Businesses in the administrative and support services sector

Data extracted in February 2023

Planned article update: 21 June 2024

Highlights

Source: Eurostat (sbs_sc_1b_se_r2)

This article presents an overview of statistics for the European Union’s (EU) administrative and support services, as covered by NACE Rev. 2 Section N. Administrative and support services comprise a variety of activities that support business operations; they can be distinguished from professional, scientific and technical services (Section M) in that their primary purpose is not the transfer of specialised knowledge. It belongs to a set of statistical articles on 'Business economy by sector'.

Full article

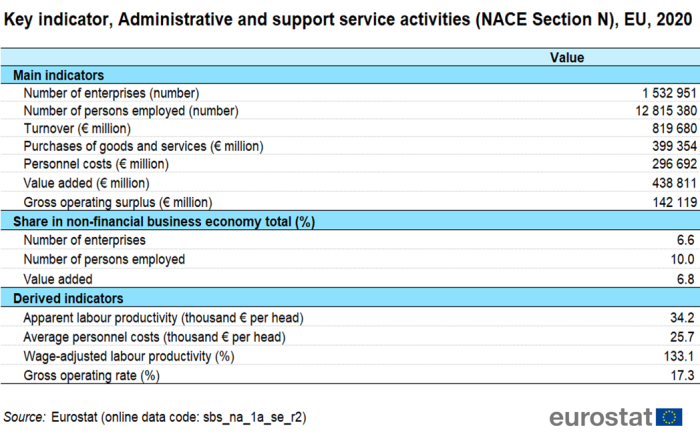

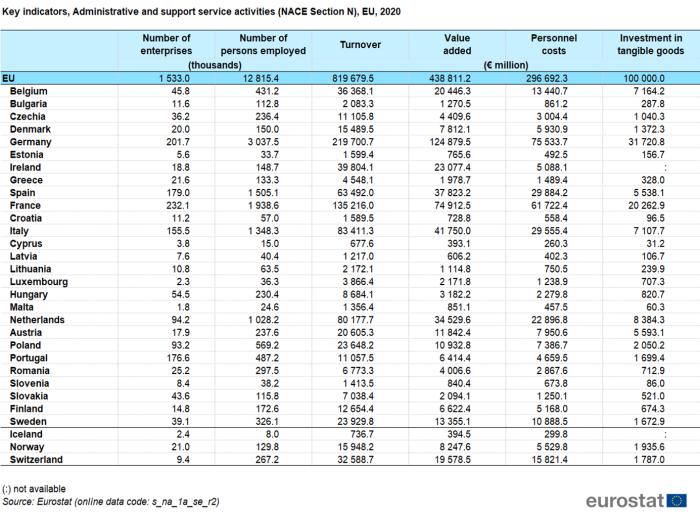

Structural profile

In 2020 there were 1.5 million enterprises active within the administrative and support services sector (Section N) in the EU; this was equivalent to 6.6 % of the non-financial business economy (Sections B to J and L to N and Division 95) enterprise population. Many administrative and support services are labour-intensive activities and often the staff employed in these activities work on a part-time basis, for example, in cleaning activities (part of services to buildings and landscape activities), security and investigation activities, or employment activities. EU employment for the administrative and support services sector reached 12.8 million in 2020, a 10.0 % share of the non-financial business economy employment; in value added terms the administrative and support services sector contributed €438 billion, some 6.8 % of the non-financial business economy total. Compared with the pre-pandemic times, a decrease of 8.0 % can be seen in the number of persons employed, while the value added of the administrative and support services sector dropped by 9.8 % compared to 2019.

Source: Eurostat (sbs_na_1a_se_r2)

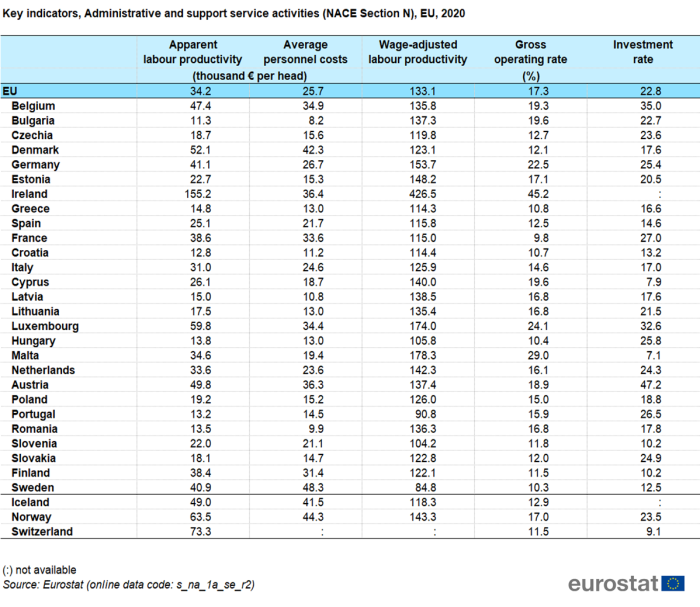

Average personnel costs for the EU’s administrative and support services sector in 2020 were equal to €25 700 per employee, which was below the non-financial business economy average (€36 400 per employee). This was the second lowest level of average personnel costs among the non-financial business economy NACE sections, higher only than for the accommodation and food sector (Section I). Both of these sectors are traditionally characterized as employing a high proportion of part-time employees, which has a downward influence on average personnel costs (which are measured in terms of a head count). The wage-adjusted labour productivity ratio is based on the relation between value added and personnel costs and is expressed as a percentage and not a per head value, and so is not directly influenced by the incidence of part-time employment. For the administrative and support services sector the wage-adjusted labour productivity ratio was 133.1 % in the EU in 2020, which was below the non-financial business economy average (139.8 %). The gross operating rate (the relation between the gross operating surplus and turnover stood at 17.3 % for the EU’s administrative and support services sector in 2020, well above the non-financial business economy average (10.2%).

Sectoral analysis

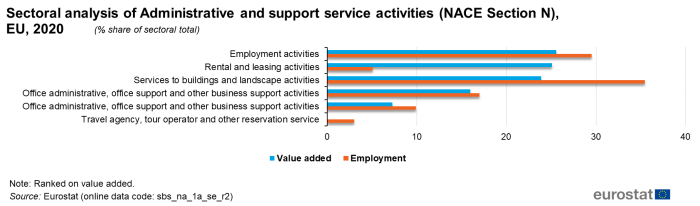

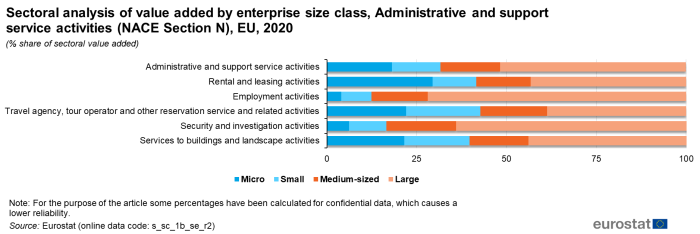

Figure 1 shows the varied contributions, depending upon whether value added or employment is chosen, of the various subsectors to the administrative and support services sectorial total. Employment activities (Division 78) accounted for the highest share of sectorial value added (25.6 %) and second highest share for employment (29.5 %).

Capital-intensive rental and leasing activities subsector (Division 77) had second highest contribution to value added share (25.1 %), being followed closely by services to buildings and landscape activities subsector (Division 81) - 23.9 %). Their employment share differentiate strongly: only 5.1 % for rental and leasing activities, indicating a very high apparent labour productivity ratio, and 35.4 % for services to buildings and landscape activities, the highest contribution to the employment share.

(% share of sectoral total)

Source: Eurostat (sbs_na_1a_se_r2)

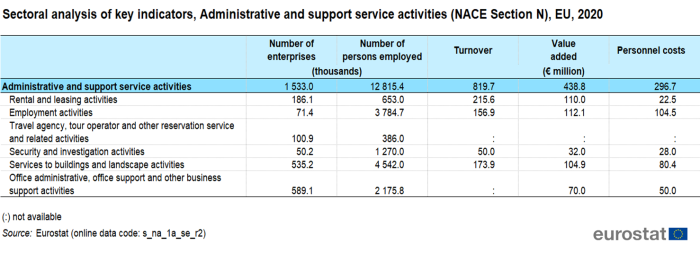

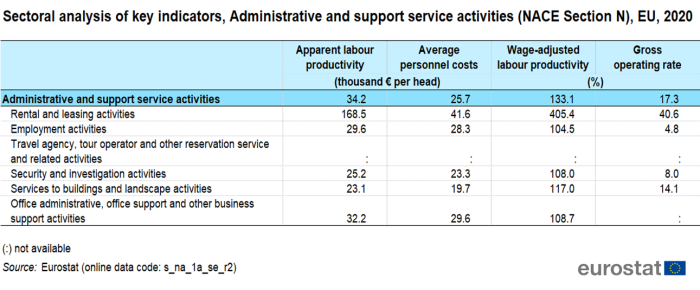

In 2020, apparent labour productivity was below the non-financial business economy average for four subsectors (for which data is available); and average personnel costs were below the non-financial business economy average for three of the subsectors. As such, the EU’s rental and leasing subsector was the main exception, as each person employed in this subsector generated an average of 168 500 per employee (third largest across the whole of the non-financial business economy at the NACE division level), while the average personnel costs were €41 600 per employee. This high level of apparent labour productivity for the rental and leasing subsector reflects the nature of the activity, which often involves purchasing capital assets and generating operating income from these assets. The rental and leasing subsector typically has very low operating expenditure while the levels of depreciation, financial charges or extraordinary expenditure may be high — none of these charges are taken into account in the calculation of value added. The elevated apparent labour productivity and relatively subdued average personnel costs translated into a very high wage-adjusted labour productivity ratio for the EU’s rental and leasing subsector, namely 405.4 %. At the NACE division level, this was the highest wage-adjusted labour productivity ratio across the whole of the non-financial business economy. Among the three remaining administrative and support services subsectors (for which data is available) no other activity recorded a wage-adjusted labour productivity ratio in the EU that was above the non-financial business economy average (133.1 %) in 2020.

(NACE Section N), EU, 2020

Source: Eurostat (sbs_na_1a_se_r2)

(NACE Section N), EU, 2020

Source: Eurostat (sbs_na_1a_se_r2)

As well as its very high levels of productivity, the EU’s rental and leasing subsector also had a very high gross operating rate. Indeed, the rental and leasing activities subsector recorded second highest gross operating rate (40.6 %) in 2020 among all of the NACE divisions within the non-financial business economy, just slightly lower then real estate activities (Division 68). The gross operating rate for the rental and leasing subsector was almost 4 times as high as the average for the whole of the non-financial business economy (10.2 % in 2020). Lowest gross operating rate in sector for which data is available was recorded for employment activities with only 4.8 % in 2020.

Country overview

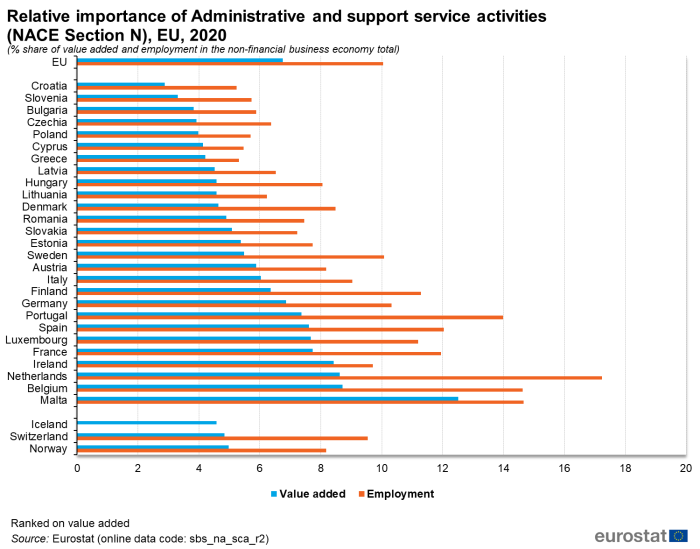

In value added terms, Malta was the most specialised EU Member State, as 12.5 % of its non-financial business economy value added was generated in the administrative and support service activities sector. It was followed by Belgium, the Netherlands, Ireland and France, which were also relatively specialised in terms of value added. By contrast, Croatia with 2.9 %, Slovenia with 3.3 %, and Bulgaria with 3.8 % recorded the lowest shares of its non-financial business economy value added generated in the administrative and support service activities sector (compared with an EU average of 6.8 %).

In the Netherands, the administrative and support service activities sector provided employment to 17.2 % of the non-financial business economy employment, which was almost 1.7 times the EU average, while Croatia had the lowest share in employment terms, as the administrative and support service activities sector provided work to 5.2 % of its non-financial business economy employment (compared with an EU average of 10.0 %).

(% share of value added and employment in the non-financial business economy total)

Source: Eurostat (sbs_na_sca_r2)

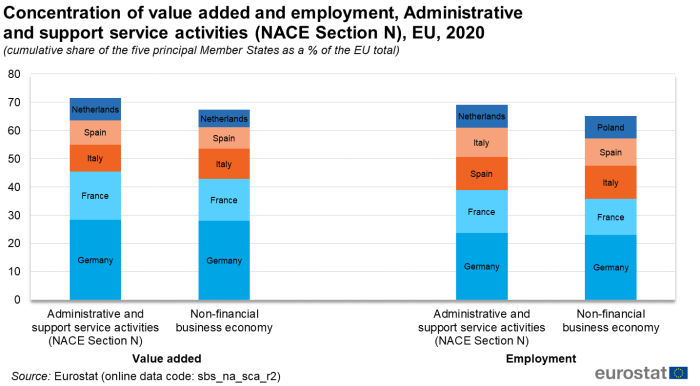

Within the administrative and support service activities sector, value added and employment were relatively concentrated in geographical terms: the five largest EU Member States generated 71.5 % of EU added value, while their share in the administrative and support services’ employment was 69.1 %.

(cumulative share of the five principal Member States as a % of the EU total)

Source: Eurostat (sbs_na_sca_r2)

As a result of its high specialisation in value added terms, Germany had the largest administrative and support services sector among the EU Member States, generating around €124.9 billion of added value (some 28.5 % of the EU total), ahead of France (€74.9 billion). Germany also had the largest employment, 3.0 million persons, equivalent to 23.7 % of the EU total, while there were 1.9 million persons employed in the administrative and support services sector in France, or 17.1 % of the EU total.

Source: Eurostat (sbs_na_1a_se_r2)

Among the six subsectors which form administrative and support services (at the NACE division level), Germany generated the highest level of value added for five of them with shares ranging from 0.5 % to 8.0 % of the EU's value added. The only subsector not dominated by Germany was employment activities for which France accounted for 6.2 % of the EU’s value added.

In each of the six subsectors which form administrative and support services, different EU Member States were most specialized in terms of value added. Highest specialization rate (6.2 %) was recorded in Ireland for rental and leasing activities. Other Member States that were particularly strongly specialised in just one of the subsectors were: the Netherlands for employment activities; Portugal for office administrative, office support and other business support activities and Spain for the services to buildings and landscape activities subsector.

Source: Eurostat (sbs_na_1a_se_r2)

Source: Eurostat (sbs_na_1a_se_r2)

Two of the EU Member States, namely Sweden (84.8 %) and Portugal (90.8 %), recorded the wage-adjusted labour productivity ratios below the parity (100 %). In the majority of the Member States, the wage-adjusted labour productivity ratio was below the average for the non-financial business economy (139.8 %); the only exceptions to this pattern were recorded in Ireland (426.5 %), Malta (178.3 %), Luxembourg (174.0 %), Germany (153.7 %), Estonia (148.2 %), the Netherlands (142.3 %) and Cyprus (140.0 %).

Size class analysis

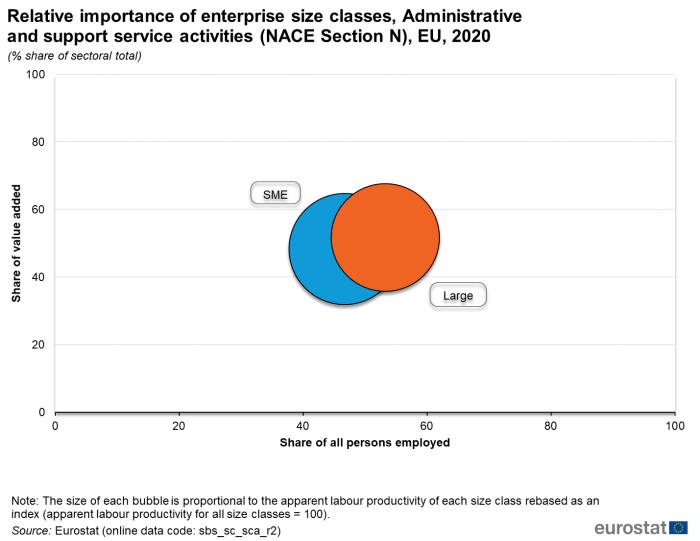

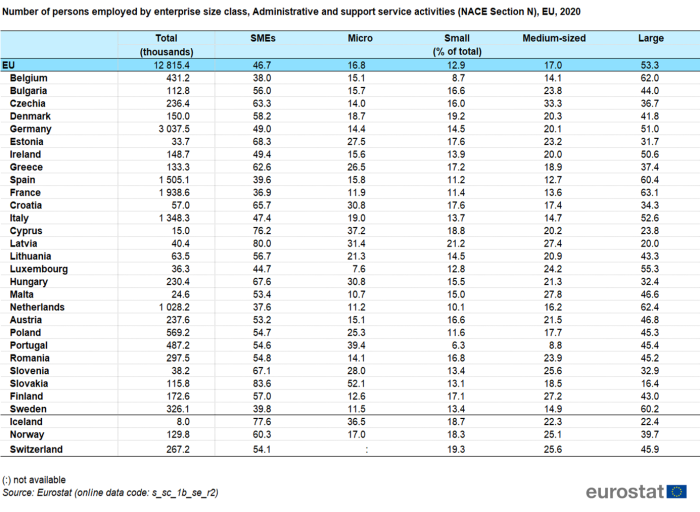

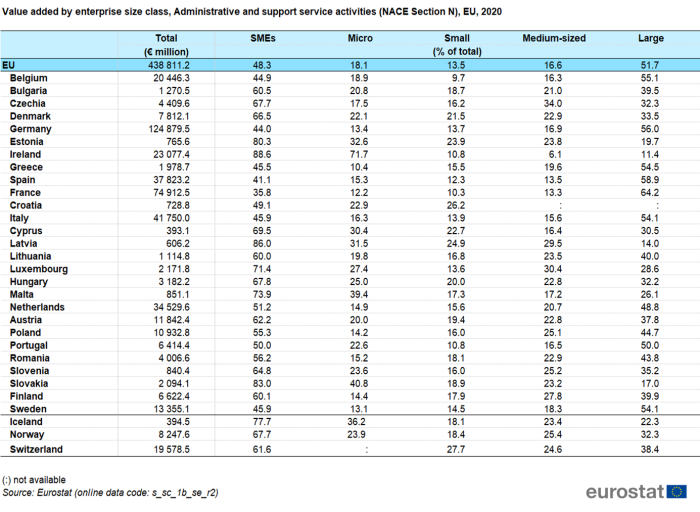

The 5 400 large enterprises (employing 250 or more persons) that were active within the EU’s administrative and support service activities sector in 2020 contributed to more than half of the sectorial employment (53.3 %), and accounted for more than half (51.7 %) of sectorial added value.

The contributions made by micro, small and medium-sized enterprises to the EU’s administrative and support service activities employment were very similar: small enterprises (employing 10 to 49 persons) accounted for 12.9 % of the sectorial employment in 2020, a share that rose through 16.8 % of the total for micro enterprises (employing less than 10 persons) to 17.0 % for medium-sized enterprises (employing 50 to 249 persons). In the micro and small-sized enterprises the share of sectoral value added is higher than in terms of employment, indicating they had higher apparent labour productivity ratios than medium-sized and large enterprises.

(% share of sectoral total)

Source: Eurostat (sbs_sc_sca_r2)

Within the six subsectors that compose the administrative and support service activities sector, large enterprises in the EU accounted for a majority of the employment (more than 50 %) within the employment activities subsector (73.9 %) and the security and investigation activities subsector (59.5 %).

In value added terms, large enterprises in the EU accounted for more than 60.0 % of value added in the employment activities subsector (71.9 %) and in the security and investigation activities subsector (65.0 %).

(% share of sectoral employment)

Source: Eurostat (sbs_sc_1b_se_r2)

(% share of sectoral value added)

Source: Eurostat (sbs_sc_1b_se_r2)

The relative importance of large enterprises in terms of their contribution to the employment within the administrative and support service activities sector was highest in France, the Netherlands, Belgium, Spain and Sweden, where around 60 % of the employment was engaged by large enterprises, peaking at 63.1 % in France.

By contrast, small and medium-sized enterprises accounted for the majority of the value added that was generated in the administrative and support service activities sector in each of the EU Member States for which data are available for 2020, with eight exceptions: France (35.8 %), Spain (41.1 %), Germany (44.0 %), Belgium (44.9 %), Greece (45.5 %), Sweden (45.9 %), Italy (45.9 %) and Croatia (49.1 %). Their highest share was registered in Ireland (88.6 %).

Source: Eurostat (sbs_sc_1b_se_r2)

Source: Eurostat (sbs_sc_1b_se_r2)

Data sources

Coverage

Administrative and support services (Section N) include the following six NACE divisions:

- rental and leasing of motor vehicles, personal and household goods, machinery and equipment, and intellectual property (Division 77);

- employment activities including recruitment and personnel selection services, as well as job placement services (Division 78);

- travel agency, tour operator, reservation services and related activities (Division 79);

- security and investigation activities, including the transportation of valuables (Division 80);

- services to buildings and landscape activities including combined facilities support and cleaning services (Division 81);

- office administrative, office support and other business support activities, including call centers and the organization of trade shows (Division 82).

The administrative and support services sector does not include financial leasing which is considered as a financial service. Renting of real estate is also excluded as is the renting of equipment with operator which is included as appropriate in the construction sector (Section F) or the transportation and storage sector (Section H). Employment activities do not include agents of individual artists which are considered to be part of a professional activity (Section M) as is the provision of security consultancy and landscape design (rather than landscaping itself). Security services do not include public order and safety activities (for example, by the police). Cleaning services do not include car washing which is part of motor trades within the activity of distributive trades (Section G).

Data sources

The analysis presented in this article is based on the main dataset for structural business statistics (SBS), size class data and regional data, all of which are published annually.

The main series provides information for each EU Member State as well as a number of non-member countries at a detailed level according to the activity classification NACE. Data are available for a wide range of variables.

In structural business statistics, size classes are generally defined by the number of persons employed. A limited set of the standard structural business statistics variables (for example, the number of enterprises, turnover, persons employed and value added) are analyzed by size class, mostly down to the three-digit (group) level of NACE. The main size classes used in this article for presenting the results are:

- small and medium-sized enterprises (SMEs): with 1 to 249 persons employed, further divided into:

- micro enterprises: with less than 10 persons employed;

- small enterprises: with 10 to 49 persons employed;

- medium-sized enterprises: with 50 to 249 persons employed;

- large enterprises: with 250 or more persons employed.

Structural business statistics also include regional data. Regional SBS data are available at NUTS levels 1 and 2 for the EU Member States, Iceland and Norway, mostly down to the two-digit (division) level of NACE. The main variable analyzed in this article is the number of persons employed. The type of statistical unit used for regional SBS data is normally the local unit, which is an enterprise or part of an enterprise situated in a geographically identified place. Local units are classified into sectors (by NACE) normally according to their own main activity, but in some EU Member States the activity code is assigned on the basis of the principal activity of the enterprise to which the local unit belongs. The main SBS data series are presented at national level only, and for this national data the statistical unit is the enterprise. It is possible for the principal activity of a local unit to differ from that of the enterprise to which it belongs. Hence, national SBS data from the main series are not necessarily directly comparable with national aggregates compiled from regional SBS.

Context

The freedom to provide services and the freedom of establishment are central principles to the internal market for services. They guarantee EU enterprises the freedom to establish themselves in other Member States, and the freedom to provide services on the territory of another EU Member State. The Directive on services in the internal market (COM(2006) 123) aims to achieve a genuine internal market in services, removing legal and administrative barriers to the development of services activities between Member States. As well as covering most administrative and support service activities (with the notable exception of services of temporary work agencies and private security services), the Directive applies to a wide variety of services including many industrial and construction activities, as well as distributive trades, accommodation and food services, real estate, and professional, scientific and technical services.

Rental and leasing services are provided to households and to business clients. The use of renting or operating leasing can increase financial flexibility, reducing the need to commit own capital, whether for machinery, equipment or appliances. Personnel services may be supplied to persons looking for work or to an enterprise trying to hire. Security and investigation activities as well as services to buildings and landscape activities are mainly business services, although there is also a market for these services among households.

Travel agencies are enterprises that are engaged in arranging transport, accommodation and catering on behalf of travellers. Travel agents act as retailers selling travel services or packaged trips to the customer. Traditionally, tour operators acted as wholesalers to travel agents but they have moved more recently towards selling directly to customers. Tourist guides and tourist information services play a supporting role, offering information and services usually at the tourism destination, but also online.

Direct access to

- SBS – services (serv)

- Annual detailed enterprise statistics - services (sbs_na_serv)

- Annual detailed enterprise statistics for services (NACE Rev. 2 H-N and S95) (sbs_na_1a_se_r2)

- SMEs - Annual enterprise statistics by size classes - services (sbs_sc_sc)

- Services by employment size classes (NACE Rev. 2 H-N and S95) (sbs_sc_1b_se_r2)

- Annual detailed enterprise statistics - services (sbs_na_serv)

- SBS - regional data - all activities (sbs_r)

- SBS data by NUTS 2 regions and NACE Rev. 2 (from 2008 onwards) (sbs_r_nuts06_r2)

- Business economy by sector - NACE Rev. 2 (online publication)

- Decision 1578/2007/EC of 11 December 2007 on the Community Statistical Programme 2008 to 2012

- Summary of EU legislation: Business statistics

- Regulation (EC) No 295/2008 of 11 March 2008 concerning structural business statistics