Balance of payments statistics - quarterly data

Data extracted in April 2024.

Planned article update: 4 July 2024.

Highlights

EU current account recorded a surplus of €97.5 billion in the fourth quarter of 2023.

In the fourth quarter of 2023 the EU goods account surplus reached €75.9 billion.

This article presents quarterly statistics on balance of payments in the EU, the euro area and the Member States. Balance of payments, which is a summary of the transactions of a given economy with the rest of the world, comprises the current account, which covers cross-border transactions in goods, services, primary income and secondary income, the capital account, which covers cross-border capital transfers, as well as the financial account, which deals with transactions involving financial claims on, or liabilities to, the rest of the world, including cross-border direct investment and purchases and sales of equities, debt securities and financial derivatives.

Full article

Current account

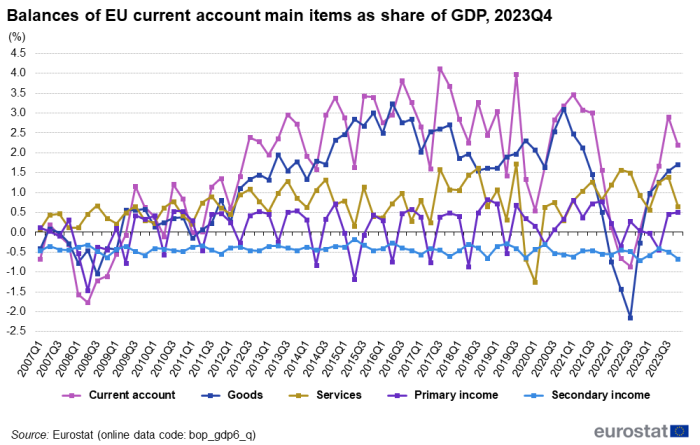

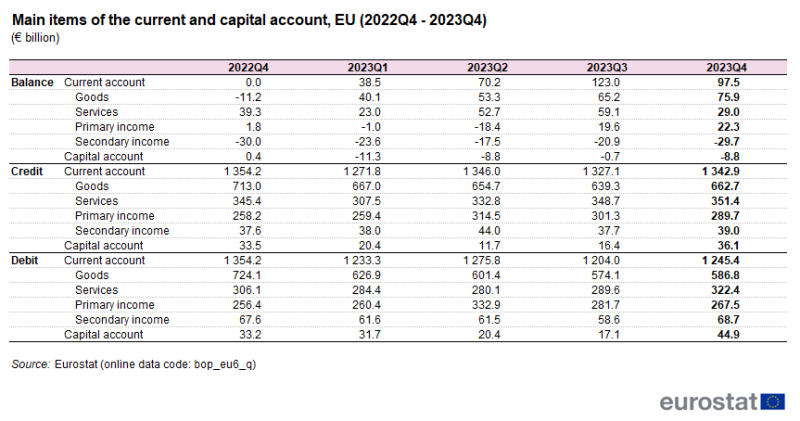

The EU non-seasonally adjusted external current account recorded a surplus of €97.5 billion (+2.2 % of GDP) in the fourth quarter of 2023, compared with the current account balance of €0.0 billion (0.0 % of GDP) in the fourth quarter of 2022, according to the estimates released by Eurostat.

Source: Eurostat (bop_gdp6_q)

In the fourth quarter of 2023 compared with the fourth quarter of 2022, based on non-seasonally adjusted data, the goods account turned from a deficit to a surplus (+€75.9 billion compared with -€11.2 billion), while the surplus of the services account decreased (+€29.0 billion compared with +€39.3 billion). The surplus of the primary income account increased (+€22.3 billion compared with +€1.8 billion), while the deficit of the secondary income account slightly decreased (-€29.7 billion compared with -€30.0 billion). In the capital account, the EU recorded a deficit of -€8.8 billion, compared with a surplus of +€0.4 billion in the fourth quarter of 2022.

Looking at values of credit and debit transactions by components of the current account, it can be observed that both credit and debit transactions for goods decreased in the fourth quarter of 2023 compared with the same quarter of the previous year. Higher decrease was recorded for debit transactions of goods account (-19.0 %), while credit transactions decreased at a lower rate (-7.0 %). The highest increase was recorded for credit transactions of primary income account (+12.2 %), followed by debit transactions of services account and primary income account (+5.3 % and +4.3 %, respectively). Credit and debit transactions of secondary income account increased as well (+3.6 % and +1.6 %, respectively).

Source: Eurostat (bop_eu6_q)

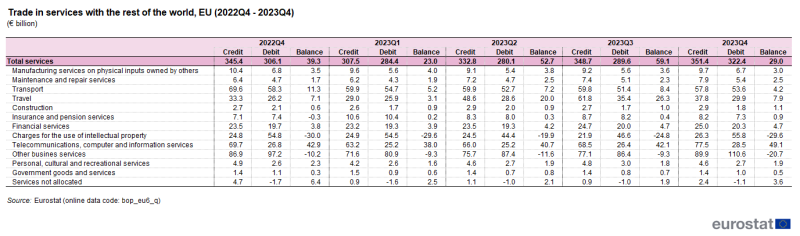

The surplus recorded in the services account (+€29.0 billion) was mainly the result of surpluses in telecommunications, computer and information services (+€49.1 billion), travel (+€7.9 billion), financial services (+€4.7 billion), transport (+€4.2 billion) and manufacturing services on physical inputs owned by others (+€3.0 billion), partially offset by deficits in charges for the use of intellectual property (-€29.6 billion) and other business services, which include research and development, professional, management consulting, technical, trade-related and other business services (-€20.7 billion).

Source: Eurostat (bop_eu6_q)

France (mainly with other business services and travel), Spain (mainly with travel), Poland (mainly with other business services and telecommunications, computer and information services), the Netherlands (mainly with charges for the use of intellectual property), Portugal (mainly with travel), Belgium (mainly with transport) and Sweden (mainly with telecommunications, computer and information services) contributed the most to the surplus. Ireland (mainly due to deficits in charges for the use of intellectual property and other business services) and Malta (mainly due to deficit in other business services) were the only EU Member States that reported deficits in trade in services with extra-EU economic counterparts, other 25 EU Member States reported surpluses.

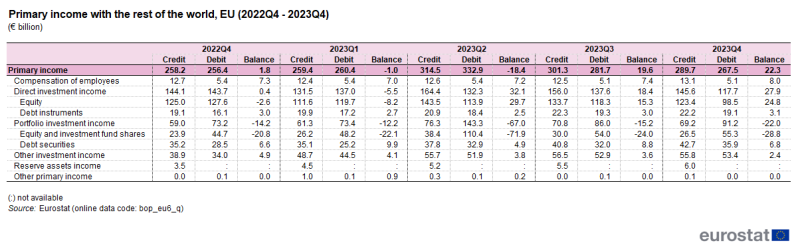

The primary income surplus (+€22.3 billion) was the result of the surpluses in direct investment income (+€27.9 billion), compensation of employees (+€8.0 billion) and other investment income (+€2.4 billion), partially offset by a deficit in portfolio investment income (-€22.0 billion).

Source: Eurostat (bop_eu6_q)

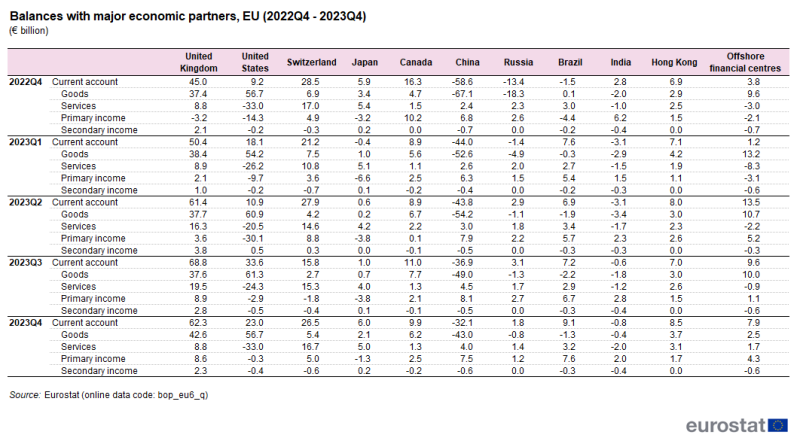

Geographical breakdown of current account transactions

In the fourth quarter of 2023, the EU external current account recorded a surplus with the United Kingdom (+€62.3 billion), Switzerland (+€26.5 billion), the United States (+€23.0 billion), Canada (+€9.9 billion), Brazil (+€9.1 billion), Hong Kong (+€8.5 billion), offshore financial centres[1] (+€7.9 billion), Japan (+€6.0 billion) and Russia (+€1.8 billion). Deficits were registered with China (-€32.1 billion) and India (-€0.8 billion).

The EU recorded highest surpluses in goods account with the United States (+€56.7 billion), the United Kingdom (+€42.6 billion), Canada (+€6.2 billion), Switzerland (+€5.4 billion), Hong Kong (+€3.7 billion), offshore financial centres (+€2.5 billion) and Japan (+€2.1 billion), while deficits were registered with China (-€43.0 billion), Brazil (-€1.3 billion), Russia (-€0.8 billion) and India (-€0.4 billion). In the services account, the surpluses took place with Switzerland (+€16.7 billion), the United Kingdom (+€8.8 billion), Japan (+€5.0 billion), China (+€4.0 billion), Brazil (+€3.2 billion), Hong Kong (+€3.1 billion), offshore financial centres (+€1.7 billion), Russia (+€1.4 billion) and Canada (+€1.3 billion), the deficits with the United States (-€33.0 billion) and India (-€2.0 billion). Highest surpluses in the primary income account occurred with the United Kingdom (+€8.6 billion), Brazil (+€7.6 billion), China (+€7.5 billion), Switzerland (+€5.0 billion), offshore financial centres (+€4.3 billion) and Canada (+€2.5 billion), while deficits were recorded with Japan (-€1.3 billion) and the United States (-€0.3 billion). In the secondary income account, surpluses were registered with the United Kingdom (+€2.3 billion) and Japan (+€0.2 billion), while highest deficits were recorded with Switzerland, offshore financial centres and China (all -€0.6 billion), India, the United States (both -€0.4 billion) and Brazil (-€0.3 billion).

Financial account

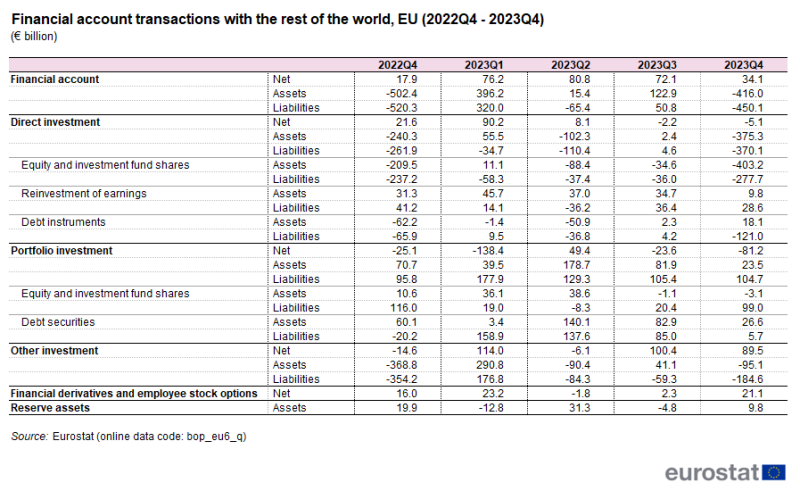

In the fourth quarter of 2023 there was a net decrease of financial assets held abroad by EU residents by €416.0 billion and a net decrease of liabilities of EU residents to the rest of the world by €450.1 billion. The EU was the net recipient of direct investment from the rest of the world with net inflows of €5.1 billion. Direct investment assets held abroad by EU investors decreased by €375.3 billion and direct investment liabilities of the EU to the rest of the world decreased by €370.1 billion.

Source: Eurostat (bop_eu6_q)

Portfolio investment recorded a net inflow of €81.2 billion. Portfolio investment assets abroad increased by €23.5 billion, as did portfolio investment liabilities of the EU to the rest of the world by €104.7 billion. Other investment recorded a net outflow of €89.5 billion. EU investors decreased their other investment assets held abroad by €95.1 billion, while other investment liabilities of the EU to the rest of the world decreased by €184.6 billion.

Current account of EU Member States (including intra-EU flows)

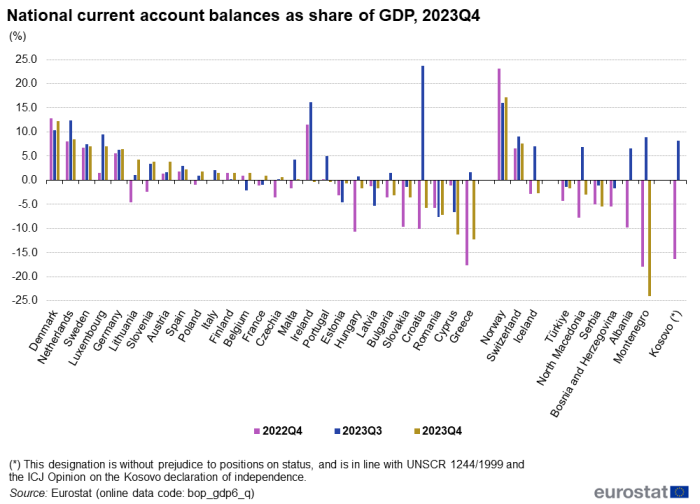

As concerns the total (intra-EU plus extra-EU) current account balances of the EU Member States, based on non-seasonally adjusted data, 15 Member States recorded surpluses, eleven recorded deficits and one Member State had its current account in balance in the fourth quarter of 2023. The highest surpluses were observed in Germany (+€68.7 billion), the Netherlands (+€22.6 billion), Denmark (+€12.1 billion), Sweden (+€10.2 billion), Italy, Spain (both +€8.5 billion) and France (+€6.5 billion), while the largest deficits in Romania (-€6.9 billion) and Greece (-€6.8 billion).

In relation to GDP (size of the economy), the highest surpluses can be observed for Denmark (+12.3 %), the Netherlands (+8.5 %), Sweden (+7.1 %), Luxemburg (+7.0 %) and Germany (+6.4 %). The largest deficits were recorded for Greece (-12.3 %), Cyprus (-11.2 %), Romania (-7.2 %) and Croatia (-5.7 %).

Source: Eurostat (bop_gdp6_q)

Trade in goods was the main account behind surpluses of Germany, the Netherlands, Denmark, Sweden, Italy, Austria, Finland and Czechia and significantly contributed to a surplus of Belgium; it was as well the main account behind deficits of Romania, Greece, Croatia, Cyprus, Bulgaria, Portugal, Latvia and Estonia. Services account decided about the surpluses of Spain, France, Poland, Luxembourg, Lithuania and Slovenia. Primary income significantly contributed to surpluses of Germany, Denmark, Sweden, France, Belgium and Finland, as well as to deficits of Slovakia, Hungary, Cyprus, Bulgaria, Ireland, Portugal and Estonia. In secondary income account, Portugal, Bulgaria, Romania and Croatia recorded the highest surpluses, while the highest deficits had Germany, France, Italy and Spain.

International investment position of EU Member States

In the fourth quarter of 2023, external liabilities were higher than assets in 15 EU Member States (representing negative net international investment position), while external assets exceeded liabilities in twelve Member States (Belgium, Denmark, Germany, Italy, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Slovenia, Finland and Sweden). Germany recorded the highest value of net IIP of €2 900.1 billion, due to direct, portfolio and other investment positions, being followed by the Netherlands (€742.6 billion), Belgium (€381.0 billion), Denmark (€220.2 billion), Sweden (€188.5 billion) and Italy (€154.6 billion), mainly due to direct investment in case of the Netherlands, Denmark and Sweden and portfolio investment in case of Belgium and Italy. France had the highest net international indebtedness among the EU Member States, at €824.5 billion, mainly due to its position in portfolio investment. Greece and Ireland recorded high indebtedness levels, which were above 100 % of GDP, mainly due to other investment in case of Greece and portfolio investment in case of Ireland.

Source data for tables and graphs

Data sources

The methodological framework followed in the compilation of the Balance of Payments and International Investment Position is that defined in the sixth edition of the International Monetary Fund Balance of Payments and International Investment Position Manual (BPM6), published in 2009.

In the compilation of BOP, responsibility is shared between Eurostat and the ECB. Eurostat is responsible for monthly BOP and quarterly and annual BOP, IIP, ITSS and FDI aggregates of the EU, as well as on detailed ITSS data also for the euro area, whereas the European Central Bank (ECB) is in charge of compiling and disseminating the euro area monthly and quarterly balance of payments, as well as quarterly international investment position statistics.

Monthly BOP data are available starting from January 1999. Quarterly BOP items are available from first quarter 1982, while quarterly IIP from fourth quarter 1993. Data are available for the European Union, EU Member States, euro area, EFTA and candidate countries. Data are compiled and disseminated for transactions and positions of the total economy vis-à-vis the rest of the world and major economic counterparts (Switzerland, Russia, the USA, Canada, Brazil, China, Hong Kong, India, Japan and Offshore financial centres[2]. Additionally, for financial account transactions and positions, as well as related income, data are available with a sector breakdown. </datadetails>

Context

In line with the agreed allocation of responsibility, the European Central Bank (ECB) is in charge of compiling and disseminating monthly and quarterly balance of payments statistics for the euro area, whereas the European Commission (Eurostat) focuses on quarterly and annual aggregates of the EU. The aggregates for the euro area and the EU are compiled consistently on the basis of Member States' transactions with residents of countries outside the euro area and the European Union respectively.

Direct access to

Database

- Balance of payments - international transactions (BPM6) (bop_6)

- Quality report on balance of payments (BOP), international trade in services (ITS) and foreign direct investment (FDI) - 2020 edition — Statistical Reports

- Quality report on balance of payments (BOP), international trade in services (ITS) and foreign direct investment (FDI) - 2019 edition — Statistical Reports

- Current account asymmetries in EU-US statistics - 2019 edition — Statistical Reports

- Quality report on balance of payments (BOP), international trade in services (ITS) and foreign direct investment (FDI) DATA 2017 — Statistical Reports

- Quality report on balance of payments (BOP), international trade in services (ITS) and foreign direct investment (FDI) statistics — Statistical Reports

- Transatlantic trade in services: Investigating bilateral asymmetries in EU-US trade statistics — Statistical Reports

- Consistency between national accounts and balance of payments statistics — An updated view on the non financial accounts — Statistical Reports

- Quality report on balance of payments (BOP), international trade in services (ITS) and foreign direct investment (FDI) statistics — Statistical Reports

- Quality report on balance of payments, international trade in services and foreign direct investments — 2014 data — Statistical Working Papers

- EU current account surplus €107.9 bn — News Release from 09/04/2024

- EU current account surplus €85.4 bn — News Release 007/2024 of 11/01/2024

- EU-27 current account surplus €73.0 bn — News Release 113/2023 of 05/10/2023

- EU-27 current account surplus €58.3 bn — News Release 75/2023 of 04/07/2023

- EU-27 current account deficit €7.9 bn — News Release 41/2023 of 05/04/2023

- EU-27 current account deficit €60.1 bn — News Release 7/2023 of 11/01/2023

- International Monetary Fund — Balance of Payments and International Investment Position Manual — 6th edition, 2009

- Balance of Payments Vademecum

- User guide on European statistics on international trade in goods — 2014 edition Publication, December 2014

- Manual on goods sent abroad for processing — 2014 edition Publication, September 2014

- Regulation (EC) No 184/2005 of 12 January 2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment.

- Summaries of EU Legislation: EU statistics — balance of payments, trade in services and foreign direct investment

- Regulation (EU) No 555/2012 of 22 June 2012 amending Regulation (EC) No 184/2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment, as regards the update of data requirements and definitions.

- Regulation (EU) No 2016/1013 of 8 June 2016 amending Regulation (EC) No 184/2005 on Community statistics concerning balance of payments, international trade in services and foreign direct investment.

Notes

- ↑ Offshore Financial Centres (OFC) is an aggregate which includes 40 countries. As examples, the aggregate contains European financial centres, such as Liechtenstein, Guernsey, Jersey, the Isle of Man, Andorra and Gibraltar; Central American OFC such as Panama and Caribbean islands like Bermuda, the Bahamas, the Cayman Islands and Turks and Caicos Islands; and Asian OFC such as Bahrain, Hong Kong, Singapore and the Philippines.

- ↑ See above Note 1.