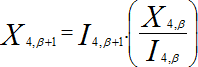

Extrapolation with an indicator is another ratio approach. For the quarters of the current year or even the most recent year, independent estimates of annual data may be unavailable. QNA estimates for these periods should be consistent with the QNA estimates for previous periods that are benchmarked against the annual data. Movements in the quarterly indicator are used to extrapolate or update the QNA estimates (i.e. benchmarked to the annual data) to derive the QNA estimates for quarters with no annual accounts values.

1. Extrapolation presentation, moving from last quarter of the last benchmark year:

2. Benchmark-to-indicator (B-I) presentation:

Where, in both cases:

is the level of the QNA estimate for quarter q=4 of year β; andis the level of the indicator in quarter q=4 of year β.

In the ratio approaches, the step problem arises because of discontinuities between years. If an indicator is growing more slowly than the annual data that constitute the benchmark, then the growth rate in the QNA estimates needs to be higher than in the indicator. For example, with the pro rata distribution, the entire increase in the quarterly growth rates is attributed to a single quarter, while other quarterly growth rates are left unchanged. The significance of the step problem depends on the size of variations in the annual B–I ratio.

3. Mathematical and statistical techniques

A third approach refers strictly to mathematical and statistical techniques. The quarterly figures are like preliminary estimates that do not match annual estimates. The resulting discrepancies have to be distributed according to some criteria. As shown above, the ratio approach brings with it the step problem. Various time series methods that avoid steps exist, but all have the same purpose: to keep the ratio of movements of the short-term benchmarked series to those in the original series as stable as possible over time.

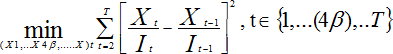

Widely known and applied, the proportional Denton method uses a least squares technique to minimise the difference in relative adjustment to neighbouring quarters, subject to an annual total binding constraint, thus avoiding the step problem. In mathematical terms, according to the basic version of the proportional Denton technique, the benchmarked series Xt is the solution of the following minimisation problem:

under the restriction that, for the flow series,

where:

is the time (e.g. t = 4y – 3 is the first quarter of year y, and t = 4y is the fourth quarter of year y and may be T);is the derived QNA estimate for quarter t;

is the level of the indicator for quarter t;

is the annual data for quarter y;

is the last year for which an annual benchmark is available; and

is the last quarter for which quarterly source data are available.

Using the proportional Denton method implies that the B–I ratio for the fourth quarter of the last benchmarked year is used to prepare the forward QNA series. The B–I ratios for quarters with annual data are usually different and change smoothly, depending on the movements in the annual B–I ratios.

The benchmarking procedure is highly dependent on revisions. When annual national accounts data for previous years are revised, the QNA data for those years are benchmarked to the revised annual data.

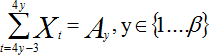

Benchmarking can be applied automatically using the following custom software:

- BENCH (Statistics Canada, 1994)—now integrated in SAS;

- ECOTRIM (Eurostat, 2001)—new version under development;

- MATLAB library (Bank of Spain, 2009), and other ad hoc implementations: Modeleasy+, Gauss, R;

- XLPBM (IMF, 2012)—an excel add-in implementing Denton PFD with enhancement for extrapolation.

Seasonal adjustment methods

Seasonal adjustment serves to facilitate an understanding of the evolution of the economy over time, and the direction and magnitude of changes that have taken place. To achieve this aim, it is necessary to compare the results of one period with those of the previous periods obtained in the same conditions. Seasonal adjustment (SA) corrects for seasonal or calendar effects, which means working under the assumptions that the temperature is exactly the same in winter as in the summer, there are no public holidays, religious holidays (e.g. Christmas, Ramadan) have no effect on behaviour, people work every day of the week with the same intensity (i.e. no break over the weekend), and so forth. The presence of such effects in a time series makes comparability more difficult. Effects that occur every year in the same period and with the same intensity, however, remain hidden under annual comparisons.

Mathematically, seasonal adjustment means using analytical techniques to break down a series into its components, with the main objective being to identify the components of the time series and thus provide a better understanding of their behaviour. The impact of the regular intra-annual seasonal pattern, the influences of moving holidays, the number of working/trading days, and the weekday composition in each period (the trading-day effect) are removed in the seasonally adjusted quarterly data. By removing the repeated impact of these effects, national accountants can produce seasonally adjusted data that highlight the underlying trends and short-run movements in the series.

Seasonal adjustment is based on the assumption that time series can be decomposed into unknown components, with the simplest presentation being the following:

- Yt = f(TCt, St, It)

Where:

- TCt is the long-term trend and cyclical movements;

- St is the seasonal (and calendar-related) effects; and

- It is the irregular component.

The trend-cycle Component (TCt) is composed of: long-term upwards/downwards (underlying) trend movement observed over decades; medium-term fluctuations, which commonly define the business cycle turning points; and abrupt changes in the level of the long-term trend. The component TCt may also be presented by its two sub-components: trend and cycle.

Seasonality (St) can be described as all types of intra-annual events that occur regularly with the same annual timing, with a fairly stable magnitude, and in the same direction. Examples of widely known seasonal events are:

- - weather seasons: weather conditions change during the year (e.g. more/less rain, warmer/colder environment);

- - institutional conventions: agreement on certain administrative rules such as tax collection, bonus payment, and the like;

- - induced seasonality: inherent industry conditions due to a relationship with seasonal activities, such as the canned fruit industry or wrapping paper production.

Seasonality (St) also includes calendar-related effects. Since a solar year is not divided into an exact number of weeks, the occurrence of each day of the week within the same month/quarter may differ (e.g. January 2011 and January 2012 both had 31 days, but in 2011 there were 10 weekend days while in January 2012 there were only 9). If a daily pattern of activity exists within the week, and such differences of days exist, then there will be an impact on monthly/quarterly measures. This is called the trading (or working) day effect. A solar year is not exactly divisible by 365 days, the remainder becomes a full day every 4 years; February 2012 had 29 days while February 2011 had 28. This event is called leap year.

The irregular component (It) comprises the remaining non-systematic volatility of the series or its unpredictability. It also contains unusual effects (of unseasonable weather, natural disasters, irregular sales campaigns, etc.) such as outliers. In time series decomposition, as well as for analysis purposes, outliers are very important effects that must be detected and treated, whether or not their cause is known.

Essentially, the decomposition of the series by components is based on an equation with two or three non-observable components, thus resulting in infinite solutions. The decomposition could be either additive or multiplicative. There is no best solution, but several possible decompositions exist. Thus, the trend is also non-unique, depending on the applied decomposition. Knowing the components of the series, seasonally adjusted series may be viewed as:

- original series from which seasonality and calendar-related effects have been removed; or

- the trend-cycle of the series, including irregular components.

Provided that seasonality and calendar-related effects evolve within certain intervals (known as stable behaviour), seasonally adjusted series contain most of the updates regarding the evolution of the series; namely, changes in trends (shifts), shifts in the cycle (turning points) and irregular effects (outliers).

The two main groups of methods for estimation of seasonal adjustments data are the following.

- Moving average-based methods, which use different kinds of moving average filters. Moving average represents a weighted sum of a certain number of values of a time series comprising the observation under consideration and neighbouring observations. While the number of values in the average is kept constant, the time periods ‘move’ successively, hence the adjective ‘moving’. These methods do not rely on an underlying explicit model and were developed mainly on an empirical basis. The best known moving average-based method is the US Census Bureau’s X-11 (and its upgrades), which involves the repeated application of suitable moving average filters. This procedure leads to a decomposition of the unadjusted data into its trend-cycle, seasonal and irregular components. The latest update of the model is X-13 ARIMA, but the upgrade most commonly used is X-12-ARIMA.

- Model-based seasonal adjustment methods estimate the trend-cycle, seasonal and irregular components with signal extraction techniques applied to an ARIMA model fitted to the unadjusted or transformed (e.g. logged) data. Each component is then represented by an ARIMA expression and some parameter restrictions are imposed to obtain orthogonal components. TRAMO/SEATS is one of the best known and most widely used methods of this type. In order to isolate a unique decomposition (i.e. the canonical decomposition), TRAMO/SEATS imposes further constraints. These constraints stipulate that the variance of the irregular component be maximised and, conversely, the other components be kept as stable as possible (compatible with the stochastic nature of the model used for their representations).

Both methods are divided into two stages. In the first stage, the model, the calendar effects, and the outliers are estimated (before adjustments and forecasts); in the second stage, the trend-cycle and the seasonal component are extracted.

In general, when applying the seasonal adjustment method based on X12-ARIMA/TRAMO-SEATS, NA compilers should follow eight steps:

Step 0: Number of observations It is a requirement for seasonal adjustment that the times series be at least 3 years long (36 observations) for monthly series and 4 years-long (16 observations) for quarterly series. Of course, these are minimum values; series should be longer for an adequate adjustment or for the computation of diagnostics on the basis of the fitted ARIMA model.

Step 1: Graph Compilers should first study the data and graph of the original time series before running a seasonal adjustment. Series with possible outlier values should be identified. It is important to check that the outliers are valid and free from sign problems (e.g. erroneous data capture). Missing observations in the time series should be identified and explained. Series with too many missing values will cause estimation problems. If series are part of an aggregate series, compilers should verify that the start and end dates for all component series are the same.

Step 2: Constant in variance

The type of transformation should be used automatically. Confirm the results of the automatic choice by looking at graphs of the series. If the tests for choosing between additive and multiplicative decomposition models are inconclusive, then national accountants may choose to continue with the type of transformation used in the past for consistency between years, or should visually inspect the graph of the series.

If the series has zero and negative values, then this series must be additively adjusted, as in the equation: Yt = TCt + St +It

If the series is decreasing with positive values close to zero, then multiplicative adjustment must be used: Yt = TCt * St *It

Step 3: Calendar Effects

Analysis should determine which regression effects, such as trading/working day, leap year, moving holidays (e.g. Easter) and national holidays, may be affecting the series. If the effects are implausible for the series or the coefficients for the effect are non-significant, then regressors (a kind of ‘independent variable’ representing the inputs or causes) should not be fitted for these effects. If the coefficients for the effects are marginally significant, then it should be determined if there is a reason to keep the effects in the model. If the automatic test of the model does not indicate the need to include a trading-day regressor but there is a peak at the first trading day frequency of the spectrum of the residuals, a trading-day regressor may be fitted manually. If the series is long enough and the coefficients for the effect are highly significant, then six regressors for the trading-day effect should be used instead of one. The regressors represent the elements of the common trading-day (TD) regression and are calculated as follows:

1t TD = (number of Mondays) – (number of Sundays)

2t TD = (number of Tuesdays) – (number of Sundays)

. . .

6t TD = (number of Saturdays) – (number of Sundays)

where t is the month or the quarter.

Step 4: Outliers There are two ways to identify outliers. The first is when identifying series with possible outlier values, as in Step 1. If some outliers are marginally significant, compilers should check if there is a reason to keep the outliers in the model. The second possibility is when automatic outlier correction is used. The results should be confirmed by studying graphs of the series, and any additional available information (economic, social, etc.) on the possible cause of the detected outlier should be used. A high number of outliers signifies that there is a problem related to weak stability of the process, or that the data are unreliable. Series with a high number of outliers relative to the series’ length should be identified. This can result in many interventions (over-specifications) in the regression model. The series should be remodelled by reducing the number of outliers. The outlier regressors that are revised should be considered carefully. Expert information about outliers is especially important at the end of the series because outlier type is unclear from a mathematical point of view, and changing outlier type (e.g. removing a level shift) leads to large revisions at a later date.

Step 5: ARIMA model Automatic model identification should be used once a year, but re-estimation of the parameters is recommendable upon adding new observations. If the results are implausible, then following the procedure described below is advisable. Non-significant high-order ARIMA model coefficients should be identified. It may be helpful to simplify the model by reducing the order of the model, taking care not to skip lags of AR (autoregressive) models. For moving average (MA) models, it is unnecessary to skip model lags whose coefficients are non-significant.

Step 6: Check the filter (optional) The critical X-11 options in X-12 ARIMA are the options that control the extreme value procedure in the X-11 module, and the trend and seasonal filters used for seasonal adjustment. National accountants should verify whether seasonal filters are in agreement with the overall moving seasonality ratio. After reviewing the seasonal filter choices, the seasonal filters in the input file should be set to the specific chosen length, so they will not change during production. The SI-ratio graphs in the X-12 ARIMA output file should be studied. Any months with many extreme values relative to the length of the time series should be identified.

Step 7: Residuals There should not be any residual seasonal and calendar effects in the published seasonally adjusted series or in the irregular component. The spectral graph of the seasonally adjusted series and the irregular component may be looked at (optional). If there is residual seasonality or a calendar effect, as indicated by the spectral peaks, the model and regressor options should be checked in order to remove the residual peaks. If the series is a composite indirect adjustment of several component series, the checks mentioned above in the aggregation approach should be performed. Among others, the tests for normality and Ljung-Box Q-statistics should be studied in order to check the model’s residuals.

Step 8: Diagnostic The stability diagnostics for seasonal adjustment are the sliding spans and revision history. Large revisions and instability indicated by the history and sliding spans diagnostics imply that the seasonal adjustment is not useful.

TRAMO/SEATS and X-12-ARIMA, together with well-documented and stable interfaces to use these tools, provide a sound basis for seasonal adjustment. The choice between these applications may be based on past experience, subjective preference and characteristics of the time series. These applications should be reviewed on a regular basis and, if necessary, updated after satisfactory testing. The methods and specifications currently used in seasonal adjustment should be clearly communicated to users.

Seasonal adjustment of QNA is a specific activity that requires specific knowledge of econometrics. Both TRAMO/SEATS and X-12-ARIMA provide extensive aids for helping analysts achieve high quality seasonal adjustments, but the range of options and diagnostics may be difficult to understand for newcomers to the field. While both programs can be configured to work automatically, the automated choices made by the software should never be accepted blindly (see steps described above), hence the strong argument for having seasonal adjustment specialists performing the seasonal adjustment for QNA.

An arrangement that has proved to be successful in a number of countries is one whereby a small team of seasonal adjustment specialists meets the seasonal-adjustment needs of the whole NSI. The specialist statisticians, including the national accounts compilers, are responsible for the routine seasonal adjustment of the data each month or quarter. Whatever the arrangements within an NSI, it is imperative to have a pool of individuals responsible for the seasonal adjustment of QNA with a high degree of seasonal adjustment expertise.

Production approach to QGDP

The production approach is the most common approach for compiling QGDP, predominantly because of the availability of data within the statistical systems. Following the national accounts methodological requirements, QGDP from the production side should be estimated based on the independent compilation of its main elements: output, intermediate consumption and net taxes on production. In standard practice, however, the quarterly data necessary for intermediate consumption estimates are often unavailable, and estimates of GVA are derived only using estimates of output or a proxy for output.

In order to derive the volume estimates of output or GVA directly, the volume indicators related to output (output-related index) may be used. Such indicators include sales or turnover data, or product quantities. This process allows for extrapolation of the output in the base period. Also, input-related indices such as employment may be used when output indices are unavailable.

The section entitled, How to measure price and volume in SNA under the Chapter 9: Volume Measures, in Building the System of National Accounts presents the basic methods for deriving volume measures.

Compiling the production account (output, intermediate consumption and GVA) at current prices and in volume terms requires detailed information on both output and current expenses, which may be unavailable at a quarterly frequency. Estimation of the missing data must rely on the use of other series as an indicator. Most commonly, output data is available, while data on intermediate consumption is missing. In other cases, data on total intermediate consumption, component(s) of intermediate consumption, labour inputs or capital inputs may be available as indicators. The quality of the estimate depends on the assumption of a stable relationship between the indicator and the target variable.

Relationships between inputs and outputs (input–output ratio or IO coefficients) may change as a result of technological changes, differences in seasonal patterns of outputs and inputs, or variations in capacity utilisation caused by changes in the business cycle. The impact of technological changes is non-significant in the short term, and the benchmarking process is capable of handling such changes if they happen gradually over a long period. It is preferable to use benchmarking rather than fixed ratios.

An implicit ratio of GVA in output (GVA/output ratio) may be established and used in order to compile current and constant price estimates in the absence of other information. These ratios, derived from annual estimates, must be checked and updated continuously. The initial estimates of quarterly GVA by kind of activity for market sector activities may also be based on the assumption that output and intermediate consumption grow with the same rate in volume terms, either from the previous quarter or from the same quarter of the previous year.

In the process of performing the inventory and assessing the available data sources, an important activity is to separate the information by activities at the classification’s chosen detail level to obtain the total GVA as the sum of corresponding values for all activities within the economy.

Output

Figure 7 presents indications on what kind of sources or information can be used in the compilations, in general, for both current and constant prices.

A summary of the main methods used for the estimation of quarterly output by activities appears below.

Agriculture, forestry and fishing

For these activities specific estimates should be made for the output produced and sold in the same quarter (e.g. milk and eggs) and the outputs that extend over a number of quarters, such as:

- cases of ‘one-off’ production, such as annual crops, trees for timber and livestock for consumption. Unfinished output, such as growing crops is classified as work-in-progress.

- ‘continuing’ production, covering, for example, fruit trees, vines, breeding, and dairy cattle. These are unfinished outputs classified as work-in-progress and converted to GFCF when completed.

For these cases, the 2008 SNA requirements recommend that the output of crops and similar production be considered in the same way as for other industries where production spans a number of quarters. Thus, the total value of the output of the crop over the whole period of production is recorded in proportion to the costs incurred in each quarter. The costs considered for inclusion are: material inputs, compensation of employees, a return to the labour and capital of unincorporated enterprises (gross mixed income), and a return to capital of incorporated enterprises (gross operating surplus).

The application of the recommendations raises two major issues: the need to estimate a value for the crop before the harvest is sold; and the imputation of a value for activity (or income) at least two quarters before it actually takes place (or is received). The two main solutions to these problems are the following.

1. First solution:

- ‐ in quarters where preparatory work is being undertaken for the harvest and the crop is reaped, output is taken to be equal to the input costs;

- ‐ in the quarter(s) in which the crop is sold, output is taken as the difference between receipts in the quarter(s) and the costs incurred in the previous quarters.

2. Second solution:

- ‐ the output of crop products at both current and constant prices are compiled on the basis of an estimation of the annual production (harvest) and a distribution on quarterly values in proportion to inputs;

- ‐ the output of animal products at both current and constant prices is obtained by extrapolation using indicators based on surveys and agricultural statistics.

Mining and quarrying Taking into account the general data sources available for this industry, the methods applied are extrapolation by quantity indicator, and inflation with the output prices, unit value indices and import indices.

Manufacturing

For the manufacturing industry, estimates should be made at the most detailed level possible (i.e. at least at the

ISIC rev.4 two-digit level). The extrapolation method can be applied using volume indicators (IPI), deflation of current values with corresponding PPI, or direct estimation based on turnover obtained from VAT statistics.

The section entitled Transition to national accounts, in the article Building the System of National Accounts - administrative sources presents the estimation of output based on administrative data source.

Electricity, gas, steam and air conditioning supply The value of the turnover from specialised enterprises can be used for the estimation of the output. In the absence of reliable information about turnover and other elements necessary for the estimation of the output, volume indicators (number of kwh or m3 of water) and price index (PPI for electricity, CPI for water supply) can be used. Current prices could be extrapolated on the basis of data from the companies (volume indicators).

Construction

The estimation of construction output on a quarterly basis is a difficult task. Feasibility is limited by the availability of data, as construction enterprises are often small and production may be hard to separate by quarters. Construction output can be measured in various ways, corresponding to different stages in the building process and the availability of source data.

- The supply of building materials is often the most readily available construction volume indicator. While building companies tend to be small and dispersed, building materials are often produced by a relatively small number of large factories and quarries. Data on exports and imports of building materials are also generally available and may be important for some kinds of building materials in some countries.

- Building permits provide information on the location, type of building (building or dwelling), kind of building activities, building costs, content, floor area and estimated building time. This information can be used to calculate, on a monthly basis, the different stages of the building process and to monitor its progress in order to identify the output.

- Turnover reported by construction businesses to the tax authority or as a result of statistical surveys.

- Households reports of their own consumption, collected by statistical surveys.

An example for the calculation of the output and intermediate consumption in construction, based on the supply of raw materials, is presented in Figure 8.

Wholesale and retail trade; repair of motor vehicles and motorcycles Sales data commonly serve as quarterly indicators for the output of wholesale and retail trade. Business surveys or administrative sources (VAT data) may yield sales data; shares of trade margins in the total sales from the previous year serve as indicators for the current price estimation. The constant prices can be obtained by extrapolating the sales based on the turnover volume index (in the absence of this information, the CPI provides an alternative), and deflation of goods bought for resale using PPI for the specific products.

Transport and storage The compilation of output should be made at a detailed level (at least at the two-digit level of ISIC rev. 4) by kind of transport services. Extrapolation of indicators based on the VAT statistics in combination with a deflator or inflator based on the relevant price index is recommendable. For some activities, volume indicators like tonne km and passenger km can be used.

Accommodation and food service activities Estimation of the output is based on turnover provided by VAT statistics or business surveys. Turnover value indices are used for deflation and estimation of the output in constant prices. For accommodation services, the extrapolation method is sometimes applied based on available volume indicators (number of beds in hotel, number of nights, etc.).

Financial and insurance services FISIM is the indirect payment to the financial institutions for intermediary services. The supply of FISIM is produced in resident financial institutions, and is imported by residents who pay interest for loans abroad and by residents who have deposits abroad. The demand for FISIM is used for intermediate consumption, final consumption expenditure and exports.

On a quarterly basis, it is possible to estimate FISIM directly based on data sources provided by the national central bank. The distribution of quarterly FISIM between users usually relies on some assumptions. For example, intermediate consumption of FISIM can be regarded as a service similar to other consumed services and is thus part of the fixed coefficient estimation of intermediate consumption (see Section 3.2). For imports and exports, the assumption is that FISIM has the same share of interests to and from abroad as in the final version of annual national accounts. The output of insurance and pension funding at current prices can be compiled by extrapolating an indicator based on the number of employees in the industry. For activities auxiliary to financial intermediation, the value of output at current prices is compiled based on data from VAT statistics. The measure of the volume of these activities on a quarterly basis usually uses the relevant index of average earnings as a deflator.

Other services, including real estate activities; professional, scientific and technical activities, administrative and support services; education, human health and social work activities (market activity); arts, entertainment and recreation (market activity); other service activities Data from VAT statistics and short-term business surveys (usually monthly) contribute to the estimation of the output. One element of the real estate activity that requires specific estimation from national accountants is the imputed rent. Data concerning the quarterly own-dwelling services can be estimated by extrapolation on the basis of the number of dwellings. If construction data do not allow estimates of the net increase in the number of dwellings, population may be used as a proxy (preferably adjusted for any trends in the average number of persons per dwelling). Due to the differences in the average rent per dwelling, the quality of the estimation can be improved by doing separate calculations by location and by different dwelling types (e.g. house/apartment, number of bedrooms). Compilers should also consider employing an adjustment factor to account for any shortcomings in this method (e.g. for long-term changes in the size and quality of dwellings). These factors should be estimated for annual accounts, so that their effects are incorporated into the quarterly estimates by the benchmarking process. The extrapolation using the turnover value indices is advisable for the estimation at constant prices. If these indices are unavailable, the use of CPI represents one option, as long as the methodological requirements are followed. The estimation of the quarterly imputed rent represents one of the challenges of this process. Based on the availability of data sources, different methods have been developed and may be applied. For instance, the use of the annual data of the previous year and the growth rate of the construction of dwellings is an option for the output estimation.

Public administration and defence; compulsory social security; education, human health and social work activities; arts, entertainment and recreation (non-market activities) The direct estimation method is applied using data from the government budget. Consumption of fixed capital, as part of the output of non-market output, may be calculated using annual figures, divided by quarter.

Education, human health and social work activities, arts, entertainment and recreation, other service activities (market activities) For this kind of activity, extrapolation of the output based on the turnover is generally used. Data from the VAT system and from short-term statistics are used.

Intermediate consumption

For the compilation of intermediate consumption data, few sources are available on a quarterly basis. Some information may be available for purchases (usually for government and sometimes for businesses) or the change in inventory, based on special surveys carried out by the statistics office.

One method for the estimation of the intermediate consumption relies on the assumption that the output and the intermediate consumption growth follow the same trend in terms of volume. Thus, the first step is to estimate intermediate consumption at constant prices using the constant price output as an indicator. This method assumes a stable ratio of the inputs in output (IO ratio), modified by annual trends in the ratio that are incorporated through the benchmarking process. Intermediate consumption at current prices can then be derived by reflating the constant price estimate by price indices that reflect the product composition of intermediate inputs. Because specific producer price indices (PPI) for inputs are non-existent, this should be constructed by weighting together relevant price indices for each component of the intermediate consumption. These indices include the CPI, PPI and foreign trade price indices—for inputs, data are supplied by imports.

The use of a fixed ratio between output and intermediate consumption is a way to make maximum use of the available information, and this method is often valid because the structure of the output and intermediate consumption in terms of volume is slow to change over time. In any event, this method has some weaknesses:

- it does not take into account the improvement of the efficiency of the production process;

- the change in volume of goods and services of the intermediate consumption can differ between quarters;

- for some industries, particularly agriculture, the input–output ratio can fluctuate greatly in the short-term.

Taxes and subsidies on products

The estimation of taxes on products in current prices is based on revenues and expenditures recorded in government and customs administrative data (excise duties, VAT on imports). Compilers should pay special attention to the application of the accrual valuation principle. For constant prices estimation, the same methods of annual estimation are applied (for more information, see Chapter 9: Volume measures).

The subsidies on products are provided by the Ministry of Finance, but the payments are usually made and recorded in a different quarter from that of the production itself. This is the case for subsidies that may be regarded as essentially annual in nature, and for which the quarterly payments are insignificant. In these cases, estimates should be obtained by relating the subsidy to the economic activity for which it is due.

Exhaustiveness

The estimation of QGDP should follow the same methodological requirements as for annual data. Adhering to this principle ensures the exhaustiveness of quarterly estimates. Differences in the size of the non-registered economy normally owe to economic and social structures, and the stage of development of the statistical system. The main topics of exhaustiveness that appear in the annual accounts should be included in quarterly GDP, too. These refer, in general, to the following areas:

- underreporting and non-registration of the activity in order to avoid the payment of taxes and fulfil the legislative requirements;

- non-coverage of the national accounts indicators due to statistical under-recording;

- estimation of the informal sector;

- estimation of illegal activities.

The Chapter 8: The informal sector, in Building the System of National Accounts includes information concerning the estimation of the non-observed economy and informal sector in annual national accounts.

Estimating the non-observed economy (NOE) for annual national accounts is a difficult task. This difficulty intensifies when compiling quarterly accounts due to the lack of sources and additional information in this area. The methods developed for quarterly estimates take into account the characteristics of the economy and the trend of the quarterly production of specific activities (e.g. the value of the non-observed economy in construction is bigger in the warmer half of the year—April to September in the Northern Hemisphere and October to March in the Southern Hemisphere—due to the increase in activity in these periods).

Usually, the method for estimating the non-observed economy is based on projections because directly measured data are unavailable on a quarterly basis. Thus, the identification of suitable indicators related to the evolution of the non-recorded data represents one of national accountants’ key tasks and requires a deep knowledge of this phenomenon, the methods used for annual estimates and the availability of data sources. The use of suitable proxy indicators based on the methodology for annual NOE estimation is common practice.

Expenditure approach to QGDP

There exist various data sources and methods for the compilation of components for QGDP using the expenditure approach, which this section expands upon.

Final consumption expenditure of households

The final consumption of households is usually the largest component of GDP by expenditure. The main sources of data on household consumption on a quarterly basis are:

- sales/turnover statistics—by ‘type of outlet’ (wholesale, retail, etc.);

- household survey on expenditure;

- value added tax (VAT) systems;

- business short term statistics—for services rendered to the population.

Apart from the above sources, data on production and foreign trade in consumer products can be used to derive estimates using the commodity flow approach. Statistics on trade and business surveys of other consumer services provided to households are also common data sources for the estimation of household consumption at current prices.

In addition to broad sources such as retail sales, VAT systems and household surveys, there are a range of specific indicators for components of household consumption, which include specialised statistical surveys, major supplying enterprises and regulators. Some information can be collected specifically for QNA, when there are a small number of large suppliers of a particular item, but the data are not currently published. An example of this is the sales of electricity, gas or water to residences, as well as some components of transport and communication. Of course, just like for annual estimates, the quarterly data need to be adjusted to the domestic concept, using information from BoPs.

The commodity flow approach can be used when there are good data on the supply of the products, namely production and imports. This method may be particularly useful for goods supplied by a relatively small number of producers and importers, and data on the supply of the goods are easier to collect than data on sales at the retail level. The household consumption is obtained as a residual from the supply approach, after the intermediate consumption, government consumption, fixed capital formation, and changes in inventories are estimated and deducted.

Figure 10 lists the main data sources for quarterly estimation of the final consumption expenditure of households, classified by COICOP (the classifications used in national accounts are presented in Chapter 4: Business register and statistical classifications).

Final consumption expenditure of general government

Government accounting data showing revenues and expenditures are often available on a monthly or quarterly basis. For quarterly national accounts, the fundamental requirement is to have the expenditures classified by economic type, in particular, consumption of goods and services, capital formation of goods and services, other expenditures.

As already mentioned (see Section 1.3 Some conceptual issues), the problem of the time of recording is an issue for government consumption (both individual and collective), due to the tendency to record expenditures and revenues on a cash basis rather than on an accrual basis. One consequence of recording on a cash basis is that the estimates of expenditures in the government account may be inconsistent with the output and income recorded by producers who have supplied goods and services. The degree of potential inconsistency is likely to vary by country, depending on the government recording practices and the nature of the spending.

National accountants should examine the series of government consumption to check whether the data appear erratic or implausible (e.g. where expenditure is much higher in the last quarter of the budget year), and are therefore unlikely to be consistent with the associated figures in the production accounts. In these situations, the national accountants, together with the providers of information, should establish suitable assumptions, and should then identify the best methods to ensure consistency with the other national accounts indicators.

Final consumption expenditure of non-profit institutions serving households (NPISHs)